Decentralized perpetual exchange (DEX) Hyperliquid (HYPE) has reached a significant milestone, surpassing $1 trillion in total perpetual contract (perps) trading volume.

This achievement comes despite a broader market downturn, where major sectors have posted losses. While there has been slight growth today, it remains minimal, highlighting the market’s challenges.

Hyperliquid Dominates Perps Market

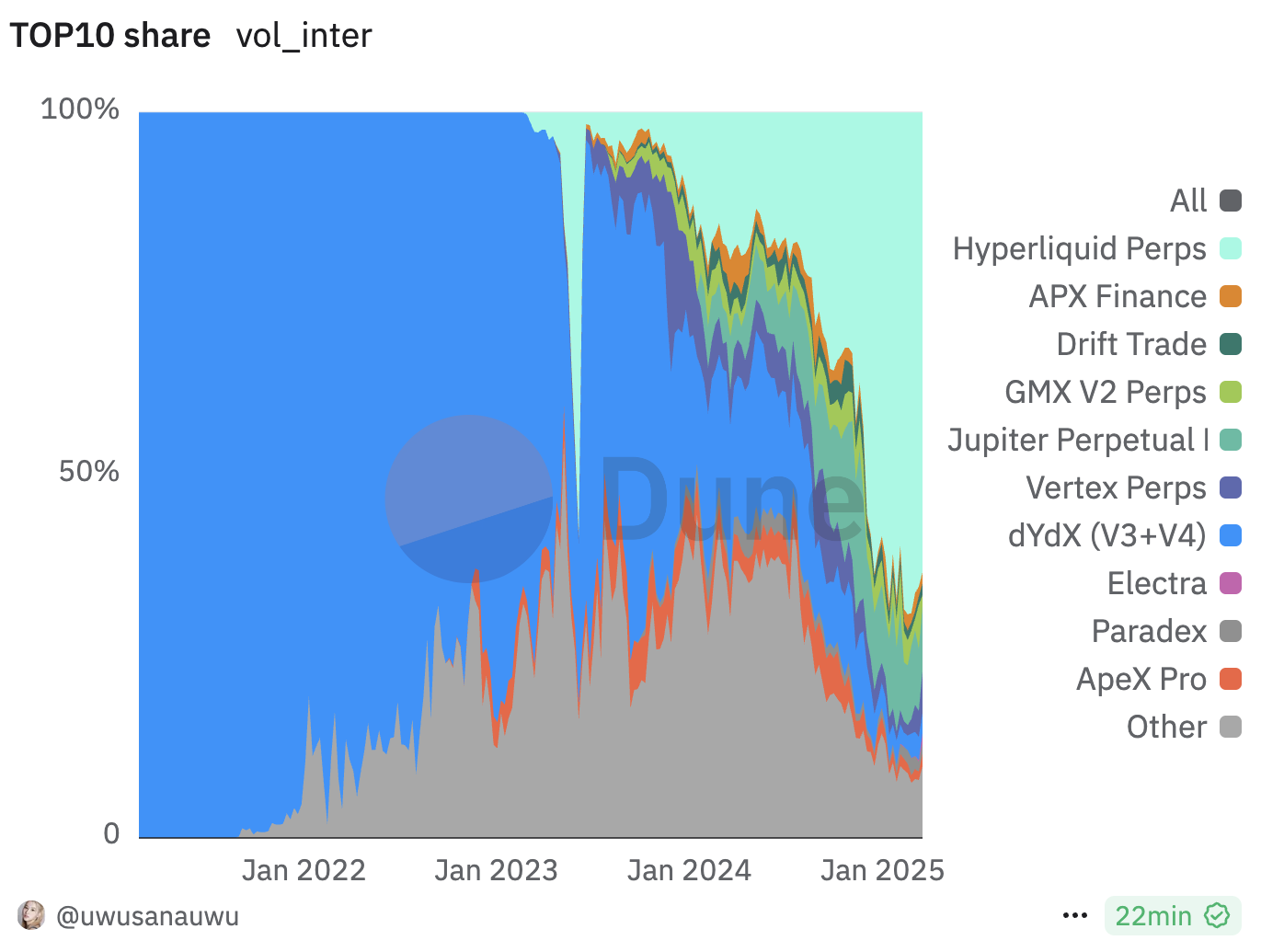

According to data from DeFiLlama, Hyperliquid perps’ cumulative trading volume has surged to $1.1 trillion. This rise in activity highlights its growing appeal among traders.

