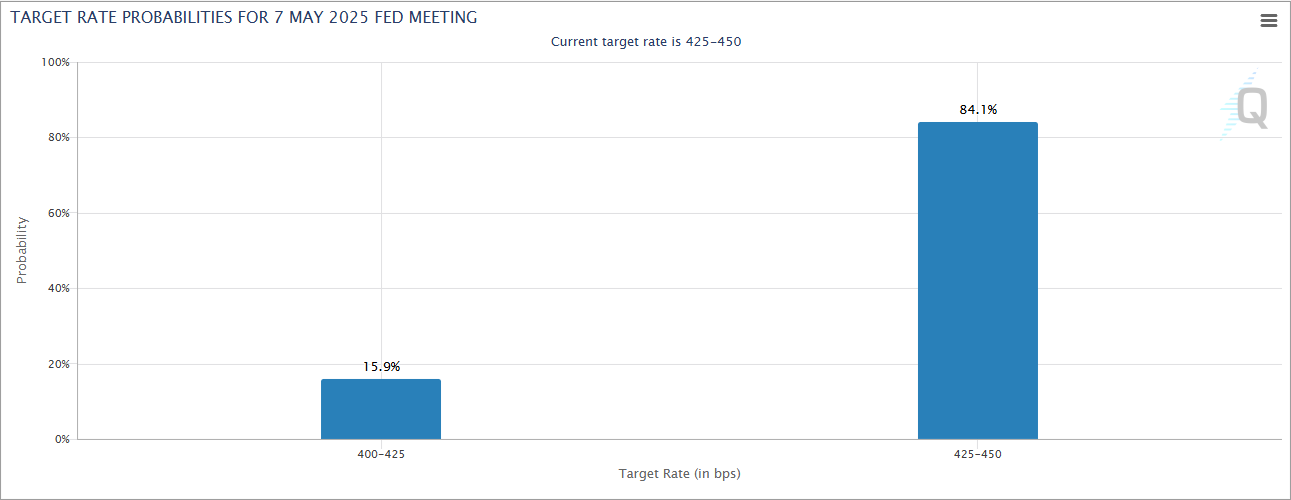

According to CME FedWatch data, the probability of a Federal Reserve interest rate cut in May has plunged from 57% to just 15%. This is due to President Trump’s 90-day tariff pause and newly released March FOMC minutes.

The March 18–19 FOMC minutes, released Tuesday, confirm that policymakers remain cautious on easing.

FOMC Minutes Reveal Hawkish Caution

While the Fed acknowledged solid economic growth and stable labor markets, officials noted that inflation is still running above the 2% target.

Many participants emphasized upside risks to inflation, particularly from broad-based tariff increases and potential supply chain disruptions.

Several Fed members observed that inflation prints for January and February came in higher than expected, and warned that the effects of new tariffs — particularly on core goods — may prove more persistent than anticipated.

Although participants supported maintaining current interest rates, they stressed that policy flexibility is essential as uncertainty surrounding trade, fiscal, and immigration policy clouds the outlook.

As of now, Trump’s decision to pause new tariffs for most countries for 90 days while raising Chinese tariffs to 125% has reduced fears of a full-blown trade war.

However, retaliatory action from China and elevated inflation expectations reinforce the Fed’s hawkish stance. So, policymakers are signaling they are in no rush to cut rates.

What It Means for Crypto

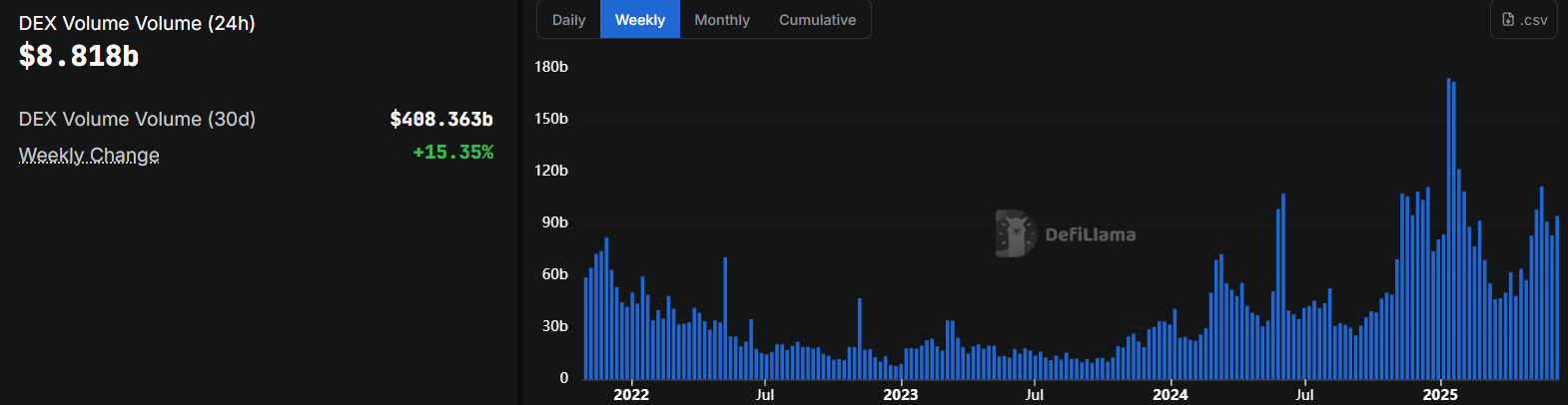

As we have seen lately, crypto markets are macro-sensitive assets. A more hawkish Fed stance and reduced odds of near-term rate cuts could lead to:

- Lower liquidity expectations, weighing on crypto asset prices.

- Stronger dollar pressure, potentially reducing Bitcoin’s appeal as an inflation hedge.

- Higher volatility, as macro uncertainty intensifies and rate cut hopes fade.

For now, the Fed’s message is clear: monetary policy remains data-dependent, but a pivot is off the table unless economic conditions deteriorate sharply.

The market is currently rallying after Trump’s 90-day Tariff pause. However, Crypto investors hoping for tailwinds from rate cuts may have to wait.

The post Fed Rate Cut Odds Collapse to 15% After Trump’s Tariff Pause appeared first on BeInCrypto.