The new DeepSeek R1 model from China launched last week. If you’re into AI or even into technology more broadly, it was hard to miss the news. Everyone was talking about it. But it’s not just that. It’s the way everyone was talking about it. I was left with the impression that DeepSeek is going to drive a stake through the heart of OpenAI and Anthropic.

The new DeepSeek R1 model from China launched last week. If you’re into AI or even into technology more broadly, it was hard to miss the news. Everyone was talking about it. But it’s not just that. It’s the way everyone was talking about it. I was left with the impression that DeepSeek is going to drive a stake through the heart of OpenAI and Anthropic.

Related Posts

Pi Network Pioneers Risk Losing Their PI Coins Over KYC Issues As Pi Day Approaches

As PI Day approaches, many Pi Network users or Pioneers could lose their accumulated Pi coins.

The risk comes following widespread complaints about the inability to complete the Know Your Customer (KYC) verification process.

Growing Frustration Among Pi Network Users

In a late February announcement, the Pi Network team stated that users who fail to complete KYC and migrate their balance to Mainnet within the extended grace period—ending at 8:00 AM UTC on March 14, 2025—”risk losing most of their mobile balance.”

“…the end of the Grace Period is inevitable to make sure the network can move on in its new phase without large sums of unverified and unclaimed mobile balances. Thus, this is the last chance for any Pioneer to complete the required steps to avoid forfeiting their past mobile balances,” read the announcement.

This announcement has sparked widespread frustration among Pioneers. Based on discontent shared on X (Twitter), many claim they have attempted but failed to complete KYC. Crypto enthusiast Rod Thompson called the situation the biggest con job of crypto, with up to 10,000 PI Coins on the line for him.

“The Pi Network has been earning ad revenue for every one of my daily mining sessions, but I’m going to lose over 10,000 pi coins because people I haven’t spoken to in two years haven’t done KYC. At least one of them passed away over a year ago. That’s over $10,000 due to me for my efforts,” Thompson lamented.

Thompson is not the only Pioneer questioning the fairness of the Pi Network system. Another user, S.O.H., described the situation as “mass social engineering on blockchain.” Meanwhile, others, such as Ahmady Ala, reported that despite mining Pi for six years, they have yet to be allowed to complete KYC.

In the same tone, some users have had their KYC documents pending for over two years without resolution.

“My KYC verification has been pending for 2.5 years. Even if it won’t be approved, shouldn’t there be an option to reapply?” user H. Ibrahim posed in frustration.

Unfair Reward Distribution, Centralization, and Migration Delays

In addition to KYC-related frustrations, many users have reported balance inconsistencies. They claim their unverified balance keeps increasing while their transferable balance is significantly reduced.

This makes the migration process confusing, and the lack of transparency leads some to label Pi a “scam network.” Another major concern is the alleged unfair distribution of rewards.

“I mined consistently for 4 years, stayed loyal to Pi Network, brought in 39 people, and even completed KYC for 17 of them—yet I got nothing. Meanwhile, others with no referrals and irregular mining have more Pi than me. How is that fair?” another user, Mango Fan Token, stated.

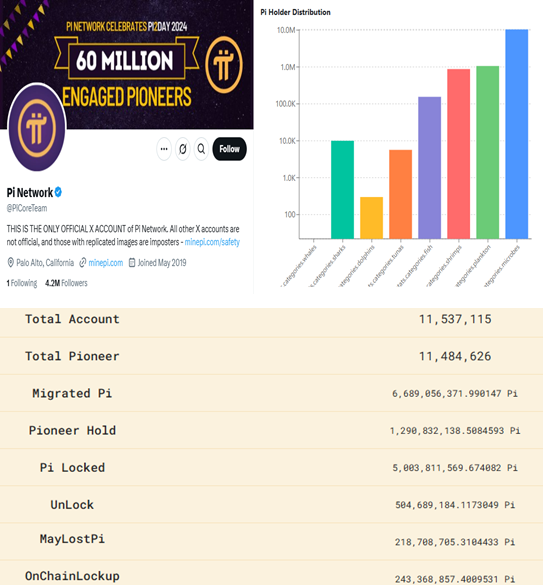

Meanwhile, despite claiming a user base of 60 million, on-chain data indicates only about 11 million active users. This led to concerns over Pi Network’s actual adoption rate.

