The post XRP Price 35% Crash Still in Play? Bears Have Eyes on $1.20 appeared first on Coinpedia Fintech News

In this ongoing market crash, XRP, Ripple Labs’ native token, is poised for a massive price decline despite its recent price recovery. Today, April 7, 2025, the overall crypto market has witnessed a significant downward rally, but it now appears to be recovering. However, some see this as a potential pullback before an upcoming price crash.

XRP Technical Analysis and Upcoming Level

According to expert technical analysis, XRP appears to be continuing its downward momentum. The daily chart reveals that XRP is currently retesting its recent breakdown of the key support level at $1.95.

In addition to the support breakdown, XRP has also breached the neckline of a bearish head and shoulders price action pattern and has closed a daily candle below the 200 Exponential Moving Average (EMA). This is the first time XRP has fallen below its 200 EMA, which now shifts it into a strongly bearish asset.

Based on the recent price action and historical momentum, the candle closing below the key level has opened the path for a massive price crash, as the next support is not nearby.

According to CoinPedia’s price analysis, if XRP fails to reclaim the $1.95 level, there is a strong possibility it could drop by 39% to reach the next support at the $1.20 level in the future.

Current Price Momentum

At press time, XRP is trading near $1.88 and has recorded a price decline of over 6.50% in the past 24 hours. Meanwhile, amid the price drop, the asset also hit a low of $1.64. This significant downside move and increased price volatility have attracted notable interest from traders and investors, resulting in a 420% surge in trading volume.

$35.40 Million Worth of Bullish Bet

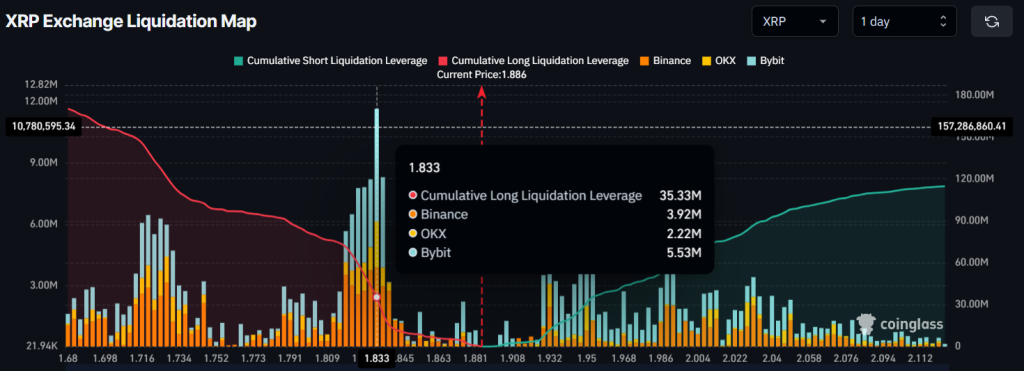

However, looking at the ongoing price recovery, trader sentiment seems to be shifting as they are strongly betting on the bullish side, according to the on-chain analytics firm Coinglass.

Data reveals that traders are currently over-leveraged at $1.833 on the lower side (support) and have built $35.40 million worth of long positions. On the other hand, $1.932 is another over-leveraged level on the upper side (resistance), where traders have built $11.80 million worth of short positions.

The on-chain data indicates that the bulls are back, as the price appears to be retesting its breakdown level.