The post Liked by Investors: This $0.03 Coin Has the Same Upside Potential as XRP (XRP) in Early Days appeared first on Coinpedia Fintech News

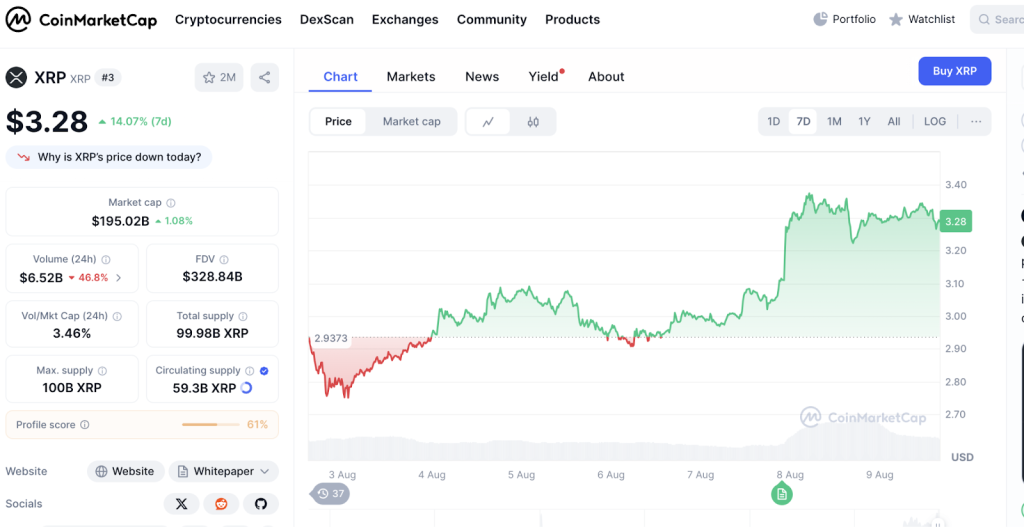

Years ago, XRP traded under a penny, shrugged off by many who didn’t fully grasp its long-term value. Now it ranks among the top tokens in the world, despite early doubt. Today, a new player is catching attention for a similar reason: solid utility, early-stage entry, and asymmetric upside. That project is Mutuum Finance (MUTM), priced at just $0.03 in Phase 5 of its presale, with over $11.7 million raised and 60% of tokens in this phase already sold. With more than 12,700 holders and deep DeFi fundamentals, Mutuum Finance (MUTM) is now being discussed in the same breath as XRP’s early rise.

That isn’t just community hype. One notable investor who previously held a six-figure XRP portfolio has now placed $12,000 into Mutuum Finance (MUTM) at $0.03 during Phase 5 of the presale. That allocation secured them 400,000 MUTM tokens, and with the $0.06 listing price locked in, this investor is already set to double their position to $24,000 by launch day.

Analysts have projected targets of $1 to $2 within the first few post-launch months. At $1, the same 400,000 tokens would be worth $400,000—a 33x return on the original $12,000 buy-in.

At $2, that value becomes $800,000—a 66x return. And at $3, the investor would be holding $1.2 million, marking a 100x gain from the Phase 5 entry point.

A Custom Lending Platform for the Whole Market, Not Just Blue Chips

Unlike traditional DeFi platforms that focus only on blue-chip coins like ETH or BTC, Mutuum Finance (MUTM) is targeting both ends of the spectrum by launching with two core lending engines. The peer-to-peer (P2P) model is built to support more volatile or illiquid tokens—like DOGE, SHIB, and other meme coins—by allowing lenders and borrowers to negotiate customized terms directly. This opens up new borrowing and earning channels for token holders who’ve typically been sidelined by major protocols.

Lenders will be able to select the terms they’re comfortable with—interest rates, loan durations, and repayment conditions—without the need for a centralized intermediary. Borrowers will post overcollateralized positions, and lenders will accept or reject those terms based on their own risk profile. This design brings real freedom into the lending space, offering an alternative to one-size-fits-all models.

Security Measures and Institutional Trust Growing Fast

One key element helping Mutuum Finance (MUTM) gain momentum is its proactive approach to smart contract safety. The protocol has been fully audited by CertiK and is now running a $50,000 Bug Bounty Program, rewarding any white-hat developers who can identify weaknesses before launch. The bounty includes rewards across four tiers—from low severity to critical—ensuring all aspects of the system are rigorously examined. Combined with a Skynet Score of 77 and a Token Scan Score of 95, the project has built real confidence across institutional desks and high-net-worth DeFi users.

Investors are already acting on that trust. A former Avalanche (AVAX) holder recently moved $18,000 into Mutuum Finance (MUTM) during this phase, positioning for a clean 3x return post listing. In another case, a $25,000 whale from Phase 1 is now up to $75,000 in paper gains and targeting another 300% post launch. These are not passive bets—they’re conviction-driven entries by traders who recognize early value in scalable DeFi models with on-chain transparency.

And while many presales are merely token offerings waiting for development, Mutuum Finance (MUTM) is preparing to launch its beta platform at the same time as its token goes live. The team has outlined a roadmap that includes Layer-2 integration for faster, lower-cost usage, passive income through mtTokens, and the rollout of a decentralized stablecoin that will always target a $1 peg. That stablecoin will only be minted when loans are initiated with overcollateralized assets, and it will be burned upon repayment or liquidation—creating both stability and deflationary pressure within the ecosystem.

As adoption grows, part of the protocol’s revenue will be used to buy MUTM tokens on the open market, sending them to mtToken stakers in dividend distribution cycles. This system will reward holders with long-term vision while creating upward pressure on the token price, especially as more users engage with the lending and borrowing functions.

The listing price of Mutuum Finance (MUTM) is set at $0.06, meaning investors who buy in now at $0.03 already stand to double their capital by Phase 11. But many are aiming far beyond. XRP once turned pennies into fortunes for early believers, and this $0.03 DeFi token now has the same ingredients: utility, demand, and a launch window narrowing by the day.

For more information about Mutuum Finance (MUTM) visit the links below:

The post Liked by Investors: This $0.03 Coin Has the Same Upside Potential as XRP (XRP) in Early Days appeared first on Coinpedia Fintech News

Years ago, XRP traded under a penny, shrugged off by many who didn’t fully grasp its long-term value. Now it ranks among the top tokens in the world, despite early doubt. Today, a new player is catching attention for a similar reason: solid utility, early-stage entry, and asymmetric upside. That project is Mutuum Finance (MUTM), …