Solana-based meme coin FARTCOIN has emerged as the top-performing cryptocurrency in the market today, surging by 19% over the past 24 hours.

It trades at its highest level since January 30, marking a 12-week peak. With buying activity still underway, the meme coin seeks to extend its rally in the short term.

FARTCOIN Buyers Tighten Their Grip

On the FARTCOIN/USD daily chart, bullish momentum continues to build. The token’s positive Balance of Power (BoP) indicator reflects a strong dominance of buyers in the market. At press time, this is at 0.69.

The BoP indicator measures the strength of buyers versus sellers in the market. When its value is positive, buyers are dominating and exerting more pressure than sellers.

Therefore, FARTCOIN’s rising positive BoP suggests increasing demand and the potential for continued upward price movement.

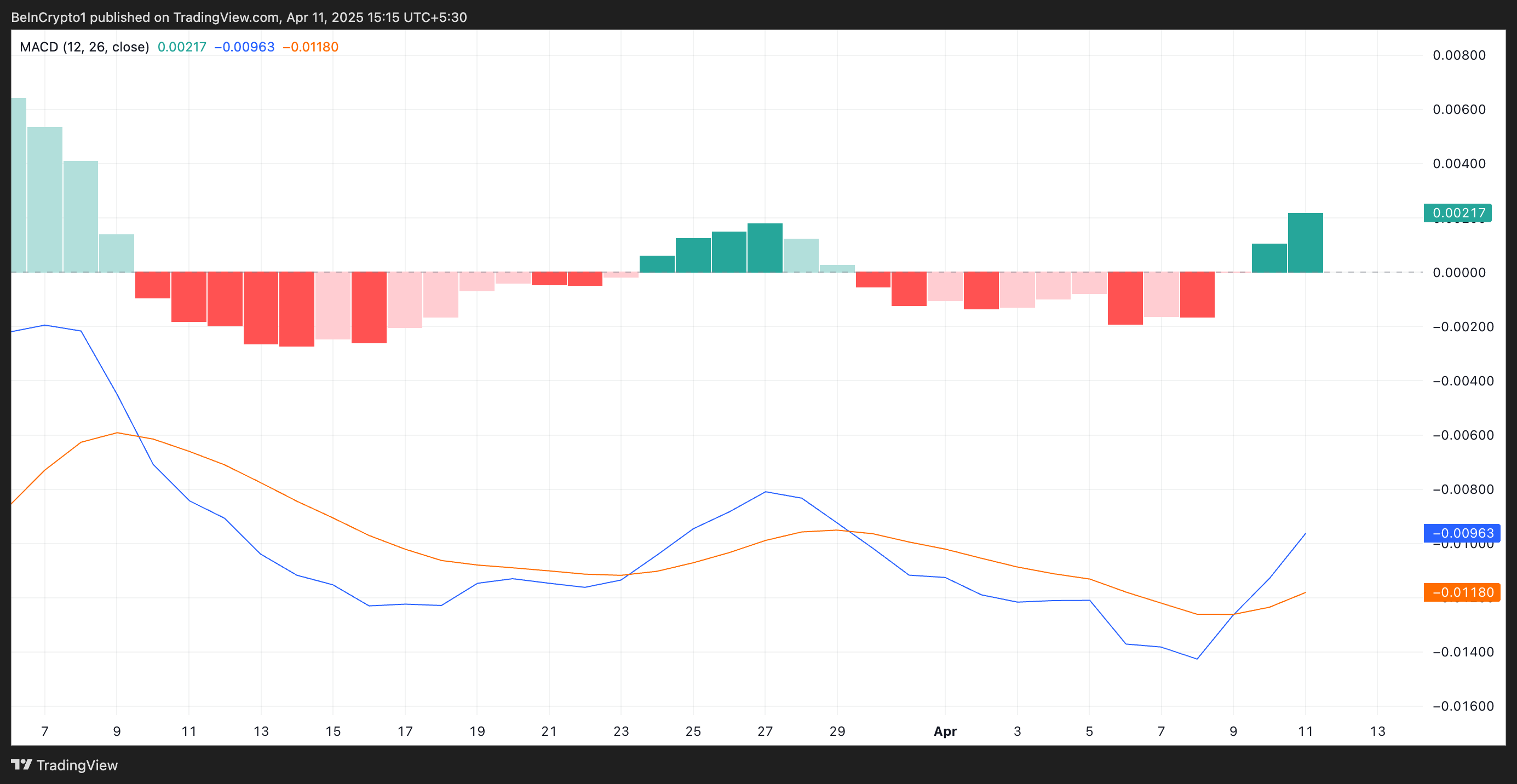

Furthermore, the bars forming FARTCOIN’s Elder-Ray Index have steadily increased in size over the past few days, highlighting a consistent rise in bullish pressure.

The Elder-Ray Index measures the strength of buyers (bull power) and sellers (bear power) by comparing an asset’s high and low prices to its exponential moving average (EMA). When its value is positive, bull power is dominant.

This growth suggests that FARTCOIN’s buyers are gaining greater control of the market, pushing prices higher with each passing session.

FARTCOIN Eyes Breakout

As of this writing, FARTCOIN trades at $1.06, just below the major resistance level of $1.16. If demand strengthens and the meme coin manages to flip this price level into a support floor, its rally would gain momentum, potentially pushing the price toward $1.46.

On the other hand, if profit-taking begins, this bullish outlook could be invalidated. In that scenario, FARTCOIN’s value may dip as low as $0.74.

If the bulls are unable to defend this support level, FARTCOIN’s price could fall further to a low of $0.19.

The post Fartcoin (FARTCOIN) Hits 12-Week High With No Signs of Slowing appeared first on BeInCrypto.