Pi Network price has fallen by 48% in one month, but the Pi Coin community remains optimistic that a surge in utility and institutional adoption from top banks will fuel a recovery. So far, Pi Coin has been adopted as a means of payment by multiple businesses. This has fuelled speculation that major banks on Wall Street will adopt Pi Network. If this happens, what will happen to PI price? Let’s explore.

Pi Network Price Analysis If Top Banks Start Using Pi Network

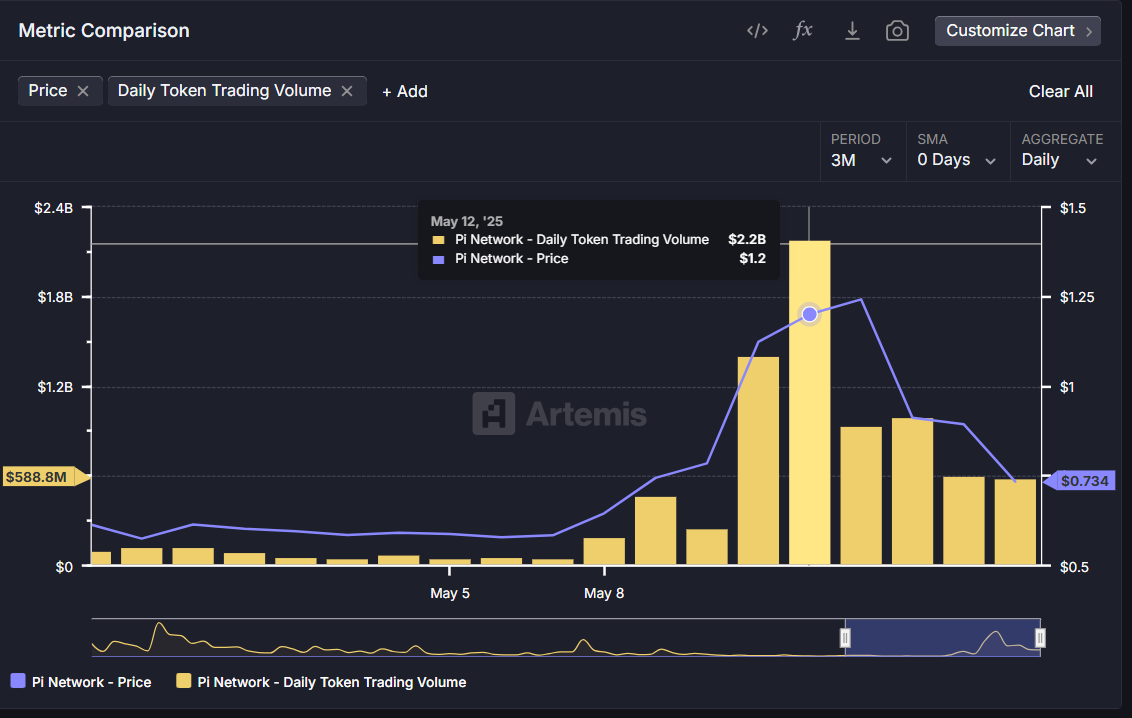

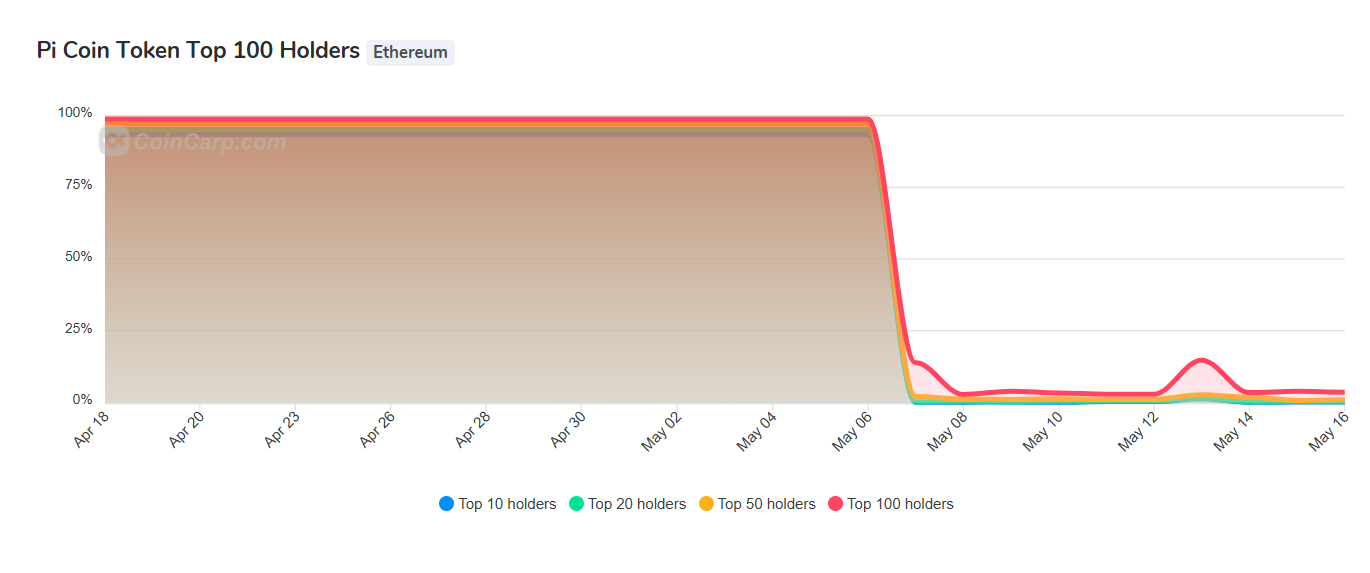

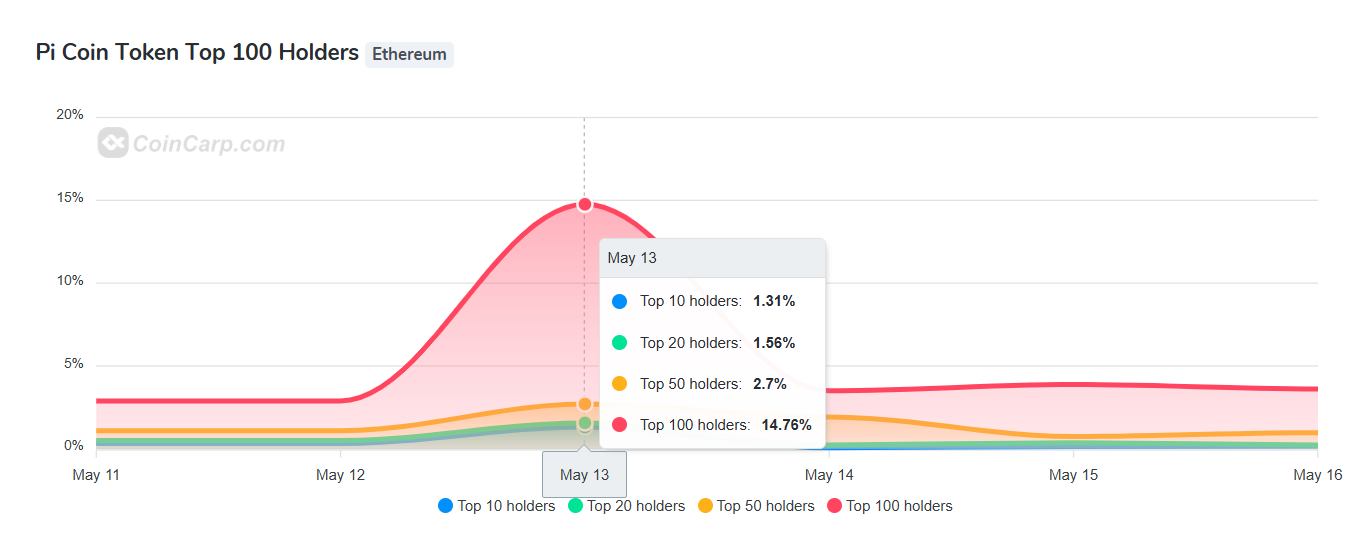

Pi Network price has struggled under bearish headwinds in recent weeks. Factors such as token unlocks and concerns about transparency have impacted investor confidence and caused a lack of fresh interest from buyers.

However, Pi Network has also expanded its presence in the US after being named an affiliate member of Stanford. Pi Coin also entered the trillion-dollar US real estate market after being adopted by Florida-based Zito Realty.

These instances have fuelled speculation that the Pi Network token will receive the attention of leading US banks, including JPMorgan and Bank of America. If these banks adopt Pi Network to integrate blockchain in services like payments and remittances, Pi Coin price will surge.

Grok3 also estimates that if top banks start using Pi Network, the price will soar to as high as $30. It stated,

“A moderate estimate of $10–$30 is plausible if banks integrate PI for significant use cases, aligning with some analyst predictions.”

