Japanese Bitcoin spot ETF may not arrive as early as once expected this week.

SBI Holdings denied earlier reports that it has formally filed for crypto-related exchange-traded funds (ETFs) in Japan, clarifying that the plans remain in the development phase.

Regulatory Clarity Still Pending

“Contrary to some media reports, we have not filed any applications with the authority to form an ETF related to crypto assets,” the SBI spokesperson told Cointelegraph on Friday. “It is only at the planning stage.”

The spokesperson said SBI will not submit any ETF applications until Japan’s Financial Services Agency (FSA) finalizes its approach to classifying crypto assets.

“In Japan, ETFs that incorporate crypto assets are expected to be approved in a way that aligns with the responses of the financial authorities and tax authorities,” the SBI representative said. “Therefore, the filing will be done after these legal revisions have been made.”

In its Q2 results announcement a week ago, SBI introduced the plan for two new ETFs: a hybrid product combining gold and digital assets, and another holding spot Bitcoin and XRP. The reports pointed to language in the company’s latest earnings presentation as evidence.

However, the presentation material did not explicitly confirm any regulatory filings, and SBI has moved to set the record straight.

In June, FSA proposed recognizing certain digital assets as financial products under the Financial Instruments and Exchange Act (FIEA), the framework that governs traditional securities.

First Publicly Listed Crypto ETF in Japan, If Approved

If approved, the change could enable the first publicly listed crypto ETFs in Japan. While clarifying it has yet to file applications, SBI has already taken steps to position itself for Japan’s anticipated ETF market. As BeInCrypto previously reported, the company has partnered with US investment firm Franklin Templeton to create a new digital asset management joint venture in Japan.

Nikkei reported that SBI will hold a 51% majority stake in the new firm, while Franklin Templeton will own the remaining shares. The partnership is designed to launch Bitcoin ETFs as soon as the FSA grants approval. The joint venture also intends to leverage Franklin Templeton’s expertise in asset tokenization to expand future product offerings.

This move runs parallel to SBI’s plans for two ETF concepts under its subsidiary SBI Global Asset Management: a pure-play spot ETF for Bitcoin and XRP, and a hybrid fund with at least 51% allocated to gold and the remainder to digital assets. The company aims to offer these products to individual investors first, aligning with its mission to “promote the democratization of alternative investments.”

SBI’s inclusion of XRP reflects its longstanding relationship with Ripple, where it remains a major shareholder. The firm has actively promoted XRP in cross-border payments throughout Asia. Analysts say a regulated ETF with direct XRP exposure could help legitimize the token for institutional adoption in Japan.

The hybrid gold-crypto ETF concept is aimed at appealing to both digital asset enthusiasts and risk-averse investors, merging the growth potential of crypto with the perceived stability of gold.

Strategic Expansion in Web3

SBI’s ETF ambitions are part of a broader Web3 strategy. The firm is expanding stablecoin initiatives, including USDC, Ripple’s RLUSD, and a planned yen-denominated stablecoin, to integrate securities, banking, and digital assets into a single financial infrastructure.

Industry observers see these steps as positioning ahead of a likely market shift once ETF approval arrives. The introduction of regulated crypto ETFs could unlock new institutional capital, especially from pension funds and asset managers who have avoided direct crypto exposure due to regulatory and tax hurdles.

While optimism is building—especially within the XRP community—industry experts warn that regulatory review and product vetting will take time. SBI has reiterated that all publicly available information on its ETF plans is contained within its earnings presentation and related statements, with no further details released on fees, custody, or launch dates.

If Japan’s FSA finalizes the proposed legal revisions, the country could join the United States and Canada in offering spot crypto ETFs. For SBI, early entry could cement its leadership in Japan’s evolving financial landscape, while partnerships like the Franklin Templeton venture underscore its intent to be ready the moment regulators open the door.

The post Japan Crypto ETF Not Officially Filed, Plans Still in Development Phase appeared first on BeInCrypto.

