The Tether Cantor Fitzgerald partnership has potentially reshaped Tether’s credibility, silencing years of skepticism surrounding USDT. Aligning with other finance giants and launching “21 Capital”, Tether appears to have quietly secured Wall Street legitimacy.

The result? A Tether that’s cozier with Wall Street than most traditional banks and more institutionalized than some of its loudest doubters ever imagined. This analysis looks at Tether’s tie-up with Cantor Fitzgerald, SoftBank, and how these alliances boost Tether’s credibility, cut regulatory risks, and position the $USDT issuer as a mainstream heavyweight.

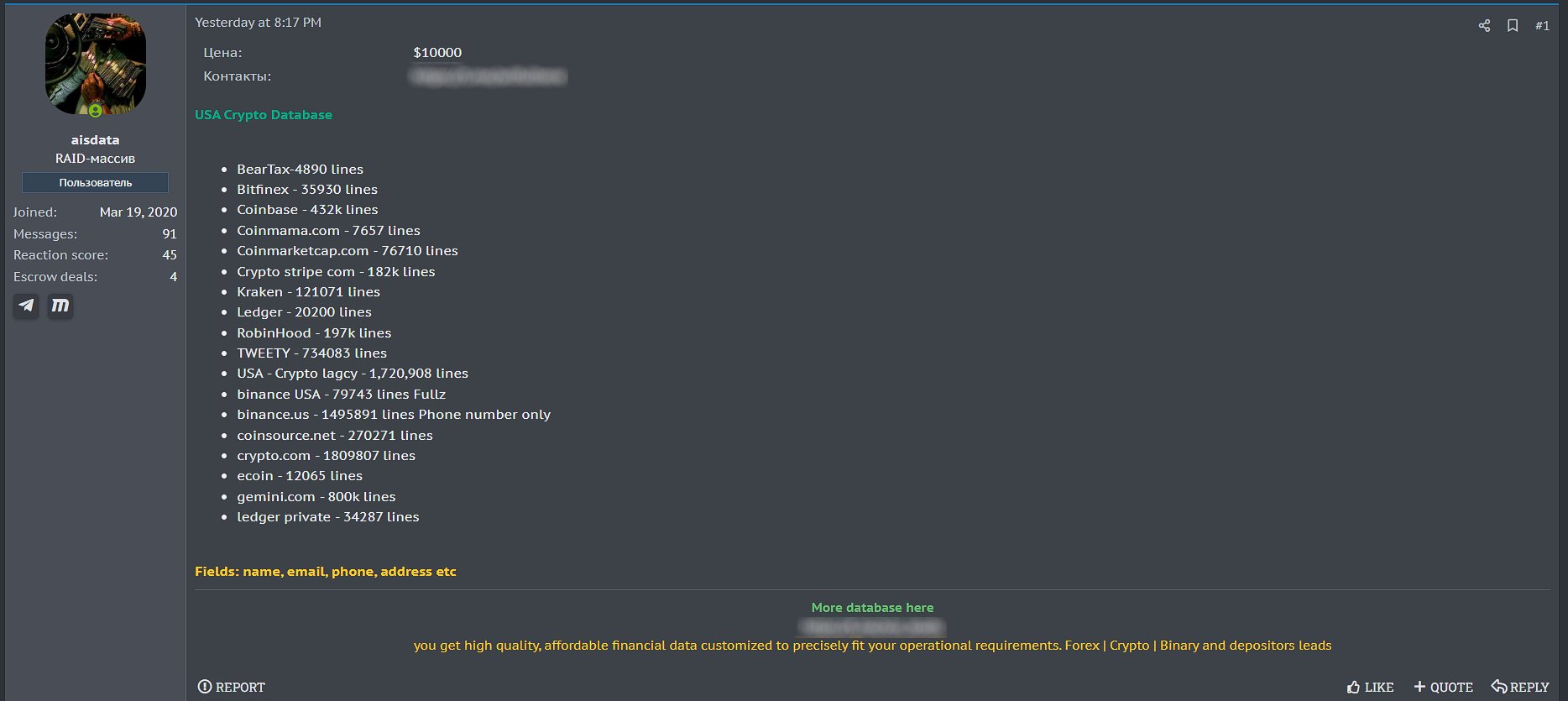

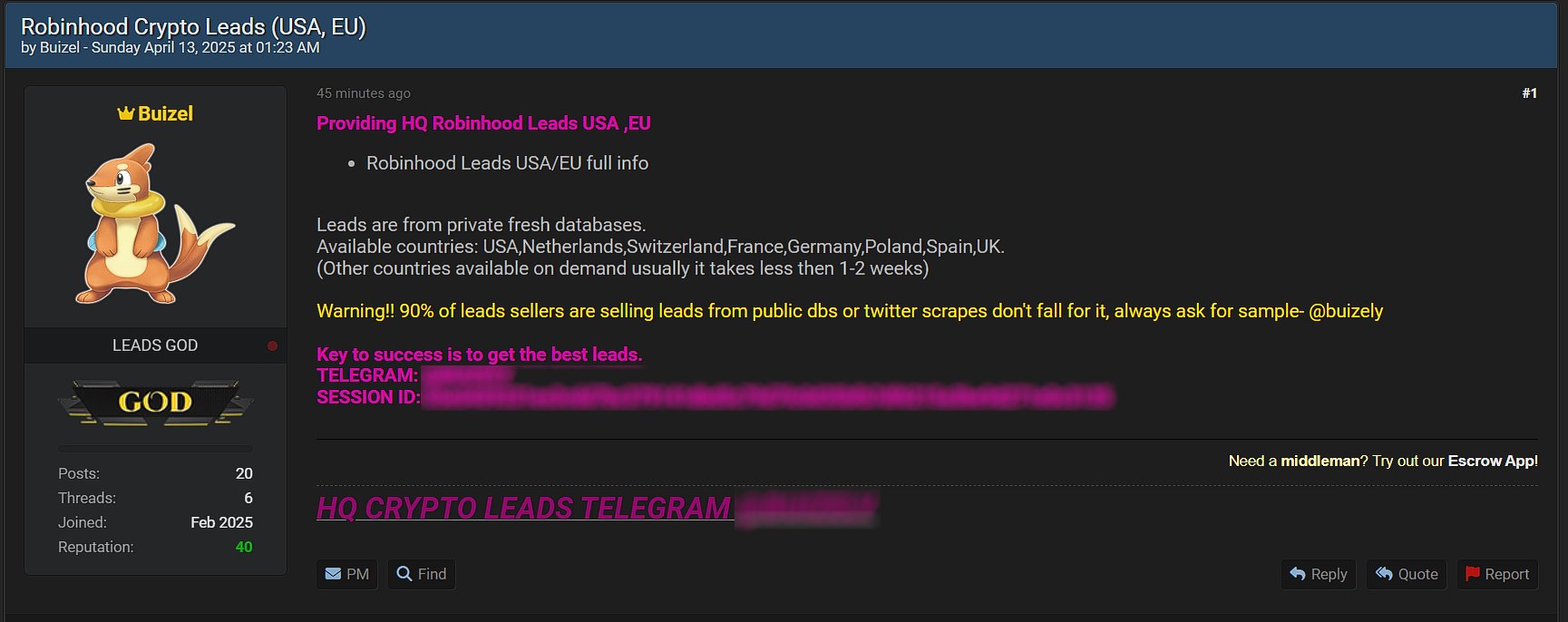

Cantor Fitzgerald: Inside the Tether Cantor Fitzgerald Partnership

Cantor Fitzgerald, a Wall Street brokerage giant, partnered with Tether in 2021 before Howard Lutnick entered government service. As the U.S. Commerce Secretary, Lutnick is responsible for promoting economic growth, job creation, and overseeing policies and programs related to trade, industry, innovation, and data collection.

This early partnership meant Cantor became the primary custodian for Tether’s U.S. Treasury reserves.

By late 2024, Cantor was already holding custody of about 80% of Tether’s $132 billion in backing. A few months later, that rose to 99% of Tether’s Treasury holdings. Skeptics who once insisted Tether’s reserves were as tangible as unicorns now have to grapple with the fact that a venerable brokerage stands guard over nearly all those assets.

Cantor Puts Its Money Where Its Mouth Is

