DeFi in Q1 2025 saw a mix of challenges and innovations, with decentralized lending and cross-chain interoperability emerging as key trends.

Institutional adoption is increasing, and DeFi platforms are focusing on security improvements, user experience, and broader integration with traditional finance.

Decentralized stablecoins will play a central role in DeFi’s future, supporting cross-chain liquidity and offering greater resilience during economic downturns.

As we progress through 2025, the decentralized finance (DeFi) sector continues to transform, with significant advancements and challenges shaping its future. The first quarter of the year presented a mixed landscape for DeFi, as economic uncertainty and security breaches affected total value locked (TVL) across the ecosystem.

However, despite these setbacks, there are clear signs of resilience, with innovations in decentralized lending, cross-chain interoperability, and decentralized stablecoins leading the way. Additionally, the integration of DeFi with traditional finance (TradFi) continues to gain traction, laying the groundwork for broader adoption.

We are grateful for the valuable insights shared by our partners, whose perspectives are essential in understanding the future trajectory of DeFi. Their contributions provide a comprehensive look at the current state of the ecosystem and the strategies being employed to address the challenges and seize the opportunities that lie ahead:

– Eowyn Chen, CEO at Trust Wallet

– Sergej Kunz, Co-founder at 1inch

– Chris Grundy, CMO at the dYdX Foundation

– Kean Gilbert, Institutional Relations Contributor at Lido DAO

– Sid Powell, CEO and Co-Founder at Maple Finance

1. How do you assess the growth of the DeFi sector in Q1 2025? What key trends have you seen so far?

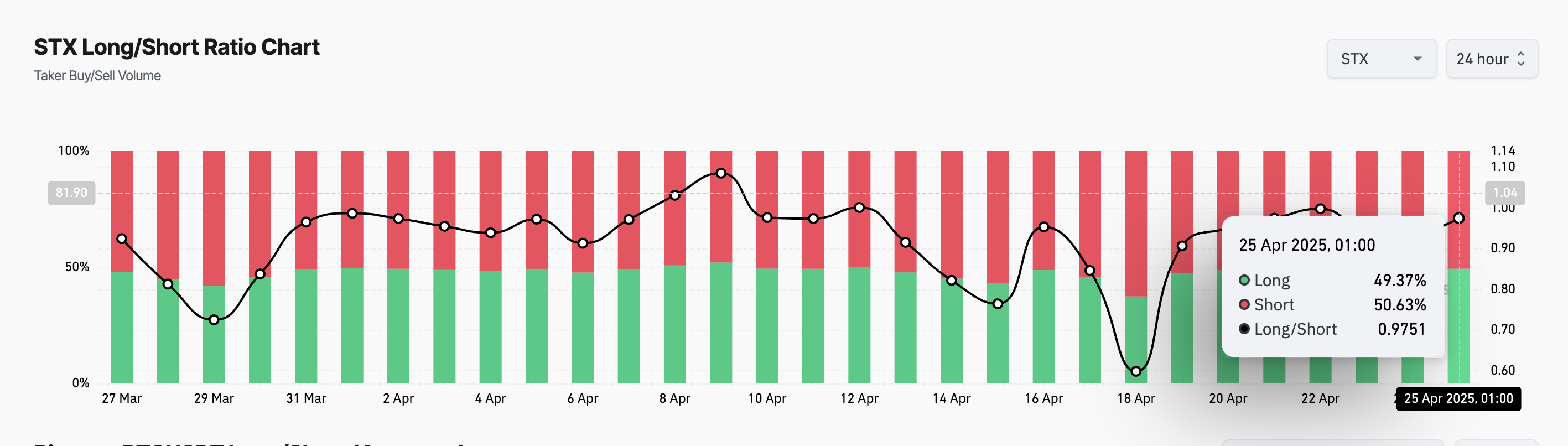

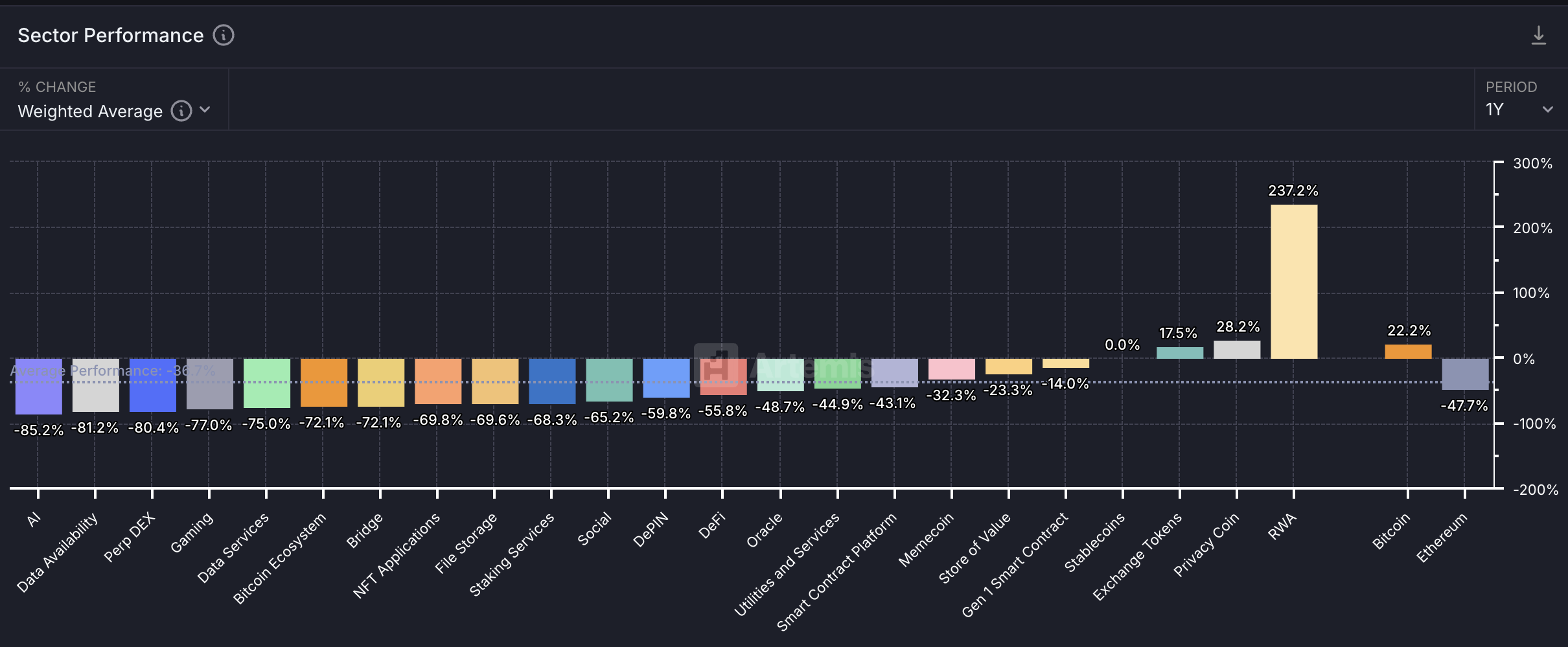

The DeFi sector in Q1 2025 showed mixed results. While the total value locked (TVL) across key platforms saw a decline due to economic uncertainty and security breaches, the long-term outlook remains positive.

The focus has shifted to more sustainable models, such as decentralized lending, asset tokenization, and cross-chain interoperability. These trends indicate that DeFi is moving away from speculative yield chasing toward a more resilient, capital-efficient future.

Eowyn Chen, CEO of Trust Wallet, noted:

“In Q1 2025, we saw a significant contraction in the sector. However, innovations in decentralized lending led by platforms like Morpho and Euler are driving growth. These curators are offering optimized yields, with some vaults outperforming benchmarks by a substantial margin.”

Sergej Kunz, co-founder of 1inch, observed a similar pattern:

“The market faced some volatility, and major chains saw declines in TVL. Despite this, we are witnessing a shift towards non-custodial solutions, which are gaining traction. Innovation continues to move forward, with decentralized solutions showing real potential for growth in the long term.”