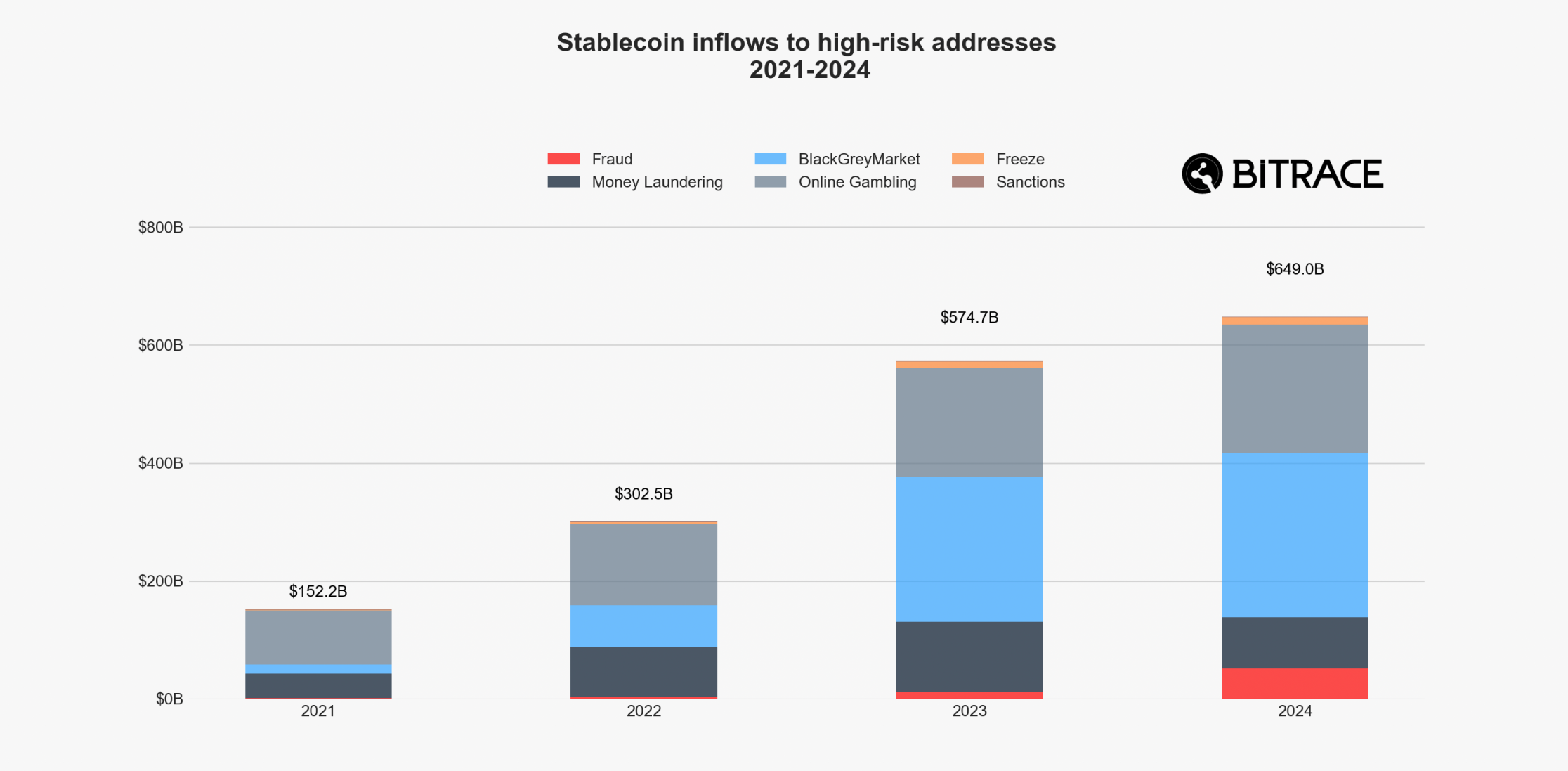

Stablecoins in Crypto Crime.

Stablecoins in Crypto Crime.