Additionally, questions about centralization have emerged. Some critics argue that the project’s control mechanisms limit the potential for a truly decentralized network. Another issue plaguing the network is the failure of many users to migrate their Pi coins to Mainnet.

BeInCrypto reported recently that Pioneers have struggled with transferring their balances, even after fulfilling all required steps. Some users, frustrated by prolonged lockup periods, have resorted to selling their PI Coin accounts on unofficial markets, raising further concerns about the platform’s credibility and long-term viability.

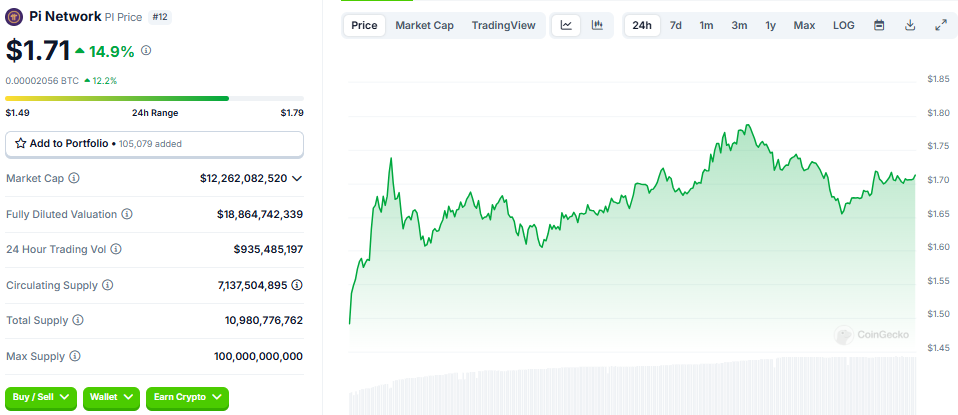

While criticism of the network continues to mount, Pi Coin has recently seen double-digit gains as investors gear up for Pi Day. Some analysts speculate that the surge is driven by optimism surrounding potential developments on March 14.

CoinGecko data shows that PI Coin’s price was $1.71 as of this writing, up nearly 15% in the last 24 hours. However, whether the price momentum can be sustained in the face of ongoing technical issues and community dissatisfaction remains uncertain.

The post Pi Network Pioneers Risk Losing Their PI Coins Over KYC Issues As Pi Day Approaches appeared first on BeInCrypto.

Top Crypto News This Week: Bitcoin Act Bill, Infinex Airdrop, Ethereum-Base Collaboration, and More

Several ecosystems will make headlines this week as part of the top crypto news list. Knowing about these events in advance can help traders and investors position their portfolios strategically to capitalize on the expected price movement.

Based on crypto’s adage to buy the rumor and sell the news situation or event, traders and investors can front-run the following events this week.

The Bitcoin Act Bill to Buy 1 Million BTC

The BITCOIN Act of 2025 is the top crypto news story this week. Introduced by Senator Cynthia Lummis, the bill proposes the US Treasury acquire 1 million Bitcoin (BTC) over five years to establish a Strategic Bitcoin Reserve, mirroring the scale of US gold reserves.

“Sen Lummis says Trump backs Bitcoin act—bill to buy 1M BTC hits floor next week,” Crypto Goos reported.

Reintroduced in March 2025, the bill gained traction after President Trump’s executive order supporting a federal Bitcoin reserve. The act mandates secure, decentralized storage across the US, with a 20-year minimum holding period and transparency via proof-of-reserve (PoR) audits.

Funding would come from Federal Reserve (Fed) remittances and revaluing gold certificates. While Trump’s backing boosts momentum, passage remains uncertain due to legislative hurdles and debates over fiscal impact.

If passed, it could position Bitcoin as a formal reserve asset, potentially driving a price surge. It would also reinforce US financial leadership.

“By codifying this effort into law, we can ensure that our nation leverages digital assets to strengthen our financial future while maintaining its global leadership,” Senator Lummis said in a statement.

As of this writing, Bitcoin traded for $105,082, up by 0.69% in the last 24 hours.

Infinex’s Airdrop for KAITO Stakers

Another top crypto news story this week concerns Infinex. The multi-chain crypto platform announced a significant airdrop for KAITO stakers.

“For those of you staking KAITO, the airdrop will occur next week. We recommend you have your Genesis NFTs in the same wallet as your sKAITO, as the snapshot will happen soon,” Infinex wrote in a post.

