The cryptocurrency market is experiencing a significant shift in investor sentiment this month. Bitcoin’s price recovery has sparked a ripple effect in demand, from large investors to smaller ones.

Bitcoin has rebounded by 25% from its early April lows. On-chain data and updated forecasts from industry experts offer insights into the sustainability of this rally.

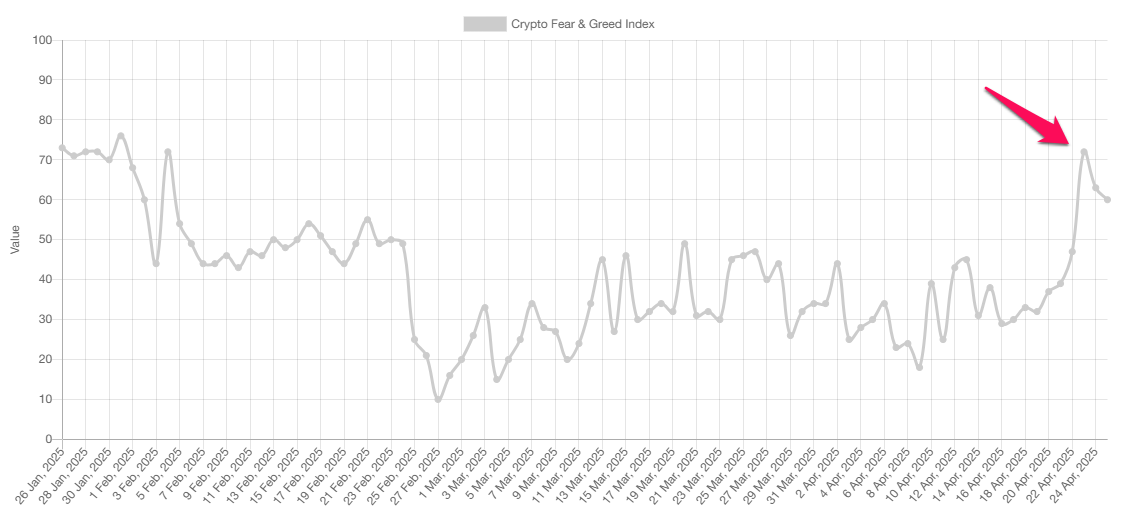

Market Sentiment Shifts from Fear to Greed

According to data from Alternative.me, the Fear and Greed Index surged from a low of 18 to a high of 72 in April. This is the highest level since February and marks a clear shift from fear to greed.

Meanwhile, CoinMarketCap’s version of the index shows a slightly different picture. It rose from 15 to 52 points, moving from extreme fear to a neutral state. Although the two indices differ, both confirm a notable shift in investor sentiment. Investors have moved past the fear that often triggers panic selling.

This neutral or greedy mindset lays the groundwork for further optimism. If it continues, the market may reach a state of extreme greed before any major correction occurs. This sentiment shift has led to five divergence signals that support the potential continuation of the recovery for both Bitcoin and altcoins.