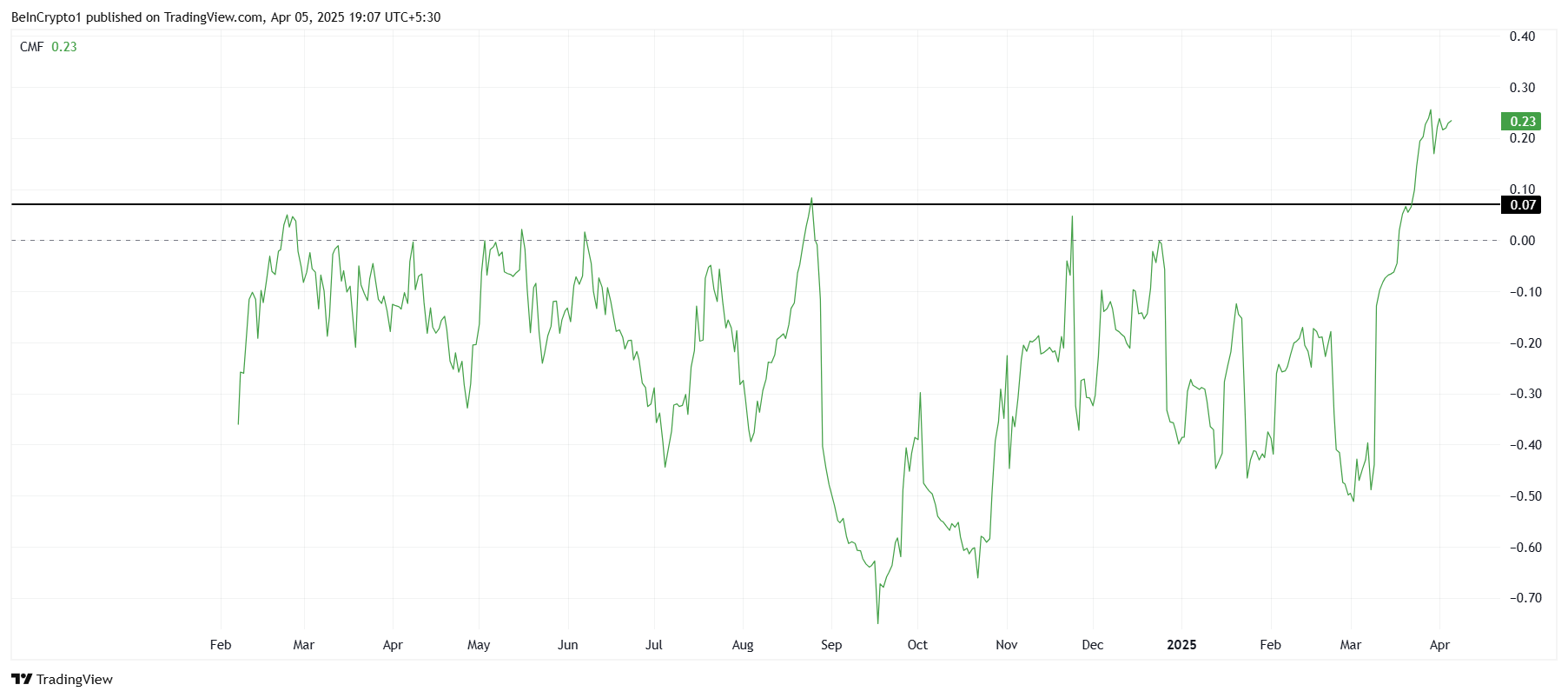

Furthermore, as reported by Dune Analytics, weekly volumes have ranged between $40 billion and $50 billion. In fact, the platform now commands over 60% of the market share among perps platforms, solidifying its position as a powerhouse in decentralized finance (DeFi).

