The new DeepSeek R1 model from China launched last week. If you’re into AI or even into technology more broadly, it was hard to miss the news. Everyone was talking about it. But it’s not just that. It’s the way everyone was talking about it. I was left with the impression that DeepSeek is going to drive a stake through the heart of OpenAI and Anthropic.

The new DeepSeek R1 model from China launched last week. If you’re into AI or even into technology more broadly, it was hard to miss the news. Everyone was talking about it. But it’s not just that. It’s the way everyone was talking about it. I was left with the impression that DeepSeek is going to drive a stake through the heart of OpenAI and Anthropic.

Related Posts

VanEck Reveals Bitcoin’s Fleeting Freedom from Stock Market Chains — Will It Last?

According to VanEck’s April 2025 Digital Assets Monthly recap, Bitcoin (BTC) outperformed equities during a turbulent month, offering a glimpse of its potential as a macro hedge.

Yet, the asset’s quick return to correlated behavior suggests Bitcoin is not yet ready to stand fully apart from risk markets.

Bitcoin Outperforms Stocks During April Market Selloff

Bitcoin briefly broke free from traditional markets like stocks and equities. However, its newfound independence may have been short-lived.

“Bitcoin showed signs of decoupling from equities during the week ending April 6,” VanEck Head of Digital Assets Research Matthew Sigel wrote.

This period coincided with US President Donald Trump’s announcement of sweeping tariff measures, which triggered a global market selloff. While the S&P 500 and gold slumped, Bitcoin rose from $81,500 to over $84,500, signaling a possible shift in investor perception.

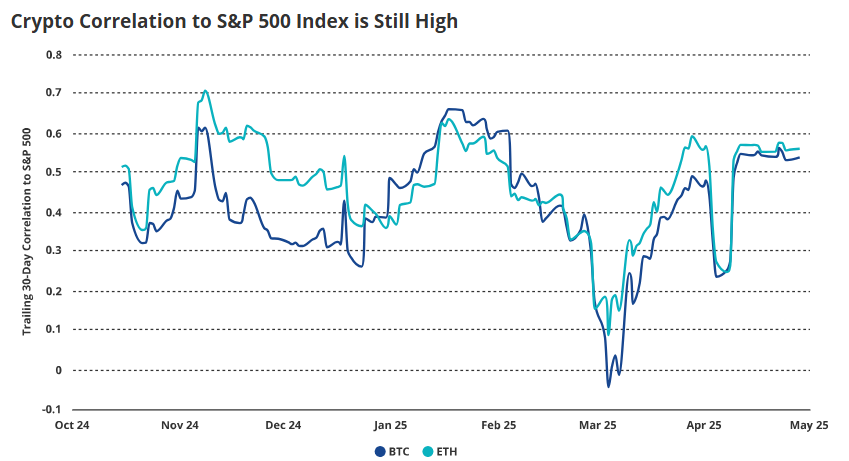

Still, the momentum did not last. As the month progressed, Bitcoin’s price action re-synced with equities. VanEck, using data from Artemis XYZ, noted that the 30-day BTC-S&P 500 correlation fell below 0.25 in early April but bounced back to 0.55 by month’s end.

“Bitcoin has not meaningfully decoupled,” the report emphasized.

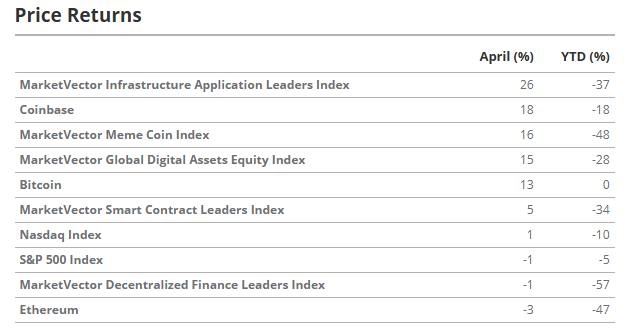

Bitcoin gained 13% for the month, outshining the NASDAQ’s 1% loss and the S&P 500’s flat performance. Perhaps more intriguingly, Bitcoin’s volatility dropped by 4%, even as equity volatility doubled amid rising geopolitical tensions and trade uncertainty.

