The post TRX Poised to Hit $0.25, Is Solana Integration Fuel the Rally? appeared first on Coinpedia Fintech News

Amidst the ongoing market uncertainty, TRX, the native token of Tron, is standing out from other assets due to its impressive performance over the past 24 hours. As of today, March 19, 2025, the asset has recorded an 8% gain, outperforming major cryptocurrencies like Bitcoin (BTC) and Ethereum, along with several others.

TRX Defies Bearish Trend and Outperforms BTC and ETH

The upside rally and price surge in TRX occurred after billionaire and Tron founder Justin Sun made a major announcement. Today, in a post on X (formerly Twitter), Sun stated, “TRX will be soon on Solana. Ready to buy and collaborate.”

It appears that this collaboration with Solana aims to enhance cross-chain transactions with SOL and other meme coins while leveraging Solana’s fast and low-cost network to improve overall efficiency.

Current Price Momentum

Sun’s announcement, amid the current market sentiment, helped TRX recover its losses, turn bullish, and sustain its upside momentum. The asset is currently trading near $0.238, recording a price surge of over 8.50% in the past 24 hours.

Additionally, following this announcement, trader and investor participation skyrocketed, leading to a 25% surge in trading volume.

Tron (TRX) Technical Analysis and Upcoming Levels

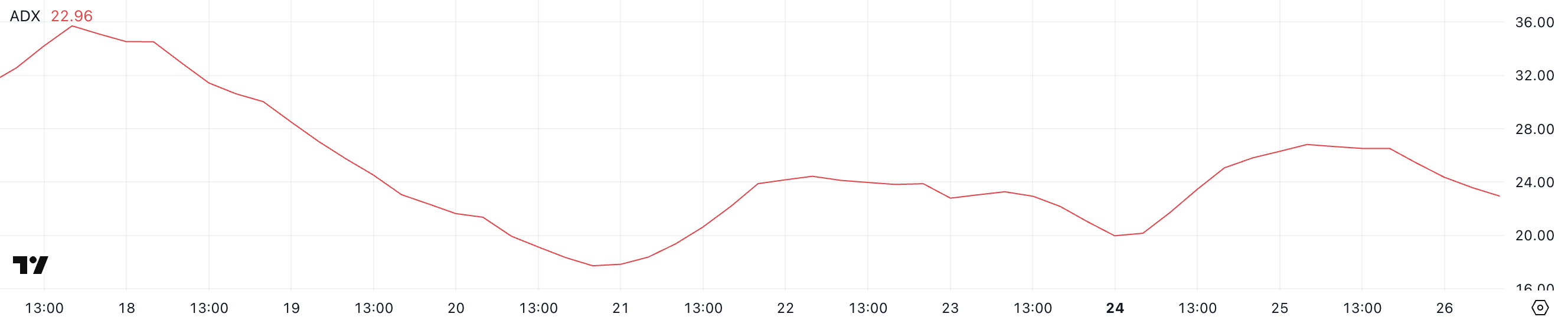

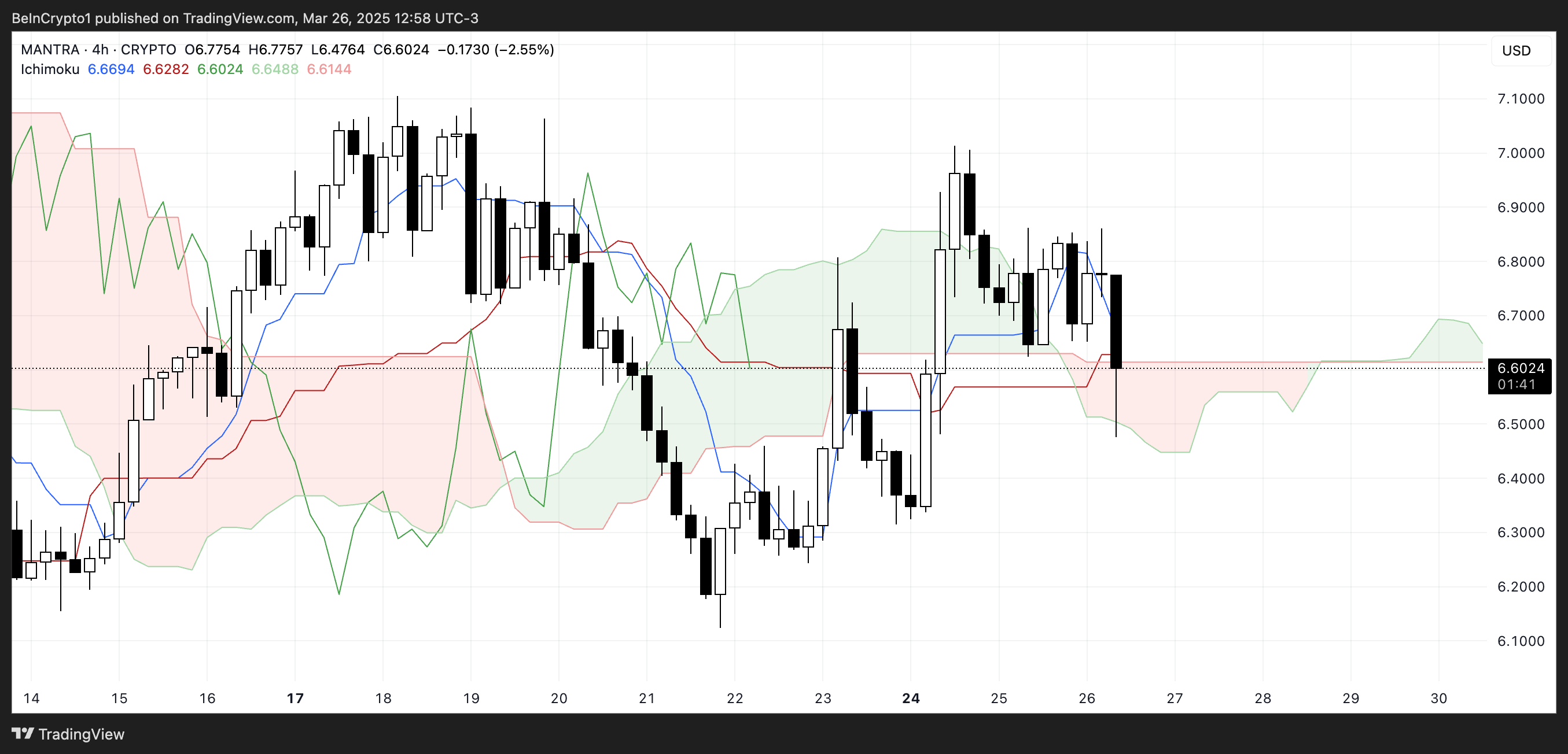

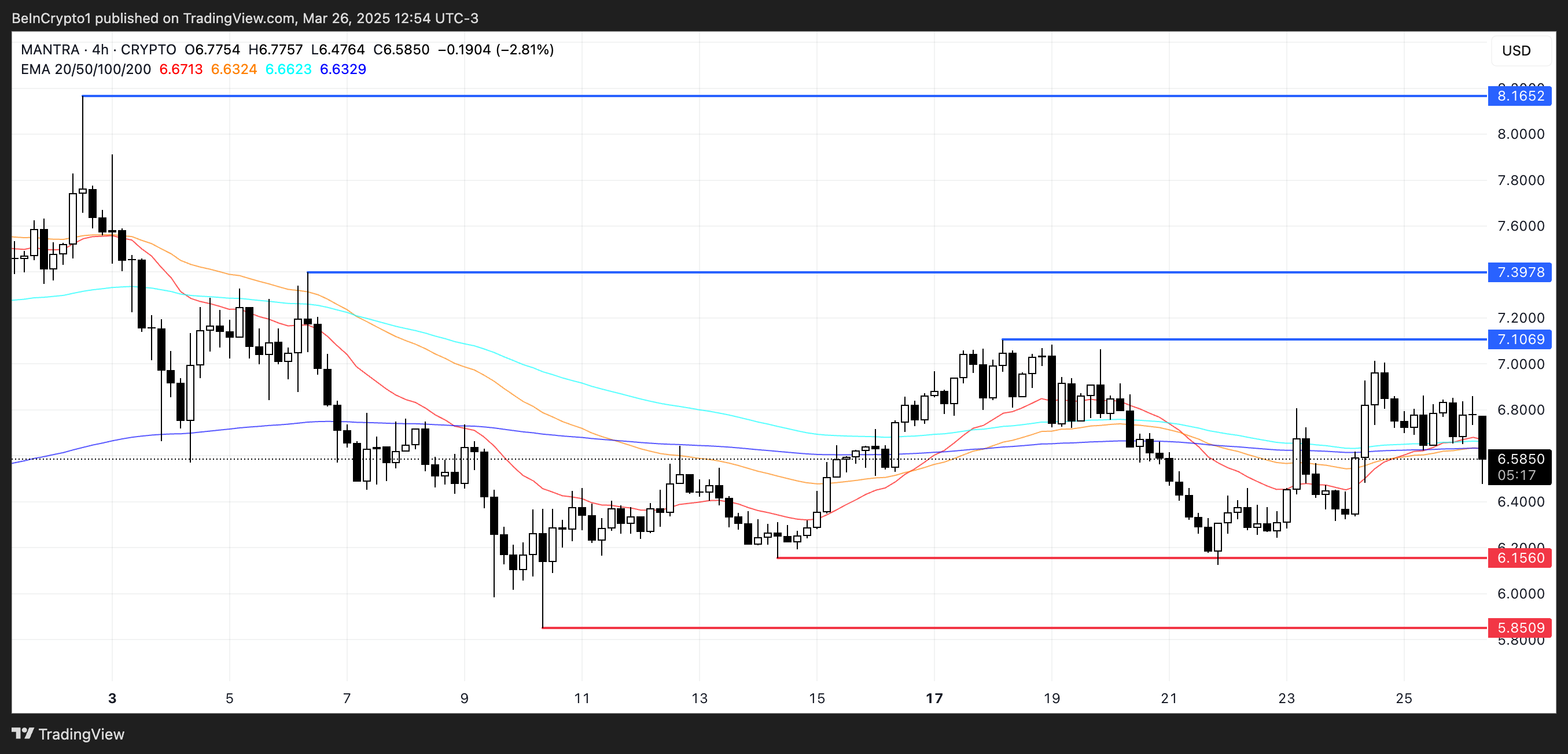

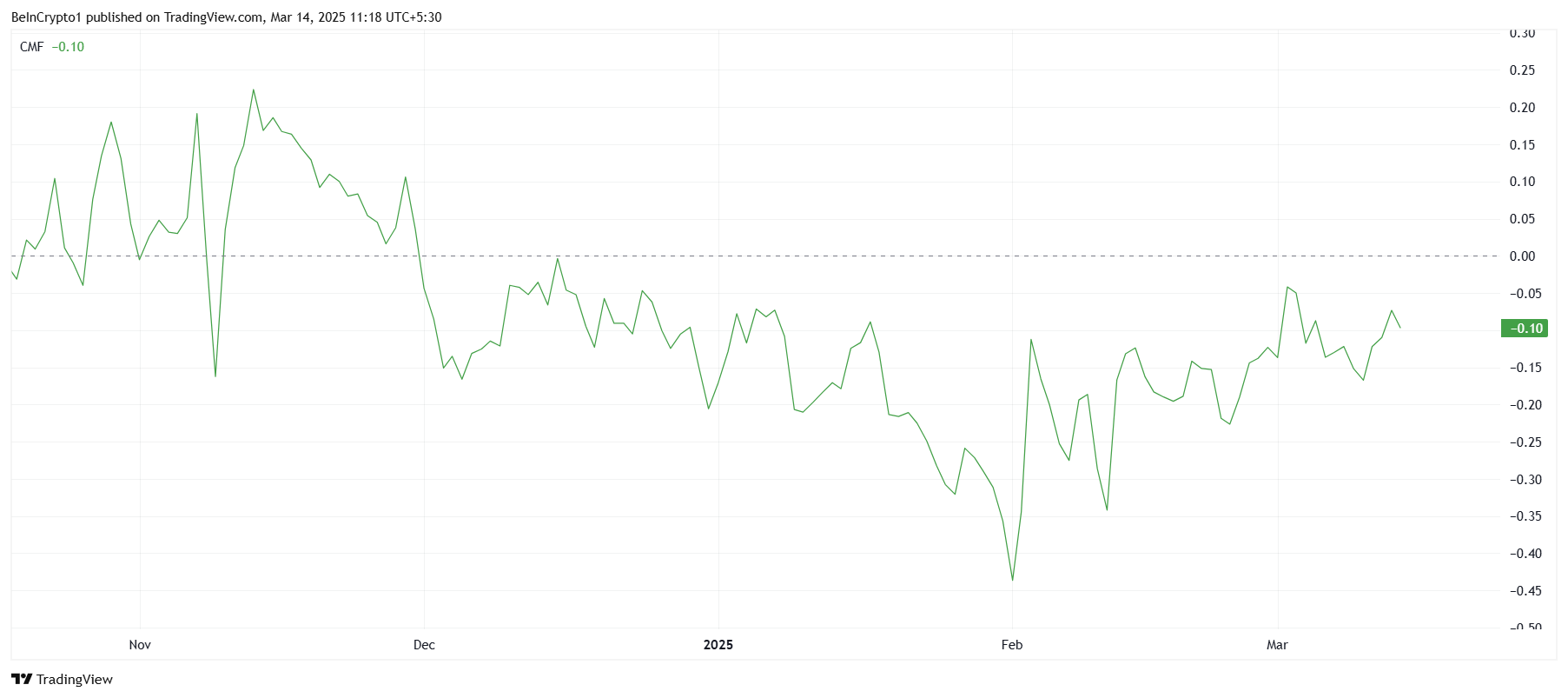

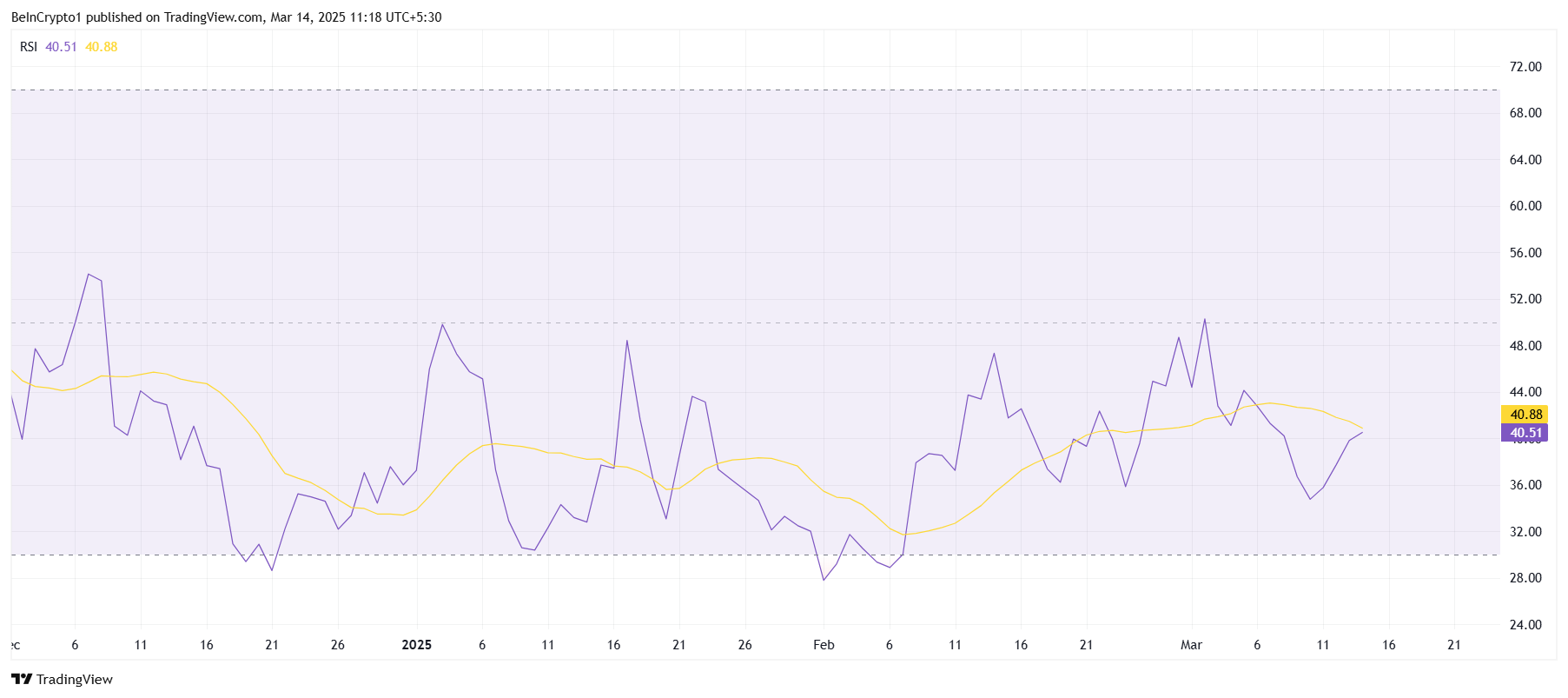

According to CoinPedia’s technical analysis, TRX appears bullish, and with the ongoing rally, it has regained one of its crucial support levels at $0.22 while moving toward the resistance level of $0.25.

The TRX daily chart shows that the asset was previously trading within a tight range between $0.2185 and $0.25. However, given the recent price rally and Sun’s announcement, it appears that the bulls are back, and the asset is poised to continue its upside momentum until it reaches the $0.25 level.

Additionally, during the recent price drop, the asset successfully retested the 200 Exponential Moving Average (EMA) on the daily timeframe, indicating that it remains in an uptrend.

(@justinsuntron)

(@justinsuntron)