The SIGN airdrop is coming up with SIGN protocol’s native token launch this April. The team has already revealed the eligibility criteria, allocation, and exchange listing, building hype among crypto investors. The anticipation for the SIGN token and the potential price at launch are also rising. Let’s discuss the key details of the airdrop and what to expect.

SIGN Airdrop Listing, Tokenomics & More

According to the official SIGN protocol announcement, the airdrop and the token launch are set to happen on April 28, 2025. The token will have a total supply of 10 billion, but the circulation supply will be only 12% of that.

The minting will take place on the Ethereum mainnet, whereas the distribution will happen through BNB and Base chain. This would ensure accessibility and cross-chain compatibility.

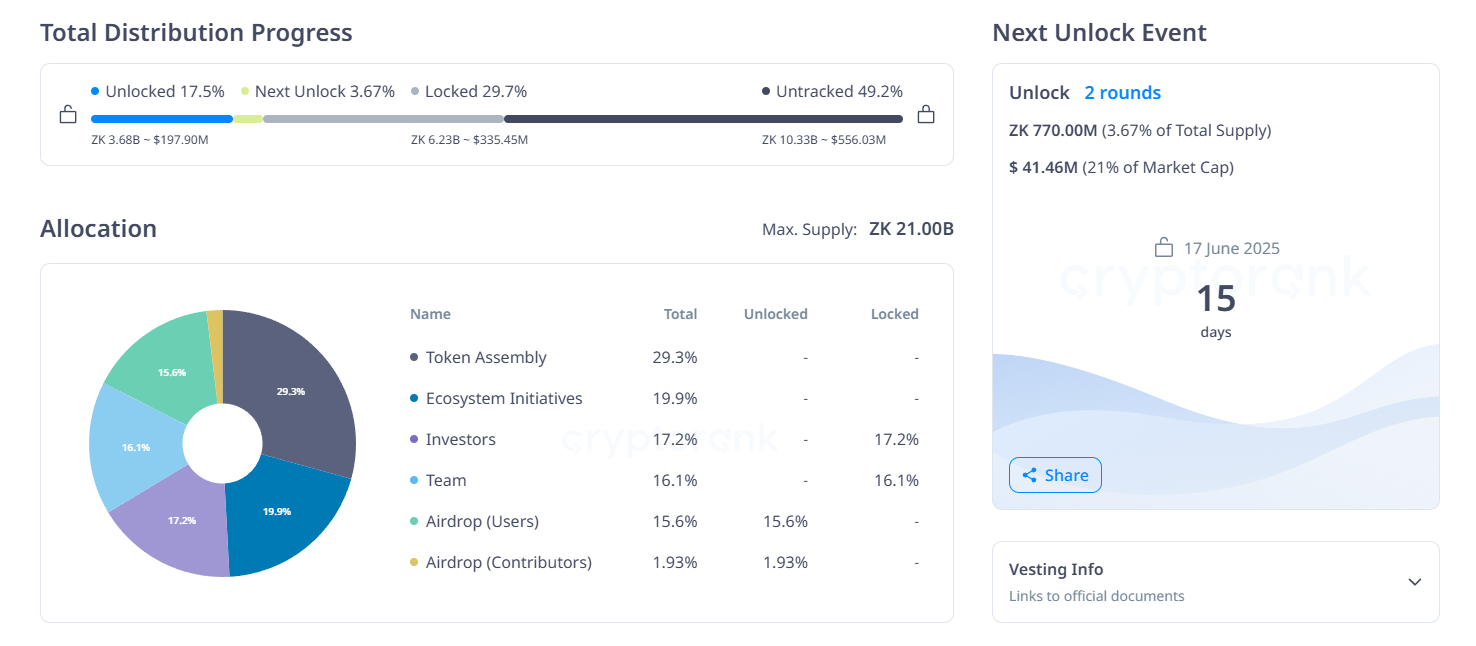

The tokenomics details reveal that 40% of the SIGN token is allocated to the community. Out of which 10% is for the TGE airdrop, making it one of the best crypto airdrops in April. The remaining 30% is for future rewards and unlocks.

The remaining 60% of the supply is allocated for backers (20%), early team members (10%), foundation (10%), and ecosystem (10%). The airdrop allocation and the Binance SIGN exchange listing are raising investors’ anticipation around the potential SIGN token price at launch.

SIGN Token Price Prediction: What Will be the Launch Price?

The SIGN token is getting listed on various popular crypto exchanges, including Binance, Bybit, and many others. This is important as this would influence the SIGN token price, as the listing on top exchanges builds credibility and visibility.

Notably, the team has not declared a launch price. However, experts claim that the price should be near $0.02 based on exchange listing, supply, and other airdrop records. ZORA airdrop went live recently and had a listing price in this range, and the same is true for many others.

More importantly, this is just an estimation, and the price could vary significantly. Interested users must await further updates on the SIGN airdrop.

The post SIGN Airdrop on April 28: Everything to Know About the SIGN Token Listing and Price Outlook appeared first on CoinGape.