The post Best Crypto to Grab Under $0.05 This Summer? Investors Are Picking This One Over Shiba Inu (SHIB), Ripple (XRP) and Cardano (ADA) appeared first on Coinpedia Fintech News

While SHIB memes fade and ADA drifts below $0.85, one DeFi protocol is quietly building momentum—with real yield, audited contracts, and tokenomics that reward holders, not hype. In a market still hunting for substance over sentiment, Mutuum Finance (MUTM) is standing out as a clear frontrunner. With a presale price of just $0.035, Mutuum Finance (MUTM)’s fundamentals are winning over investors who are tired of waiting for utility to arrive in projects like XRP, SHIB, and ADA.

The DeFi sector is already watching as this under-$0.05 token races into the second half of 2025 with traction that few saw coming. Unlike high-supply meme coins or stalled Layer-1s, Mutuum Finance (MUTM) brings something many investors are now demanding—reliable yield, real borrowing activity, and an actual roadmap backed by revenue-generating products.

Why Shiba Inu (SHIB), Ripple (XRP) and Cardano (ADA) are Not a Priority Now

Shiba Inu (SHIB), Ripple (XRP), and Cardano (ADA) have faced challenges in maintaining strong market performance. SHIB, a meme coin, struggles with limited utility beyond community hype and token burning, which lacks sustainable demand compared to utility-driven coins. Its price volatility and reliance on speculative trading hinder long-term growth.

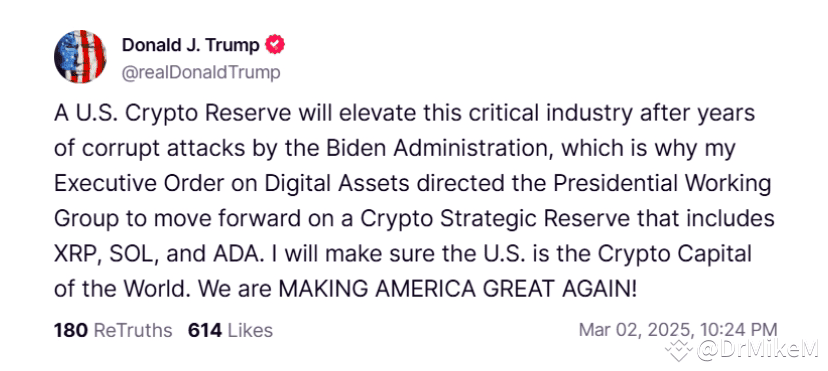

XRP, despite Ripple’s institutional partnerships, faces regulatory uncertainty and competition from stablecoins, reducing its appeal for cross-border payments. Additionally, its centralized ledger limits adoption among decentralized finance enthusiasts.