The airdrop follows a $6 million token distribution in May 2025, which propelled Infinex to the top spot on Kaito’s sentiment rankings, with trading volume surging 320% to $18 million within hours.

KAITO, an AI-driven crypto analytics platform, rewards user engagement, and this crypto airdrop targets its stakers, offering tokens to boost ecosystem participation.

Infinex’s non-custodial wallet supports EVM chains and Solana, integrating staking and trading with a user-friendly interface. The airdrop aims to drive liquidity and attract speculators, though historical data suggests potential post-airdrop price volatility.

Infinex Wallet Adding Avalanche Support

Beyond crypto airdrops for KAITO stakers, Infinex will also add support for the Avalanche blockchain, expanding its multi-chain wallet capabilities.

“We have received proof of patron from Emin Gün Sirer. Avalanche incoming on Infinex next week,” wrote Infinex Kain.avax.

Emin Gün Sirer is the founder and CEO of Ava Labs and developed the Avalanche Consensus protocol underlying the Avalanche blockchain platform.

The update enhances Infinex’s ecosystem, which supports EVM chains like Base, Arbitrum, Optimism, and Solana (SOL).

Avalanche’s high-throughput, low-latency network will enable Infinex users to trade, stake, and bridge assets seamlessly, tapping into Avalanche’s DeFi and NFT ecosystems.

Meanwhile, Infinex’s passkey-based security and gas-free transactions aim to simplify the user experience and compete with centralized exchanges (CEXs).

The integration could drive trading volume in AVAX and related tokens, with Infinex’s prior $6 million airdrop showing 320% volume spikes. Staking opportunities may also extend to Avalanche assets, attracting yield farmers.

Traders should monitor AVAX price action and Infinex’s token (INF) for potential volatility post-launch.

Ethereum’s New Initiative with Base

Also among the top crypto news this week, Ethereum is expected to announce a new initiative in collaboration with Base, Coinbase’s layer-2 scaling solution.

Base, built by Coinbase, enhances Ethereum’s scalability with low-cost, fast transactions while maintaining security. The initiative may focus on advancing DeFi or NFT ecosystems, given Base’s integration with Ethereum’s mainnet.

“Next week, in collaboration with Base and Ethereum, we are pushing a new initiative (for the culture). So look out for that,” Ethereum.org wrote on May 30.

The collaboration could involve new dApps, staking enhancements, or cross-chain interoperability, building on Base’s support for Optimism’s tech stack. This aligns with Ethereum’s broader push to improve user experience and reduce gas fees, potentially boosting adoption.

World Computer Summit

Another top crypto news this week concerns the World Computer Summit, starting Wednesday, June 3, hosted by DFINITY Foundation in Zurich, Switzerland.

Posts on X suggest that the event will feature major announcements and decentralized computing. It celebrates the fourth anniversary of the Internet Computer Protocol (ICP).

“What is the World Computer Summit 2025? It’s a global gathering of builders, thinkers, visionaries reimagining the internet for a decentralized world. Held in Zurich on June 3, it marks 4 years of the Internet Computer Protocol,” wrote Miss Knighty, a popular user on X.

The summit could reveal advancements in Web3, AI, and blockchain interoperability. Projects like Internet Computer (ICP) may unveil updates on decentralized AI or global compute networks, given their focus on a “World Computer” vision.

Past summits have driven market activity, with tokens like ICP seeing surges post-announcements. As of this writing, ICP traded for $4.93, up nearly 1% in the last 24 hours.

