The post XRP, PEPE Rebound Underway, But Cardano and This DeFi Token Look Stronger appeared first on Coinpedia Fintech News

The crypto market pulses with activity as XRP tests key resistance levels, PEPE hints at a bullish reversal, and Cardano edges closer to a golden cross. Yet amid these developments, Rexas Finance (RXS) emerges as a standout contender, leveraging real-world asset tokenization to redefine blockchain utility. While XRP battles the $2.22 resistance and PEPE eyes a potential double-bottom breakout, RXS has already surged 6.6x during its presale, drawing $48 million from investors eager to capitalize on its transformative vision.

XRP Price Tests Crucial Resistance

XRP hovers near $2.15, consolidating within an ascending triangle pattern. Analysts highlight the $2.22 resistance as a critical threshold, with a breakout potentially propelling the token toward $2.40. The Moving Average Convergence Divergence (MACD) tilts bullish on 4-hour charts, and the Relative Strength Index (RSI) at 60 leaves room for upward momentum. Legal clarity from Ripple’s recent $125 million settlement with the SEC adds optimism, but uncertainty lingers. While XRP’s technicals suggest growth, its reliance on broader market sentiment contrasts sharply with Rexas Finance’s tangible use cases.

PEPE Coin Eyes Reversal Amid Bullish Patterns

PEPE’s price action reveals a double-bottom formation, with analysts predicting a 100% surge if it breaches the $0.000092 neckline. The Relative Strength Index (RSI) inches toward neutrality, and a falling wedge breakout hints at renewed momentum. Despite these signals, PEPE remains tethered to meme coin volatility, lacking the foundational utility driving projects like RXS.

Cardano’s Golden Cross Signals Accumulation

Cardano’s 10% weekly gain aligns with a rising Average Directional Index (ADX), signaling trend strength. Whale wallets show tentative accumulation after hitting a 14-month low, and a looming golden cross could ignite a rally toward $0.70. However, ADA’s trajectory hinges on broader adoption—a challenge Rexas Finance sidesteps by directly linking blockchain innovation to real-world assets like real estate and commodities.

Rexas Finance Bridges Real-World Assets and Blockchain

Rexas Finance dismantles barriers to global investment by tokenizing assets like real estate and gold. Imagine a nurse in Nigeria owning a fraction of a Tokyo apartment, earning passive income through blockchain-secured ownership. This system democratizes access, enabling users to buy, sell, or fractionalize assets with a click. The $256 trillion global real estate market alone underscores RXS’s potential, positioning it to dominate the $16 trillion tokenized asset sector projected by 2030. Rexas empowers users to tokenize assets effortlessly via its Token Builder, while its Launchpad lets projects secure funding without intermediaries. Coupled with tools like QuickMint Bot for instant asset conversion and AI Shield for fraud detection, RXS erases complexities plaguing traditional finance.

CertiK-Audited Security Fuels Presale Momentum

Rexas prioritizes trust, undergoing rigorous CertiK audits to validate its smart contracts. Investors have responded emphatically: 92.2% of the 500 million RXS presale allocation sold out, raising $48.1 million. A whale recently snapped up 750,000 RXS ($150,000) at $0.20 per token, anticipating gains post-listing. With the final presale stage priced at $0.20 and a confirmed $0.25 listing price in 2025, RXS offers a 25% upside at launch—and analysts project a $10+ valuation as adoption accelerates.