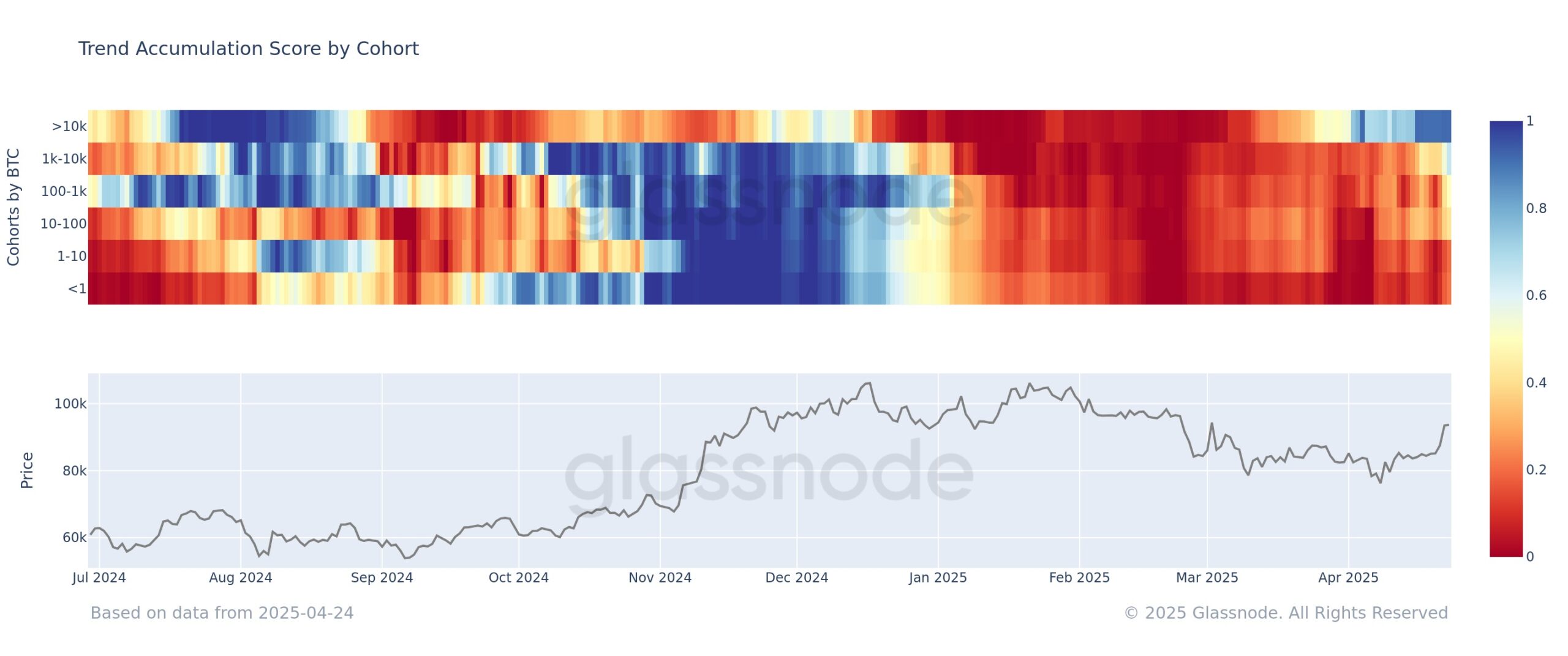

Bitcoin Accumulation Spreads from Large to Smaller Wallets, Indicating a Positive Outlook

On-chain data shows that whale accumulation has helped Bitcoin hold above $93,000 in the final week of April.

A chart from Glassnode reveals a clear transition from a distribution phase (marked in red) to an accumulation phase (marked in green) during April. This timing aligns with Bitcoin’s rebound from its monthly low.

Specifically, Bitcoin whales—wallets holding over 10,000 BTC—have been accumulating at near-perfect levels. Their Trend Accumulation Score is around 0.9.

Following the whales, wallets with 1,000 to 10,000 BTC gradually increased their accumulation score in the second half of April. Their score reached 0.7, as seen by the chart’s color shift from yellow to blue. Other wallet tiers also show signs of accumulation, reflecting changing sentiment among smaller whales.

“So far, large players have been buying into this rally,” Glassnode explained.

Additionally, a recent report from BeInCrypto highlights that Bitcoin ETFs recorded $2.68 billion in inflows last week. These ETFs have seen five consecutive days of positive inflows. These metrics confirm that demand is returning and lay the foundation for continued price gains.

