The post FTX Unstaked 186,000 SOL Tokens—Should You be Worried about the Upcoming SOL Price Rally? appeared first on Coinpedia Fintech News

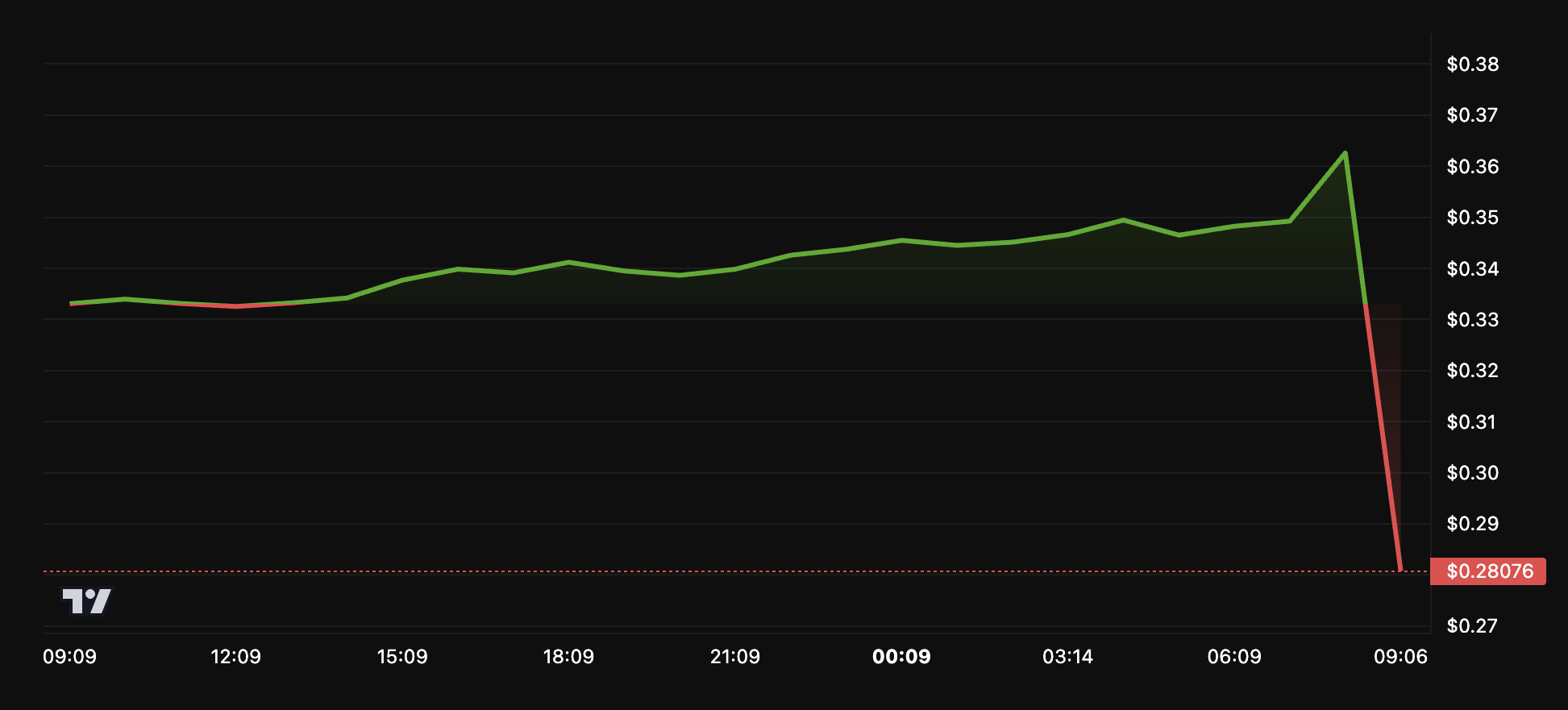

The markets are recovering from the trade-war turmoil, which has dragged the Solana price below $100 for a while. The bears did try to drag the price below the range for two consecutive days but failed, with the price reclaiming $120 in no time. Since then, the price has been consolidating around the gains, aiming to reclaim the crucial resistance at $125, which could clear the path to $135. With this, the SOL price could probably rise above the bearish influence, but if the selling pressure mounts, the token may face a significant setback.

