In a strategic move to bolster the Web3 ecosystem, venture capital firm Lemniscap has unveiled a new $70 million fund aimed at early-stage blockchain startups. Announced on August 28, this latest initiative marks a significant expansion of Lemniscap’s commitment to nurturing blockchain innovation across multiple sectors.

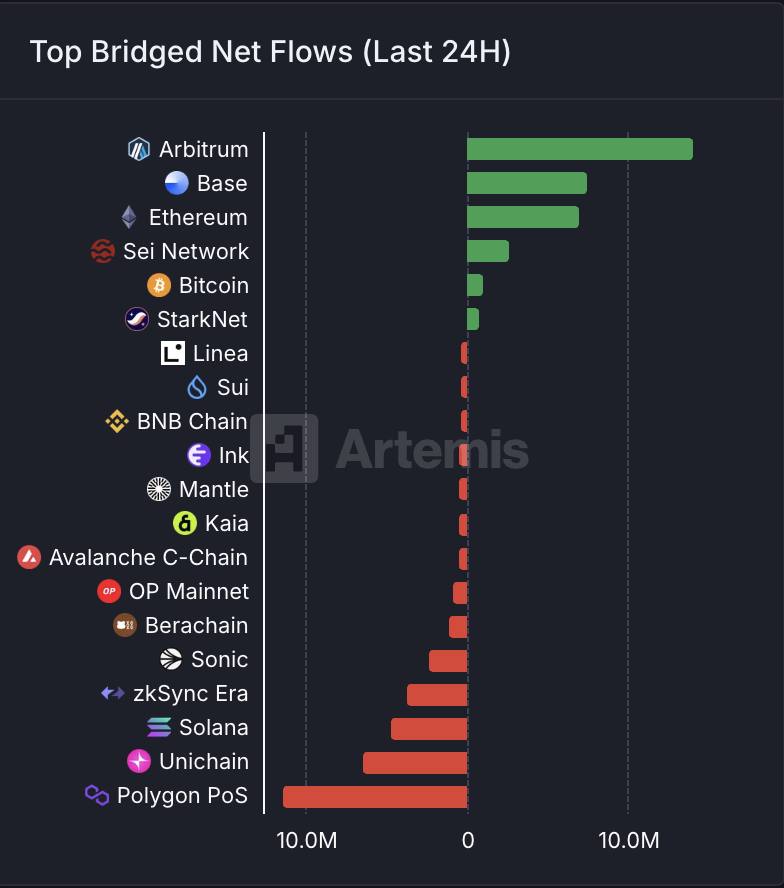

The newly established fund is set to allocate resources to a diverse array of Web3 projects, including zero-knowledge infrastructure, consumer applications, emerging Bitcoin ecosystems, security, and decentralized physical infrastructure (DePIN). Notably, the fund has garnered support from Accolade Partners, a prominent fund of funds known for its focus on early-stage blockchain ventures.

Lemniscap, a veteran in the venture capital space, has been a key player in the blockchain industry since launching its first fund in 2017, just before the 2018 crypto market downturn. The firm has since established a robust track record, investing in over 130 Web3 projects and backing notable protocols such as Avalanche, Fairblock, Celestia, and Axelar. Lemniscap’s investment philosophy emphasizes long-term success over immediate gains, providing not just financial backing but also strategic guidance to its portfolio companies.

The Web3 startup ecosystem is showing signs of revival in 2024, following a challenging year marked by bankruptcies, regulatory hurdles, and a decline in crypto token prices. According to Pitchbook, crypto startups raised a substantial $2.7 billion in the second quarter of this year, with infrastructure projects like Monad and BeraChain leading the charge. Despite a 12.5% decrease in the number of deals, the increased capital per deal suggests a more selective but optimistic investor outlook.

In 2023, the crypto sector secured $10.1 billion in investments, and current trends indicate a potential increase to $10.8 billion by the end of 2024. This growth underscores the ongoing interest and confidence in blockchain technology, with investors focusing on projects with robust potential for long-term impact.

As Lemniscap’s new fund prepares to deploy capital, it stands as a testament to the enduring promise of Web3 innovation and the evolving landscape of venture capital in the blockchain space.