Hedera (HBAR) has been stuck in a prolonged period of consolidation, leaving traders unsure of its next move. While its stability has prevented significant losses, it has also left market participants waiting for a breakout, with growing impatience in the community. This indecisiveness has caused Hedera traders to closely watch Bitcoin for cues, as the two assets share a growing correlation.

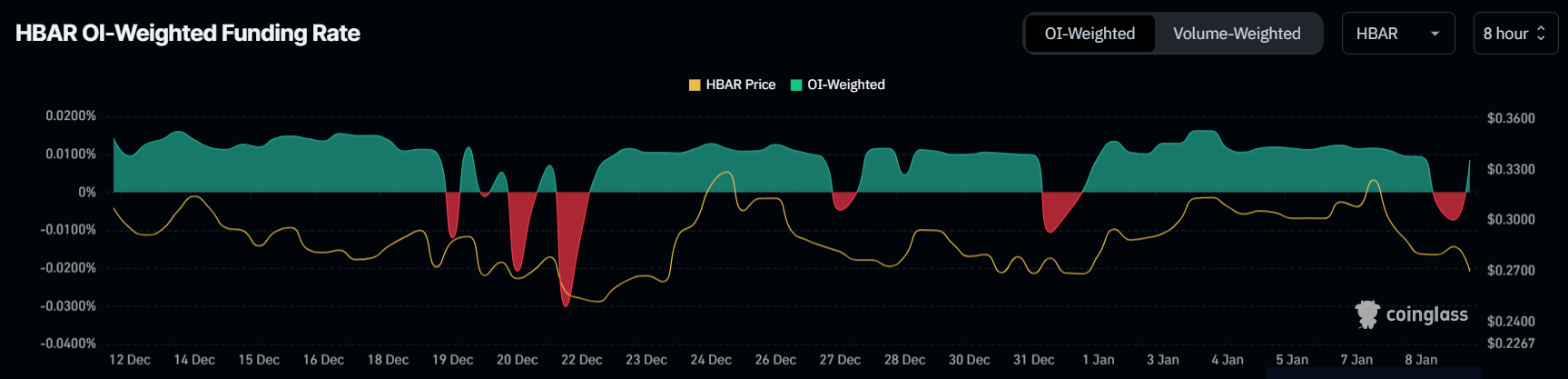

The funding rate for HBAR, which has been fluctuating between positive and negative, mirrors the market’s uncertainty. Traders are positioning themselves to capitalize on either a potential price surge or a further decline, but this tug-of-war of sentiment has resulted in an erratic funding rate. This volatility suggests that participants are unsure whether Hedera is poised for a breakout or if further downside is more likely.

In the midst of this uncertainty, traders’ impatience could lead to abrupt decisions, which could further impact HBAR’s price. With sentiment divided, the altcoin may face additional pressure, continuing its lack of momentum. Currently, HBAR’s macro momentum is closely tied to Bitcoin, which has a correlation of 0.65 with the asset. If Bitcoin manages to reclaim the $100,000 mark and sustains its rally, HBAR could see a similar boost, breaking free from its consolidation phase.

However, Bitcoin’s performance remains pivotal. Should Bitcoin falter, HBAR’s reliance on its correlation with the leading cryptocurrency could put it at risk. As of now, HBAR is trading at $0.27, hovering between the $0.25 and $0.33 range. Without a clear sentiment shift, this sideways movement could persist, leaving traders uncertain about the asset’s trajectory.

For HBAR to break out of its current consolidation, it will need Bitcoin’s momentum. A move above $0.33, supported by broader market positivity, could propel Hedera toward $0.39, invalidating the bearish outlook. Conversely, if market sentiment continues to sour, HBAR may test critical support levels, potentially pushing it lower. The next few weeks could be crucial for Hedera’s fate, with Bitcoin’s performance likely to set the tone for its next major move.