This morning, I came across some interesting news about Google’s updated site reputation abuse policies. Apparently, they’ve revised their main guidelines with some fresh updates.

This morning, I came across some interesting news about Google’s updated site reputation abuse policies. Apparently, they’ve revised their main guidelines with some fresh updates.

Related Posts

EU Officials Warn US Stablecoin Push Could Undermine Euro Stability

The European Stability Mechanism (ESM) has raised concerns that the United States’ growing support for dollar-backed stablecoins could threaten Europe’s financial stability and monetary sovereignty.

These concerns come as stablecoin regulation gains traction in the US. US national banks and federal savings associations can offer services without prior regulatory approval.

EU Warns US Stablecoins Could Threaten Euro Stability

Pierre Gramegna emphasized the urgency of the European Central Bank’s (ECB) digital euro initiative as a countermeasure. As the Managing Director of the ESM, Gramegna urged expedition to preserve the country’s monetary sovereignty and financial stability.

“It could eventually reignite foreign and US tech giant’s plans to launch mass payment solutions based on dollar-denominated stablecoins. And, if this were to be successful, it could affect the euro area’s monetary sovereignty and financial stability,” Gramegna stated at a Eurogroup meeting.

The EU is advancing its digital euro project to safeguard its financial independence. The ECB has long warned that reliance on US-backed stablecoins could weaken the euro.

He echoes recent remarks by ECB official Piero Cipollone during an early February interview. Then, Cipollone indicated that the Trump administration’s support for stablecoins would likely accelerate legislation surrounding the digital euro. Such an outcome, he said, would position it as a necessary alternative.

“The US and Europe have differing views on stablecoins. The Trump administration sees them as a tool to strengthen the US dollar’s global presence, whereas the ECB fears they could destabilize Europe’s financial system,” Cipollone explained.

The ESM supports the ECB’s digital euro project and the European Commission’s efforts to revise the MiCA (Markets in Crypto-Assets) directive. Gramegna emphasized that these measures are critical in preventing a scenario in which European consumers and businesses become overly reliant on US-backed stablecoins.

Indeed, these concerns come as the United States government has increasingly favored crypto, particularly stablecoins pegged to the US dollar. Federal Reserve Governor Christopher Waller recently asserted that stablecoins could enhance the US dollar’s global role.

Federal Reserve Chair Jerome Powell has also advocated for stablecoin regulation to solidify their role in financial markets. Meanwhile, new rules now permit US banks to offer stablecoin services, signaling further integration of stablecoins into traditional finance (TradFi).

These developments could accelerate the dominance of US-backed stablecoins in global transactions. Reports suggest that even Bank of America (BoA) is exploring launching its own stablecoin, while Circle CEO Jeremy Allaire is pushing for mandatory US registration of stablecoin issuers.

The debate over stablecoins mirrors broader geopolitical concerns. The dollar’s dominance in digital payments could grow as US financial institutions integrate stablecoins into their services. This could limit the euro’s influence.

European policymakers advocate for a strong regulatory framework and an accelerated timeline for the digital euro’s rollout to counter this.

The post EU Officials Warn US Stablecoin Push Could Undermine Euro Stability appeared first on BeInCrypto.

Hedera (HBAR) Defies Death Cross With a 20% Surge—Is More Upside Ahead?

A death cross appeared on HBAR’s daily chart on April 14, signaling potential downside. However, the token has defied bearish expectations, rallying 20% over the past two weeks amid a broader market rebound.

While bullish momentum has cooled slightly in recent days, the bulls remain in control. If demand grows further, the HBAR token could be poised for more upside.

HBAR Bulls Stay in Control After Death Cross

A death cross occurs when an asset’s short-term moving average—typically the 50-day—crosses below its long-term moving average, usually the 200-day.

This crossover means the asset’s recent price momentum is weakening, and a longer-term downtrend may take shape. The pattern often signals increased selling pressure as traders usually interpret it as a marker of a negative shift in market sentiment.

However, this is not always the case, especially in volatile or recovering markets where price action can defy traditional technical signals. For instance, HBAR’s value rocketed 20% in the past two weeks.

