PancakeSwap (CAKE) has experienced a notable recovery recently, surging by 55% over the past week. This sharp rise has reversed the significant losses seen in late February, with the altcoin now trading at $2.68.

As the price has soared, traders and investors have become increasingly bullish, prompting a surge in trading activity and increased optimism for future price movements.

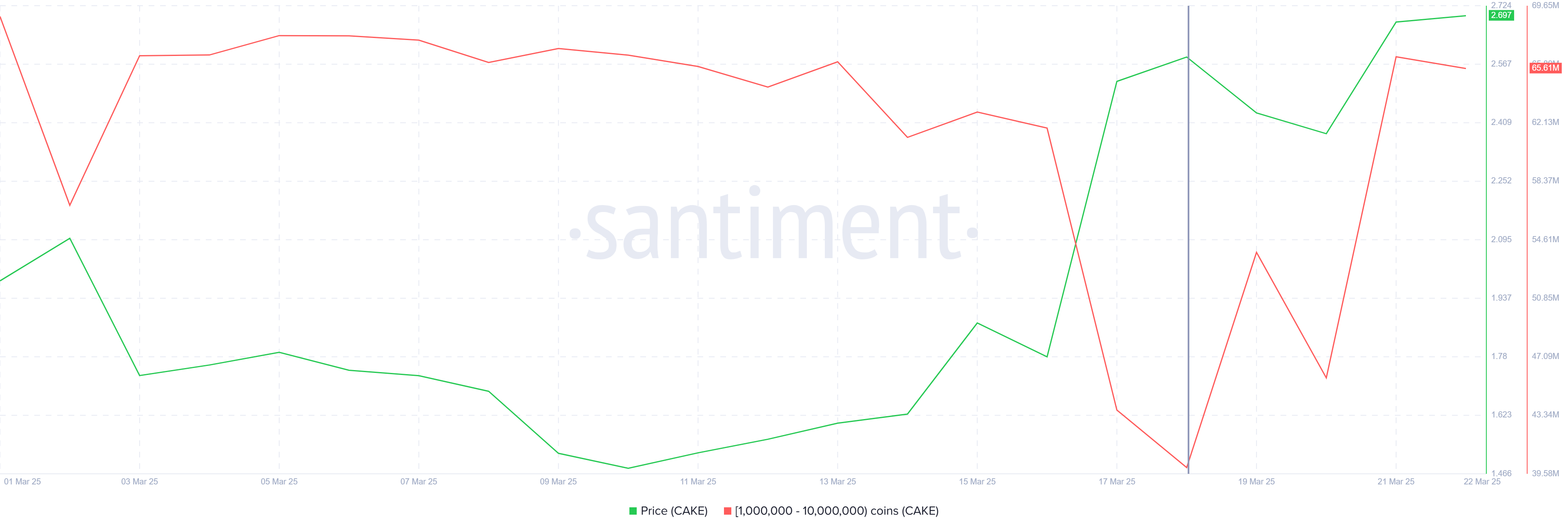

PancakeSwap Notes Surge In Whale Activity

In the past four days, whale addresses have accumulated 25 million CAKE tokens worth approximately $69 million. This massive accumulation follows a 50% surge in price over the past week, further fueling the positive market sentiment.

The increase in whale activity indicates strong confidence in PancakeSwap’s future prospects, suggesting that large investors expect further gains for the crypto coin.

The bullish sentiment is not just confined to the spot market. Whales’ actions have had a ripple effect, contributing to a broader market uptrend.

As the price continues to rise, the influence of these larger traders could drive additional interest from smaller investors, helping to maintain the upward momentum.

