Arbitrum (ARB) wanted to join Nvidia’s Ignition AI Accelerator program but was reportedly turned down as part of the chipmaker’s risk control strategy.

The Layer-2 (L2) network has been strategically attempting to rebuild its reputation amid an ongoing struggle to recover from an 85% price dip.

Nvidia Turns Down Arbitrum’s Bid

Reports indicate that Arbitrum had originally planned to be the Ethereum partner in Nvidia’s Ignition AI Accelerator program. However, the L2 network was reportedly turned down at the last moment.

As it happened, the American multinational technology company prefers to avoid crypto firms for risk control purposes.

“Nvidia recently explicitly excluded cryptocurrency-related projects from its Inception program,” Wu Blockchain reported.

Indeed, when Nvidia launched its accelerator program, the firm articulated on the application page that crypto-related firms would not be eligible.

“The following types of organizations do not qualify for membership: Consulting and outsourced development firms, companies associated with cryptocurrency, cloud service providers, resellers and distributors, and public companies,” read an excerpt on the application page.

This stance presents a calculated risk to preserve the GPU giant’s AI-first brand identity. Nevertheless, some say the move could stifle innovation as artificial intelligence and decentralized systems tend to intersect.

“The recent announcement by Nvidia to exclude cryptocurrency-related projects from its Inception program raises questions about the future of collaboration between traditional tech giants and the blockchain sector,” one user shared on X (Twitter).

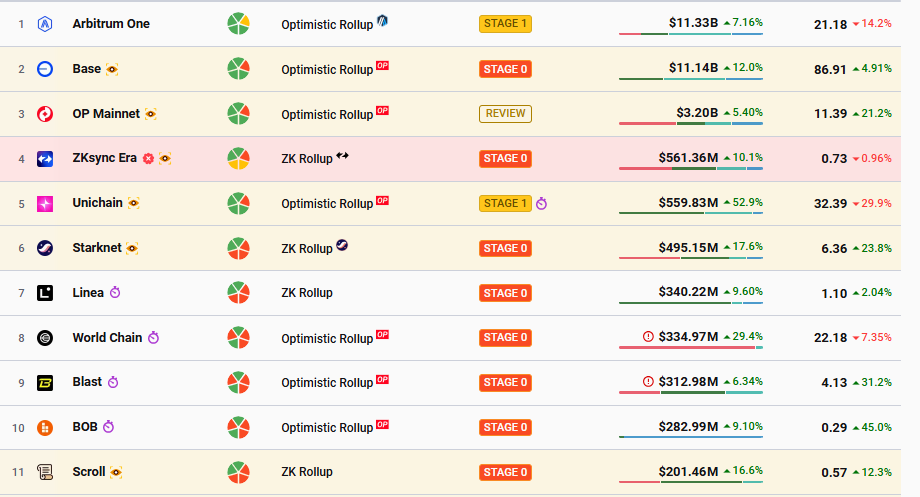

Arbitrum is Ethereum’s largest layer-two scaling solution, trailed by other players in the same space, including Optimism (OP). Data on L2Beats shows Arbitrum One, the optimistic rollup that inherits Ethereum’s security by posting transactions on-chain, leads L2s in TVL metrics.

While Arbitrum leads L2 scaling solutions, it remains well below its December 6, 2024, high of $1.2384. Against this backdrop, the network has been taking steps to recover.

