TRUMP’s price has been stuck in a downtrend for the past month despite the media attention surrounding US President Donald Trump’s recent statements. The altcoin has faced difficulty breaking through the critical resistance level of $17.14.

However, investor sentiment remains strong, and with the upcoming White House Crypto Summit, there may be a chance for recovery.

TRUMP Notes Strong Inflows

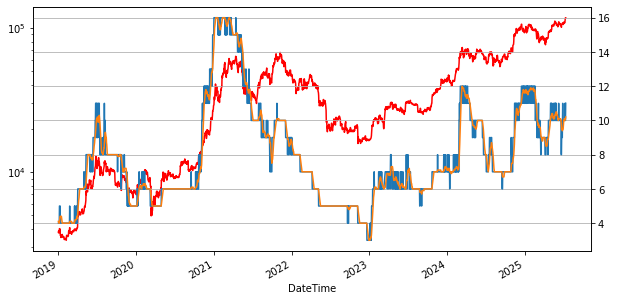

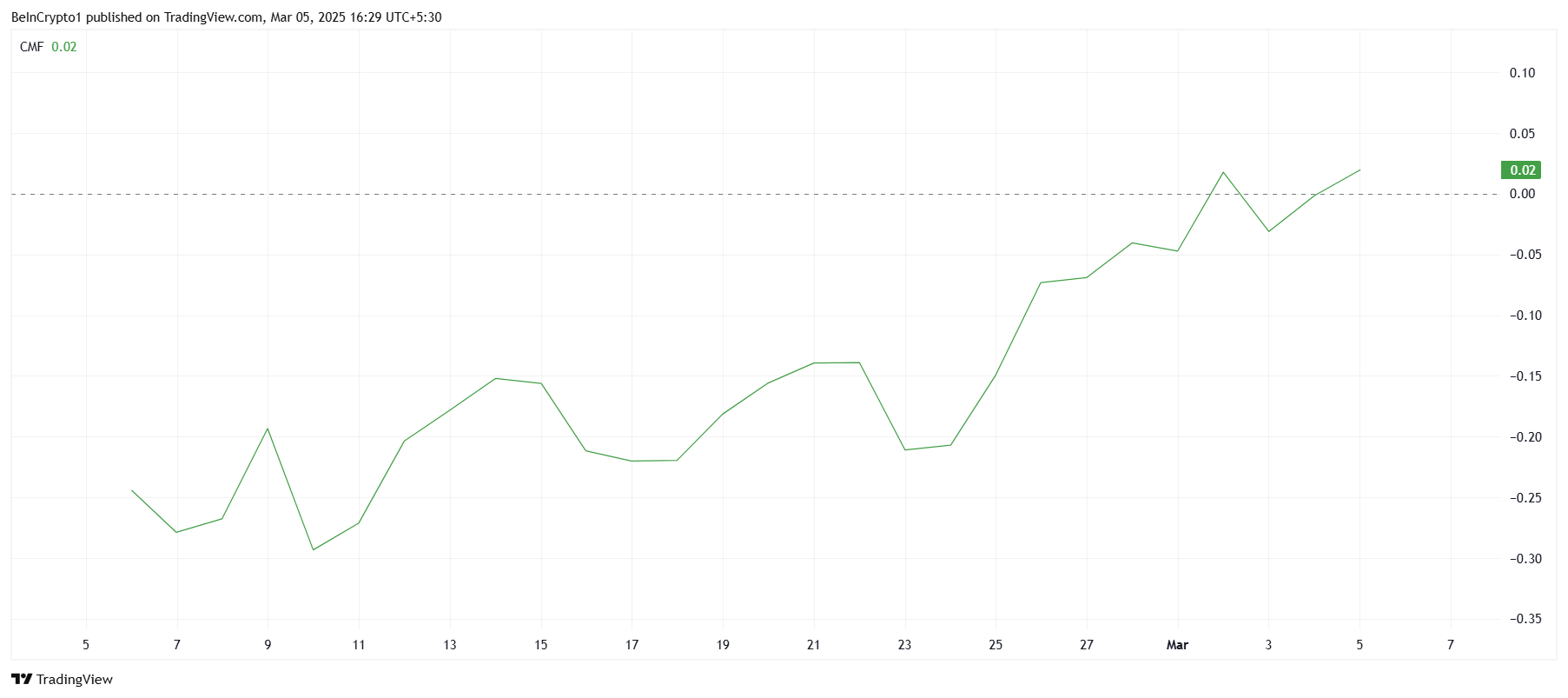

The Chaikin Money Flow (CMF) indicator shows positive signs for TRUMP, with the indicator currently above the zero line. This suggests stronger inflows than outflows, indicating that investors are optimistic about the altcoin’s future.

