Shiba Inu (SHIB) has been experiencing mixed signals in recent weeks. The meme coin has made attempts to secure a breakout, but this effort hinges heavily on investor support.

Unfortunately, this support has been weak recently, forcing SHIB to rely on the broader market, particularly Bitcoin (BTC), for direction. If Bitcoin continues its upward trajectory, Shiba Inu may have a shot at a recovery rally.

Shiba Inu Needs Support

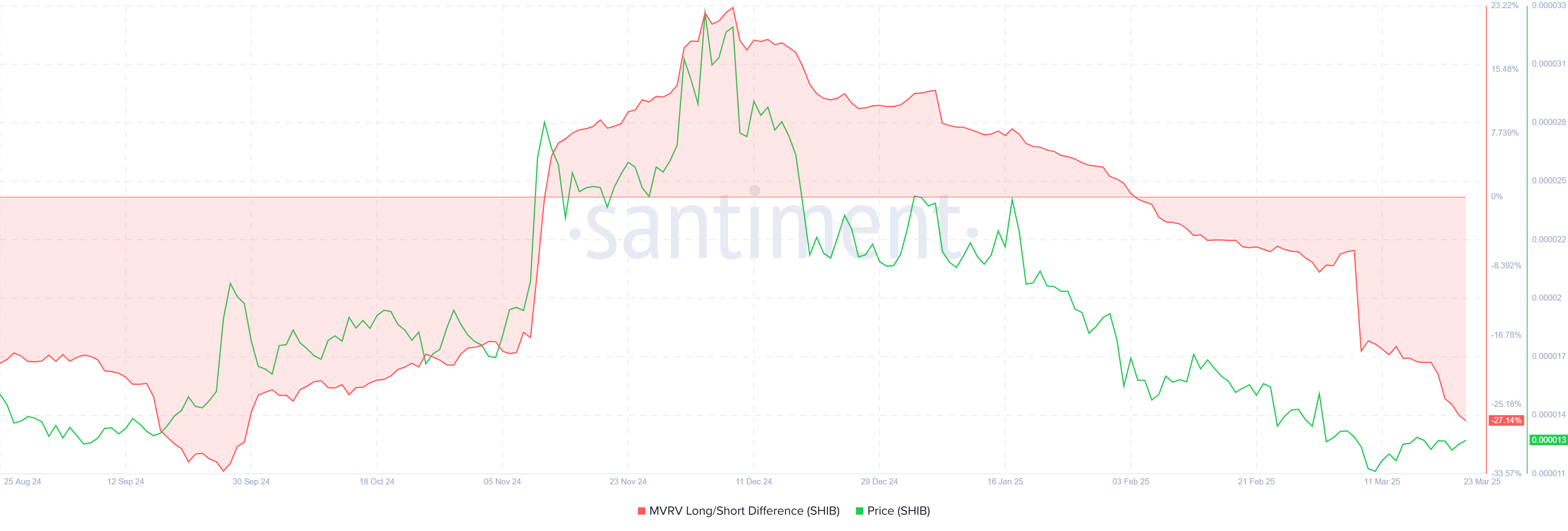

The MVRV Long/Short Difference for Shiba Inu is currently at a 6-month low, a key indicator suggesting that short-term holders are experiencing substantial profits.

This is a bearish sign for the cryptocurrency, as these investors are typically more inclined to sell when they are in profit. As a result, the potential for a sell-off is higher, and the price of Shiba Inu could take a hit as these holders exit their positions.

This behavior could put downward pressure on SHIB, limiting its chances of maintaining or building upon its recent gains. The lack of strong support from long-term holders, combined with the large profit-taking from short-term traders, creates an unstable market dynamic for Shiba Inu at present.

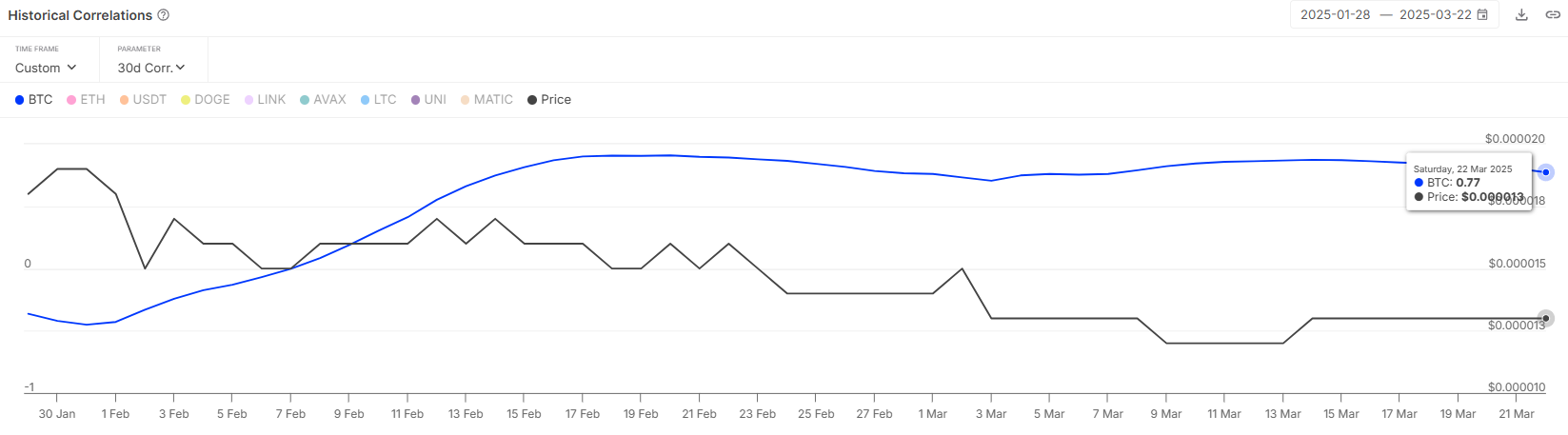

Shiba Inu’s correlation with Bitcoin remains strong, currently sitting at 0.77. This indicates that SHIB tends to move in tandem with Bitcoin, and as the largest cryptocurrency gradually recovers, Shiba Inu could follow suit.

Bitcoin’s potential rally toward the $90,000 mark would likely provide the necessary boost for SHIB to continue its own recovery.

If Bitcoin breaches the $90,000 level, it will instill further confidence in the broader cryptocurrency market. This, in turn, could help lift Shiba Inu from its current consolidation phase, giving it the momentum needed to push past key resistance levels.

SHIB Price Is Aiming At Recovery

At the time of writing, Shiba Inu is trading at $0.00001296, just above its support level of $0.00001275. The altcoin is attempting to hold this support and bounce off it, but its ability to maintain this level depends on market conditions.

Should Bitcoin rise further, Shiba Inu may find some support to reach or surpass the $0.00001462 barrier. However, if Bitcoin experiences a slip, SHIB will likely remain consolidated around $0.00001275 or potentially fall to $0.00001141, depending on the strength of the bearish pressure.

The only way this bearish-neutral outlook would be invalidated is if Shiba Inu breaks through the $0.00001462 resistance and flips it into support.

A successful rally above this level could pave the way for SHIB to rise to $0.00001676 and beyond, marking the start of a more bullish trend for the meme coin.

The post Shiba Inu (SHIB) Price Trajectory Largely Depends on Bitcoin appeared first on BeInCrypto.