Bitcoin (BTC) experienced a sharp decline, dropping nearly 4% in just 24 hours. The price fell from $72,500 to just above $69,000, contributing to a broader crypto market retreat that saw overall market capitalization decrease by 5.5%. This downturn was particularly impactful, leading to over $250 million in liquidations of bullish futures positions.

Extreme Greed Signals Market Top

On Thursday, the Fear and Greed Index—a key sentiment tracker in the crypto space—flashed “extreme greed.” This reading historically suggests that the market may be reaching a local top, and by Friday, the index adjusted to “greed,” indicating a potential for further price corrections. Such sentiment extremes highlight the emotional nature of the market, where periods of extreme fear can present buying opportunities, while extreme greed often precedes corrections.

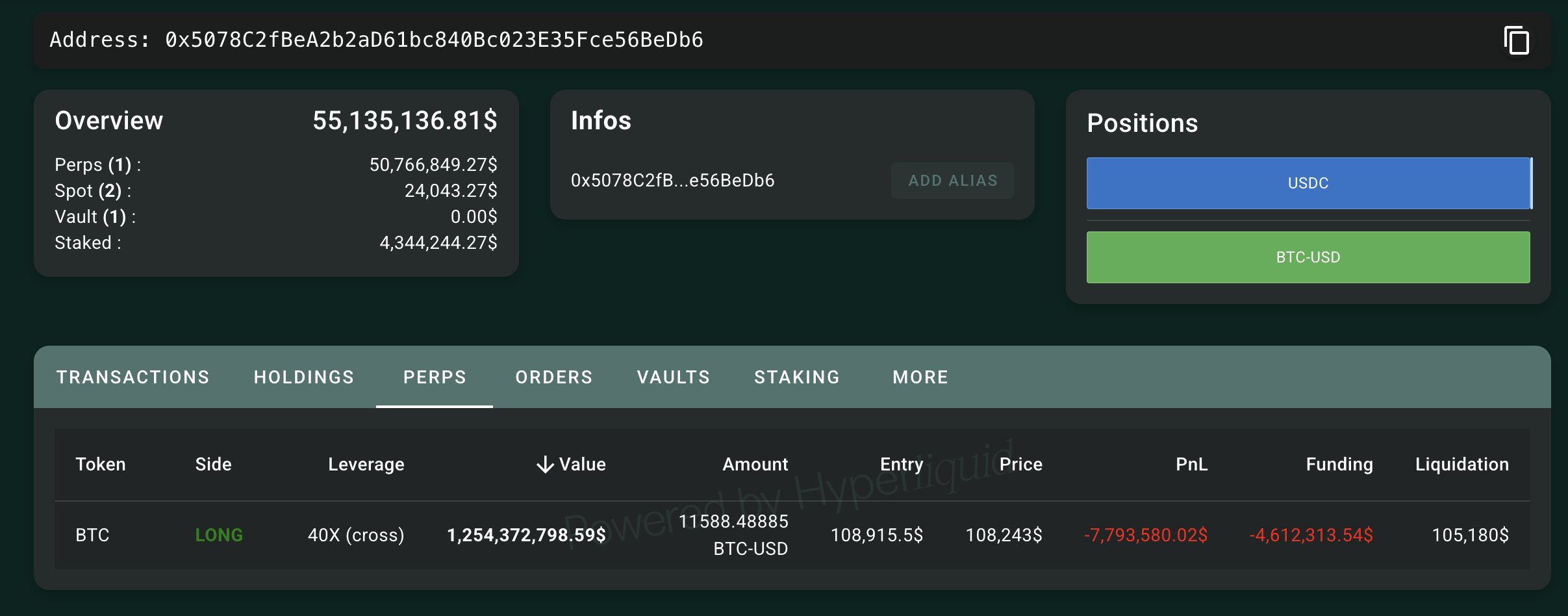

Liquidations Rock Futures Traders

The rapid price decline sent shockwaves through the futures market, resulting in significant losses for traders. According to CoinGlass, approximately $88 million in BTC futures bets were liquidated, alongside $44 million in ether (ETH) futures and nearly $15 million in losses for both Solana (SOL) and Dogecoin (DOGE) futures. The overwhelming bullish sentiment prior to the drop, with nearly 90% of futures positions betting on price increases, amplifies the shock of this correction.

Also Read: Can Ripple’s XRP Replace SWIFT? How RippleNet’s 300+ Partnerships Could Push XRP To $500

A Turning Point in Market Sentiment?

This cascade of liquidations suggests that the market may be experiencing a turning point. When traders are overly leveraged and sentiment shifts suddenly, it can trigger a rapid decline in prices as exchanges forcibly close positions due to margin calls. This recent correction comes on the heels of Bitcoin’s open interest reaching a record high of over $43 billion earlier in the week, only to drop to just over $41 billion by Friday.

Despite the current volatility, many traders remain optimistic about Bitcoin’s future, with some targeting $80,000 in the coming weeks. The recent pullback, however, raises questions about whether such targets are realistic, especially with the U.S. elections on November 5 potentially influencing market dynamics.