XRP recently hit a new all-time high before entering a period of sideways consolidation. The cryptocurrency has struggled to break past resistance but has also managed to avoid a major correction.

This equilibrium, however, may not last much longer as investor behavior signals a shift in momentum.

XRP Investors Are Not Confident

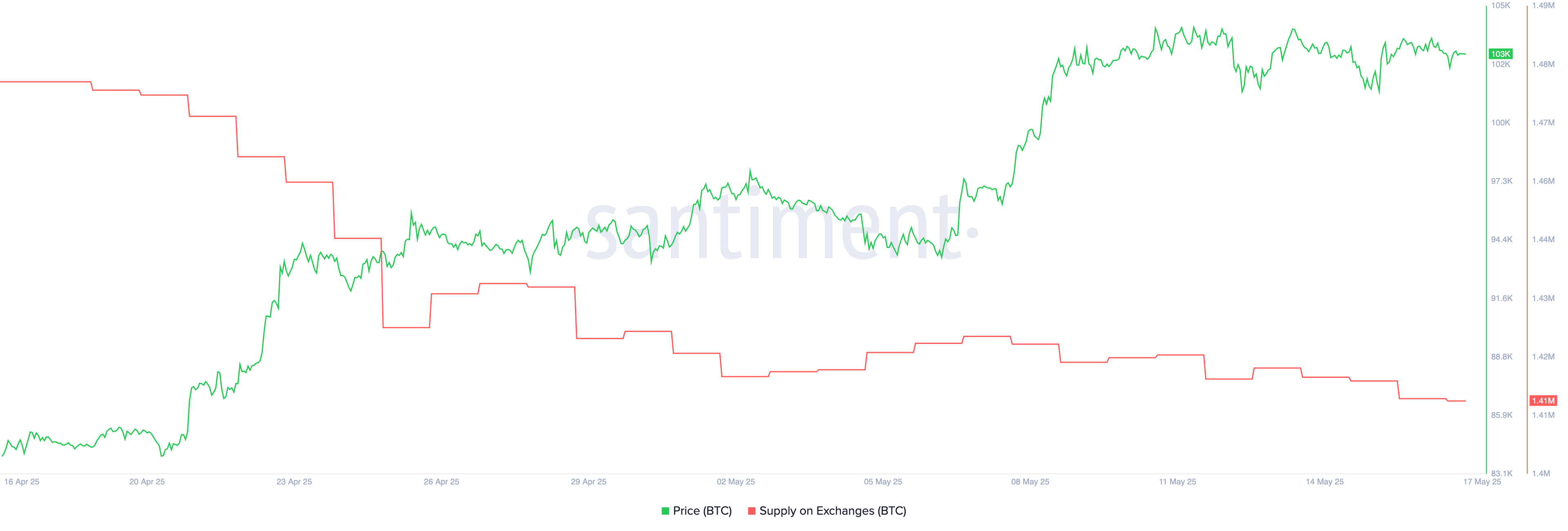

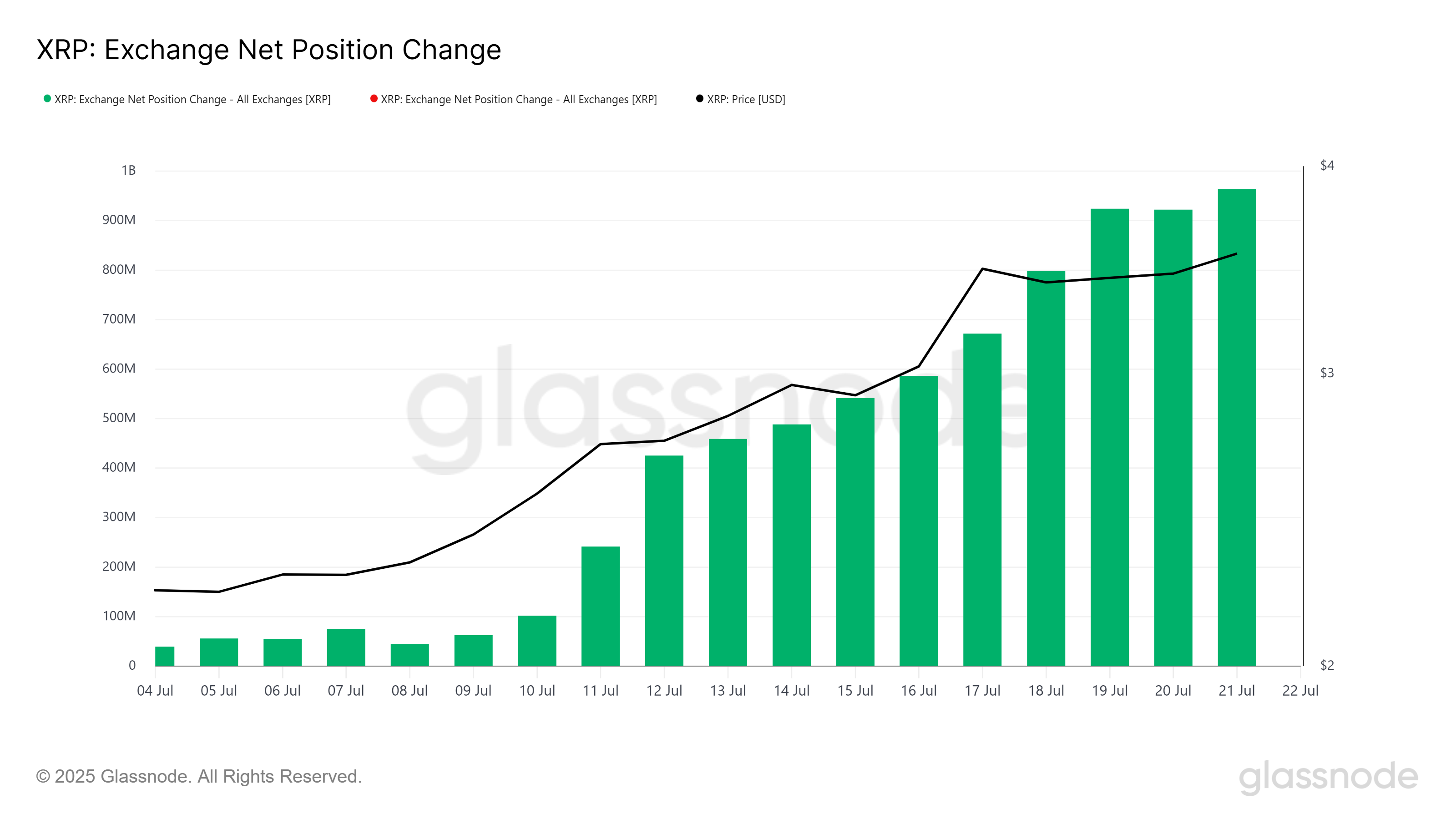

Investors have started selling off large amounts of XRP, suggesting declining confidence in further upside. Over the past week, exchange wallets saw an influx of nearly 450 million XRP, valued at more than $2.81 billion. This spike in supply indicates that holders are moving their assets to sell, usually a bearish indicator in market cycles.

The rapid profit booking appears to be fueled by concerns that XRP has peaked in the short term. As investors move to secure their gains, the pressure on XRP’s price increases. A continued rise in selling could result in a drop below the immediate support levels, making recovery more difficult.

On-chain data further confirms the bearish sentiment. Liveliness, a metric used to track long-term holder (LTH) behavior, is currently at a three-month high. This suggests that LTHs, typically known for their conviction and market influence, are now selling XRP.

Their shift in behavior is a strong indicator of potential downward pressure.

Historically, an uptick in Liveliness precedes market corrections. Since LTHs hold a large portion of the supply, their decisions significantly impact price trends. The increase in Liveliness reflects a broader change in market outlook, aligning with the recent surge in exchange supply and overall decline in bullish sentiment.

Can XRP Price Form Another ATH?

