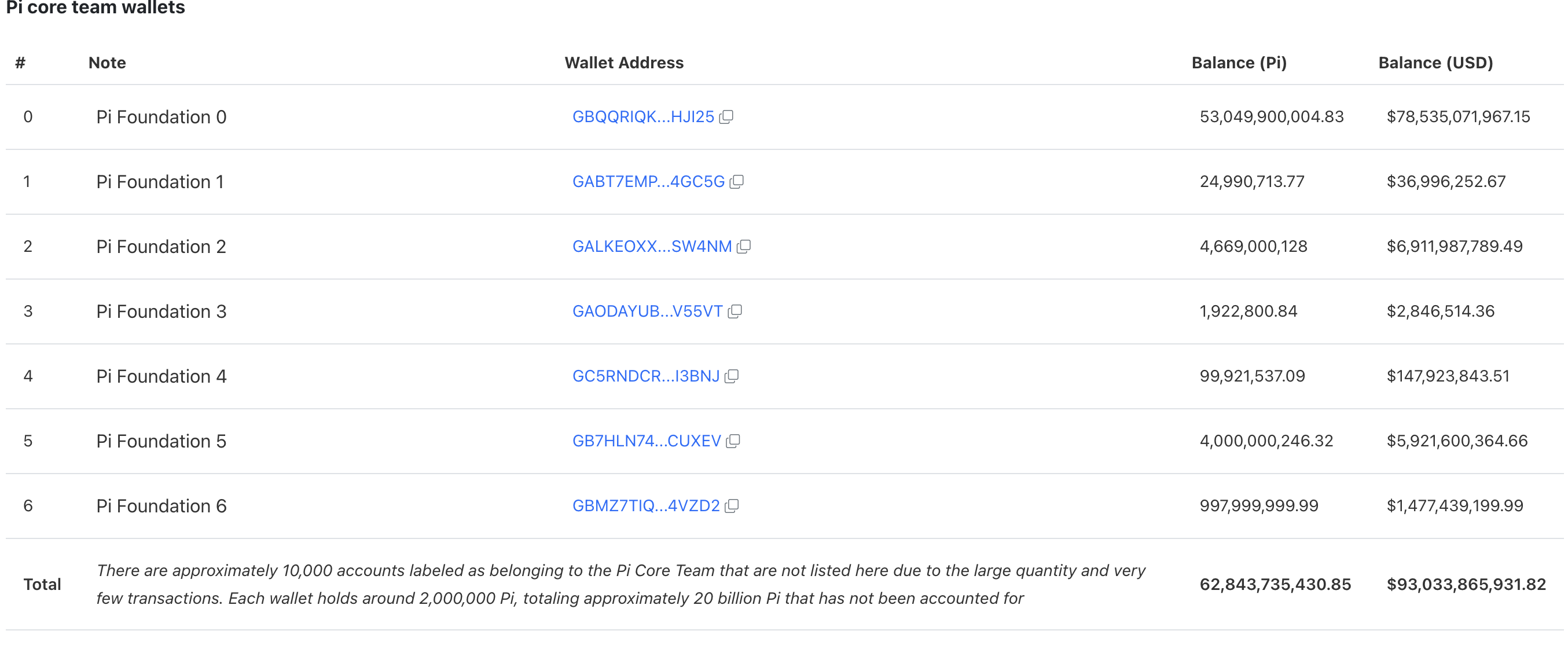

According to data from PiScan, the Pi Network’s core team currently holds the majority of the total Pi Coin (PI) supply.

While such concentration may be necessary during the early stages of a network’s development, it also raises significant concerns about the project’s future decentralization.

Pi Coin Supply Concentration: Core Team’s Control Sparks Worries

The latest data reveals that the Pi Network’s core team controls approximately 62.8 billion Pi Coins across six wallets. Additionally, around 20 billion PI sits in roughly 10,000 unlisted wallets that belong to the team.

This brings the total supply held by these entities to about 82.8 billion PI. It represents a major chunk of the total maximum supply of 100 billion.

Further complicating the centralization issues, Pi Network is currently operating with only 43 nodes and three validators globally. In stark contrast, more established Layer 1 networks, such as Bitcoin (BTC), operate with over 21,000 nodes. Moreover, Ethereum (ETH) has over 6,600, and Solana (SOL) has around 4,800 nodes.

The limited number of nodes and validators means that control of the network is concentrated in the hands of a few entities. Therefore, this makes the network much more centralized than its more established counterparts.