This bullish Pi Network price prediction is achievable as the project is quickly gaining adoption across the Web3 industry after the recent partnership with Banxa and integration with Chainlink Data Streams.

Meanwhile, popular analyst Dr Altcoin recently stated that one of the main factors that will prevent Pi Coin price from falling is institutional adoption. However, he also opined that the blockchain would have to undergo upgrades for this to happen.

Pi Coin Price Defends Support, Eyes Recovery

The one-hour Pi Network price chart shows that the token is defending support at $0.60. Looking at past performance, this support level is crucial to the performance of the token. If Pi Coin can make a decisive close above this support level, it may record a relief rally. Conversely, if it breaches this support, it will cause a downswing.

If Pi Coin extends its rally above this support level, it faces the next resistance at $0.64. Moving above this level will place the next target price for the token at $0.73.

Meanwhile, the MACD line is rising, despite remaining in the negative region. This suggests that the downtrend is weakening. The MACD line needs to cross above the zero line to confirm that the trend has changed to bullish.

Considering the speculation that the Pi Network token may receive adoption from top US banks, bullish momentum is surging around it, which may spark a rebound. At the same time, the one-hour Pi Coin chart indicates the altcoin may be poised for a recovery after the recent dip.

The post How High Will Pi Coin Price Go If Major Banks Start Using Pi Network? appeared first on CoinGape.