Solana Labs co-founder Anatoly Yakovenko has addressed the controversy surrounding the blockchain network’s recently deleted ad. The advertisement, which aimed to promote the upcoming Solana Accelerate conference, faced harsh criticism for its portrayal of gender issues.

The ad, now taken down, sparked backlash from the community, especially for its tone-deaf approach to gender identity. The Solana team has since been forced to manage the aftermath, with investors and users questioning the impact on the project’s public image.

Solana Labs Co-Founder Responds to Backlash

Solana Labs co-founder Anatoly Yakovenko has responded to the backlash in a post on X. He said he was sorry for the lack of sensitivity that was used in the advert and for not considering how such a piece can hurt minority groups. “The ad was bad, and it’s still gnawing at my soul,” Yakovenko said, following the mistake which had been made. He also confessed that at first, he had minimized the situation and did not speak out about it as it deserved to be.

Yakovenko went on to also express gratitude to the developers and artists in the Solana ecosystem who openly seceded the ad; some did it publicly while others privately. He effectively also appericated their collaboration in pointing out such content.

Nonetheless, Yakovenko sought to cool down the tensions, stating that Solana Labs would keep true to its objectives: decentralization and open-source software. He noted that the Solana Foundation would not interfere with culture wars and would stick to the principles on which Solana was established.

Marketing Missteps and Community Reaction

This ad was widely regarded as provocative as it presented a character called “America” speaking about ideas of invention during a therapy session. Instead of giving him theories about technological development, the therapist advised him to stick to matters like gender and pronoun.

In the end, the ad concluded with the character stating that he was going to ‘invent technologies not genders. The depiction was also considered by many as being sexist and an awkward response to the present culture and political correctness.

The response was immediate, with many people in the crypto-sphere expressing their disgust on social networks. Some of the critics felt that the ad was vulgar and insensitive towards some of the vices in the society towards Solana. Subsequently, the company removed the video, however, by that time the video had received millions of viewers and thousands of comments. Some questioned the Solana marketing team for not thinking past such a message, especially during the current political climate of gender issues.

Solana Price Trends Amid the Controversy

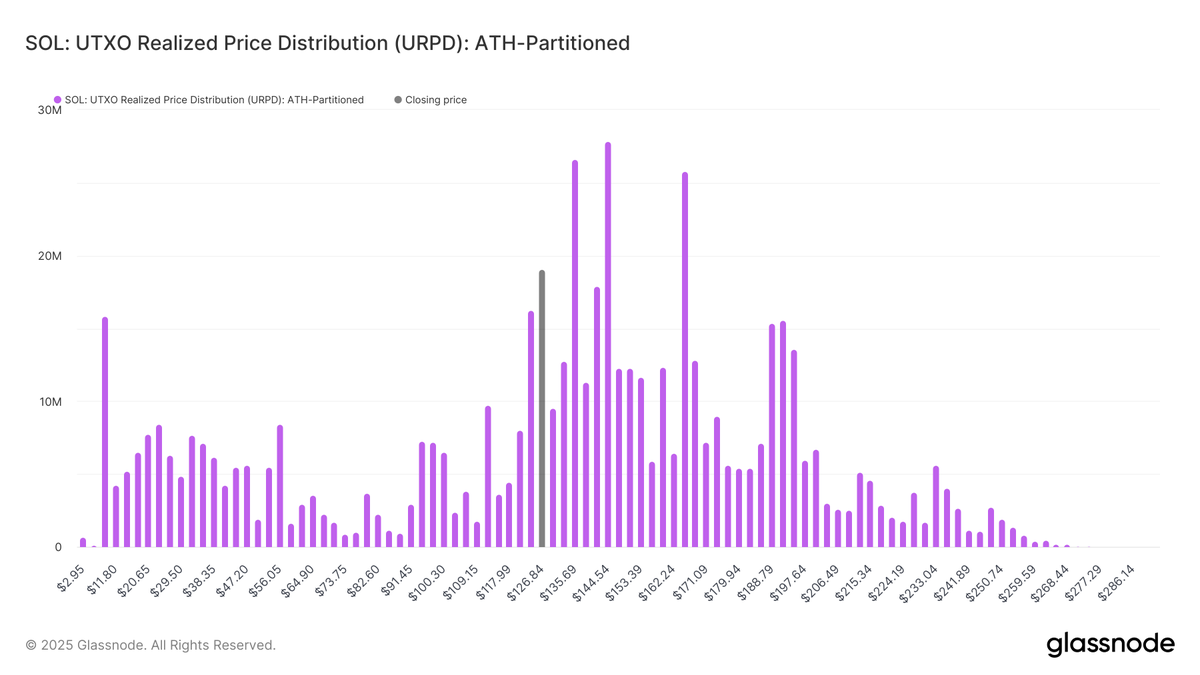

Following the controversy, many investors have been closely monitoring the impact on Solana’s market performance. While Solana remains one of the largest blockchain networks, the incident has raised concerns over potential consequences for SOL’s price. As of March 19, Glassnode’s URPD (Unrealized Realized Price Distribution) chart suggests key support and resistance levels that could be affected by this negative publicity.

The first strong support level is $112.10 according to Glassnode where 9.7 million SOL (approximately 1.67% of the total) is stored. This level proves important, in the light of the fact long-term investors might be willing to support the stock after acquiring stakes hence this presents a cost base. On this context, the $94, $97, and $100 levels support around 21 million SOL which is 3.5% of the total supply and breakdown of any of these levels may lead to bearish pressure.

On the upside, there is resistance around $135, where 26.6 million SOL is concentrated, and particularly at $144, where 27 million SOL (nearly 5% of supply) is held. These levels could provide significant selling pressure, as many investors who bought at or near these levels may look to exit at break-even, adding additional selling pressure on the price.

The post Solana Labs Co-Founder Breaks Silence on Controversial Ad Amid Backlash appeared first on CoinGape.