Furthermore, with the White House Crypto Summit scheduled for March 7, investors are looking to capitalize on potential price movements ahead of the event. Many are likely to accumulate at low levels, anticipating the summit’s influence on both the market and TRUMP’s price.

The positive CMF reading supports the idea that investors are positioning themselves for a potential breakout. As the summit approaches, TRUMP’s price could see upward momentum. Historically, significant events like these tend to influence altcoins, especially when there’s optimism about new regulations or policy changes in the crypto space.

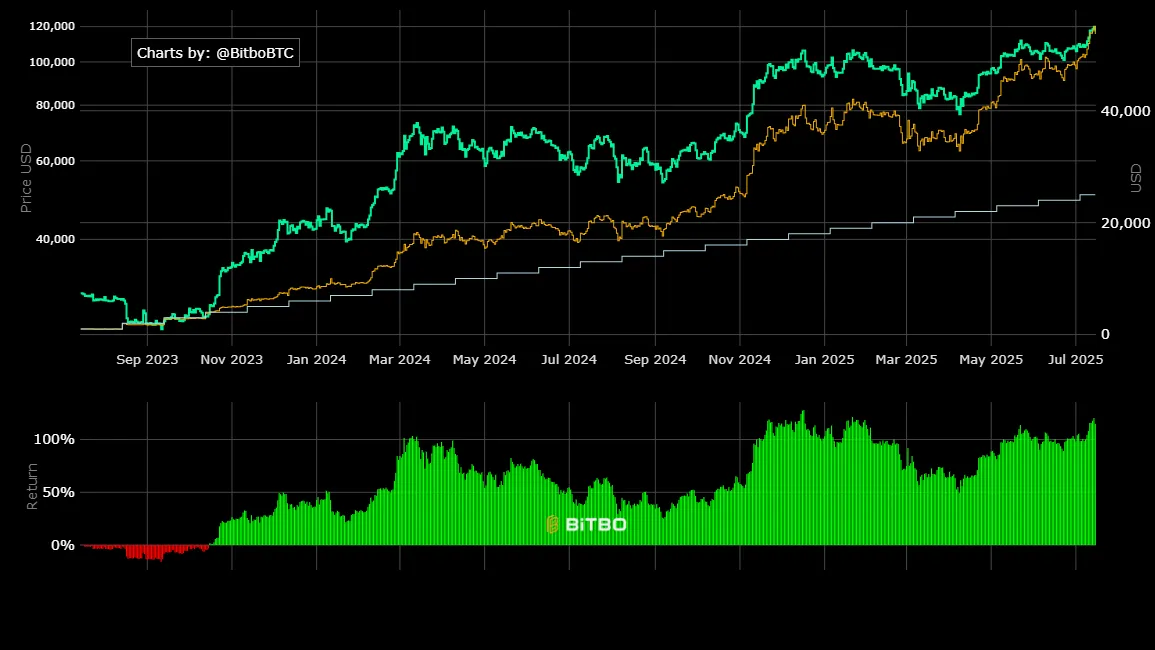

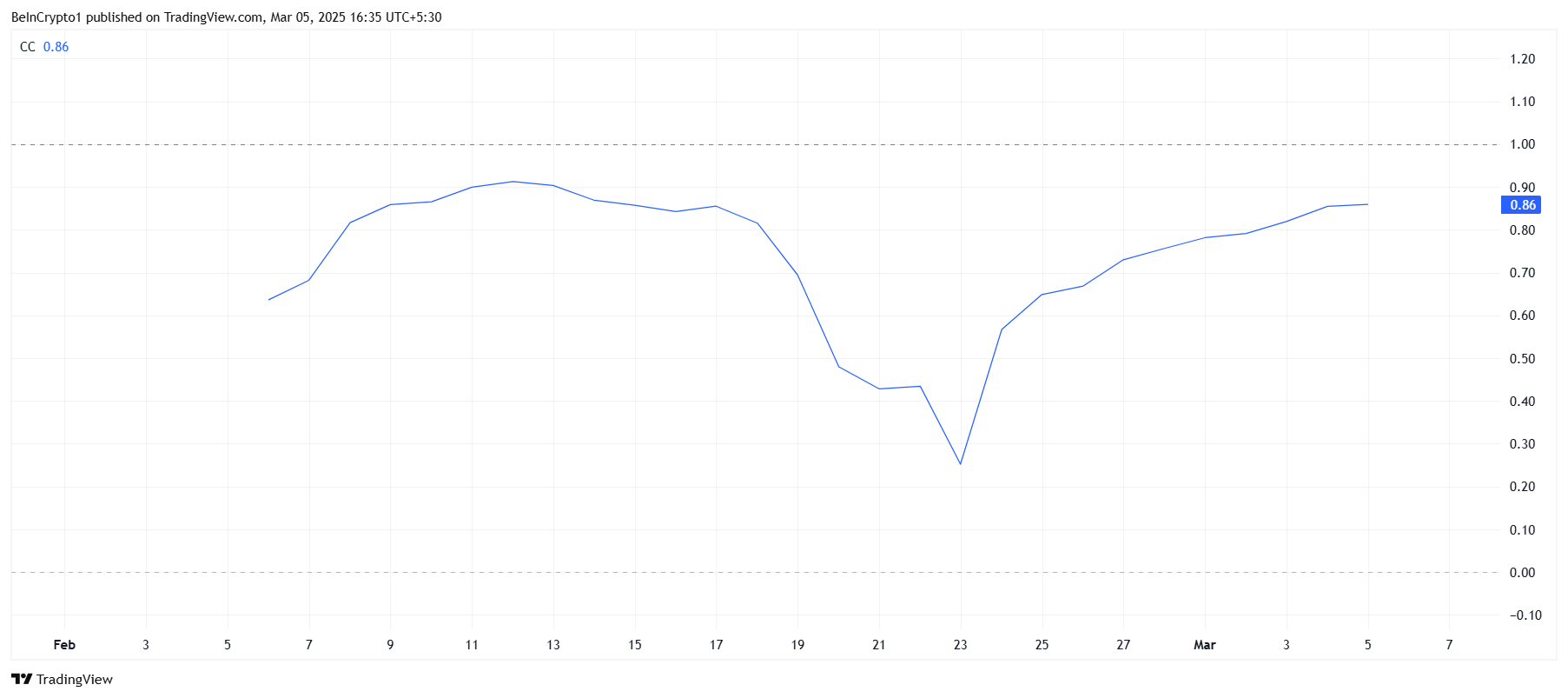

TRUMP shares a strong correlation of 0.86 with Bitcoin (BTC), which suggests that the altcoin is likely to follow BTC’s lead. Given that BTC’s price is also influenced by broader market trends, TRUMP’s price could rise alongside Bitcoin if the hype around the White House Crypto Summit continues to build.

Bitcoin’s potential rise in anticipation of the summit could lift TRUMP’s price as well. The correlation indicates that as BTC moves up, so too could TRUMP. Should the broader market experience positive momentum, both Bitcoin and TRUMP are poised for potential rallies, with TRUMP looking to benefit from increased attention during the summit.

TRUMP Price Aims At Key Barrier

Currently trading at $13.38, TRUMP is holding above the critical support level of $12.41. The altcoin remains stuck under the month-long downtrend, unable to break above the key resistance at $17.14. However, the bullish sentiment driven by the upcoming White House Crypto Summit could spark a rally for TRUMP.

The altcoin’s target would be to secure $17.14 as support. If successful, TRUMP price could note a 27% rally and push to $21.45, marking a significant recovery from its current levels. The optimism surrounding the summit could provide the necessary catalyst for this price movement.

On the other hand, if the altcoin fails to break through the downtrend and the market sentiment weakens, TRUMP could drop below its support of $12.41. This would lead to a decline to $11.07, its current all-time low (ATL), or possibly lower, invalidating any bullish outlook.

The post TRUMP Price Eyes Breakout Ahead of White House Crypto Summit appeared first on BeInCrypto.