Fidelity and ARK Invest Update Bitcoin Forecasts

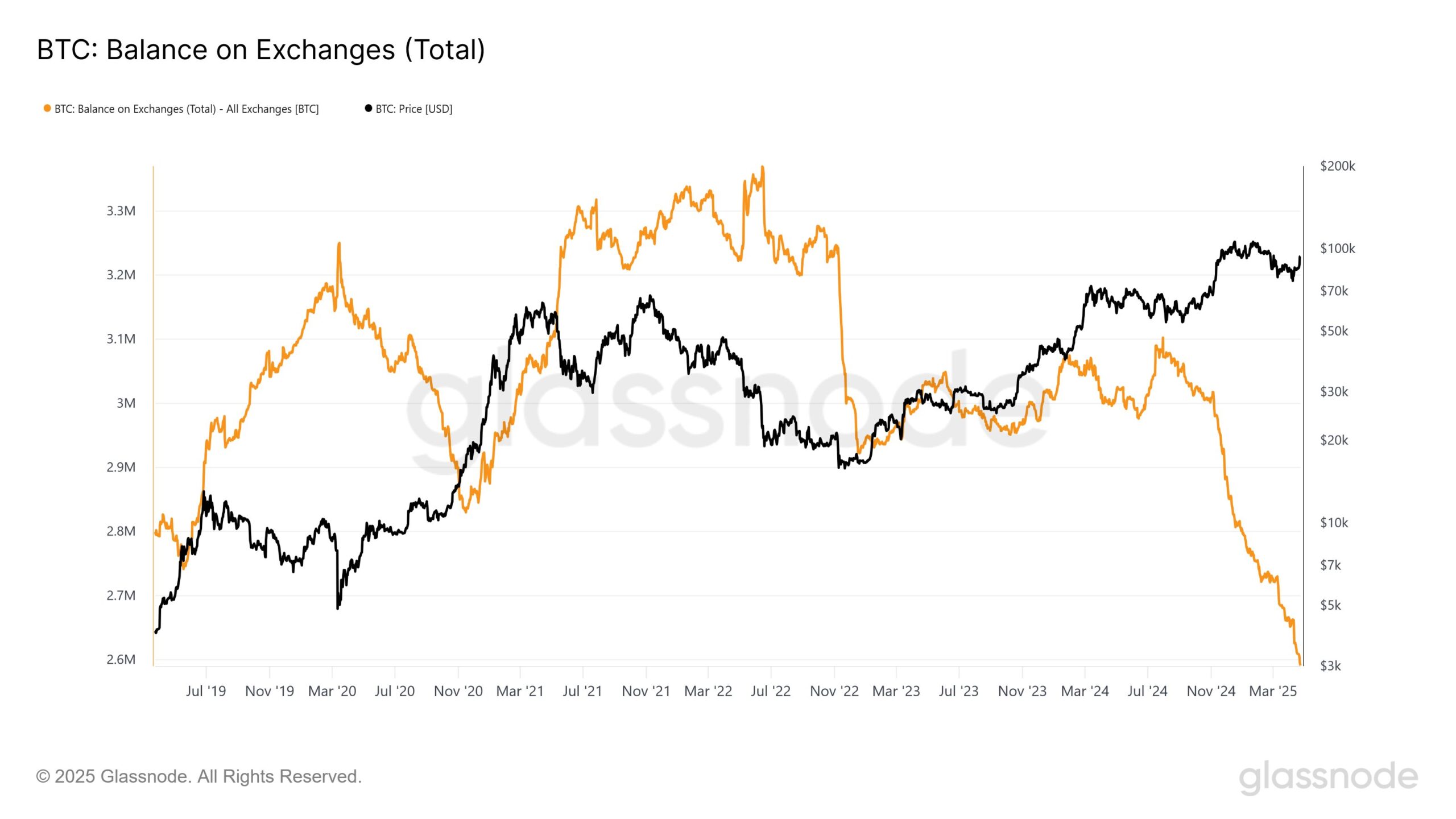

Fidelity Digital Assets, a branch of the $5.8 trillion asset management giant Fidelity Investments, reports that Bitcoin supply on exchanges has dropped to its lowest level since 2018, with only about 2.6 million BTC remaining.

Fidelity also noted that more than 425,000 BTC have left exchanges since November 2024. Public companies have added nearly 350,000 BTC since the US election and are buying over 30,000 BTC monthly in 2025. Fidelity expects this trend to continue.

“We have seen Bitcoin supply on exchanges dropping due to public company purchases—something we anticipate accelerating in the near future,” Fidelity Digital Assets stated.