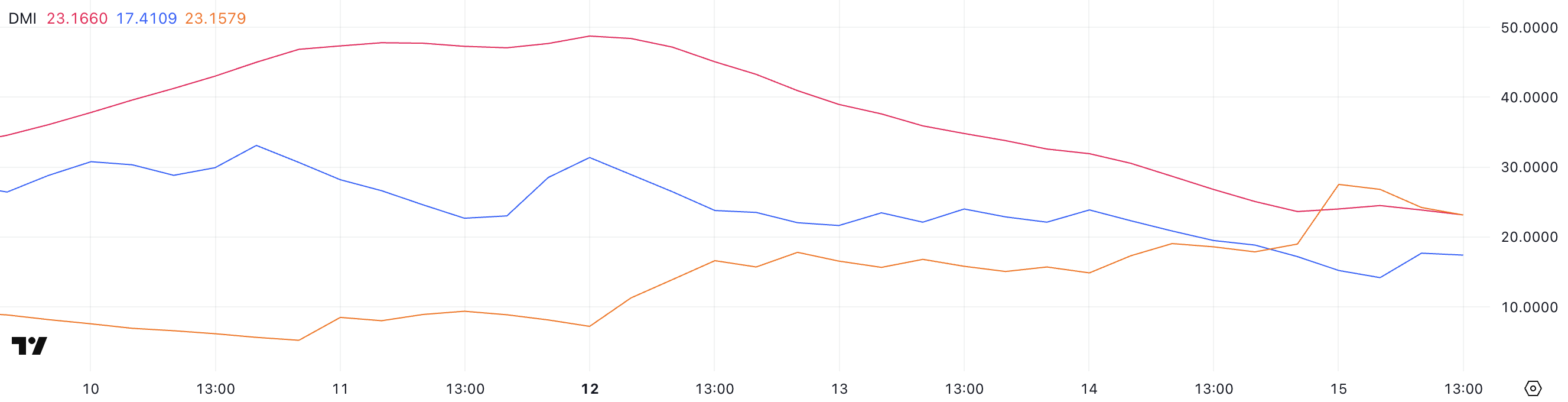

The overall macro momentum of PancakeSwap has shown a clear shift in favor of bullish market sentiment. One key indicator of this is the significant growth in Open Interest, which surged by 326% over the past week.

From $23 million to $98 million, this increase highlights that traders are increasingly betting on future price rises, particularly through long contracts in the Futures market.

The rise in Open Interest shows that the market is confident in the spot price and is also positioning for continued growth in the coming weeks.

This increased activity in Futures contracts suggests that traders are preparing for further upward price action, supporting the case for additional gains in CAKE’s price.

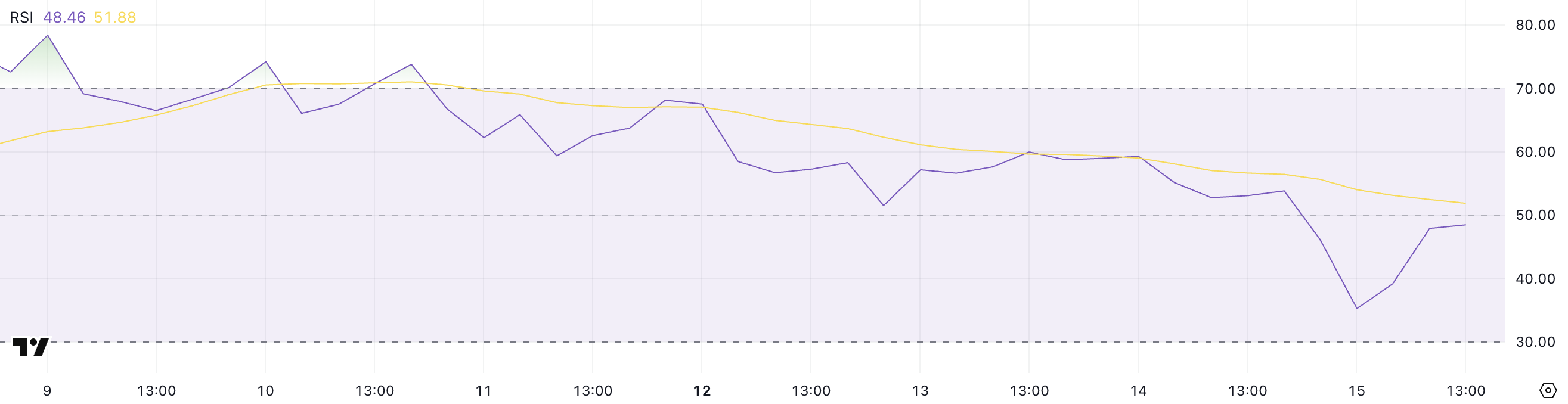

CAKE Price Nears Critical Resistance

CAKE has seen a remarkable 81% price increase over the last ten days, bringing its price to $2.67. In doing so, the altcoin has successfully erased the 47% losses it experienced in late February. The rapid price recovery suggests that there is significant momentum behind the asset.

Currently, PancakeSwap faces a resistance level of $2.85, which has not been established as support since early 2025. If the momentum persists, CAKE could break through this barrier and potentially surpass $3.00.

A successful breach of this level would suggest that the altcoin is poised for further growth.

However, if CAKE fails to break through the $2.85 resistance, it could retreat to $2.30. Such a drop would erase recent gains and invalidate the bullish outlook, possibly signaling a temporary halt in the recovery trend.

The post PancakeSwap (CAKE) Open Interest Grows 326% As Price Nears $3 appeared first on BeInCrypto.