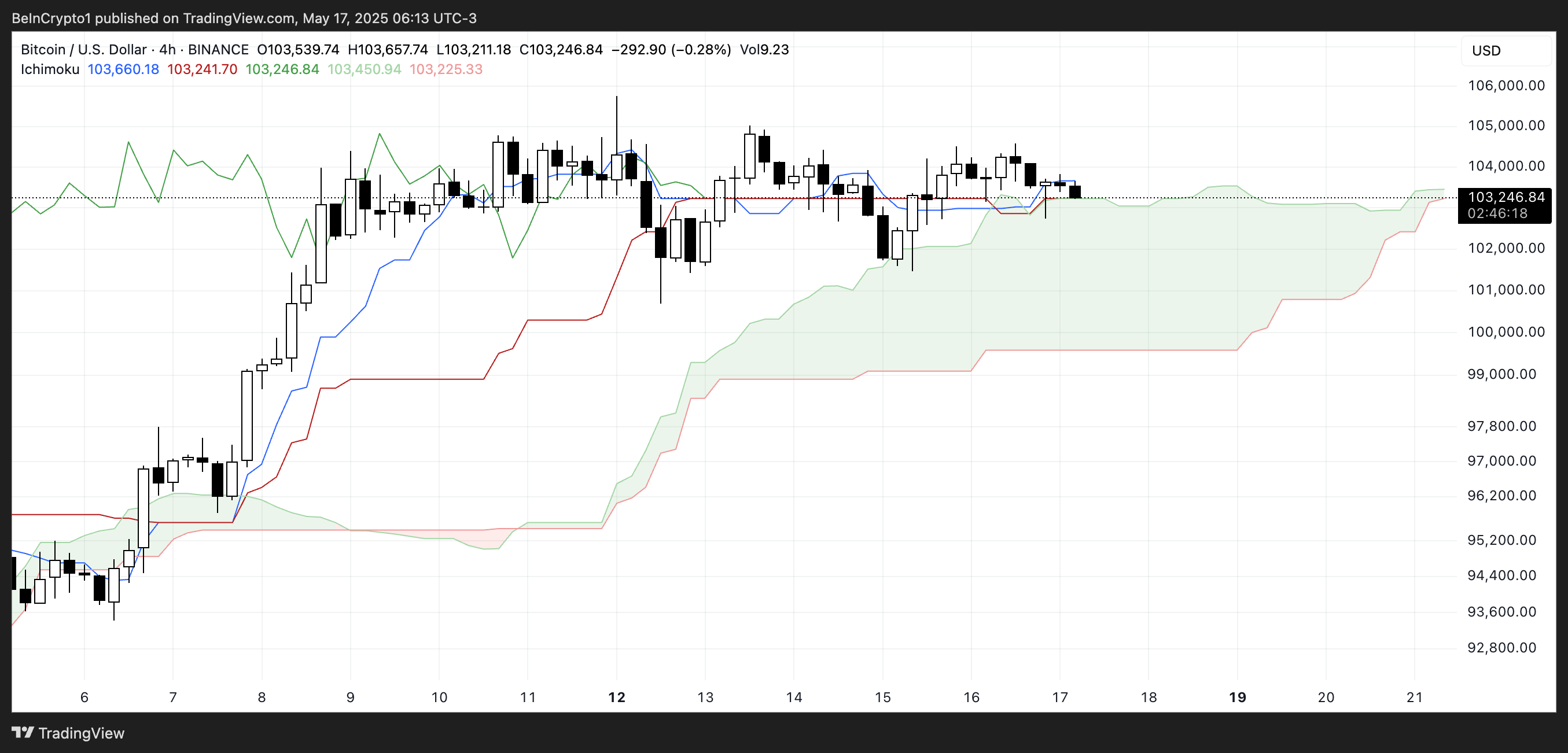

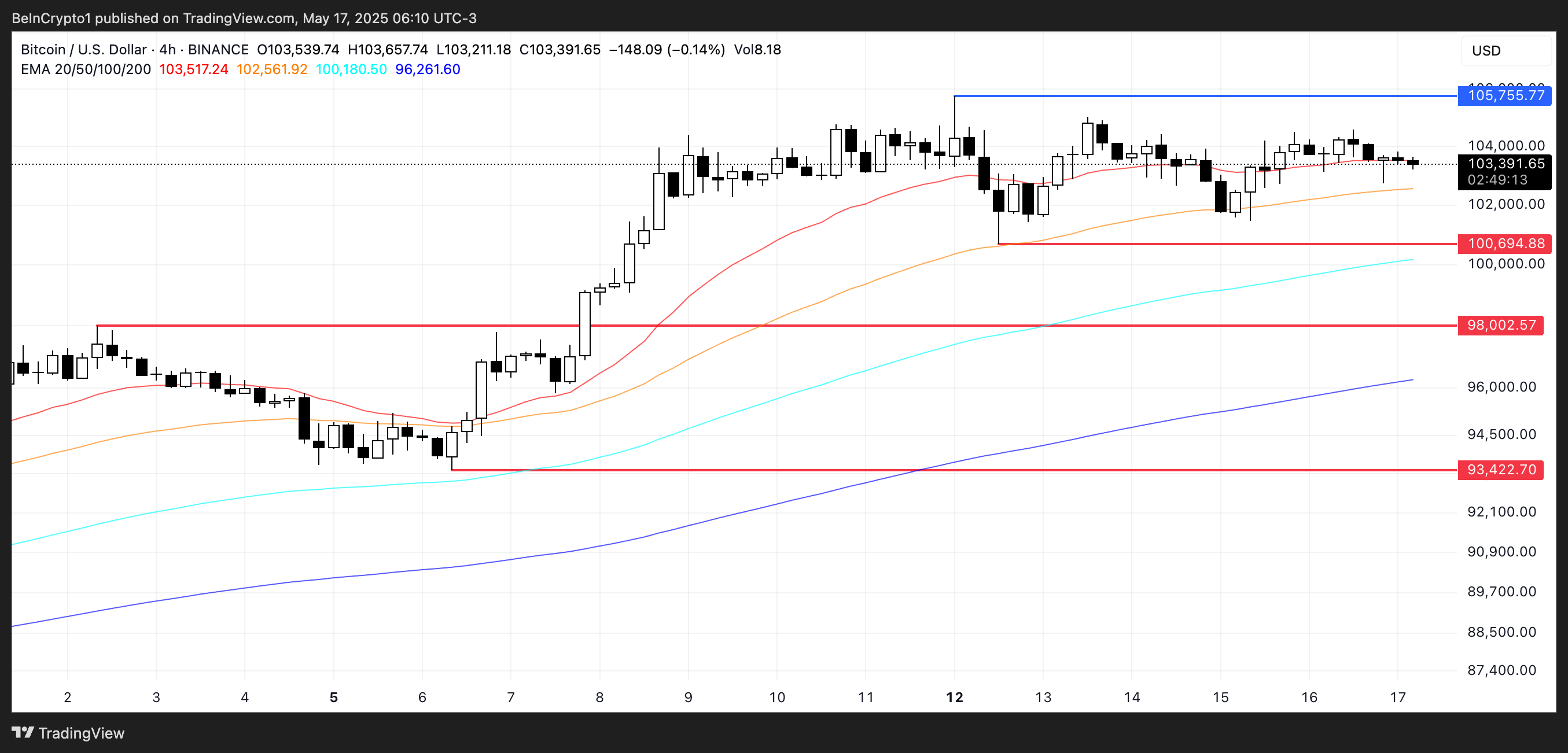

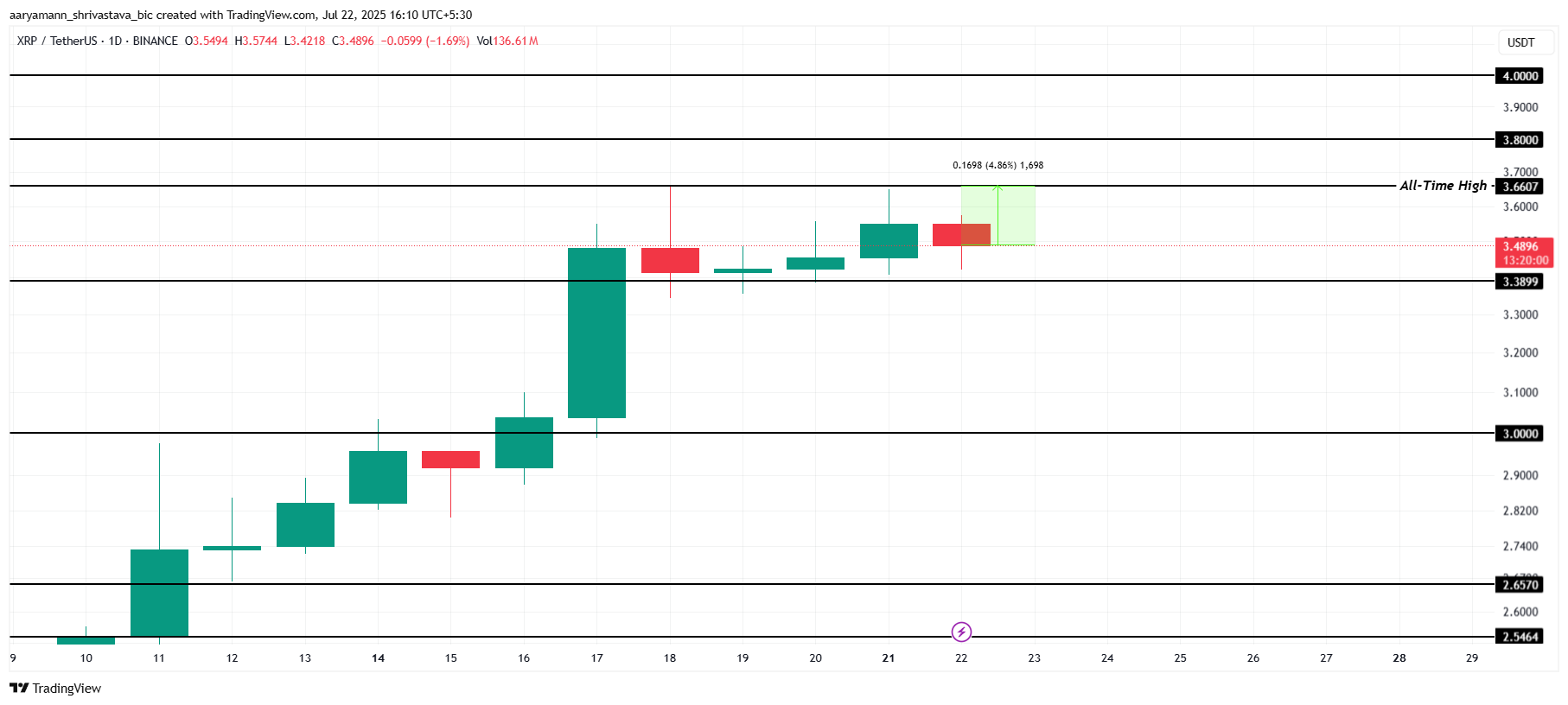

XRP is currently trading at $3.48, only 4.8% away from its all-time high. Despite the proximity, the altcoin is showing signs of weakness and is clinging to the $3.38 support level. Without renewed buying interest, this support may not hold much longer.

If investor selling continues, XRP could fall through $3.38 and test the $3.00 support. A drop to this level would erase the recent gains and confirm a near-term bearish reversal. The loss of $3.00 could signal a longer consolidation phase or deeper correction.

However, if market participants absorb the sold supply and restore demand, XRP could rebound quickly. In this scenario, the altcoin might surpass $3.66, breach $3.80, and aim for $4.00. Such a move would invalidate the bearish outlook, and XRP Price could form a new ATH.

The post XRP Price Reversal Likely After $2.81 Billion Selling in 7 Days appeared first on BeInCrypto.