The sector remains resilient, with institutional adoption growing alongside a focus on scalability and security. The trends of decentralization and user control are becoming more ingrained in the industry.

2. What are the biggest challenges your company has faced in the first quarter, and how have you addressed them?

The first quarter of 2025 presented challenges that were largely tied to market instability and security concerns. As the industry grapples with these hurdles, companies have been working to enhance their infrastructure and user experience.

For Trust Wallet, the fluctuations in on-chain trading activity required quick adjustments to their product offerings. Eowyn Chen shared:

“The first quarter was challenging due to shifts in market behavior. We had a meme coin surge, especially on Solana and BNB Chain, which spiked interest but also led to a decline in organic on-chain activity by March. In response, we focused on improving the wallet experience to better navigate these fast-changing trends.”

For Sergej Kunz of 1inch, the major hurdle was securing the ecosystem amidst market downturns. He said:

“The volatility in DeFi activity posed a challenge, but we took action by enhancing our security infrastructure and expanding our Fusion+ cross-chain solution. We’re prioritizing safety while improving how we serve users with more secure cross-chain operations.”

At dYdX, Chris Grundy acknowledged that the market uncertainty also influenced user behavior. He explained:

“We saw that mobile trading was becoming more prevalent, so we launched a completely redesigned mobile trading experience. This was necessary to simplify perpetual trading and make it more intuitive for both professionals and newcomers.”

3. Looking forward to Q2 2025, what major developments or new features are you planning to roll out in your DeFi offerings?

Looking ahead, DeFi companies are gearing up for significant upgrades and new features aimed at enhancing usability and expanding access.

Trust Wallet is focusing on improving its wallet experience by introducing easier ways for users to access stablecoin yields and experimenting with new technologies to reduce friction. Eowyn Chen said:

“In Q2, we’re working on refining the wallet experience even further, focusing on making stablecoin yield access more intuitive. We’re also exploring gas abstraction technologies, such as 7702, to reduce user friction and enhance DeFi interactions without compromising decentralization.”

Sergej Kunz from 1inch shared that his team is extending the platform’s reach:

“We’re looking to extend 1inch beyond just EVM chains to non-EVM chains, opening up new ecosystems and user bases. Additionally, we’re focused on refining our aggregation and cross-chain algorithms to provide users with the best execution rates, which is key to maintaining our competitive edge.”

At dYdX, the emphasis is also on mobile and user experience, as Chris Grundy highlighted:

“We’re continuing to refine the mobile trading experience to ensure its user-friendly and accessible to a broad audience. Our goal is to simplify the complexities of perpetual trading, allowing both professionals and new users to engage more easily.”

4. With the increasing institutional interest in DeFi, how do you see the relationship between traditional finance and DeFi evolving in the near future?

The growing institutional interest in DeFi is reshaping the financial landscape. As institutions explore ways to integrate DeFi’s advantages, the boundaries between traditional finance (TradFi) and DeFi are becoming increasingly blurred.

DeFi’s efficiency, transparency, and composability are driving this integration, with more players from the traditional finance sector eager to tap into these benefits. Kean Gilbert, Institutional Relations Contributor at Lido DAO, explained:

“Institutional participation in Ethereum staking is growing, supported by improving tools for compliance and operational flexibility. The Lido protocol is evolving to support more flexible staking while preserving decentralisation and expanding access. DeFi’s foundations remain strong, supported by this growing and diverse community of participants.”

Sid Powell, CEO of Maple Finance, shared his view:

“We’re not waiting for TradFi to understand DeFi; we’re building products they can’t ignore. The future will revolve around shared infrastructure—compliance-first rails, credible underwriting, and real yield. We’re moving beyond pilots to plugging into TradFi at scale.”

This maturation signals a future where DeFi and TradFi coexist, with DeFi becoming an integral part of the financial ecosystem.

5. Security has always been a key concern for DeFi platforms. How is your platform addressing these concerns, and what new security measures are you implementing in 2025?

As security remains a fundamental concern for DeFi platforms, companies are prioritizing the protection of user funds and data.

