Fartcoin price has become one of the best-performing cryptocurrencies this month. It has surged by over 170% in the last 30 days, outperforming the stock market and top coins like Bitcoin and Ethereum. Fartcoin is still showing bullish signs, a trend that may be boosted if Solana price surges to $200.

Fartcoin Price Would Benefit if Solana Surges to $200

The ongoing Fartcoin surge has triggered more upside for some popular Solana meme coins. Dogwifhat has jumped by 37% in the last seven days, while Popcat, Cat in a dogs world, and Gigachad have soared by 20% and 50%, respectively.

The rally has also sparked a substantial Solana price comeback. After bottoming at $94.5 earlier this month, SOL has soared by 40% to $135, outperforming comparable tokens like Cronos and Avalanche.

This Solana rally has excited some crypto investors, some whom expect it to rebound to $200 eventually. Such a move would signal a 50% surge from the current level. Such a rebound is possible since the coin has a history of dropping and rising over time.

For example, Solana price crashed to $168 on January 13 and then recovered by 75% to $295 a few days later. Also, as shown below, Solana plunged to $109 in August last year and then soared by 140% to $265 a few months later.

A renewed Solana surge would be highly bullish for meme coins in its ecosystem like Fartcoin, Bonk, and Dogwifhat.

Fartcoin Technical Analysis and Key Targets

Fartcoin price has soared after bottoming at $0.19 in March. It has soared by over 300%, making it the best-performing major coins in the market, and pushing its market cap close to the $1 billion mark.

The token moved above the key resistance point at $0.6345 on April 9. This was a notable level since it was the upper side of the cup and handle pattern, a highly accurate continuation sign.

This C&H pattern had a depth of 71%. The coin has now moved above the 25-day Exponential Moving Average (EMA), which is a bullish sign.

Therefore, measuring 71% from the upper side of the cup brings the target price at $1.0730, which also coincides with the 61.8% Fibonacci Retracement level. That target would be a 20% above the current level. A move above that target would point to an increase to the 50% retracement point at $1.3732. A recent CoinGape article quoted an analyst who predicted that Fartcoin would soar to $1.29.

The bullish Fartcoin price forecast will be canceled if the price drops below the crucial support at $0.6345, the upper side of the cup. It would signal a potential drop to the lower side of the cup at $0.2125.

The post How High Can the Fartcoin Price Surge if Solana Soars to $200? appeared first on CoinGape.

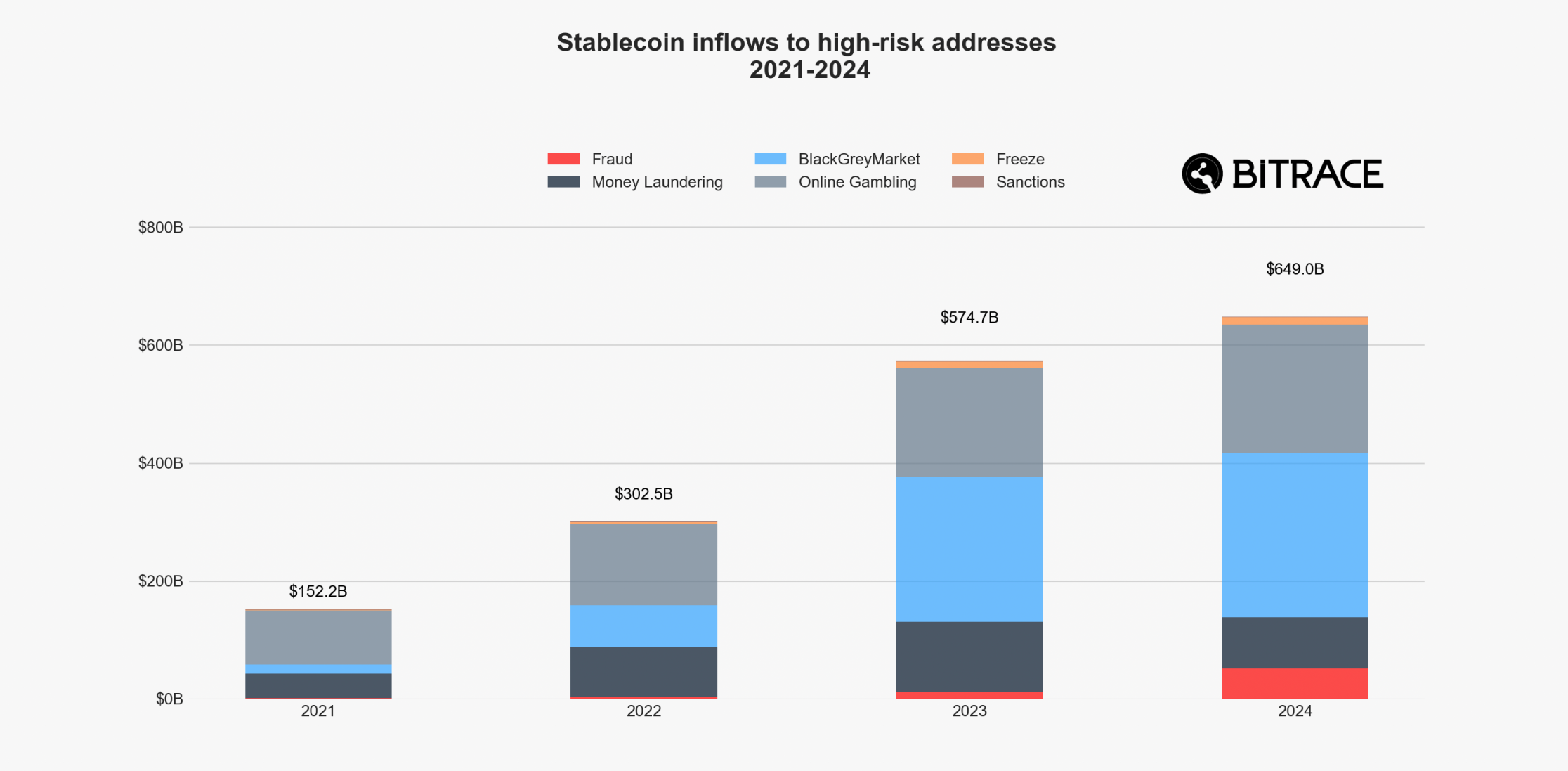

Stablecoins in Crypto Crime.

Stablecoins in Crypto Crime.