That’s not all. This lack of transparency adds another layer of uncertainty.

“Analyzing Pi Network’s source code and on-chain data is currently challenging due to its incomplete openness,” PiScan posted on X.

Meanwhile, Pi Network has also raised doubts regarding privacy and third-party involvement. In the 2025 privacy policy update, Pi Network revealed that it uses ChatGPT for its Know Your Customer (KYC) process. This feature was not mentioned in the previous version of the policy.

“We use ChatGPT, as a trusted AI partner, to automate identity verification and enhance security measures. By using our KYC services, users consent to the use of ChatGPT, and other AI providers that may be later implemented, as part of our KYC process,” the document states.

The introduction of artificial intelligence (AI) into the KYC process brings a new layer of complexity to how user data is shared and processed.

These concerns add to a growing list of issues surrounding Pi Network. The community has previously highlighted technical difficulties during the mainnet migration. In addition, many users, frustrated by the long lockup period and limited immediate access to their tokens, have been trying to sell their accounts.

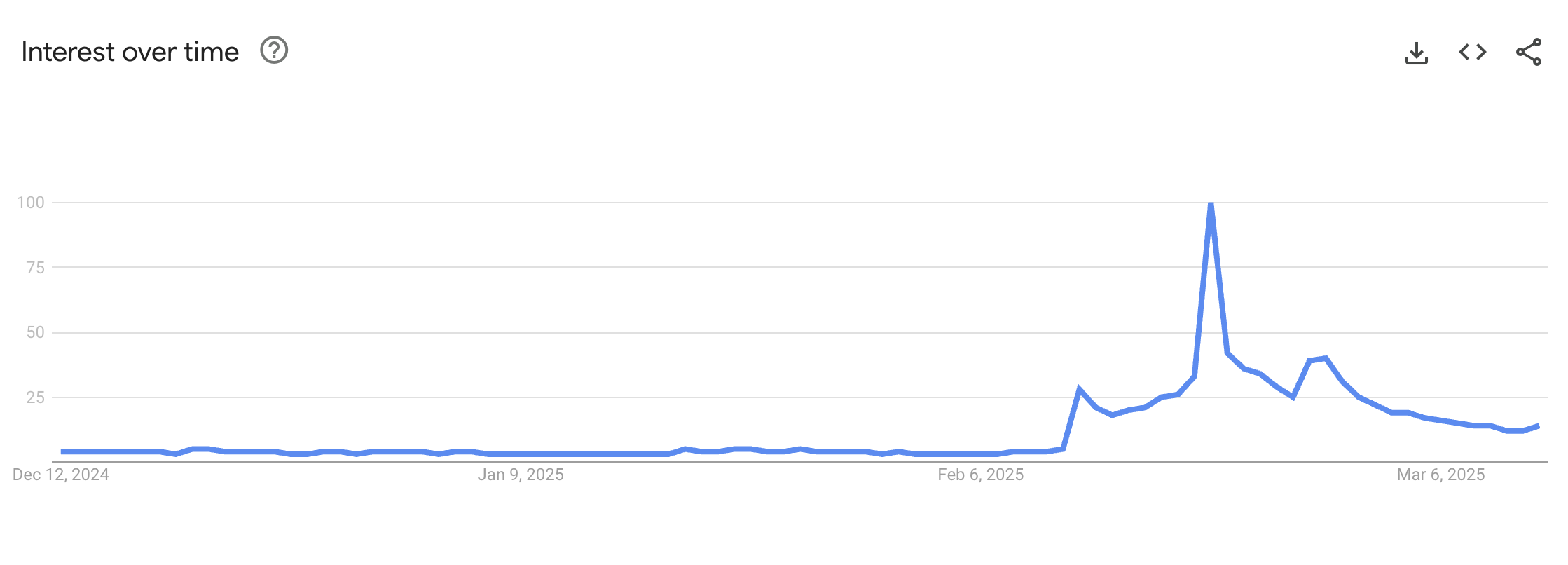

This dissatisfaction has resulted in a sharp decline in Pi Network’s popularity. According to Google Trends, the search interest for “Pi Network” has dropped significantly since the mainnet launch on February 20.

On launch day, the search interest was at 100, indicating a peak of public attention and excitement surrounding the event. However, this figure has plummeted to just 12 at the time of this report, reflecting a steep decline in interest.

The post Pi Network’s Centralization Worries Grow as Core Team Holds 82.8 Billion Pi Coins appeared first on BeInCrypto.