The trade war between the United States (US) and China is heating up, which is threatening to tumble the global markets, including the crypto market. Specifically, the US has announced that a 104% tariff rate on China will begin on April 9, while the Asian country is already making moves to retaliate.

Crypto Market Risks More Downside With US Set To Impose 104% Tariffs On China

The crypto market risks a further crash as the trade war between the US and China heightens. According to a Bloomberg report, US officials revealed that the country will proceed with a 104% tariff on Chinese goods, which takes effect from April 9.

As Coingape reported, US President Donald Trump threatened an additional 50% tariff on Chinese goods if the country fails to lift its 34% counter-tariffs by April 8. However, China has made it clear that it has no intention to lift the 34% tariffs.

As such, the 104% tariffs are a cumulative of all earlier tariffs that Trump imposed, plus the 50% that he threatened to impose yesterday. China is also expected to retaliate with further tariffs as the country has promised to fight till the end.

The crypto market is reacting to the news of the 104% tariffs on China, with the Bitcoin price sharply dropping below $77,000. Coinglass data shows that the market has recorded almost $50 million in liquidations in the last one hour. Long positions have suffered the most, with almost $40 million in long positions wiped out.

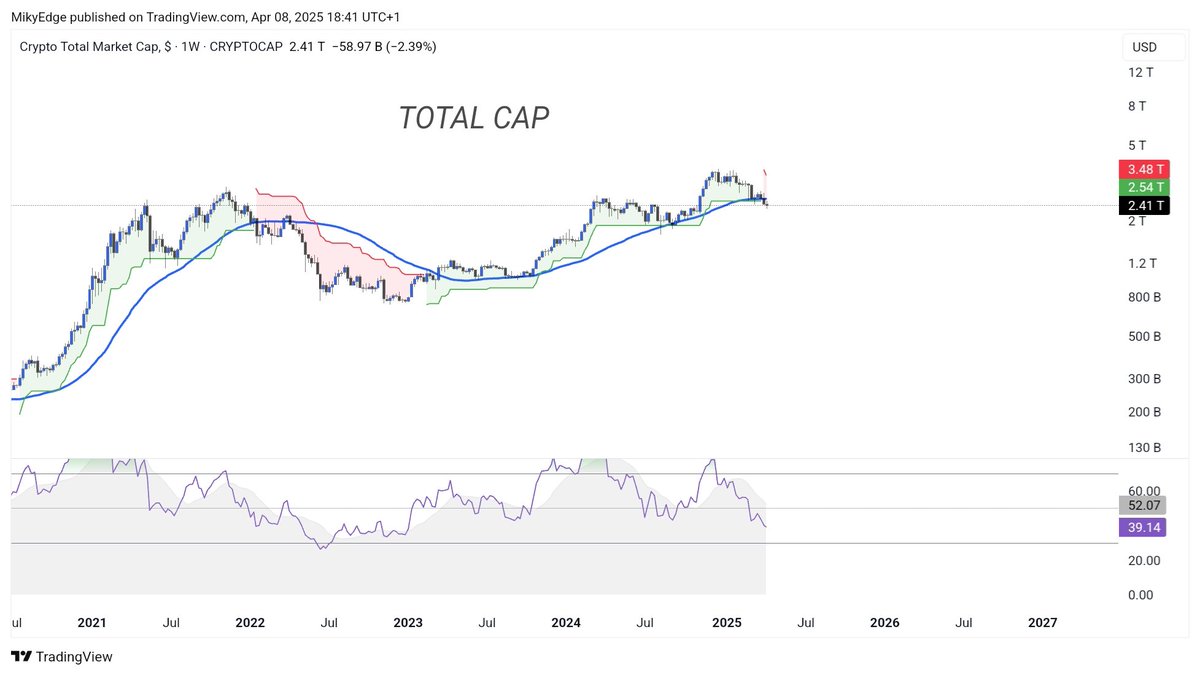

Crypto analyst Mikybull Crypto revealed that the total cap has just flashed on the sell signal, providing a bearish outlook for the market. The analyst noted that this same thing happened in 2018 and 2022, which began the bear market. He added that 2019/2020 was the outlier due to the pandemic.

BTC Could Still Drop To As Low As $70,000

Crypto analyst Rekt Capital has predicted that the Bitcoin price could bottom at around $70,000 amid the US-China trade war. The analyst noted that whenever Bitcoin’s daily RSI crashed into the sub-28 RSI level, it wouldn’t necessarily mark out the price bottom.

Rekt Capital stated that, historically, the actual price bottom would be -0.32% to 8.44% lower than the price when the RSI first bottomed. He revealed that BTC is currently forming its second low, -2.79% below the first low. The analyst claimed that a repeat of -8.44% below the first low would see the Bitcoin price at around $70,000.

In line with this, the crypto market could witness a massive crash as Bitcoin drops to $70,000. The Ethereum price has again dropped below $1,500, while other altcoins risk dropping to new lows.

The post US-China Trade War: Crypto Market Risks More Downside As Tariffs Go Into Effect appeared first on CoinGape.