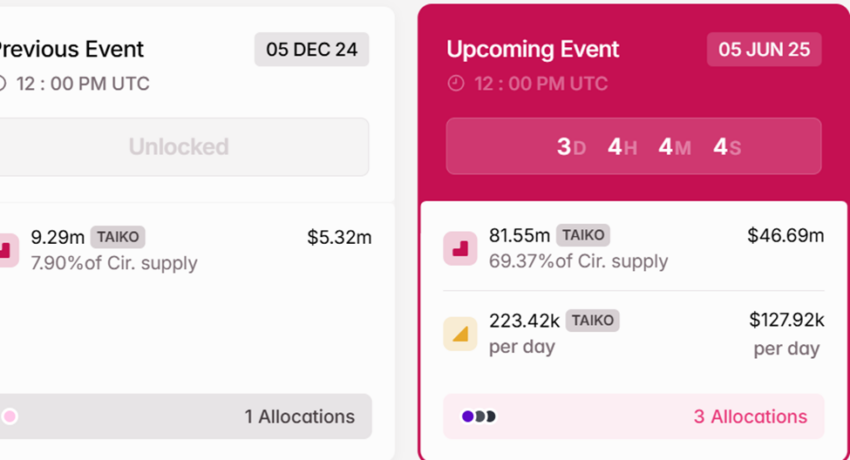

$46 Million TAIKO Unlock

Meanwhile, with key token unlocks to watch this week, the Ethereum-based L2 scaling solution, Taiko, will unlock $46 million worth of TAIKO tokens on June 5. This unlock will constitute over 69% of its circulating supply.

This significant unlock could introduce volatility, as historical data shows large token unlocks often lead to sell-offs.

Taiko’s total supply is 1 billion, with 241 million tokens currently circulating. The unlock of 21.84 million tokens, valued at $42 million in August 2024, suggests a rising token price. With 81.55 million TAIKO tokens unlocked on Thursday, volatility is expected, especially if recipients cash in for early gains.

NotabThesens will be allocated to investors, protocol guild airdrop, and Taiko Labs, constituting the core team.

The post Top Crypto News This Week: Bitcoin Act Bill, Infinex Airdrop, Ethereum-Base Collaboration, and More appeared first on BeInCrypto.

Why Analysts Claim XRP Price Pattern Is Not Bearish

Despite recent volatility, prominent analysts argue XRP’s technical setup is not bearish yet. They highlight specific price levels crucial for confirming the trend.

A technical evaluation of XRP’s recent 5-day chart adds context to these analyst views.

Analysts Remain Cautiously Optimistic About XRP Price

XRP prices dipped nearly 7% over the past week amid heightened geopolitical tensions, notably driven by US airstrikes on Iranian facilities. The altcoin fell from roughly $2.20 to a low near $1.90 before stabilizing around $2.06.

Veteran trader Peter Brandt highlighted a potential Head-and-Shoulders (H&S) pattern on XRP’s chart. This is traditionally a bearish indicator that signals a reversal from bullish to bearish if key support levels break.

However, Brandt emphasizes caution against premature bearish conclusions. He explicitly notes the importance of XRP maintaining support above $1.80.

Treat the Apr 7 overshoot as an out-of-line movement and we have a possible H&S top in $XRP

For the sake of the uneducated trolls among you, this chart need NOT be interpreted as bearish

Price is at support right now

I will review if price closes below 1.8xxxx pic.twitter.com/YlsqLi2SzN— Peter Brandt (@PeterLBrandt) June 23, 2025

A decisive weekly close below that critical level would be needed to confirm a bearish scenario.

Meanwhile, analyst EGRAG CRYPTO provided a detailed bullish perspective using multiple technical indicators.

The Gaussian Channel is a volatility indicator used to identify trend strength and potential reversals. Closing within this channel boundary, around $1.75 currently, could signal weakening momentum and possible downward pressure.

EGRAG emphasizes the importance of XRP staying above this boundary to maintain bullish strength.

Additionally, the 21-week EMA acts as a critical moving average that traders use to identify macro trends.

A close above the EMA level of $2.33 would signify strong bullish momentum.

Moreover, breaking above the resistance at $2.65 would confirm a robust long-term bullish trend.

EGRAG also applies Elliott Wave analysis, a technical approach that identifies repeating patterns (waves) in market prices to forecast potential targets.

Using Elliott Wave ratios, the analyst projects XRP could reach between $9 and $10 if the altcoin successfully completes its anticipated fifth wave, provided current support levels hold firm.