Cantor hasn’t just served as Tether’s lockbox, though. In late 2024, it bought a 5% equity stake in Tether worth around $600 million. According to press reports, although Howard Lutnick divested his interests in Cantor Fitzgerald and stepped aside to fulfill his Commerce Secretary ethics requirements, his son Brandon Lutnick is now the Chairman of Cantor Fitzgerald – suggesting the family’s continued involvement.

That closeness extends beyond business statements; multiple industry reports state that Brandon once interned at Tether’s Lugano offices, a signal that the relationship may be as personal as it is corporate. With Cantor’s public backing and money on the line, the days of Tether-haters yelling “Show me the reserves!” lost a bit of steam. A high-profile firm like Cantor does real diligence—it doesn’t just stash billions under a mattress and hope for the best.

By hosting Tether’s Treasuries, taking an ownership stake, and presumably monitoring Tether’s finances, Cantor has given Tether a big shield against regulatory nightmares. There’s no formal “Tether protection plan” from the Commerce Department, but Tether certainly benefits from the brand halo that Cantor’s decades of credibility provide.

Cantor is also incentivized to ensure Tether remains compliant. If Tether gets hammered by regulators, Cantor loses a revenue stream and the value of its stake tanks. This alignment of interests is likely music to Tether’s ears. After all, having a Wall Street ally that vouches for the stablecoin’s solidity is a welcome change from the days Tether faced endless rumors about its reserves.

SoftBank’s Involvement: Global Legitimacy and Influence

In April 2025, SoftBank joined Tether and Cantor to launch 21 Capital, committing $900 million to this new $BTC-focused entity. Tether and Bitfinex hold the majority stake, while SoftBank remains a minority shareholder. SoftBank rarely hops into bed with questionable ventures, so its involvement here implies thorough due diligence.

