The post Why Ethereum Price is Up Today— Key Reasons Behind It appeared first on Coinpedia Fintech News

Ethereum, the world’s second-largest cryptocurrency, has made a strong comeback after dipping below $1,400 not long ago. Now, it’s back above $1,800, a three-week high, and investors are starting to ask, What’s behind this sudden surge?

Let’s take a look at the key reasons.

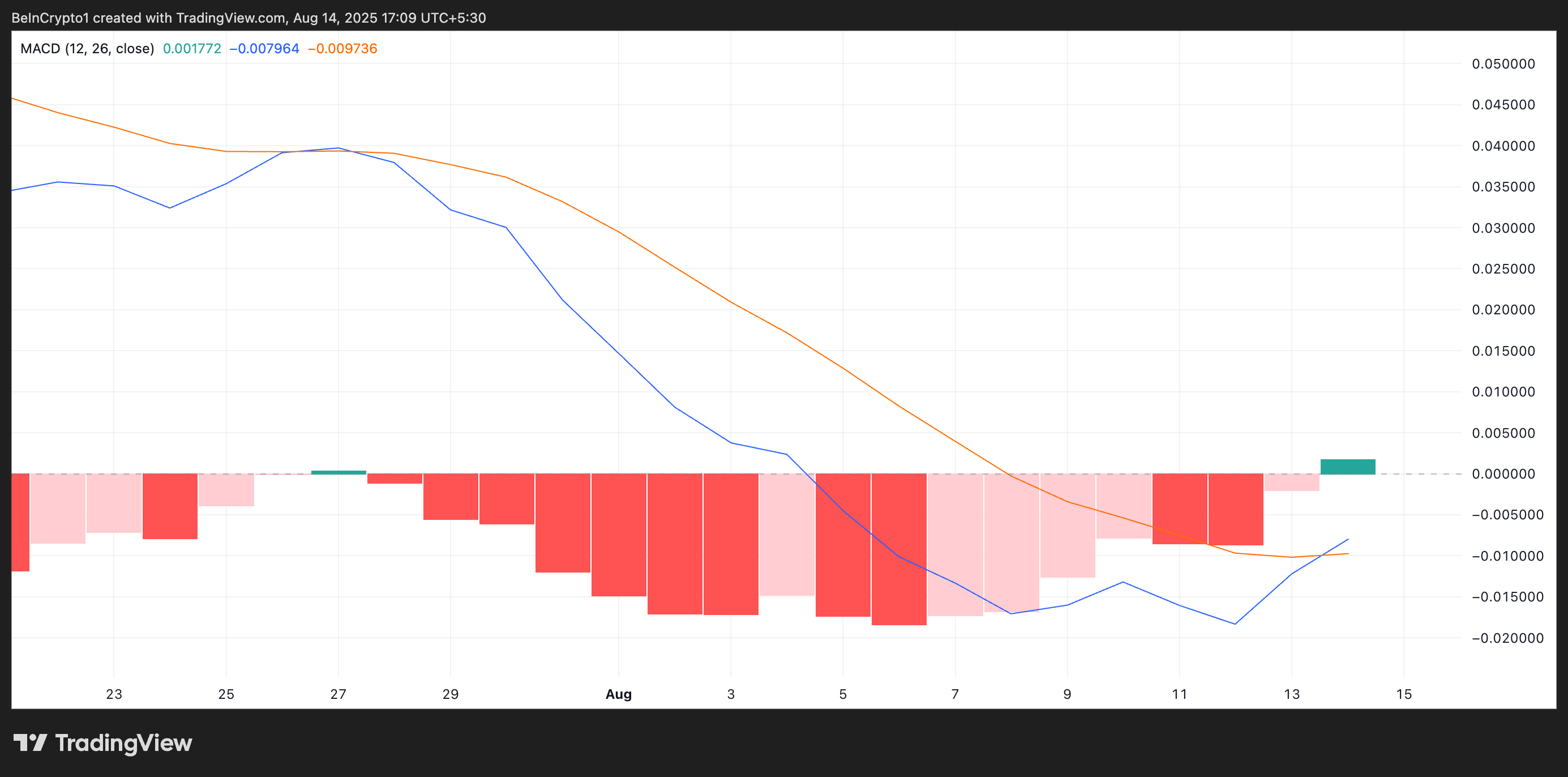

Ethereum Rises as Short Bets Drop

One major reason why Ethereum’s price has risen recently is that fewer traders are betting against it. Short positions on the CME have dropped to under $500 million, the lowest in 2025.

Previously, traders made money from a large gap between Ethereum futures and its current price. But when Trump’s tariffs eased and the market dropped, that gap became smaller, making the trade less profitable. This led traders to sell their Ethereum, which caused a price drop.

Now, with fewer traders betting against it and less selling pressure, Ethereum’s price is starting to recover.

Ethereum ETF Sees Inflow After 8 Days

Another major boost came from institutional investors. After more than a week of outflows, Ethereum ETFs finally saw positive inflows of $38.8 million. The biggest contribution came from Fidelity FETH with $32.7 million, and Bitwise ETHW added $6.1 million.

This strong inflow shows growing interest from investors, which could mean more price growth.

Bitcoin’s Rally is Lifting Ethereum Too

Let’s not forget Bitcoin’s influence. BTC just hit a seven-week high of $94,000, which naturally sent a wave of positive energy through the entire crypto market. As Bitcoin leads the way, Ethereum, the largest altcoin, is also benefiting from this surge.

Ethereum Faces Little Resistance Ahead

According to on-chain data from IntoTheBlock, Ethereum doesn’t have too many strong price barriers ahead. The biggest possible sell zone sits around $1,860. This means some people might start selling at that level, which could slow down Ethereum’s rise.

But here’s the good news, if Ethereum breaks through this $1,860 level, there might not be much stopping it from going even higher. And that’s when the big target comes into view, $2,000.

However, if Ethereum can’t stay above $1,800, the price might drop again. The first support level is around $1,765, and a stronger one sits near $1,710.

The post Why Ethereum Price is Up Today— Key Reasons Behind It appeared first on Coinpedia Fintech News

Ethereum, the world’s second-largest cryptocurrency, has made a strong comeback after dipping below $1,400 not long ago. Now, it’s back above $1,800, a three-week high, and investors are starting to ask, What’s behind this sudden surge? Let’s take a look at the key reasons. Ethereum Rises as Short Bets Drop One major reason why Ethereum’s …