Short-Term Technical Analysis Supports Caution

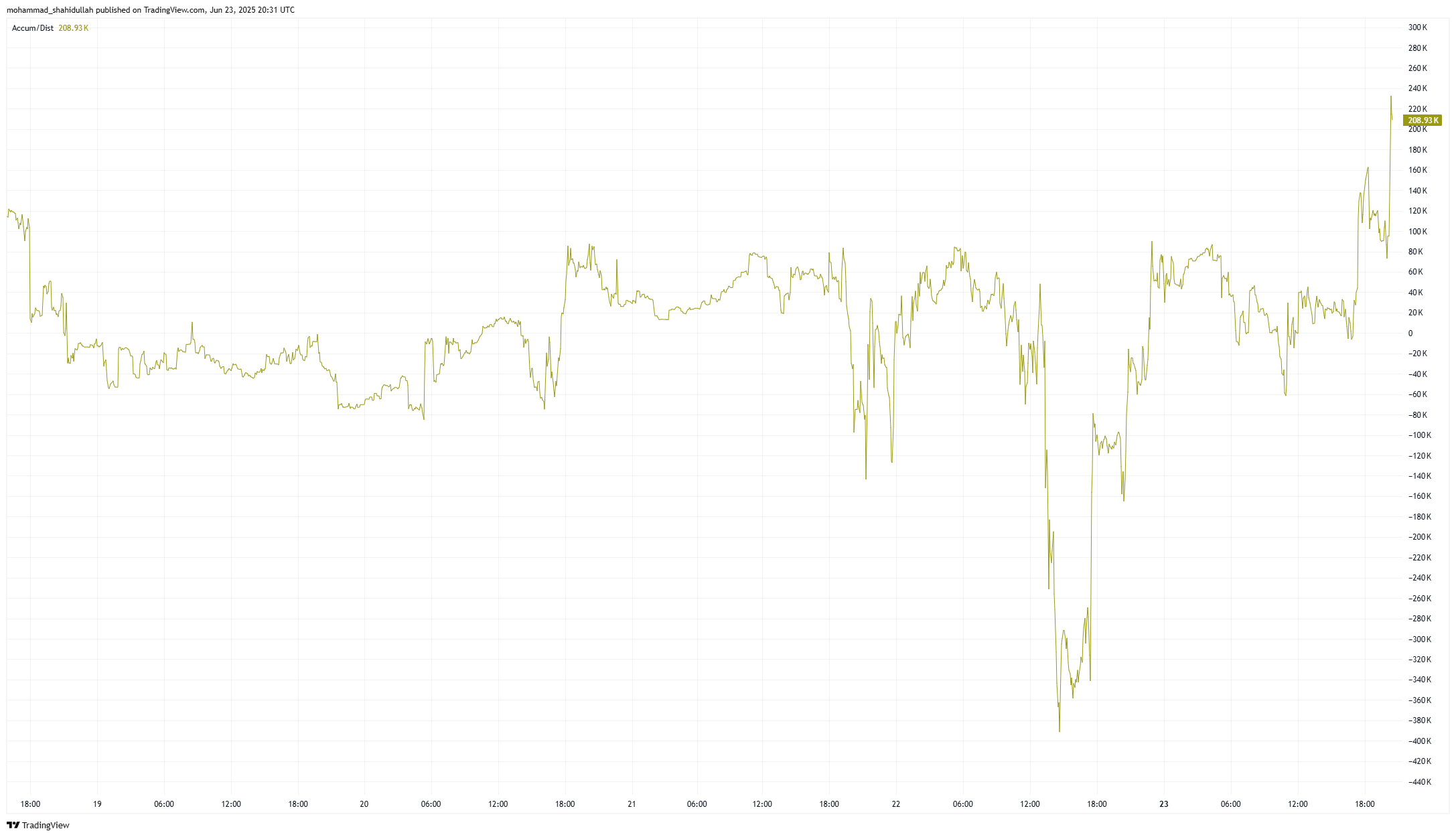

XRP faced significant selling pressure as prices declined sharply towards $1.90, confirmed by the Accumulation/Distribution (A/D) line dropping notably.

The A/D line measures cumulative buying and selling pressure, and its decline indicates higher trading volume on price decreases, reflecting strong seller activity.

As XRP price reached support near $1.90, the A/D line stabilized and began a modest climb during the rebound, indicating renewed buyer activity.

Nevertheless, the accumulation during this rebound has not yet fully neutralized the earlier distribution, suggesting caution remains warranted.