Besides its market dominance, Hyperliquid has made headlines for being central to a major development. As BeInCrypto reported, the platform gained widespread attention after a whale trader opened a 40x leverage BTC short position worth $423 million, triggering a “whale hunt.”

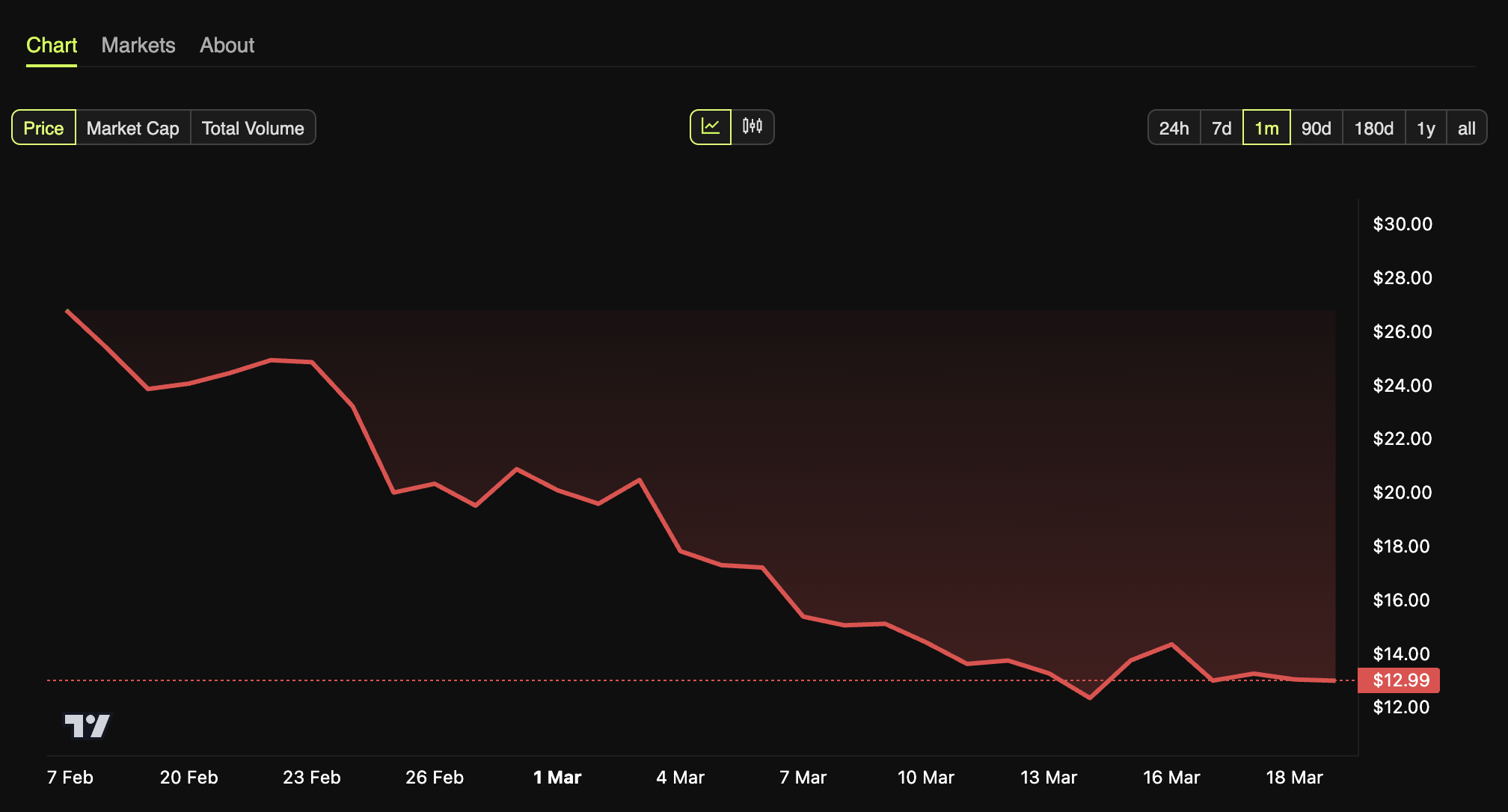

Nonetheless, the developments have not done much for the platform’s native token, HYPE. Instead, it has been underperforming, maintaining a consistent downtrend.