Trust Wallet, for example, has strengthened its security infrastructure by enhancing threat detection and smart contract interaction protocols. The company is also leveraging AI for real-time risk alerts and fraud detection. Eowyn Chen explained:

“Security is a top priority for us. In 2025, we’re improving threat detection systems, refining smart contract flows, and enhancing MEV protection. We’re also exploring how AI can help with scam detection and real-time risk alerts to further protect users.”

Sergej Kunz at 1inch emphasized the importance of offering robust security features:

“We’re developing 1inch Shield, an advanced transaction protection layer. This solution will provide additional security to the ecosystem and help safeguard transactions across various DeFi protocols.”

Chris Grundy from dYdX highlighted the platform’s new Permissioned Keys feature. It enhances security by providing more granular control over trading access for institutions and professional users. He said:

“Our Permissioned Keys feature gives institutions the flexibility to configure access controls, such as limiting who can withdraw funds or trade specific assets, enhancing operational security while maintaining performance.”

6. As DeFi becomes more integrated with the broader crypto ecosystem, how important do you believe cross-chain interoperability will be in the coming months?

Cross-chain interoperability has become a critical factor for the future growth of DeFi. As liquidity and users are distributed across multiple blockchains, platforms are focused on ensuring seamless interaction between networks to facilitate greater liquidity and user access.

DeFi companies are investing heavily in cross-chain solutions to meet the increasing demand for interoperability. Sid Powell emphasized:

“Interoperability is no longer just a feature—it’s a necessity. Capital and users are increasingly chain-agnostic, and platforms that can offer seamless cross-chain interactions will have a competitive advantage. At Maple, we’re exploring integrations beyond Ethereum L2s to expand our cross-chain capabilities.”

Eowyn Chen from Trust Wallet added:

“Cross-chain access is essential for the next phase of DeFi’s growth. Users want seamless access to tokens, dApps, and yield strategies across chains, and interoperability will be the key enabler.”

For Sergej Kunz, cross-chain interoperability is a cornerstone of future success:

“We see cross-chain interoperability as foundational to DeFi’s evolution. Our Fusion+ solution is designed to facilitate frictionless cross-chain swaps, which will be crucial as DeFi grows into a more integrated ecosystem.”

7. What role do you see decentralized stablecoins playing in the future of DeFi, particularly in relation to asset-backed tokens and traditional fiat systems?

Decentralized stablecoins are set to play a crucial role in the future of DeFi, providing resilience and transparency. While fiat-backed stablecoins have played an important role in onboarding users, decentralized alternatives offer more flexibility, security, and resistance to censorship.

These stablecoins are becoming essential for cross-chain liquidity and decentralized finance applications. Kean Gilbert shared:

“Decentralized stablecoins are going to be foundational for DeFi’s long-term success. As the ecosystem matures, they’ll provide the resilience needed during systemic shocks and offer a more transparent alternative to fiat-backed stablecoins.”

Sid Powell added:

“Decentralized stablecoins will fill gaps that traditional banking systems can’t reach. Over time, credible decentralized stables will grow in importance, offering more transparency and better liquidity for DeFi users.”

Sergej Kunz from 1inch emphasized their role in cross-chain interoperability:

“Decentralized stablecoins are becoming a key part of liquidity provision across chains. Their role in DeFi will only grow as users seek permissionless access to stable, decentralized assets.”

Conclusion

The DeFi sector in Q1 2025 faced a mix of challenges and opportunities, with declines in TVL due to market volatility and security concerns, yet continued innovation in decentralized lending, cross-chain interoperability, and decentralized stablecoins.

As institutional adoption grows, DeFi is evolving into a more mature and scalable financial ecosystem. Moving into Q2 2025, DeFi platforms are focusing on enhancing security, user experience, and cross-chain solutions, with decentralized stablecoins playing a pivotal role in future developments.

We would like to thank our partners once again for sharing their valuable insights. Their contributions have provided an essential perspective on the state of DeFi and the path ahead for the industry.

The post DeFi in 2025: Trends, Challenges, and What’s Next for Q2 appeared first on BeInCrypto.