Solana (SOL) has increased by 2% in the last 24 hours, riding the broader market’s optimism ahead of the upcoming FOMC meeting. The Layer-1 (L1) coin currently trades at $147.83.

On-chain data shows a spike in demand for long positions, indicating that a growing number of traders are positioning for a price rally.

Solana Futures Show Strength Ahead of FOMC

The slight uptick in trading activity across the crypto market over the past 24 hours has pushed SOL’s price up by 2%. This modest gain reflects growing investor optimism as markets gear up for today’s FOMC meeting.

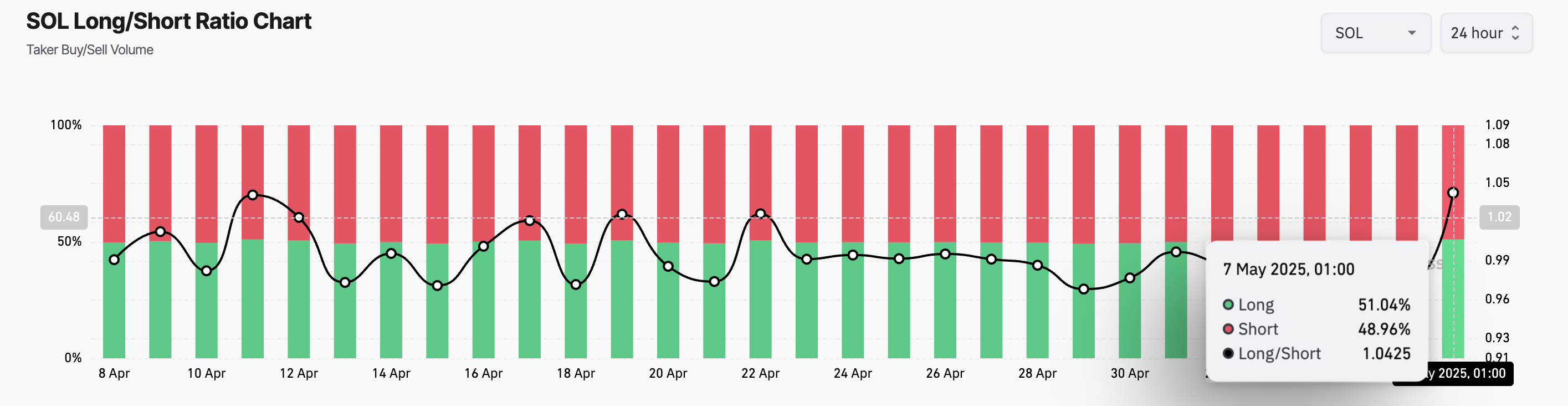

SOL’s futures traders have expressed optimism by upping their demand for long positions. According to Coinglass, the coin’s long/short ratio is at a monthly high of 1.04, signaling a preference for long positions among its futures market participants.

The long/short ratio measures the proportion of bullish (long) positions to bearish (short) positions in the market. When its value is below one, more traders are betting on an asset’s price dip than on its rally.

Conversely, as with SOL, a ratio above one means more long positions than short ones. This suggests bullish sentiment, with most SOL futures traders expecting its value to rise.