Over the past day, it has depreciated by 3.4%. At press time, it traded at $12.9, marking lows not seen since December 2024. Moreover, the platform has faced increased scrutiny following concerns about potential money laundering.

Analyst Forecasts: Will HYPE Reach $100?

Despite these struggles, an analyst predicted that HYPE could reach $50-$100, citing its status as the leading crypto DEX and its high-throughput Layer 1 blockchain.

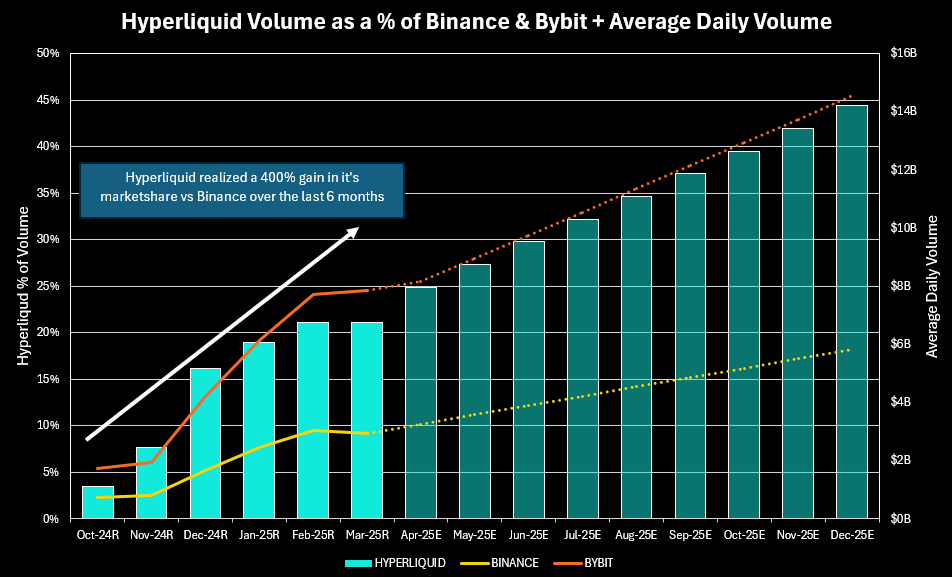

In the latest X (formerly Twitter), he highlighted Hyperliquid’s impressive growth. The platform averages $6.7 billion in daily volume, a significant increase from $1.1 billion in October. This surge has increased its market share relative to Binance, jumping from 2% to 9% in just six months.

“If Hyperliquid can maintain just a fraction of its growth rate, we could see it reach ~20% of Binance’s volumes by the end of the year,” the post read.

According to the analyst, this expansion could significantly boost the HYPE token’s valuation.

“If Hyperliquid is able to reach 20% of Binance’s volume, I think we could easily see $40-50 HYPE with the uptick in earnings and a slight multiple expansion,” he said.

He also highlighted several factors that could fuel Hyperliquid’s continued success. The recent addition of native spot Bitcoin (BTC) trading, coin margin functionality, and the possibility of launching a delta-neutral stablecoin are seen as major catalysts for future growth.

Another key development is the evolution of Hyperliquid’s Layer 1 blockchain ecosystem. The platform has attracted over 50 projects and holds over $2.3 billion in USDC and BTC deposits.

The analyst added that Hyperliquid has a strong potential to establish itself as the third most used blockchain, following Ethereum (ETH) and Solana (SOL), within the next few years.

“Given ETH and SOL are worth $230 billion and $75 billion, respectively what does that make Hyperliquid’s potential L1 valuation? Even at 15-25% of ETH or SOL, that adds another $10-50 to the token price. $50 for the perps/spot/stablecoin product + another $50 for the L1 and $100 HYPE seems possible,” he predicted.

The post Hyperliquid Surpasses $1 Trillion in Perps Volume, but HYPE Token Continues to Struggle appeared first on BeInCrypto.

NEW: The Fed says it’s scrapping “reputational risk” as a factor in how it supervises banks.

NEW: The Fed says it’s scrapping “reputational risk” as a factor in how it supervises banks.