Solana has been making a concerted effort to recover from the losses it faced over the past three months. Recently, the altcoin has been gaining traction, aided by Long-Term Holders (LTHs) who have joined the rally.

This support is likely to help solidify Solana’s path toward a full recovery in the coming month.

Solana Investors Have Something To Look Forward To

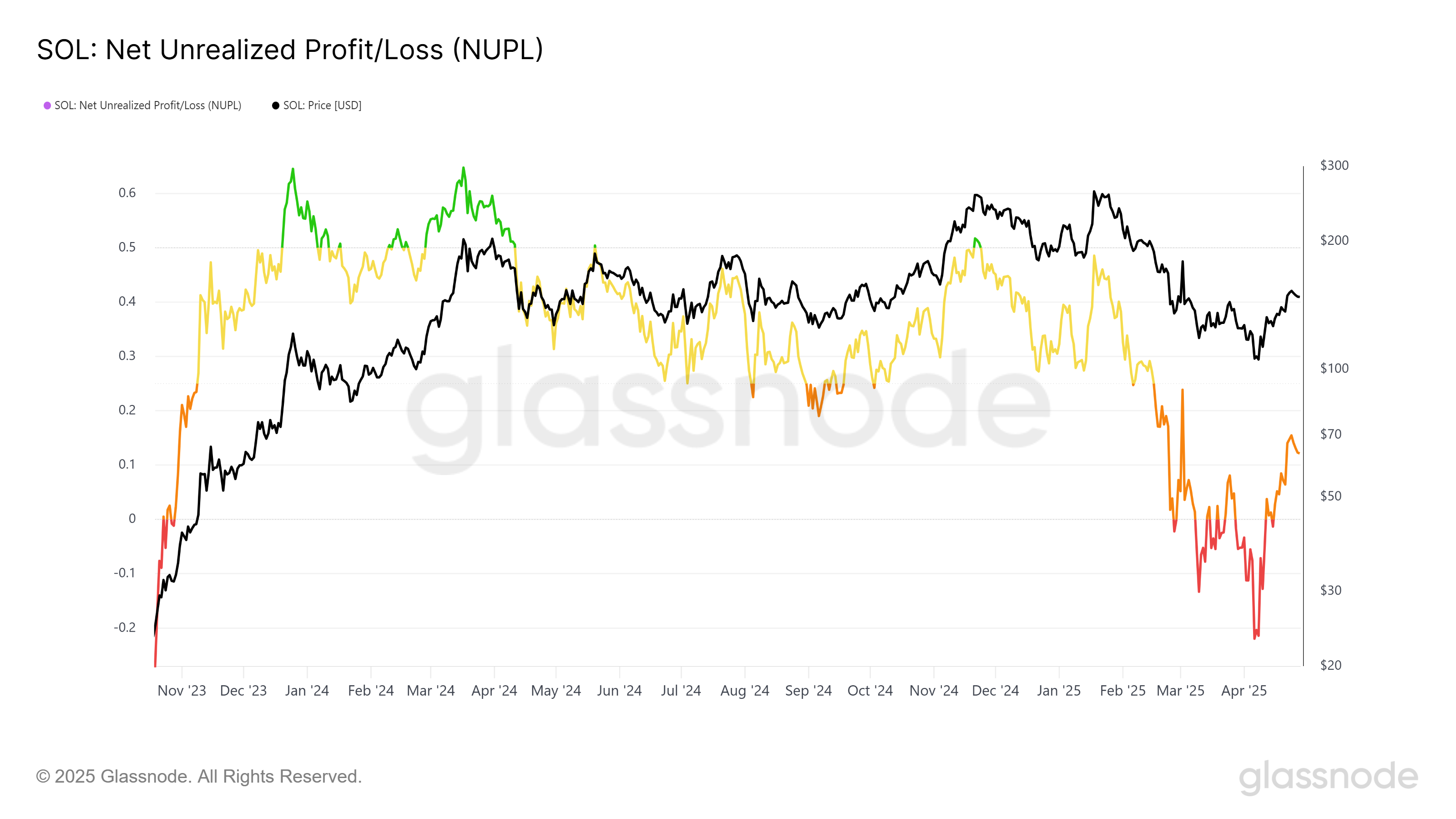

Currently, Solana is in the “Hope” zone according to the Net Unrealized Profit/Loss (NUPL) indicator. Historically, when Solana entered this zone, it often preceded price increases, with the price rising as the indicator moves closer to the “Optimism” zone at 0.25. While Solana is still far from this threshold, the altcoin’s price could rise in anticipation of further bullish momentum.

In addition to the strong NUPL signal, Solana is seeing significant interest from institutional investors. This interest is further reinforcing the positive market sentiment as more institutional investors are increasing their exposure to Solana. This institutional confidence is likely to contribute to the ongoing positive price action and add strength to Solana’s recovery.

Recently Canada approved the world’s first spot SOL ETF which is a big deal considering US investors have been asking for the same longer. But Chris Chung, CEO and Co-Founder at Titan during a discussion with BeInCrypto talked about their weak impact.

“Canada’s approval of spot SOL ETFs isn’t enough to buoy Solana’s price in and of itself, but what it does do is send a clear signal that the institutional world is ready for Solana. Especially considering the Ontario Securities Commission (OSC) has approved staking, which has been a contentious issue for a long time. Now, the US SEC will almost certainly have to follow suit soon, which will be a bigger deal in terms of inflows,” Chung stated.