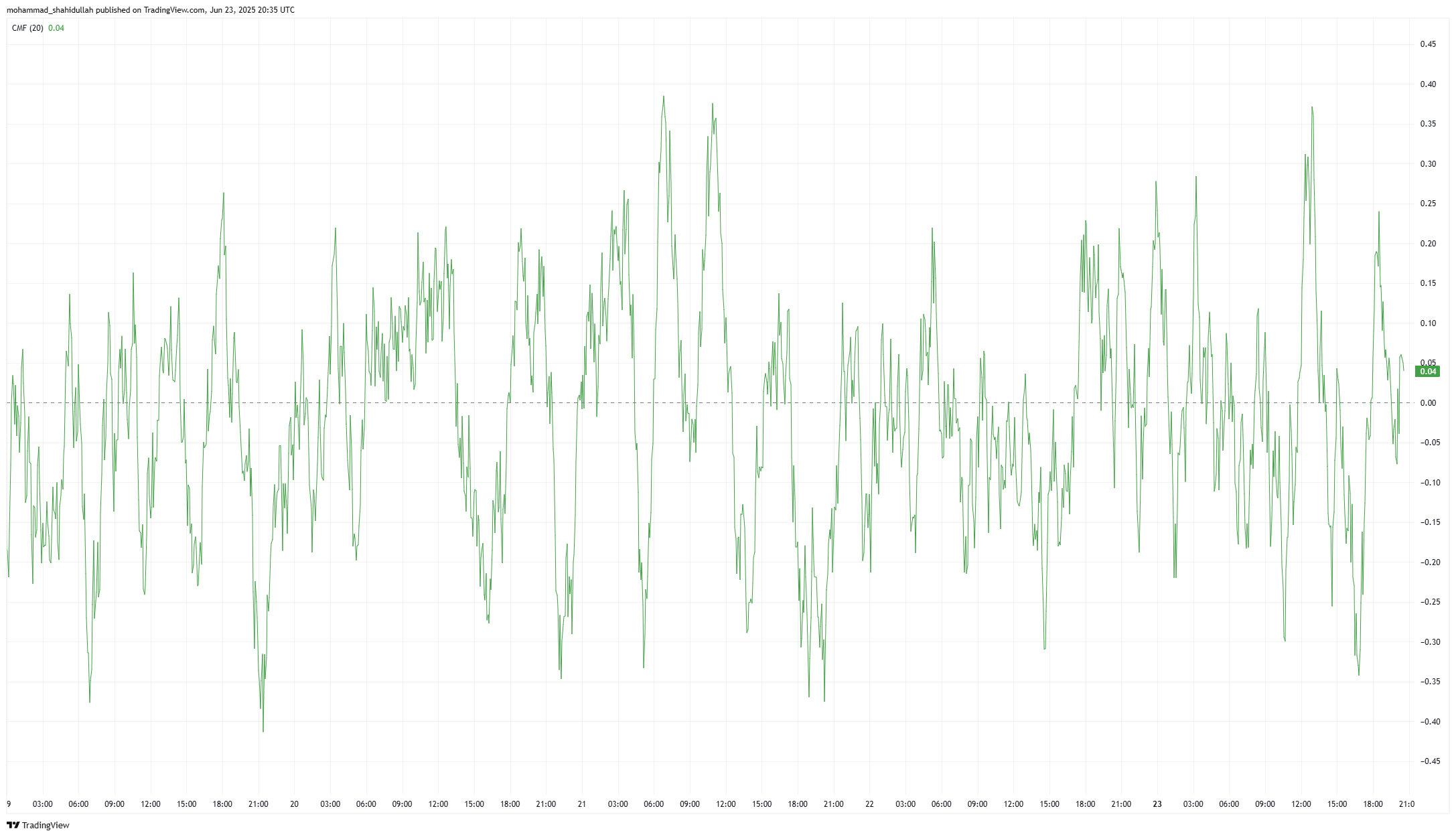

Meanwhile, the Chaikin Money Flow (CMF), an indicator showing the strength of money flowing into or out of an asset, turned negative during the sell-off, confirming strong outflows.

Although CMF improved somewhat during XRP’s rebound, it remained weak and did not enter positive territory, signaling that buyers remain tentative.

Consolidation and Critical Levels to Watch for XRP

These technical indicators suggest XRP is currently in cautious consolidation. While support near $1.90 proved strong, the limited improvement in CMF indicates ongoing market uncertainty.

Overall, this analysis aligns with analyst views that key support around $1.75 to $1.80 remains intact. Only a decisive weekly close below these supports would validate a bearish outlook.

Traders should closely monitor XRP’s interaction with critical support and resistance levels.

Specifically, a confirmed breakout above $2.33 and then $2.65 would signal bullish continuation, while a decisive breach of $1.75-$1.80 support would indicate increased bearish risk.

The post Why Analysts Claim XRP Price Pattern Is Not Bearish appeared first on BeInCrypto.