Tether-backed Bitcoin investment firm Twenty One Capital has acquired 4,812 BTC valued at $458.7 million, according to a U.S. Securities and Exchange Commission (SEC) filing dated May 13. The transaction is part of a private investment in public equity (PIPE) deal tied to the firm’s ongoing SPAC merger with Cantor Equity Partners.

This buy comes amid Bitcoin price movements suggesting a potential new all-time high, with the asset trading around $103,540 at the time of purchase.

Twenty One Capital Bitcoin Acquisition Linked to SPAC Merger

The purchase was executed by stablecoin issuer Tether, which transferred the BTC to an escrow wallet on May 9. The Bitcoin was later moved to a wallet controlled by Tether, and will be sold to the public entity Twenty One Capital for $458.7 million.

This transfer is part of a PIPE arrangement connected to the company’s SPAC merger with Cantor Equity Partners. Once the merger is finalized, the company will trade under the ticker XXI. Currently, it trades under CEP, and the SPAC is backed by Wall Street firm Cantor Fitzgerald.

The newly acquired BTC increases Twenty One Capital’s total holdings to 36,312 BTC. Of this amount, 31,500 BTC is held on behalf of the company by Cantor Equity Partners, as disclosed in the SEC filing.

Company Positioning and Ownership Structure

Twenty One Capital is led by Jack Mallers, founder of the BTC payments app Strike. The firm has adopted a Bitcoin-focused strategy similar to that of Michael Saylor’s Strategy. In April, the firm told the SEC that it aims to become a “superior vehicle” for capital-efficient BTC exposure.

Tether and its sister company, Bitfinex, are majority owners of the company. Japanese investment group SoftBank has invested $900 million and holds a minority stake. Cantor Fitzgerald is both sponsor and advisor to the merger, and has raised $585 million to fund future BTC purchases.

According to filings, the company’s goal is to reach 42,000 BTC in total holdings upon its public launch. Expected contributions include 23,950 BTC from Tether, 10,500 BTC from SoftBank, and 7,000 BTC from Bitfinex. These will be converted into equity at $10 per share.

Market Reaction and Trading Activity

Shares of Cantor Equity Partners (CEP) experienced high volatility following news of the BTC purchase. On May 2, the share price rose from $10.65 to $59.73, before falling back to $29.84. After the recent filing, the stock gained another 5.2% in after-hours trading.

According to BitcoinTreasuries.net, Twenty One Capital is now the third-largest corporate holder of BTC, behind MicroStrategy (568,840 BTC) and MARA Holdings (48,237 BTC). The firm’s strategy is to measure performance using Bitcoin per share rather than earnings per share.

Other firms are also increasing their exposure with, Japanese firm Metaplanet adding 1,271 BTC for $126.7 million on Monday.

Bitcoin Price Nearing New All-Time High

The purchase by Twenty One Capital coincides with a strong upward trend in Bitcoin’s price, which has surged to around $103,540. This puts the cryptocurrency within range of its previous all-time high. Market analysts are watching closely for a breakout.

Michaël van de Poppe, a market analyst, noted on X that recent Consumer Price Index (CPI) data showed inflation to be lower than expected. He said, “Inflation is calming down… this would also signal that the FED can lower interest rates.” According to him, this environment could create favorable conditions for the crypto’s next upward move to a new ATH.

