The post SUI Price Eyes $5.30 ATH, Can On-Chain Strength Drive A Breakout This Quarter? appeared first on Coinpedia Fintech News

Key Highlights

- SUI price maintains its bullish structure, with price consolidating near key resistance at $4.50.

- Recent developments like Phantom integration, NFT partnerships, and institutional inflows signal growing adoption.

- Technical analysis shows bullish EMA alignment, but RSI near 68 hints at potential consolidation.

- On-chain metrics such as $2.18B TVL and $11B+ monthly DEX volume reflect record activity and sustained DeFi momentum.

- SUI is consolidating near $4, following a brief intraday pullback on May 13, while maintaining bullish structure overall.

SUI Coin has surged 75% over the past month, reclaiming $4 for the first time since February. Backed by record on-chain metrics and strong technicals, the altcoin holds a bullish structure as traders eye a breakout toward the $5.30 ATH.

Catalysts Behind SUI’s Momentum

- Phantom Wallet Integration (May 13): The popular multichain wallet added support for the Sui Network, allowing users to seamlessly swap assets between Sui, Ethereum, Solana, and Base. This expanded access and simplified token purchases directly from the wallet, enhancing user adoption and activity across the ecosystem.

- Axelar Bridge Launch (May 8): Axelar integrated Sui via its Interchain Token Service (ITS), enabling native assets to be bridged to and from other major blockchains. This boosted Sui’s DeFi composability, allowing protocols to tap into external liquidity while remaining native to the Sui chain.

- Upcoming Sui Odyssey Event (May 17): The fifth edition of “The Great Sui Odyssey” will take place in Vietnam, spotlighting new developments in AI, DeFi, and gaming — all of which could act as forward-looking catalysts for continued growth.

On-Chain Data Confirms Explosive Growth in SUI Ecosystem

- TVL grew from ~$1.8B in early April to $2.183B by May 14. The stablecoin market cap stands near $919M with inflows up 39.5%. If it crosses $1B, price could trend toward $4.50 under current dynamics.

- Monthly DEX volume peaked at $782M on April 23 — the highest single-day volume in Sui’s history — within a broader monthly surge. As of May 14, the 7-day total sits above $3.98B, up nearly 40% week-over-week and nearly triple April 10’s $253M figure.

- Futures open interest surged from ~$600M in early April to $1.86B by May 14 — a yearly high — showing strong leveraged demand across Binance, Bybit, and others.

- Sui has consistently maintained over 1.5 million daily active addresses through April and May, peaking at 1.7 million on April 29. On average, 1.2M–1.5M wallets interact daily, with a healthy mix of new and returning users.

