XRP has suffered a near 10% decline over the past week, dampening trader sentiment and triggering a wave of sell-side activity in its futures market.

As buying pressure wanes, the altcoin risks plunging below the key support formed at $2 in the near term.

XRP Futures Traders Position for Decline

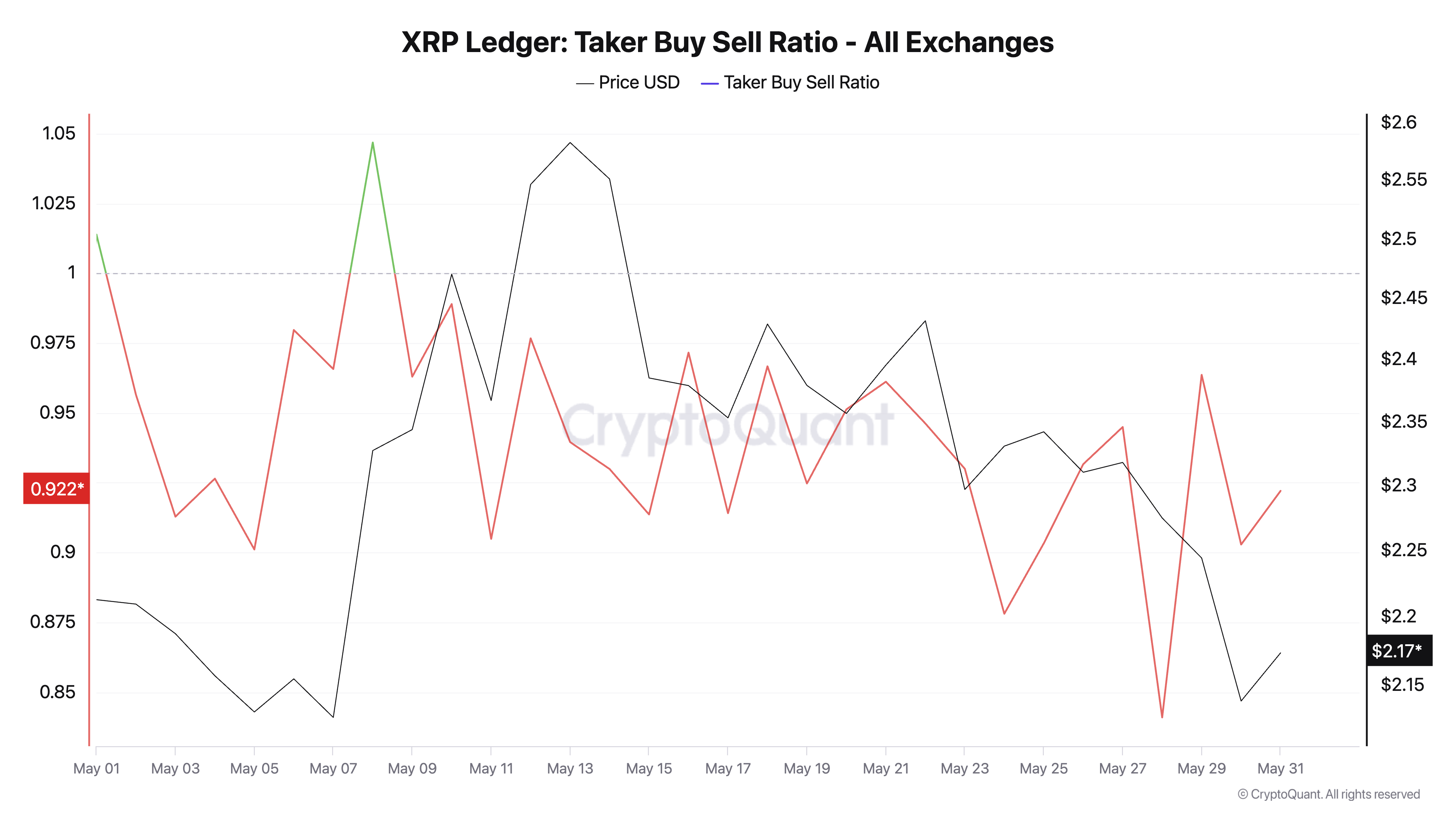

The bearish tone in the XRP market is evident in the token’s taker buy/sell ratio, which has consistently posted negative values for the past two weeks.