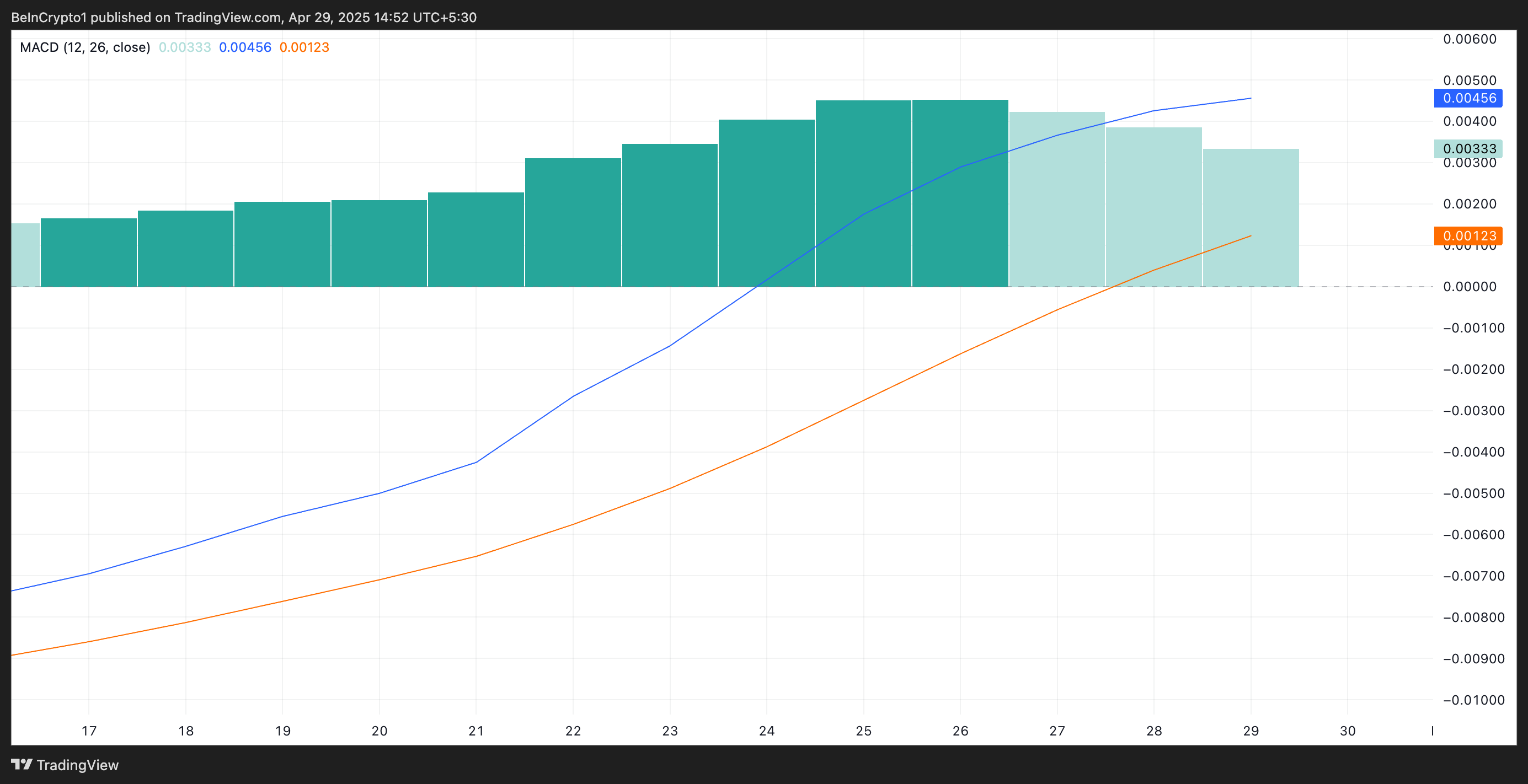

Although the bullish momentum has eased slightly over the last three trading sessions, the bulls remain firmly in control. Readings from HBAR’s Moving Average Convergence Divergence (MACD) indicator confirm this.

While the bars that make up this indicator have diminished over the past three days—reflecting a slowdown in bullish momentum amid broader market consolidation—the MACD line remains above the signal line, indicating that buying pressure still prevails among traders.

This setup hints at the likelihood of further price gains despite the death cross.

HBAR Climbs Steadily—Will It Hold the Line or Slip Back to $0.15?

Since April 16, HBAR has traded along an ascending trend line, a bullish pattern formed when an asset consistently posts higher lows over time. This indicates growing investor confidence and sustained upward momentum, even amid short-term pullbacks.

For HBAR, this trend suggests buyers continue stepping in at increasingly higher price points, reinforcing support levels. If the trend holds, it could pave the way for further gains, especially if market sentiment remains positive.

HBAR’s price could break above the $0.19 resistance in this scenario and rally toward $0.23.

Conversely, if selloffs resume, the price of the HBAR token could fall to $0.15.

The post Hedera (HBAR) Defies Death Cross With a 20% Surge—Is More Upside Ahead? appeared first on BeInCrypto.

Kamala Harris’ $100M Tax Plan – Unrealized Gains Targeted Despite 75% Opposition

As the 2024 U.S. presidential election approaches, the economic policies of candidates are under intense scrutiny. Vice President Kamala Harris’…