Why Rexas Finance Stands Out

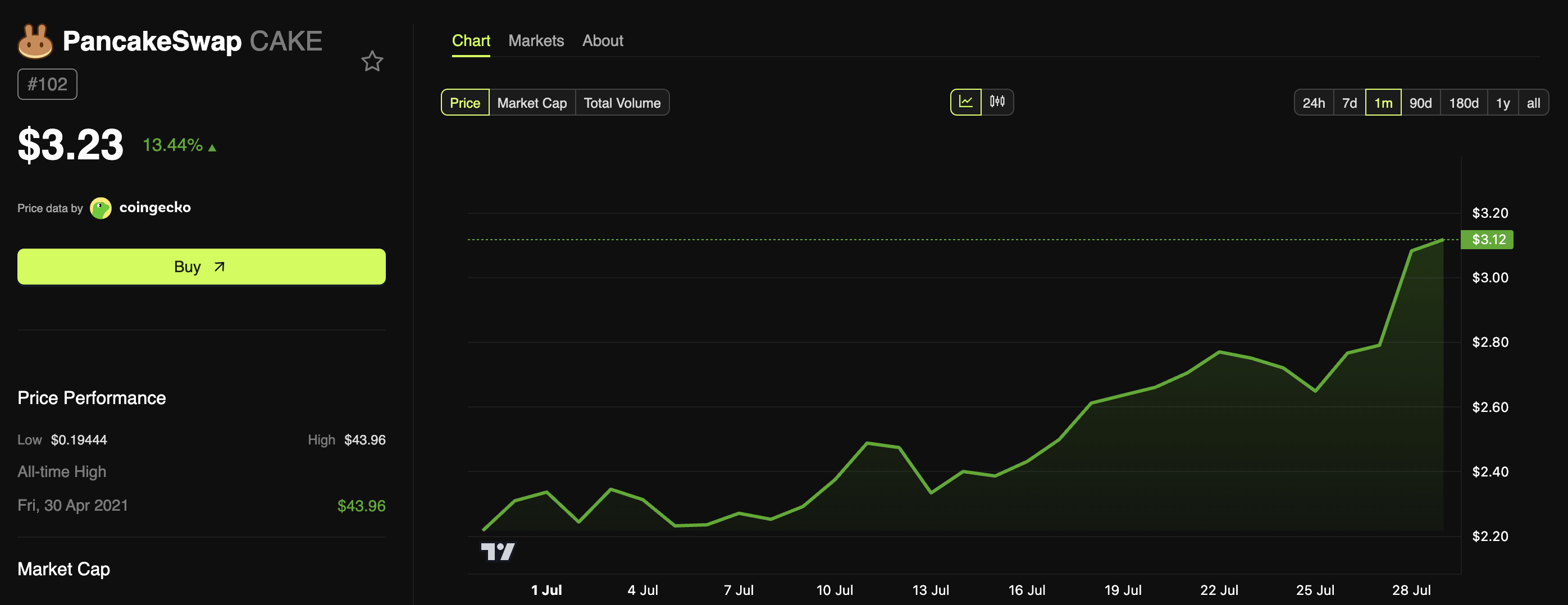

While XRP and Cardano hinge on market sentiment, RXS thrives on utility. Its $1M “Rexas Millionaire Giveaway” amplifies visibility, rewarding 20 winners with $50,000 each. Listings on CoinMarketCap and CoinGecko bolster credibility, and plans to debut on three top-tier exchanges promise liquidity. By rejecting VC funding in favor of public presale access, Rexas aligns incentives with everyday investors. Rexas Finance delivers substance. From fractional Tokyo apartments to AI-driven security, RXS isn’t just riding trends—it’s building the future. As the presale’s final stage nears completion, the window to join this revolution narrows.

For more information about Rexas Finance (RXS) visit the links below:

Win $1 Million Giveaway: https://bit.ly/Rexas1M

Whitepaper: https://rexas.com/rexas-whitepaper.pdf

Twitter/X: https://x.com/rexasfinance

Telegram: https://t.me/rexasfinance

The post XRP, PEPE Rebound Underway, But Cardano and This DeFi Token Look Stronger appeared first on Coinpedia Fintech News

The crypto market pulses with activity as XRP tests key resistance levels, PEPE hints at a bullish reversal, and Cardano edges closer to a golden cross. Yet amid these developments, Rexas Finance (RXS) emerges as a standout contender, leveraging real-world asset tokenization to redefine blockchain utility. While XRP battles the $2.22 resistance and PEPE eyes …