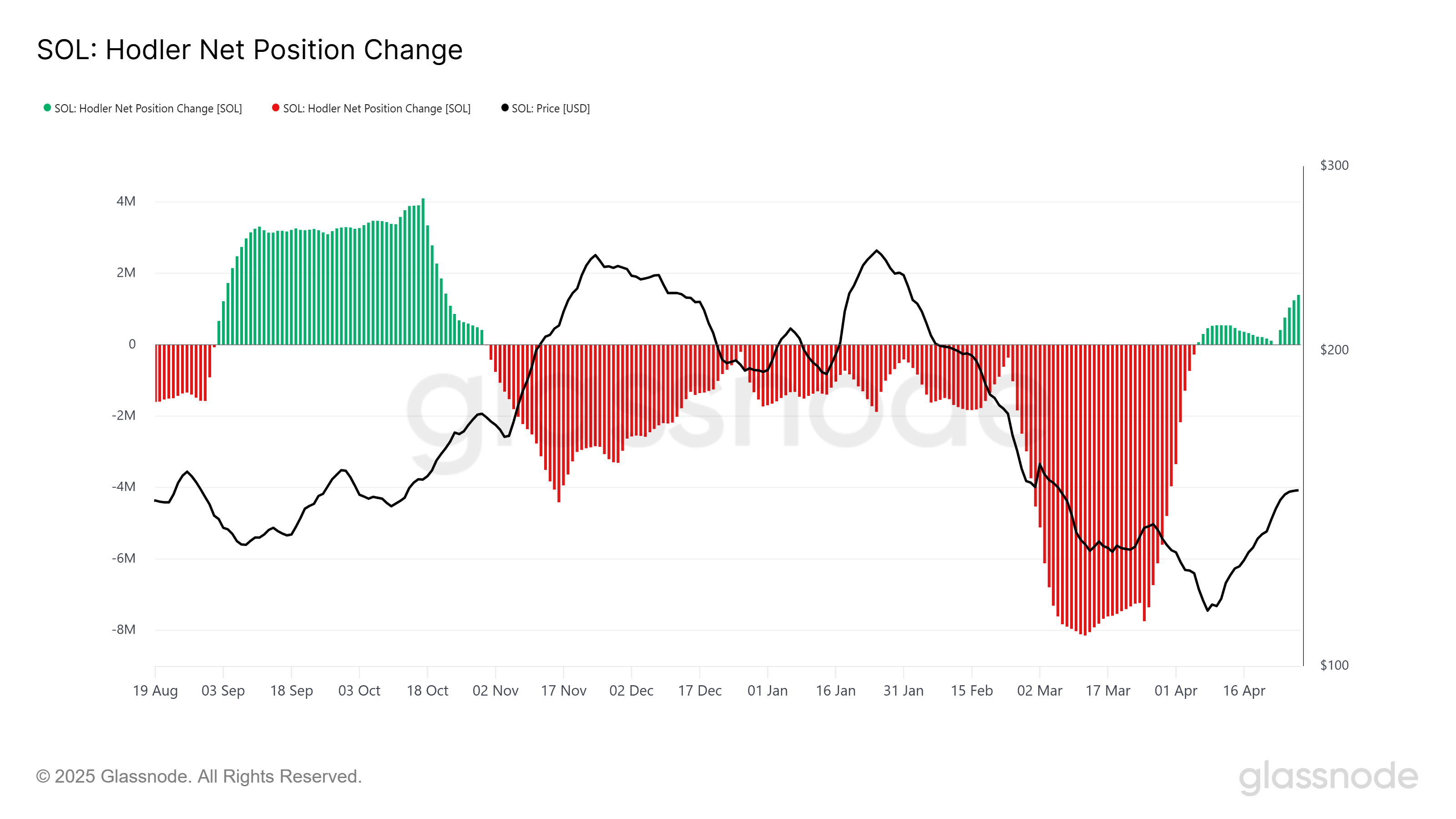

Thus, Solana’s macro momentum is also showing signs of improvement, as the HODLer Net Position Change has recently spiked. This spike is indicative of an increasing accumulation by Long-Term Holders (LTHs), which suggests a growing conviction in the asset. LTH accumulation signals confidence in Solana’s long-term price rise, and the altcoin is likely to benefit from this continued accumulation.

The fact that LTHs are increasingly holding their positions is a strong indicator of confidence in Solana’s future. This trend could help stabilize the price and support further growth, as LTHs typically strongly influence market direction. With more investors holding onto their SOL tokens, the foundation for a sustained upward movement is being laid.

SOL Price Is On Track To Rally

Solana’s price has surged by 41% this month, reaching $149 at the time of writing. The next major resistance is at $180, and breaching this level would mark a significant recovery from the losses experienced in March. To reach $180, SOL needs a 21.8% rise, which seems attainable given the current momentum.

If Solana successfully breaks through $180, it will be well-positioned to maintain its bullish momentum. A continued rise could help SOL recover losses from February as well, potentially pushing the price to $221. However, this price increase would likely come with some market saturation, capping further immediate gains.

However, if investors decide to sell their holdings prematurely, Solana’s price could take a significant hit. Failing to break through the $180 resistance level could result in a decline, possibly falling back to $123. This scenario would invalidate the current bullish thesis, signaling a potential reversal and halting the recovery.

The post What To Expect From Solana (SOL) In May 2025? appeared first on BeInCrypto.