Solana was one of the most exposed tokens after FTT following the collapse of the FTX exchange back in 2022. The SOL price faced a massive pullback and dropped to a single-digit figure from the highs above $240 following a huge uncertainty over the token. However, the token rebounded finely and surged close to $300, forming a new ATH. In a new update ahead of FTX’s repayment program scheduled for May, the exchange has unstaked large amounts of SOL, raising concerns over the upcoming price action.

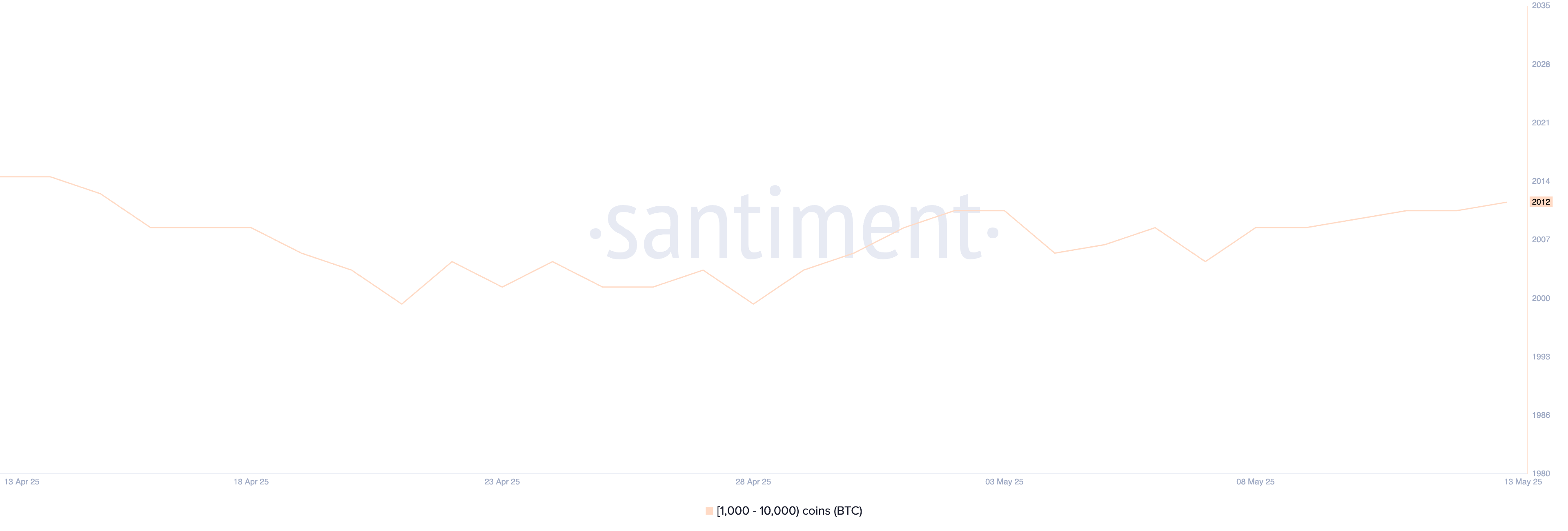

The FTX exchange has just unstaked over 186,000 SOL worth nearly $22 million, which may push the price into a decisive phase. Although unstaking does not directly mean dumping, as the creditors may certainly not sell out their holding as soon as they get it, some probability of a pullback remains higher. Currently, no major price change is seen as the market sentiment remains bullish after the Bitcoin price climbed back above $81,000.

Should you be worried about the SOL price rally?

