As the specter of war looms in the Middle East, traditional safe-haven assets like gold and crude oil are experiencing significant price surges. However, Bitcoin, often hailed as a digital alternative, is heading in the opposite direction, sparking renewed debate on its role as a safe haven in times of crisis.

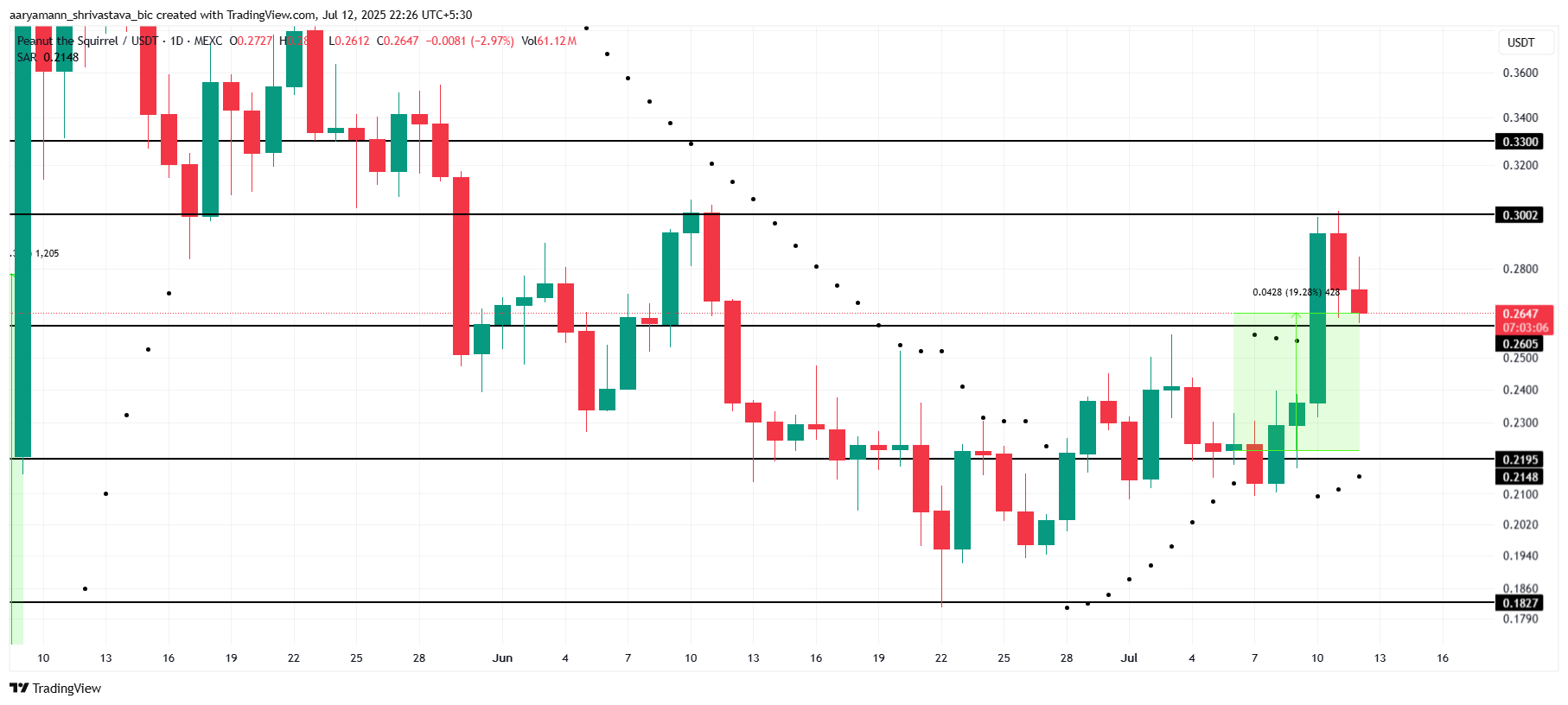

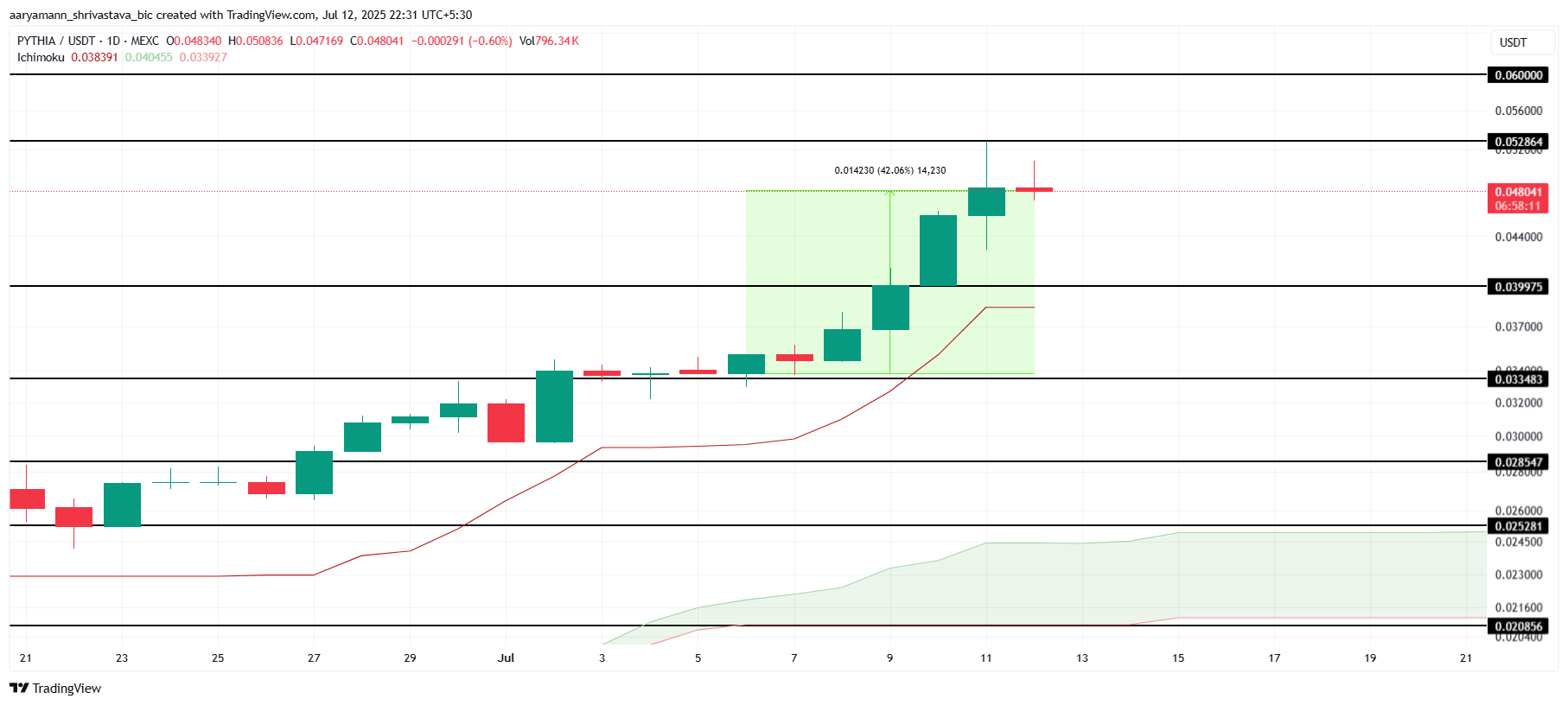

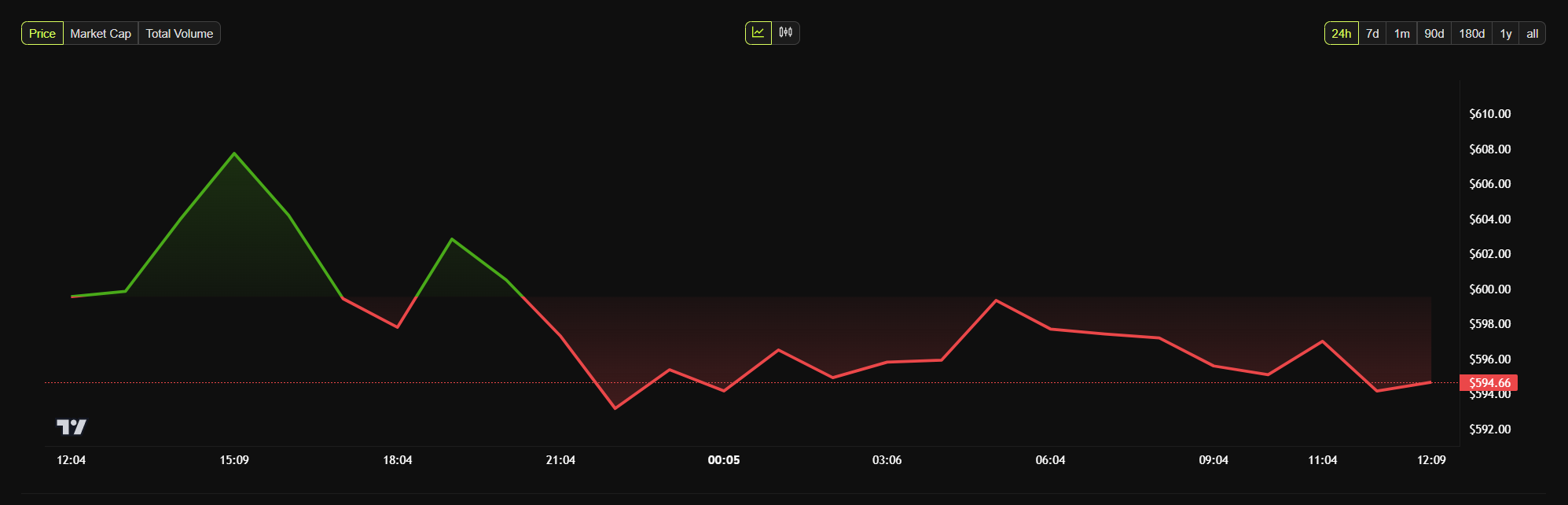

On October 1, 2024, gold prices rose by 1.4%, reaching $2,665 per ounce, just shy of their all-time high, according to Goldprice.org. Crude oil prices also spiked, with a 7% jump pushing prices to $72 per barrel. In contrast, Bitcoin plummeted by more than 3%, losing nearly $4,000 in value, from an intraday high of $64,000 to $60,315, before a slight recovery to $61,800.

The Middle East Conflict And Market Reactions

The sudden price movements in commodities and Bitcoin occurred against the backdrop of escalating violence in the Middle East. On the evening of October 1, Iran launched an airstrike targeting Israeli sites, leading to a sharp increase in geopolitical tensions. Israel’s air defenses intercepted most of the 180 missiles, but the markets quickly reacted to the brewing conflict.