This indicates that sell orders dominate buy orders across the XRP futures market. At press time, this stands at 0.92, per CryptoQuant.

An asset’s taker buy-sell ratio measures the ratio between the buy and sell volumes in its futures market. Values above one indicate more buy than sell volume, while values below one suggest that more futures traders are selling their holdings.

The sustained decline in XRP’s taker buy/sell ratio over the past few weeks points to a mounting sell-off among futures traders, many of whom are increasing their exposure to short positions.

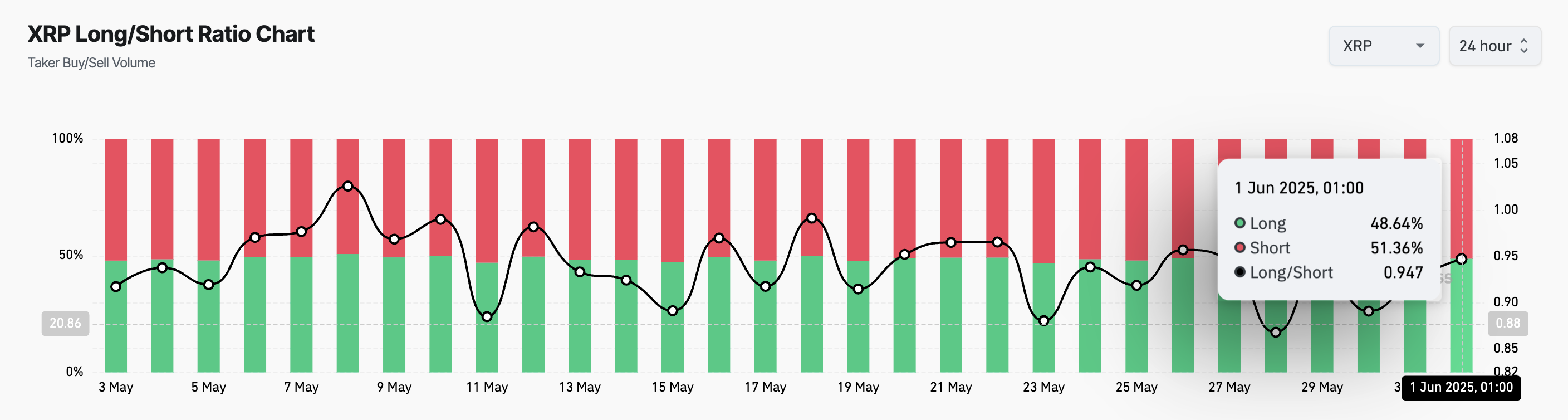

This is reflected by the token’s long/short ratio, which currently stands at 0.94.

For context, this metric has remained below one since May 8, highlighting that traders have been positioning for a downside move for nearly a month.

The extended demand for short positions suggests that XRP’s price dip is not just a reaction to short-term volatility. It also shows a broader bearish tilt increasingly driven by expectations of lower prices.

Will XRP Hold the $2 Support?

At press time, XRP trades at $2.13. If bearish pressure gains momentum, the token risks slipping below the psychological $2 mark. A breach of this key support line could deepen the ongoing correction and cause XRP to trade below $1.99.

However, a resurgence in new demand for the altcoin could invalidate this bearish outlook. If buying surges, the XRP token could witness a bullish correction and climb to $2.29.

The post XRP Futures Show Increasing Sell Orders – Will It Drop Below $2? appeared first on BeInCrypto.