USDC stablecoin issuer Circle just applied to become a US national trust bank. But the bigger story isn’t banking—it’s stablecoin dominance.

As Congress moves to regulate stablecoins with the GENIUS Act, Circle’s move could signal a coming power shift from USDT to USDC in the US market.

Circle’s Trust Bank Could Change the Stablecoin Market

If approved by the OCC, Circle’s new entity—First National Digital Currency Bank—would allow the company to custody its own reserves.

Also, it would be permitted to hold digital assets like tokenized bonds and stocks on behalf of institutional clients.

However, the trust bank license will not allow Circle to take deposits or issue loans.

This marks a strategic regulatory step following Circle’s IPO earlier this month, which valued the company at nearly $18 billion.

More importantly, it signals Circle’s intent to align with forthcoming US stablecoin regulation.

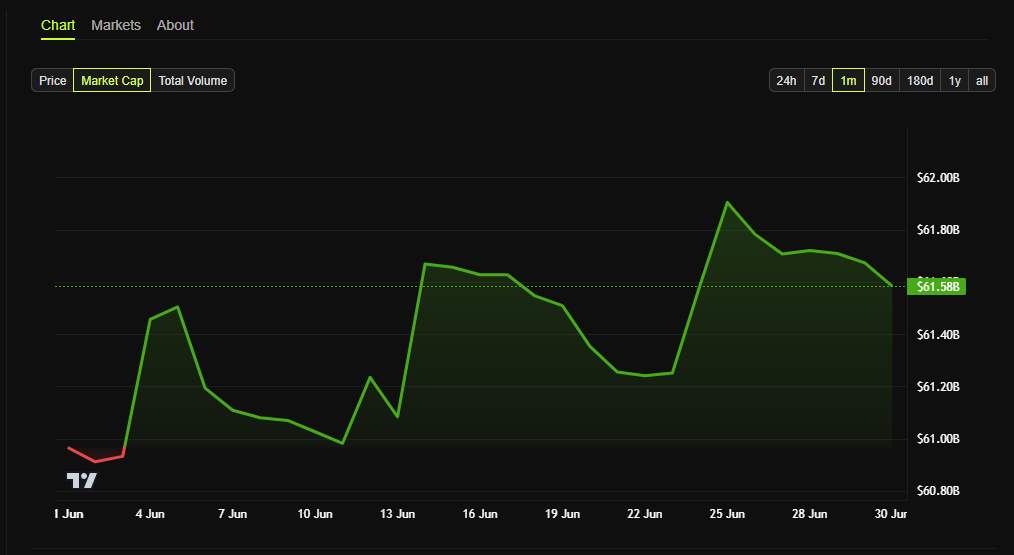

Tether’s USDT still dominates the global stablecoin market, with a 62.5% share. Much of that usage occurs outside US borders, especially across Asia.

USDT’s popularity comes from its liquidity and deep exchange integrations. But in the US, the regulatory space is shifting.

Congress is preparing to pass the GENIUS Act into law. This landmark stablecoin bill requires issuers to hold fully backed reserves and obtain federal licenses.

Once passed, only licensed firms like National Trust Banks would be allowed to issue stablecoins at scale. This gives Circle a first-mover advantage.

Tether’s USDT Still Dominates—But for How Long?

By becoming a national trust bank, Circle positions USDC as a fully compliant, US-regulated stablecoin.

It would likely become the preferred choice for banks, fintechs, and regulated institutions looking to integrate stablecoins.

Meanwhile, Tether operates under an El Salvador registration and is not regulated under US federal frameworks.

That gap could become more problematic if US exchanges are required to delist or restrict access to unlicensed stablecoins.

Circle’s strategy goes beyond regulation. It aims to control more of its infrastructure by directly managing USDC reserves, rather than relying on custodians like BNY Mellon.

The trust license would also allow Circle to serve institutional clients seeking to custody tokenized stocks and bonds—not just crypto.

This positions Circle to lead in the next phase of stablecoin adoption, as tokenized assets and real-world applications grow.

For everyday users, this could mean broader USDC integration in wallets, payment apps, and financial services. As regulation tightens, US-based platforms may shift preference from USDT to USDC.

To sum it up, USDC could:

- Be used more in tokenized finance (real estate, stocks).

- See better integration with banking apps and neobanks.

- Offer stronger consumer protections under US law.

Tether still holds global dominance. But Circle’s trust bank application could shift the balance within US markets.

In the coming months, the US may have to choose between offshore liquidity and onshore compliance. Circle just made its move.

The post What Circle’s US Trust Bank Bid Means for USDT and Stablecoin Competition appeared first on BeInCrypto.