HBAR has seen a notable rally recently, bringing the altcoin back into a key consolidation zone just under $0.20. Trading close to this critical level, HBAR is showing signs of strong momentum.

A successful breach of $0.20 could mark the beginning of further upside, provided bullish market conditions continue to support the move.

HBAR Traders Are Optimistic

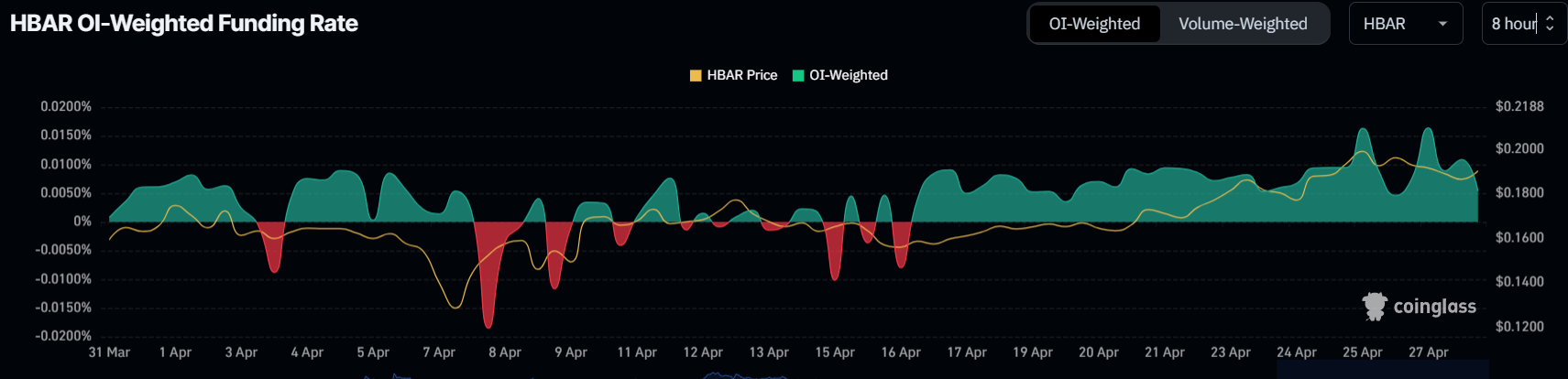

The market sentiment around HBAR remains highly optimistic, as indicated by its funding rate, which has stayed positive for nearly two weeks. A positive funding rate suggests that traders are confident in the altcoin’s bullish trajectory and are positioning themselves to benefit from potential gains.

Additionally, the dominance of long contracts highlights the heightened bullishness among investors. Traders are betting heavily on HBAR’s price increase, reinforcing the view that the altcoin could soon breach its key resistance.

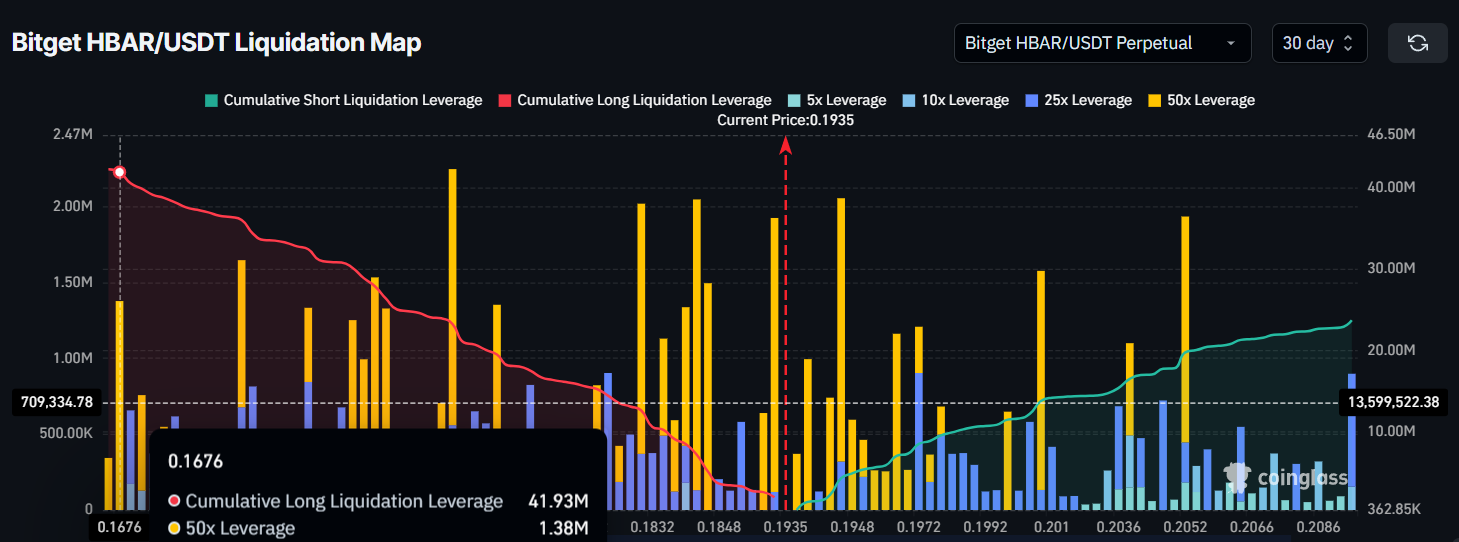

The broader macro momentum for HBAR is mixed, presenting both opportunity and risk. The liquidation map shows that about $42 million worth of long contracts are at risk if the HBAR price falls to $0.167. This exposure underlines the critical importance of the $0.200 resistance.

Given this setup, maintaining current price levels is crucial for HBAR. If the altcoin fails to sustain its upward momentum and investors lose confidence, the resulting liquidations could significantly impact its price trajectory.

HBAR Price Aims To Breach $0.20

HBAR is currently priced at $0.193, holding just under the critical $0.200 resistance. This level has remained unbroken for more than a month and a half. Historically, repeated failures to breach significant resistance levels have often led to declines, making the current situation pivotal for HBAR’s near-term direction.

If HBAR fails to break through $0.200, the altcoin could lose its $0.182 support and slip to $0.167. A fall to this level would trigger the liquidation of the $42 million worth of contracts mentioned earlier, likely intensifying the downward pressure and causing further market distress.

Conversely, if broader market conditions remain favorable and investors continue to support HBAR, the altcoin could successfully breach the $0.200 barrier. Achieving this would invalidate the bearish outlook and set HBAR on a course toward $0.222, opening the door for renewed bullish momentum.

The post HBAR Price’s Fall to $0.16 Could Lead to $42 Million Liquidations appeared first on BeInCrypto.