If Cantor contributes Wall Street respect, SoftBank ($SFTBY) supplies its global investment clout. The Japanese conglomerate is known for placing huge bets on everything from ride-sharing apps to artificial intelligence. Its partnership with Tether signals that stablecoins are on SoftBank’s radar.

The 21 Capital SPAC merger potentially offers Tether a giant reputational gift. For any lingering cynics, the presence of Softbank is a huge deal. SoftBank brings more than money; it brings a network that extends into telecom, finance, and tech around the world. Tether suddenly has a well-connected friend in places like Asia, the Middle East, and beyond.

Regulators observing Tether’s alliances might roll their eyes at crypto hype, but they’ll also realize Tether is no longer potentially perceived as a back-alley operation. It’s embedded in a SoftBank venture that has to meet corporate governance standards. That alone ratchets down suspicions.

Bitfinex: Reinforcing an Internal Alliance

Bitfinex and Tether share ownership under the iFinex umbrella, and they’ve faced their fair share of scrutiny.

Now, however, Bitfinex has joined Tether and SoftBank in 21 Capital, chipping in $600 million via Bitcoin contributions. Together, Tether and Bitfinex will hold the majority stake. This keeps the steering wheel firmly in Tether’s hands while letting SoftBank hitch a ride.

Why does this help Tether’s risk profile? For one, Bitfinex is a top crypto exchange where USDT is heavily traded. Ensuring Bitfinex and Tether stay on the same page reduces the possibility of messy public disputes or misalignments. If Tether thrives, Bitfinex benefits, and vice versa.

Bitfinex’s involvement in a publicly listed vehicle also increases transparency. While the exchange itself remains private, some of its activities within 21 Capital will be subject to public disclosure. This indirectly nudges Bitfinex to keep its ducks in a row. If regulators ever come knocking, they’ll see a venture partially integrated into Nasdaq’s reporting framework.

21 Capital: The Culmination of the Tether Cantor Fitzgerald Partnership

All these alliances culminate in 21 Capital, the newly formed investment vehicle that’s heading to Nasdaq under the ticker symbol “XXI.” High-profile Bitcoin entrepreneur, Jack Mallers, is set to lead the charge as CEO.

This marks a major leap for Tether’s institutional aspirations. Being part of a public company means dealing with SEC rules, quarterly disclosures, and endless analyst questions. Critics who slammed Tether for being opaque might need new material – some portion of Tether’s operation will now live under the glare of public markets.

Granted, Tether’s stablecoin business isn’t fully merging with the SPAC. But 21 Capital’s large BTC treasury – 42,000 coins at launch – will be a window into Tether’s broader ecosystem. Investors can see how this chunk of Tether-linked assets performs.

That’s a level of transparency absent in Tether’s old model.

Control remains in Tether’s hands, which means Tether gets the best of both worlds: public markets credibility without handing the company car keys to outside shareholders. It also cements Tether’s status among the big players holding vast amounts of Bitcoin. Think Strategy ($MSTR) but with more direct ties to a global stablecoin giant.

The presence of Cantor Fitzgerald as the SPAC sponsor and SoftBank as a co-investor suggests corporate governance won’t be an afterthought. If 21 Capital does something questionable, Cantor’s brand is on the line, and SoftBank’s capital is at stake.

This step also ushers Tether into direct competition with other publicly listed Bitcoin-heavy entities. 21 Capital’s war chest is massive from day one, so it can act as a prominent institutional buyer or holder. A strong showing in the public markets might even bolster Tether’s stablecoin business.

Crypto’s Biggest Cloud Of Uncertainty Is Now A Ray Of Sunshine

Cantor’s custodianship of Tether’s reserves, along with the firm’s equity stake, has placed a traditional finance heavyweight squarely in Tether’s corner. SoftBank’s involvement added another jolt of credibility, opening Tether up to a global network that can expand its reach.

These moves drastically reduce the regulatory and reputational risks that once overshadowed Tether. It’s harder for critics to portray Tether as a “rogue actor” now that it’s closely aligned with well-established corporate giants. Public listing requirements, Cantor’s scrutiny, and SoftBank’s due diligence each force Tether to maintain higher standards.

“Markets need reliable money to measure value and allocate capital efficiently,” – Jack Maller, CEO of 21

That doesn’t mean Tether is off the hook. The stablecoin sector is still a prime target for regulators worldwide, and Tether’s leadership will be under pressure to keep everything above board. Any slip-ups could drag Cantor and SoftBank into the fray—something Tether and its partners would like to avoid.

When Tether started back in 2014 and introduced the US Dollar peg, few would have guessed it would end up embedded in the highest echelons of Wall Street and hook up with a behemoth like SoftBank. Yet here we are, watching Tether prepare for a Nasdaq debut via 21 Capital(date still unknown).

Even though Tether still has to keep regulators and watchdogs onside, it has come a long way. Thanks to the Tether Cantor Fitzgerald partnership, along with Lutnick’s family ties and Softbank’s heft, the stablecoin now carries a distinctly corporate aura.

The post Why the Tether Cantor Fitzgerald Partnership Changes Everything appeared first on BeInCrypto.