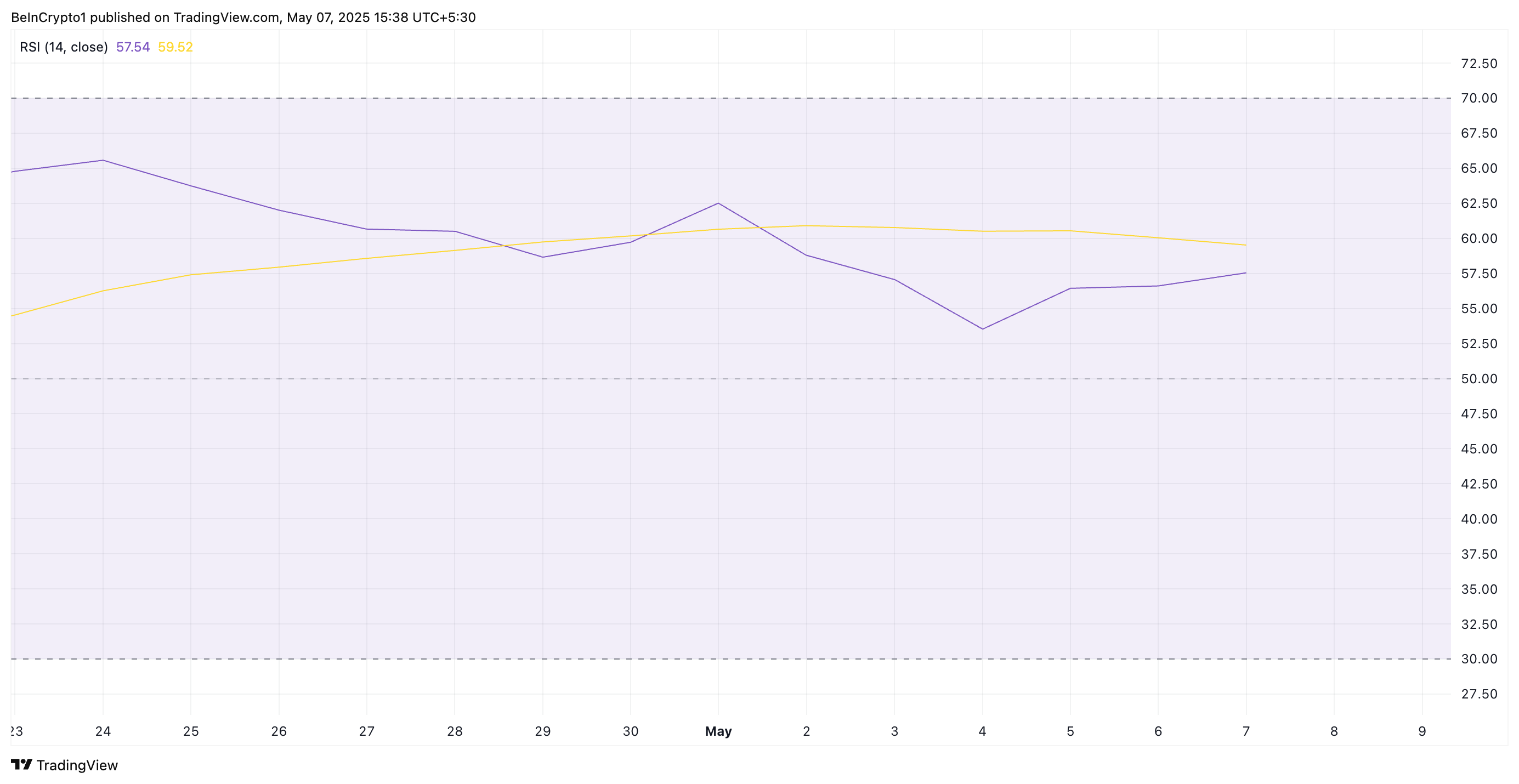

Further, on the daily chart, SOL’s rising Relative Strength Index (RSI) confirms the spike in demand for the altcoin. At press time, this momentum indicator is at 57.54.

The RSI indicator measures an asset’s overbought and oversold market conditions, ranging from 0 to 100. Values above 70 typically signal an asset is overbought, while an RSI below 30 indicates oversold.

SOL’s current RSI reading signals growing bullish momentum and leaves room for further upward movement before entering overbought territory.

SOL Price Balances on Support Line

As of this writing, SOL trades at $147.69, bouncing off the support at $142.59. If demand soars and market conditions remain favorable post-FOMC meeting, SOL could extend its rally and climb toward $171.88, a high it last reached on March 3.

However, if the upcoming FOMC meeting sparks a resurgence in bearish pressure, SOL could face renewed selling momentum. In such a scenario, the coin may break below the support level at $142.59, paving the way for a deeper decline toward $120.81.

The post Solana (SOL) Climbs Ahead of FOMC, Bullish Bets Reach Monthly High appeared first on BeInCrypto.