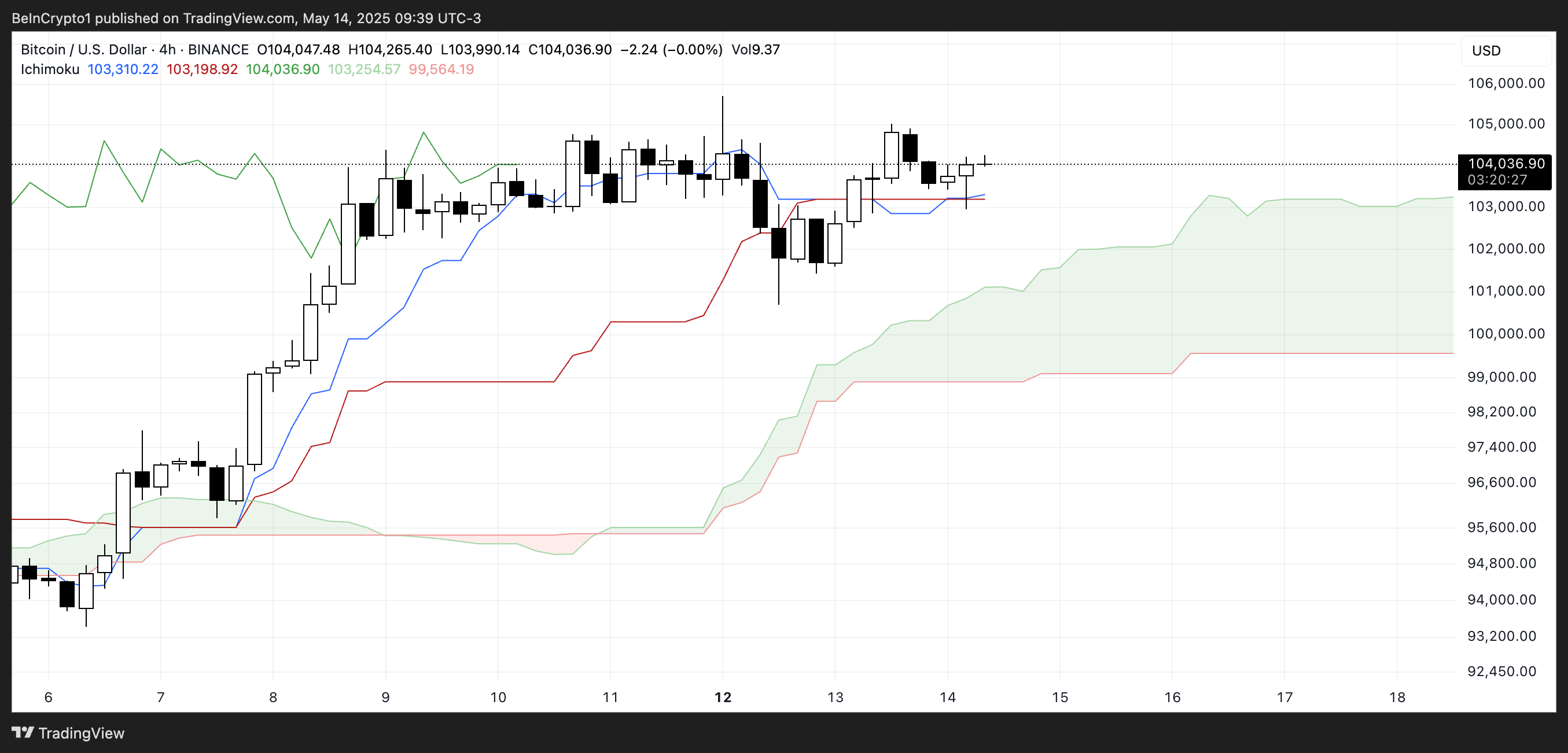

The SOL price in the short term is trading within an ascending triangle and is testing the upper resistance zone between $119.54 and $120.84. The RSI is rising while the Stochastic RSI has entered the overbought zone. Therefore, this carries some possibility of a pullback but as long as RSI maintains a strong ascending trend, the Solana price is believed to maintain a strong upswing and test the higher targets mentioned above.