In the aftermath, both bonds and the U.S. dollar strengthened as investors flocked to traditional safe-haven assets. Li Xing, a financial markets strategist with Exness, commented, “The escalating conflict in the Middle East has prompted investors to seek security in gold, bolstering its appeal amidst broader market uncertainty.”

While traditional assets like gold soared, Bitcoin’s drop brought into question its role in such volatile conditions. According to data from Coinglass, approximately 154,770 traders were liquidated in the past 24 hours, with total liquidations reaching $521 million. This marked one of Bitcoin’s largest sell-offs in recent weeks.

Bitcoin’s Status as a Safe Haven Challenged

The sharp contrast between the performance of gold and Bitcoin has reignited the debate about whether Bitcoin can truly be considered a safe haven asset. Jeroen Blokland, founder of the Blokland Smart Multi-Asset Fund, speculated that some investors are selling Bitcoin to buy gold amid the uncertainty. Similarly, precious metals analyst Jesse Colombo noted that Bitcoin tends to “tank” during times of geopolitical fear, unlike gold, which has historically retained its value in crises.

Despite this, some experts continue to defend Bitcoin’s potential as a hedge against inflation. BlackRock CEO Larry Fink, in a July 2023 interview with Fox Business, stated that Bitcoin could still serve as an alternative hedge, particularly against inflation. However, Markus Thielen, Head of Research at 10x, reminded investors that Bitcoin was originally designed as a peer-to-peer payment system, not a safe haven asset. He added that Bitcoin’s price is more closely linked to economic cycles than to geopolitical risks.

Conclusion: The Safe Haven Debate Continues

As the Middle East conflict escalates, the divide between traditional assets and Bitcoin becomes increasingly apparent. While gold and crude oil rise amid uncertainty, Bitcoin’s recent sell-off suggests it may not yet be the reliable safe haven some had hoped for. With more turbulence expected, investors will continue to watch closely as Bitcoin’s role in the global economy remains a subject of debate.

Also Read: Zest Protocol Launches BTCz Token – Earn Rewards On Bitcoin With 1,000 BTC Staked In Just Days

Only time will tell whether Bitcoin can evolve into a true safe haven or if it will remain subject to the whims of economic and liquidity cycles.