With over 861 million users globally, the crypto industry is entering a new phase: adoption at scale. In this context, MERGE Madrid 2025, held at the iconic Palacio de Cibeles from October 7–9, positions itself as a must-attend event to understand, anticipate, and lead the future of digital finance and blockchain technology.

In its third edition, MERGE will welcome over 3,000 attendees, 500 international organizations, and more than 200 high-profile speakers, ranging from central banks and financial institutions to leading blockchain protocols, emerging startups, and global corporations already leveraging Web3 as a strategic innovation driver.

Will Spanish Banks Launch Their Own Stablecoins?

Stablecoins are emerging as blockchain’s true killer app, creating real utility even for non-crypto-native users. In France and Germany, Société Générale and Deutsche Bank have already launched corporate stablecoin projects. In the U.S., banking consortia are discussing joint stablecoin initiatives to enhance efficiency and scalability.

MERGE Madrid 2025 will be the ideal stage to analyze and debate these developments, bringing together traditional finance and native Web3 ecosystems. Confirmed participants include Santander, BBVA, BNP Paribas, TowerBank, Wenia (Bancolombia) and many others.

A Full Week of Vision, Tech, and Web3 Culture

This year, MERGE Madrid expands into a multi-layered experience, built around a weeklong program connecting every part of the ecosystem.

- October 7: Private roundtables with regulators at MERGE Institutional, followed by a VIP Cocktail.

- October 8–9: The main conference, the heart of the event, will explore business strategies, global regulation, digital finance, immersive art, cultural experiences, and Web3 adoption frameworks.

- October 10: MERGE Tech Summit, a full day of developer bootcamps, workshops, and technical sessions.

- October 11–12: The weekend Hackathon, where innovation comes to life.

This structure ensures representation from decision-makers and regulators to the developers building the future from code. MERGE transforms Madrid into a real bridge between institutional, technical, and creative worlds, shaping the future of the token economy.

The Bridge Between Latin America and Europe

MERGE Madrid strengthens its role as a strategic connection point between Europe and Latin America, uniting institutions, governments, and businesses from both regions around Web3 innovation.

Previous editions have welcomed institutions like the Central Bank of Brazil, Argentina’s Central Bank, Argentina’s National Securities Commission, El Salvador’s Digital Assets Commission, the European Banking Authority, and governments from Madrid and Buenos Aires, many of whom are returning in 2025.

This transatlantic connection takes on special significance as MERGE coincides with Hispanic Heritage Week, positioning Madrid as a capital of Ibero-American collaboration in decentralized economics.

A World-Class Speaker Lineup

MERGE is growing in every direction – and its speaker agenda is no exception. The 2025 edition features over 200 top experts and international C-level leaders, curated to provide a 360° view of the Web3 ecosystem:

- Traditional financial institutions: Key figures include Coty de Monteverde (Banco Santander), Francisco Maroto (BBVA), David Cunningham (Citi), Gabriel Campa (TowerBank), and Pablo Arboleda Niño (Bancolombia) — all leaders in institutional investment and crypto asset adoption.

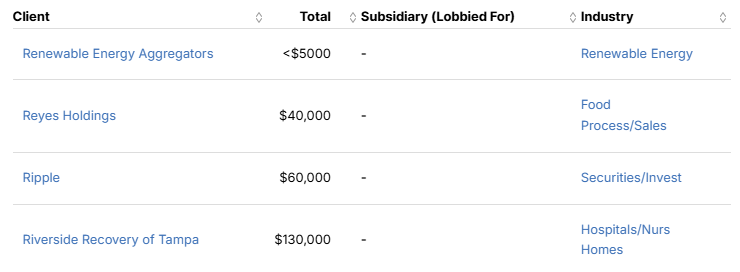

- Native Web3 projects: Influential voices such as Staci Warden (CEO at Algorand Foundation), Cassie Craddock (Managing Director UK & Europe at Ripple), Robby Yung (CEO at Animoca Brands), Eric Piscini (CEO at Hashgraph), Charles d’Haussy (CEO at dYdX Foundation), and Robert Drost (CEO at Eigen Foundation) will be present, driving infrastructure, DeFi, and the convergence of AI and Web3.

- Major corporations and fintech: The program includes executives such as Damu Winston (Global Head of Web3 Innovation at Amazon), Esteban Sadurni (Director of Digital Assets and Blockchain at Checkout.com), Michael Higgins (International CEO at Hidden Road), Dotun Rominiyi (Technology Leader at London Stock Exchange Group), and Jaime de Mora (CTO for Startups & Unicorns at Microsoft EMEA), showcasing the strategic and technical role of digital transformation.

Top-Tier Industry Support

Great events attract great partners. This year, MERGE is backed by leading organizations such as: BingX, Bit2Me, Ripple, ATH21, Boerse Stuttgart Digital, ikigii by Towerbank, Arbitrum, Asensi Abogados, Avenia, BSV Blockchain, Chainlink, CryptoMKT, EigenLayer, Finreg360, Lace, Notabene, Parfin, Stakely, Taurus, TRM Labs, and WOW!?

The post Could This Be the Year of Bank-Issued Stablecoins? Watch It Unfold at MERGE Madrid appeared first on BeInCrypto.