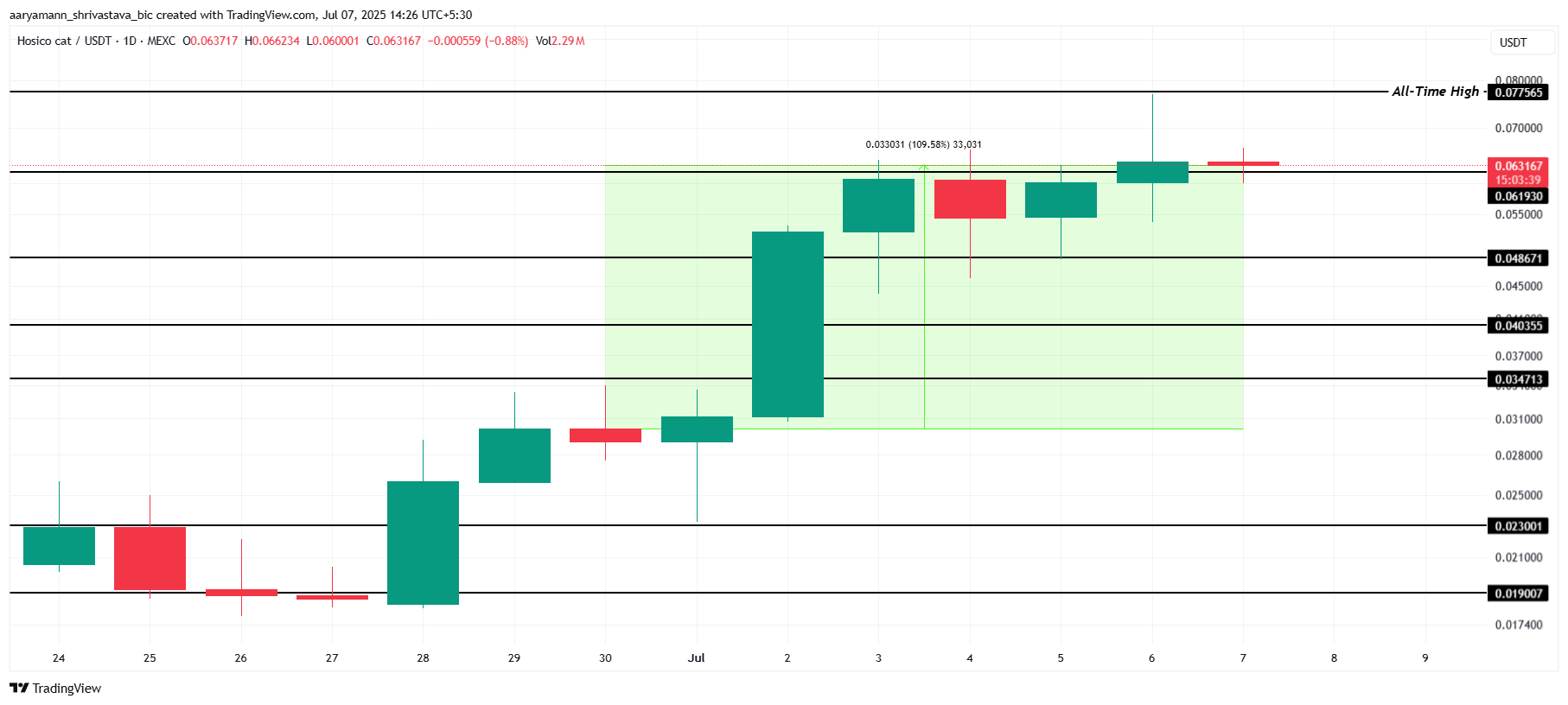

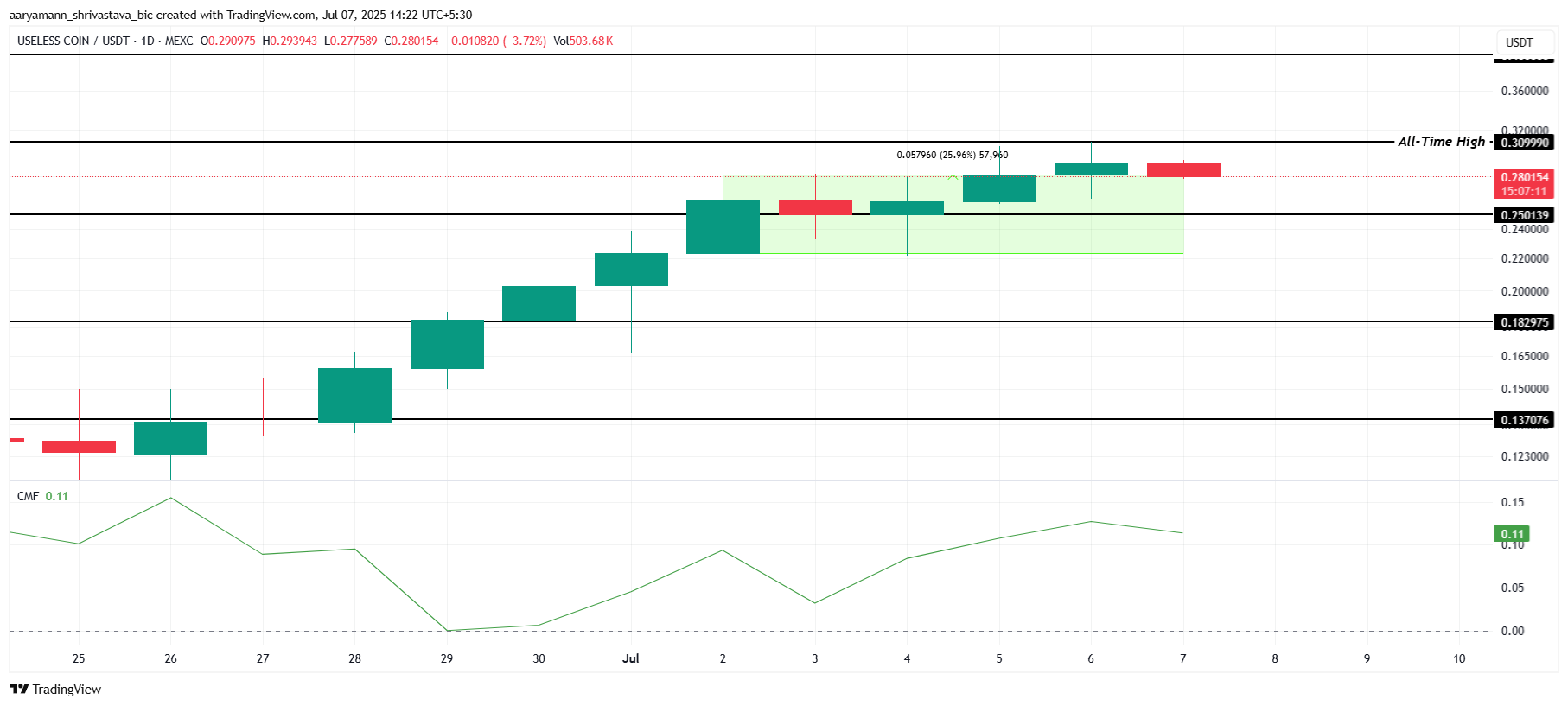

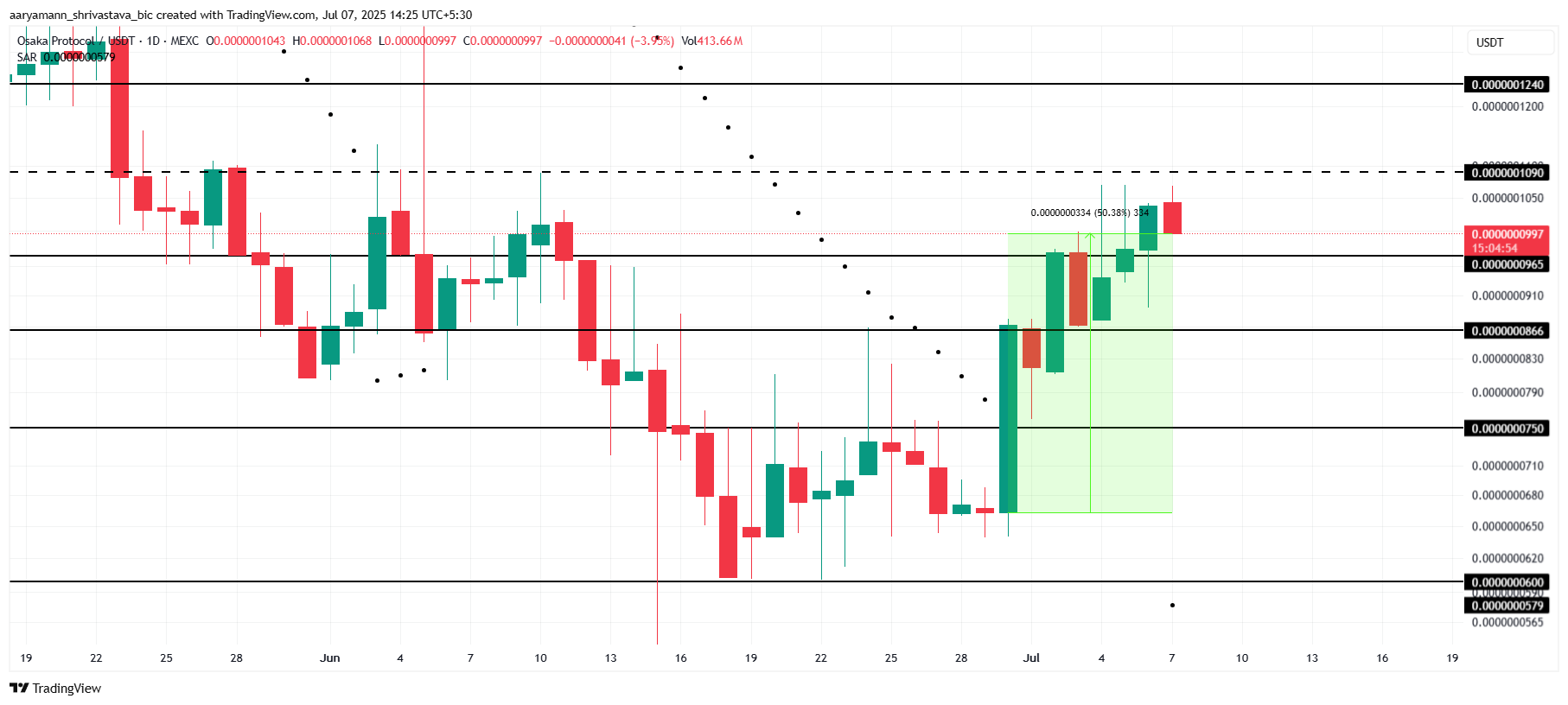

SUI/USD Approaches Key Resistance After 140% Rally

- SUI price has gained over 140% from its April 13 low of $1.73, reaching $4.20 on May 10 — the first time it reclaimed $4 since January 17, 2025. The rally gained momentum after breaking out of the $2.80–$3.10 consolidation zone on April 23. Notably, this breakout coincided with SUI’s DEX volume all-time high of $782M — confirming the strength behind the price surge.

- Price currently trades above all major EMAs, with the 20 EMA (~$3.58) providing near-term dynamic support. The $3.53–$3.85 region is acting as a structural base.

- SUI is consolidating between $3.85 and $4.15 — a former January supply zone — with visible buying support on pullbacks.

- A daily close above $4.35 would confirm breakout continuation and likely target the $5.30 ATH ( Dec 20, 2024).

- RSI is holding near 68.2 — slightly below overbought — suggesting slowing bullish momentum but no breakdown yet.

- Key support zones include $3.53 (20 EMA) and $3.10–$3.20 (aligned with 50 EMA and April breakout base).

Can SUI Break $5.30 This Quarter? Metrics Remains Bullish

SUI’s bullish structure is reinforced not just by technical strength, but by fundamental catalysts like Phantom wallet integration, Axelar cross-chain support, and institutional inflows.

SUI’s structure remains bullish, supported by rising volume, strong on-chain data, and active user growth. A close above $4.35 could trigger a breakout in the next 2–3 weeks. If DEX volume returns to April highs, SUI may revisit its $5.30 ATH before the quarter ends. Support at $3.50–$3.85 continues to provide a solid accumulation zone