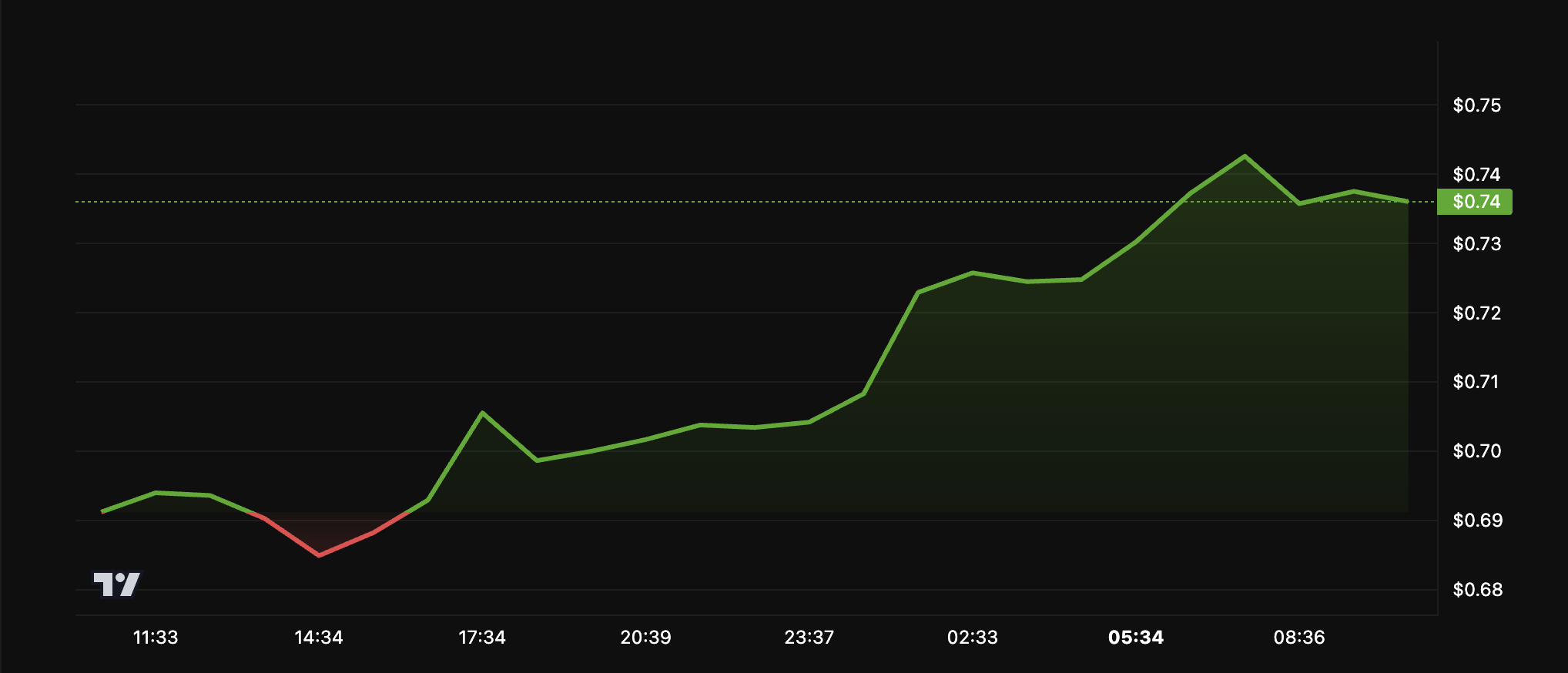

Ripple’s U.S. dollar-pegged stablecoin, RLUSD, has officially launched, sparking curiosity about which major exchanges will support it. While Ripple’s Senior Vice President of Stablecoins, Jack McDonald, remained tight-lipped about specific exchange partnerships, he hinted at future listings, including potential support from leading platforms like Coinbase. This week, Bitstamp confirmed its support for RLUSD, marking a significant step in Ripple’s journey to expand its stablecoin presence.

In a recent interview with The Block, McDonald discussed the complexities of securing exchange listings, emphasizing the technical challenges involved. “There’s a lot that goes on [beyond a handshake], especially considering the diverse blockchains that stablecoins like RLUSD operate on,” McDonald explained. The stablecoin is currently supported on both Ethereum and XRP Ledger, following approval from the New York State Department of Financial Services (NYDFS).

Ripple’s RLUSD is the first XRP Ledger-based stablecoin to secure NYDFS approval, positioning it as a key player in the regulatory-compliant stablecoin market. McDonald noted that this approval could encourage other NYDFS-regulated entities to adopt RLUSD, making it an attractive asset for exchanges.

When discussing other potential exchanges, McDonald mentioned that platforms like Coinbase and Binance have historically shown exclusivity toward certain stablecoins due to strategic partnerships, such as Coinbase’s relationship with Circle’s USDC. However, he remains optimistic that exchanges will eventually expand their stablecoin offerings, including the possible inclusion of RLUSD.

Looking ahead to 2025, McDonald predicted that stablecoin issuers with strong institutional backing and regulatory compliance frameworks will dominate the market. Smaller, less compliant entrants may struggle to compete as liquidity and institutional trust become key factors in exchange and liquidity provider decisions.

Also Read: Ripple’s Role In The Evolution Of Crypto-Focused Banking.

With Ripple’s RLUSD making strides in both regulatory approval and exchange partnerships, the stage is set for it to challenge the dominance of existing stablecoins in the coming year.