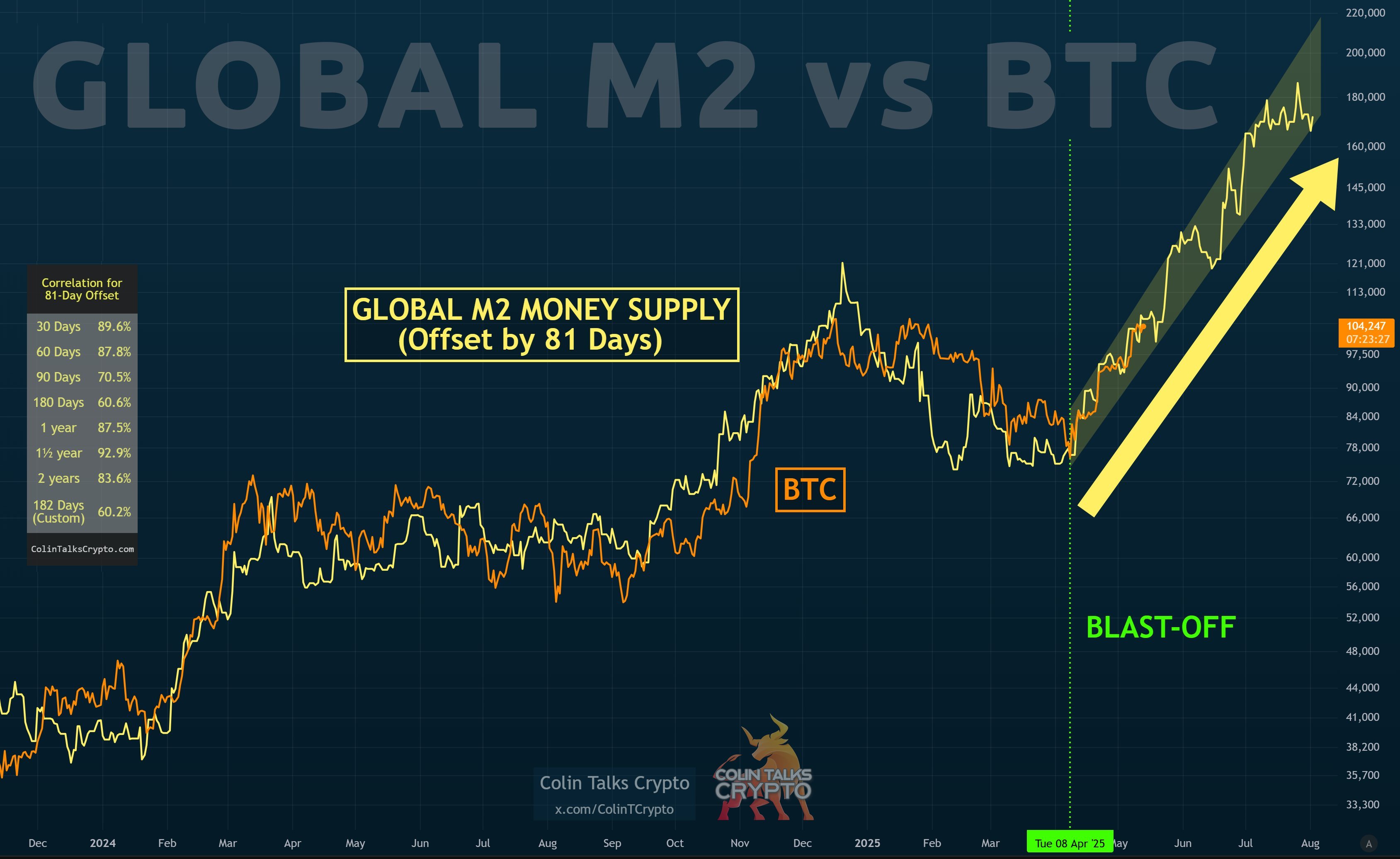

Another analyst ColinTCrypto, also referred to the ongoing correlation between BTC and the Global M2 money supply. He pointed out that the current cycle mirrors patterns seen earlier in the year when BTC rose from $76,000 to $105,000 between April 8 and mid-May nearing the all-time high at $109k. He added that Bitcoin is “still right on track with Global M2,” and suggested a breakout above $120,000 could occur by the end of May to set a new all-time high.

The post Tether Backed Twenty One Capital Buys $458.7M in Bitcoin As Price Eyes New ATH appeared first on CoinGape.

GoldSeek | SilverSeek (@goldseek)

GoldSeek | SilverSeek (@goldseek)

(@SaharaLabsAI)

(@SaharaLabsAI)