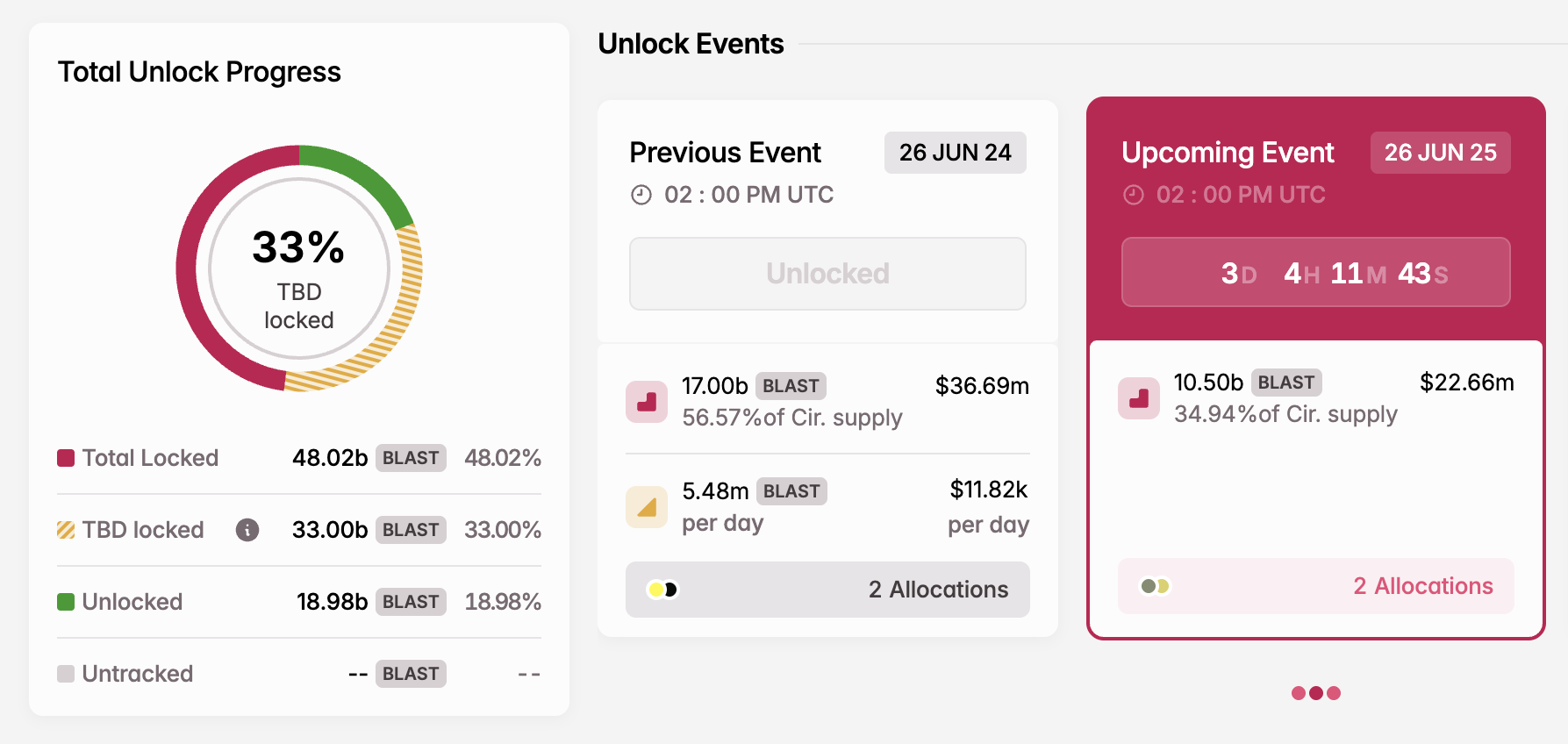

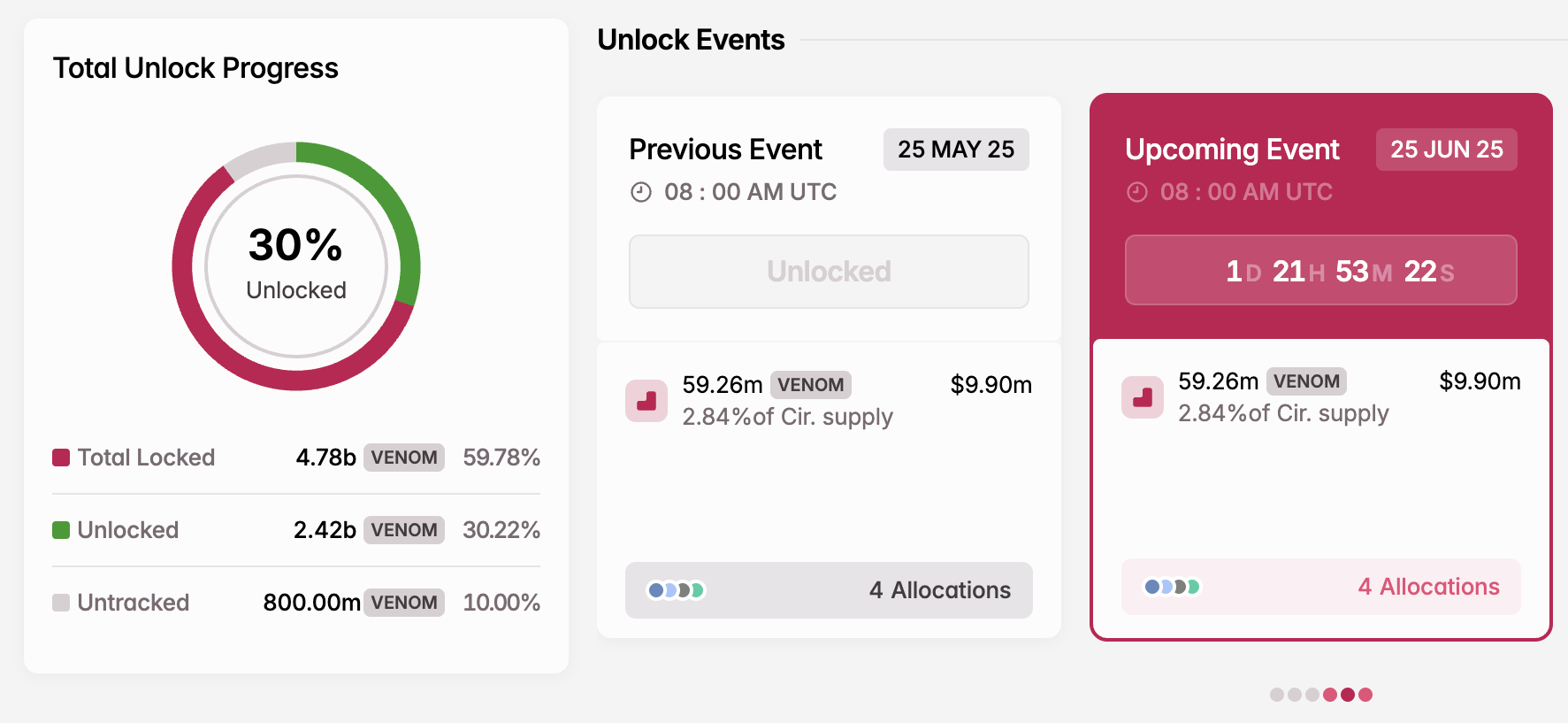

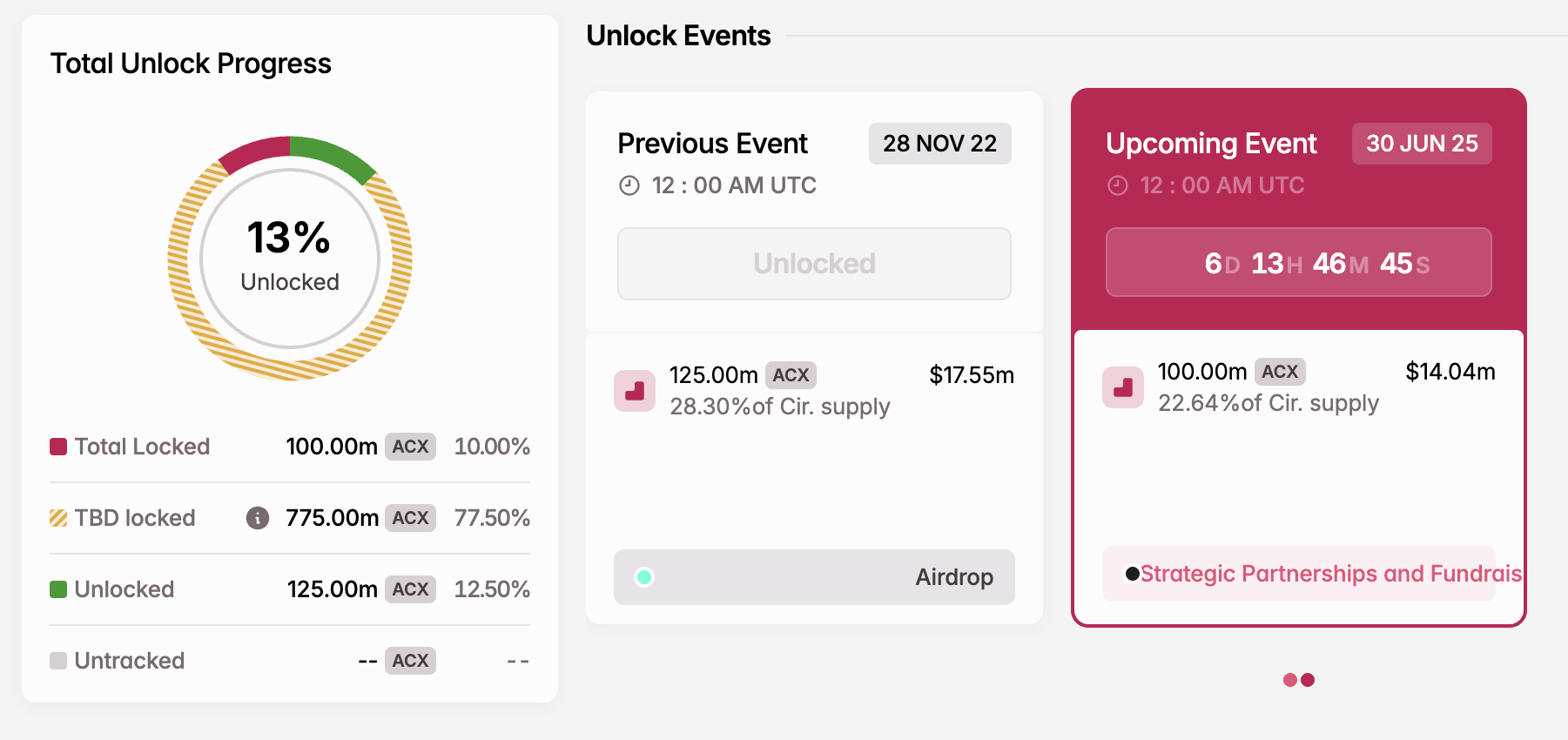

Among them is a token buyback initiative in March to strengthen its ecosystem and absorb supply shocks due to a massive token unlock event. For a time, the initiative worked, buoying ARB price 36% before the downtrend continued, bottoming out at $0.2420 on April 7.

Nevertheless, analysts suggested more interventions with the token still over 70% below its December highs. Yogi, a well-known wallet maxi, said strategies like token buybacks lack long-term vision as they signal a slowdown in innovation.

Similarly, a Messari Crypto researcher, Patryk, suggested that Arbitrum remains flexible and deploys funds into strategic areas over time rather than committing to a rigid framework such as token buybacks.

“I think projects will do this eventually. It’s just difficult to announce a concrete plan for the funds at the beginning of buybacks, like those that Arbitrum just announced. Remain flexible,” the researcher suggested.

Accordingly, Arbitrum may have considered pivoting to Nvidia’s accelerator program for a competitive edge. Now that this plan has fallen, Aributrum faces an ARB airdrops proposal to incentivize early supporters.

The post Nvidia Snubs Arbitrum’s AI Ambitions: What’s Next for Ethereum’s Leading L2? appeared first on BeInCrypto.