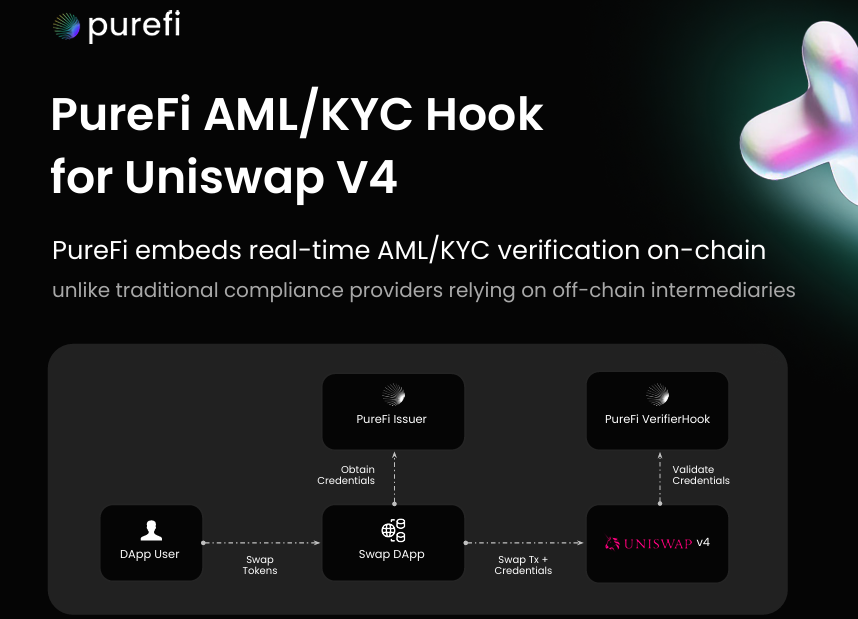

PureFi, a ZK privacy-based compliance infrastructure provider for institutional grade DeFi projects like Panther protocol, Astra DAO and RAILGUN has launched the integration of its advanced AML/KYC framework directly into Uniswap V4’s smart contract. This upgrade addresses critical security gaps by enforcing regulatory compliance at the protocol level, ensuring all transactions undergo verification before execution—effectively closing loopholes exploited by malicious actors.

Protocol-Level Compliance: Closing Security Gaps at the Core

Unlike traditional security solutions that apply compliance measures solely at the front-end, PureFi’s technology embeds verification into the blockchain’s core logic. This ensures compliance persists even when users bypass interfaces and interact directly with smart contracts, the same method used in the recent Bybit hack when the Lazarus Group was able to swap 8000 mETH using Uniswap. PureFi was created with the aim of enabling tailored, rules-based compliance without compromising the core values of decentralization and privacy.

“Combating on-chain criminality is absolutely essential to not only ensuring privacy sets like RAILGUN can safely grow, it’s also vital to the sustainability of DeFi. PureFi is leading the way in real time analytics to keep you and your funds safe on-chain.” – Railgun Team

Bridging Compliance with Decentralization: PureFi’s Uniswap V4 Integration

Built on Uniswap V4, PureFi Dex demonstrates how decentralized exchanges (DEXs) can align with regulatory standards without compromising decentralization. Its architecture includes:

- Custom Compliance Routers: Replacing standard Uniswap interfaces with protocol-specific routers.

- Level Based Verification: A dynamic system scaling checks based on transaction volume:

- Low-volume: Basic identity and sanctions screening.

- Mid-volume: Enhanced liveness checks and source-of-funds validation.

- High-volume: Comprehensive KYC, risk-based wallet scoring, and real-time monitoring.

“We’re not enforcing compliance on DeFi. We’re giving protocols the tools to interact with new user groups — especially institutions — in a secure, privacy-preserving way. And we’re doing it in a way that anticipates future regulation, while respecting today’s decentralization ethos.” – Slava Demchuk, CEO, PureFi Protocol

PureFi vs. Predicate: The Competitive Edge in DeFi Compliance

PureFi’s framework outperforms alternatives like Predicate through:

- Centralized Issuer Reliability: A unified issuer service powered by AMLBot’s compliance engine and integrated KYC/KYT providers ensures consistency. Predicate’s reliance on multiple third-party Operators introduces fragmentation risks.

- Hybrid Transaction Security: Combining co-signed transactions with user-managed whitelists reduces delays for institutional traders while maintaining compliance. Whitelisted addresses engaging in suspicious activity are revoked instantly.

- Unified KYC/AML Workflow: Unlike Predicate’s disjointed compliance tools, PureFi integrates both checks into a single system.

- Progressive Enforcement: Cumulative transaction thresholds mirror centralized exchange (CEX) standards, enabling adaptive compliance.

Features: Enabling Secure, Privacy-Preserving, and Compliant DeFi

Rule-Based and Customizable

Rule-Based and Customizable

PureFi’s system isn’t about enforcing blanket KYC — it’s about enabling contextual compliance. Protocols and institutions can define flexible rules (e.g., based on transaction volume or risk profiles) and adapt over time. Since global DeFi regulation is still evolving, we mirrored existing CeFi compliance frameworks to provide a usable starting point and future customise the rule-based approach based on the regulations and market demand.

PureFi Is Built On SSI Concept

PureFi Is Built On SSI Concept

Our initial design was based on the Self-Sovereign Identity (SSI) principle — putting control in the user’s hands. However, due to practical and legal constraints (like GDPR, which does not recognize users as data controllers in a VASP context), we developed a more robust, on-chain identity system that preserves decentralization while meeting compliance needs. When regulations mature to allow a truly decentralized SSI setup, our infrastructure is ready to support it.

Zero-Knowledge Proofs at the Core

Zero-Knowledge Proofs at the Core

Privacy is not an afterthought — it’s fundamental. PureFi uses ZK proofs so that once a user is verified, no personal data is revealed to third parties or the DeFi protocol itself. The system simply checks whether a user meets a predefined rule — nothing more, nothing less.

A Blueprint for Future Regulation-Ready DeFi

PureFi Dex is currently operational for UFI/BNB trading pair, offering a blueprint for secure, regulation-ready DeFi platforms. Its modular design allows seamless updates to compliance rules via off-chain configuration, eliminating the need for smart-contract redeployment as regulations evolve.

About PureFi

PureFi specializes in blockchain-native compliance solutions, enabling DeFi protocols, institutions, and traders to meet global regulatory standards without sacrificing decentralization. PureFi DEX enables fully compliant DeFi swaps and liquidity management for Hedge funds, trading desks and institutions.

The post PureFi Advances Privacy-Based ZK Compliance Infrastructure for Institutional-Grade DeFi Protocols appeared first on BeInCrypto.