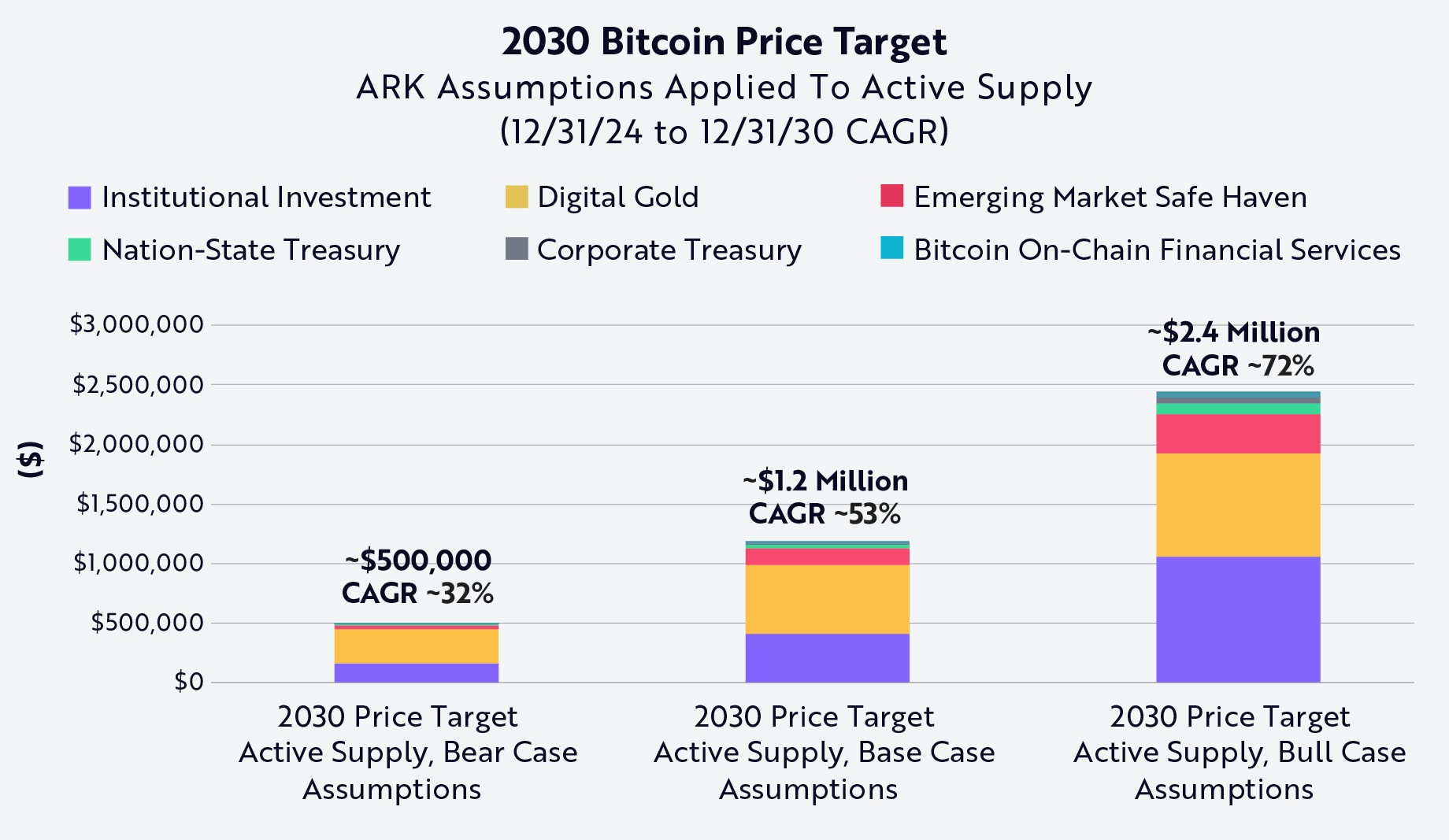

Meanwhile, ARK Invest has updated its Bitcoin price projection in the Big Ideas 2025 report. Under its most bullish scenario, Bitcoin could reach $2.4 million by 2030—far above its previous forecast of $1.5 million.

This projection relies on several factors: increasing institutional investment, the possibility of nations treating Bitcoin as a strategic reserve asset, and its growing role in decentralized finance.

While fund managers like Fidelity and ARK Invest have a positive outlook for April, some retail investors are beginning to express caution. The idea of “sell in May” is starting to surface, reflecting concern amid unpredictable macroeconomic factors, such as tariffs and interest rate shifts, that could strongly impact the market in the near future.

The post Market Sentiment in April Shifts to Greed as Bitcoin Whales Ramp Up Accumulation appeared first on BeInCrypto.