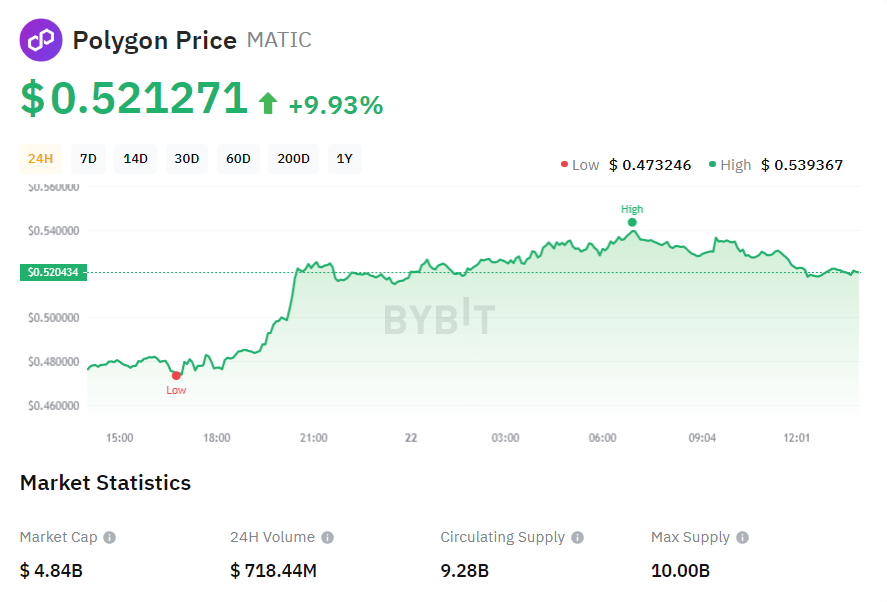

Polygon (MATIC) has been a bright spot in a largely sideways market, defying the trend with an impressive 20% gain since last Friday. This bullish run comes as Polygon prepares for a significant update: the rebranding of its native token from MATIC to POL, effective September 4th.

The 1:1 token swap aims to solidify POL’s role as the gas and staking token for the Polygon ecosystem, with potential expansion to its aggregation platform (AggLayer). But will this be enough to propel MATIC, soon to be POL, past its August losses?

Charting a Course for Recovery

The daily chart paints a promising picture for MATIC. It recently broke above the crucial $0.42 resistance level, reversing most of its August decline. As of writing, MATIC sits at $0.52, with its sights set on two key hurdles: $0.49 and $0.55.

The bullish momentum is further fueled by the RSI (Relative Strength Index) exceeding its average level, indicating strong buying pressure. However, a potential cool-off is on the horizon, as the Stochastic RSI ventures into overbought territory.

Support and Resistance: A Delicate Balance

Should the rally lose steam, $0.46 and $0.42 act as crucial short-term support levels. These areas will be vital in preventing a reversal of recent gains.

Profit Taking: A Potential Threat

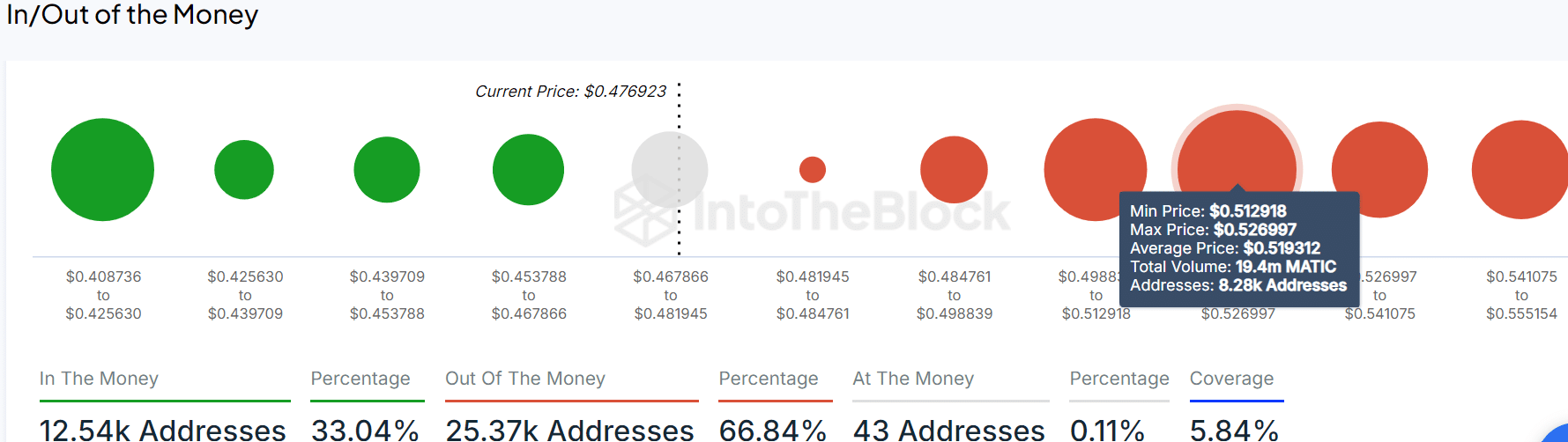

Interestingly, MATIC boasts positive market sentiment, with speculators bullish on its potential. However, the recent price hike has pushed the 30-day MVRV (Market Value to Realized Value) to +8%. This suggests recent buyers are sitting on unrealized profits, potentially leading to profit-taking around resistance levels.

IntoTheBlock data further reinforces this concern. Between $0.40 and $0.55, only 33% of addresses are currently in profit. A significant number of holders, particularly those between $0.51 and $0.52, are waiting to break even, potentially triggering sell-offs at these resistance points.

Can POL Overcome the Hurdles?

The upcoming rebrand to POL injects uncertainty into the equation. While the token swap itself shouldn’t impact price, the broader market reaction remains to be seen.

The road ahead for POL (formerly MATIC) is paved with both opportunities and challenges. Overcoming the resistance levels at $0.49 and $0.51 will be crucial in determining whether it can surpass its August losses and continue its bullish trajectory.