Based on historical data, July could be the next bullish month for the XRP price, which continues to consolidate amid this crypto market downtrend. Despite the market downturn, crypto analysts like CasiTrades are confident that the altcoin could still reach a new all-time high (ATH) in this market cycle.

Historical Data Points To July Being The Next Bullish Month For The XRP Price

Cryptorank data shows that July could be the next bullish month for the XRP price. This is based on the fact that the altcoin has recorded significant gains in each of the last five Julys.

Unlike July, April to June have been mixed for XRP over the last five years. For April, the last three out of five months have been bearish for the altcoin, although it recorded a 174% gain in April 2021.

For May, three out of the last five months have been bearish for the XRP price, although it recorded meagre gains in May 2023 and 2024. Meanwhile, June has been completely bearish for the altcoin, as it recorded monthly losses in the last five months.

It is worth mentioning that four out of the five monthly gains for XRP in July have been double-digit gains. As such, Ripple’s native crypto could again record double-digit gains this coming July.

Interestingly, crypto analyst Egrag Crypto predicted that XRP could reach double digits by its July 21 cycle peak. He alluded to the altcoin’s previous bull runs as to why July could mark this cycle’s peak. The analyst believes the Ripple price could reach $27 by then.

Analysts Argue XRP’s Consolidation Could End Soon

Amid this historical data, crypto analysts Dark Defender and CasiTrades have suggested that the XRP price consolidation could end soon. In an X post, Dark Defender stated that the altcoin’s consolidation is nearing an end and that he believes this is the final consolidation of the monthly structure.

Once this consolidation is done, the crypto analyst remarked that market participants can expect the Wave 5, which will send Ripple’s native crypto to new highs. He highlighted $2.22 and $2.30 as the major resistances to watch out for, while $1.88 and $1.63 are the major support levels. Meanwhile, the targets on this Wave 5 up are $3.75 and $5.85, which will mark a new ATH for the altcoin.

As CoinGape reported, crypto analyst CasiTrades also predicted that the XRP price could soon reach $6 as Wave 2 correction nears its end. The analyst also raised the possibility of the altcoin rallying to as high as $9.50 and $12 if it reaches the 2.618 and 3.618 Fibonacci extension levels, respectively.

However, there is still the possibility of the XRP price dropping below the $2 level before it rallies to new highs. Egrag Crypto warned that Ripple’s native crypto could still drop to as low as $1.4 in the event of a major liquidation.

The post XRP Price History Signals July As The Next Bullish Month appeared first on CoinGape.

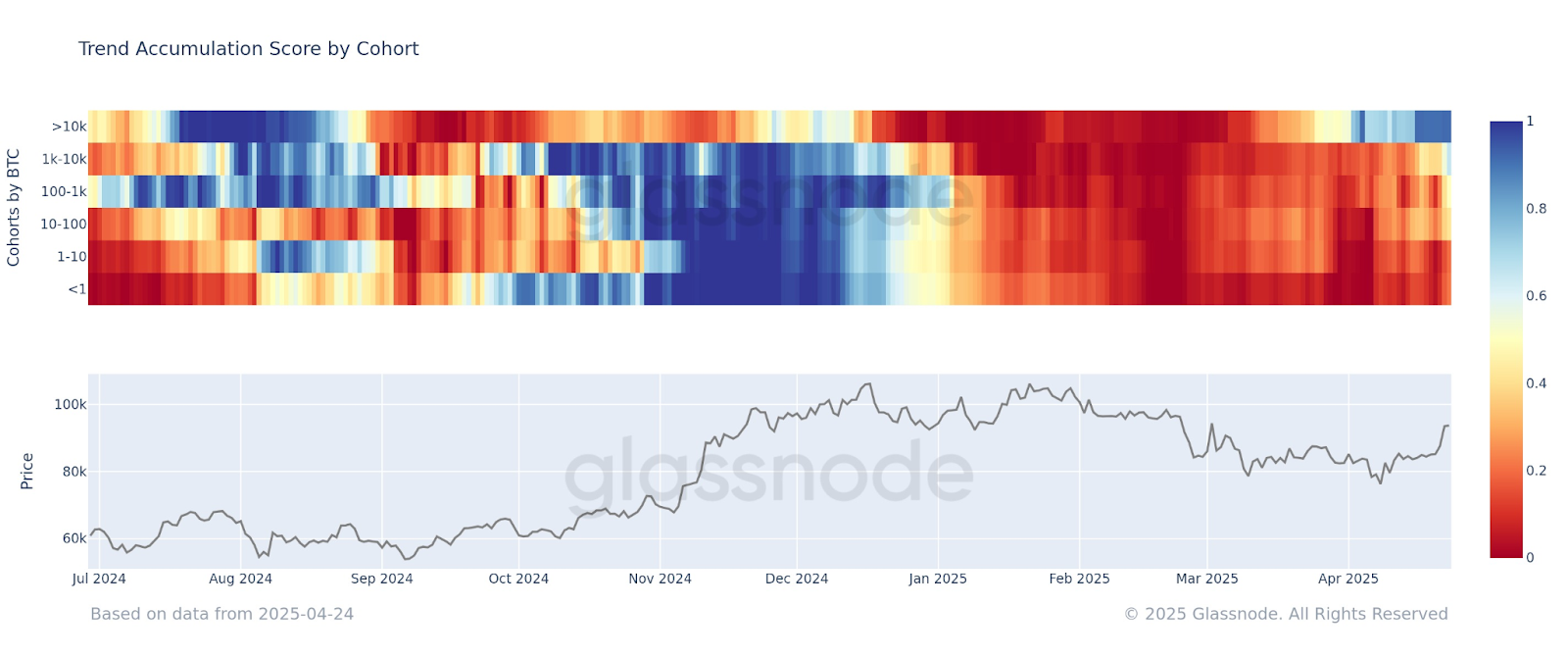

Bitcoin’s value has jumped +11.2%, and this has once again coincided with key whales & sharks adding on to their already enormous bags. Wallets holding 10-10K

Bitcoin’s value has jumped +11.2%, and this has once again coincided with key whales & sharks adding on to their already enormous bags. Wallets holding 10-10K