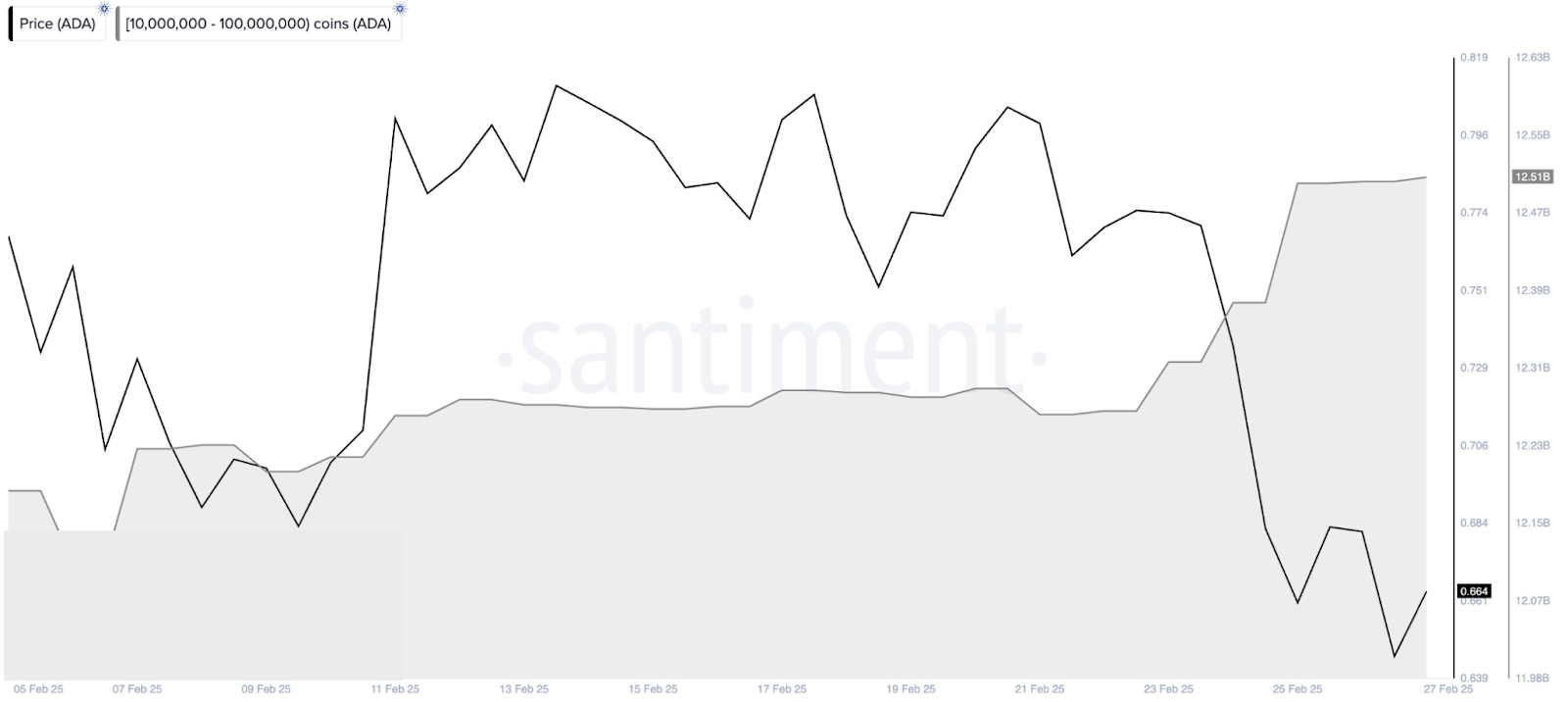

Cardano (ADA) contends with a slower development pace and high expectations for its academic approach, which has yet to translate into widespread adoption. Its market cap trails competitors like Ethereum and Solana, signaling weaker developer interest. Declining trading volumes and market conservatism further dampen momentum for all three, as investors await clearer catalysts or shift focus to newer altcoins with stronger fundamentals.

Mutuum Finance (MUTM)

What will make Mutuum Finance (MUTM) stand out is its dual lending engine, which will offer users two distinct ways to earn or borrow. First is the Peer-to-Contract (P2C) model, where users will deposit stablecoins or major blue-chip assets into smart contracts to earn yield generated from borrower interest. For example, a user who deposits $10,000 worth of BNB into a lending pool will start earning 12% APY(depending on pool utilization)—equivalent to $1,200 per year in fully passive income.

This system will be powered by interest-accruing mtTokens, which will track the user’s position and grow in value over time. Lenders will also be able to use these mtTokens as collateral or stake them in smart contracts to earn additional MUTM rewards, distributed through open market buybacks fueled by protocol revenue.

Then there will be Peer-to-Peer (P2P) lending—designed for more risk-tolerant participants and built on an isolated pool structure. In this model, lenders will negotiate terms directly with borrowers who post higher-risk assets like meme coins. With this level of flexibility, Mutuum Finance (MUTM) will attract traders looking for faster, higher-yielding opportunities beyond the usual low-return blue-chip lending platforms.

Risk management across the protocol will be handled through overcollateralization and an algorithmically-adjusted Stability Factor, preventing liquidation spirals and maintaining systemic health. Borrowers will be able to repay loans at any time, unlocking stablecoin liquidity without having to sell their assets—a vital capability during periods of market uncertainty and volatility.

$0.035 Entry Won’t Last—The Smart Money Is Moving

While most top-20 coins are still flatlining in mid-2025, the presale for Mutuum Finance (MUTM) is speeding through Phase 6. The token is priced at $0.035, and 95% of the 170 million token allocation is still available in this round. With over $13.7 million already raised and 14,500+ holders already on-chain, the buzz is becoming hard to ignore. Once Phase 7 begins, the price will jump to $0.040—locking out buyers from sub-$0.04 territory. That’s a 15% increase overnight, and momentum shows no signs of slowing down.

Security-conscious investors are also leaning into the project’s strong audit credentials. Mutuum Finance (MUTM) scored a 95.00 in its full CertiK audit, with a Skynet rating of 78.00, backed by both manual code reviews and static analysis. A $50,000 bug bounty is also live via CertiK’s official system, covering all four severity tiers—providing further assurance to larger wallets entering during this phase.

And to sweeten the deal, Mutuum Finance (MUTM) is currently running a $100,000 giveaway, where 10 investors will each walk away with $10,000 worth of MUTM tokens. Winners will be selected from current holders, meaning presale participants are directly eligible as the campaign progresses.

One investor already capitalized on the opportunity early. After moving $5,000 out of XRP (then priced at $0.62) and into MUTM during Phase 1 at just $0.01, that same holding is now worth about $17,500—a gain of +250%. When the project hits its listing price of $0.06, that position will be worth $30,000. That’s a 6x return secured before the token has even gone live.

Phase 7 Incoming, $0.040 Around the Corner, Get In Now

While ADA lingers below $0.85 and meme coins continue to bleed relevance, smart capital is rotating into next-gen DeFi platforms offering real yield, strong utility, and a path to actual revenue. Mutuum Finance (MUTM) is that platform. Its P2C and P2P models are reshaping what’s possible in crypto lending, and mtToken mechanics ensure users earn on every dollar put to work. When combined with a high-grade CertiK audit, governance-based token utility, Layer-2 integration, and upcoming beta platform launch, Mutuum Finance (MUTM) is rapidly transforming from presale gem to serious DeFi contender.

Phase 7 is about to go live, raising the price to $0.040. Anyone still holding out below the $0.05 mark is running out of time. Mutuum Finance (MUTM) is not waiting for retail to catch on—its community is growing fast, its security is verified, and its launch economics are set. Grab this under-$0.05 DeFi rocket before it vanishes.

For more information about Mutuum Finance (MUTM) visit the links below:

The post Best Crypto to Grab Under $0.05 This Summer? Investors Are Picking This One Over Shiba Inu (SHIB), Ripple (XRP) and Cardano (ADA) appeared first on Coinpedia Fintech News

While SHIB memes fade and ADA drifts below $0.85, one DeFi protocol is quietly building momentum—with real yield, audited contracts, and tokenomics that reward holders, not hype. In a market still hunting for substance over sentiment, Mutuum Finance (MUTM) is standing out as a clear frontrunner. With a presale price of just $0.035, Mutuum Finance …