Yet while the short-term picture remains muddled, VanEck sees early signs of a structural shift. The report highlights a growing sovereign and institutional interest in Bitcoin as a store-of-value asset with long-term macro hedging potential.

“Structural tailwinds are forming. Bitcoin continues to find support as a sovereign, uncorrelated asset,” wrote Sigel.

VanEck pointed to Venezuela and Russia’s use of Bitcoin in international trade as an early signal of this transition.

Corporate Bitcoin Accumulation Grew In April

Meanwhile, corporate BTC accumulation surged in April. Notable purchases included 25,400 BTC by Strategy (formerly MicroStrategy) and fresh allocations by Metaplanet and Semler Scientific.

Softbank, Tether, and Cantor Fitzgerald also launched a new firm, 21 Capital, with plans to acquire $3 billion worth of Bitcoin.

These developments follow Standard Chartered’s assertion that Bitcoin is now growing into a hedge against traditional finance (TradFi) and US Treasury risk.

The bank argued that Bitcoin’s resilience amid monetary stress reflects its growing role as portfolio ballast against the fragility of fiat-denominated debt markets.

“I think Bitcoin is a hedge against both TradFi and US Treasury risks. The threat to remove US Federal Reserve Chair Jerome Powell falls into Treasury risk—so the hedge is on,” Geoff Kendrick, Head of Digital Asset Research at Standard Chartered, told BeInCrypto.

However, this resilience did not extend to the broader crypto market. According to VanEck, altcoins stumbled as meme coins, speculative DeFi AI tokens, and Layer-1 networks like Ethereum and Sui fell sharply.

The MarketVector Smart Contract Leaders Index dropped 5% in April and is down 34% year-to-date. Solana stood out as a rare winner, gaining 16% thanks to network upgrades and increasing institutional treasury interest.

Sui posted a 45% jump in daily DEX volume and entered the top 10 in smart contract platform revenue. By contrast, Ethereum lagged, declining 3% as its fee revenue share shrank to just 14%, down from 74% two years ago.

The broader trend in altcoins was bearish, and speculative energy continued to fade. Trading volumes in meme coins dropped by 93% between January and March, with the MarketVector Meme Coin Index down 48% year-to-date.

Even so, regarding price and volatility metrics, Bitcoin’s relative strength in April could hint at where the asset is headed. VanEck’s report concludes that while Bitcoin has not yet fully broken from risk asset behavior, the groundwork for long-term decoupling is quietly being laid.

The post VanEck Reveals Bitcoin’s Fleeting Freedom from Stock Market Chains — Will It Last? appeared first on BeInCrypto.

World Liberty Financial Invests $10 Million in a Synthetic Dollar Project

Trump family’s decentralized finance (DeFi) project, World Liberty Financial, has extended its reach into the stablecoin market, investing $10 million into a synthetic dollar protocol.

The investment cements WLFI’s growing influence in the stablecoin market following the recent launch of its own fiat-backed digital asset, USD1.

Trump Family’s DeFi Firm Bets on Falcon Finance’s Project

The funding will bolster Falcon’s technical development in areas such as shared liquidity provisioning. Other areas include multi-chain compatibility and smart contract-based conversions between Falcon’s USDf and WLFI’s USD1.

Falcon Finance’s synthetic dollar, USDf, recently surpassed $1 billion in circulating supply.

USDf is designed to offer institutions and retail users a novel way to access stable digital dollars.

It operates on a dynamic, risk-adjusted overcollateralization model accepting various crypto assets as collateral.

“This investment validates our approach to creating more efficient on-chain dollar instruments for institutional users. We are excited to collaborate with WLFI to redefine digital dollar solutions,” read an excerpt in the announcement, citing Andrei Grachev, Managing Partner of Falcon Finance.

USD1, meanwhile, is fully redeemable 1:1 for the US dollar. It is backed by a reserve of US government money market funds and dollar-denominated cash equivalents.

The asset, which is now tradeable, is now also being used as collateral within Falcon’s protocol.

“This strategic partnership with Falcon Finance represents a significant step forward in our mission to build a comprehensive DeFi ecosystem,” Zak Folkman, co-founder of World Liberty Financial, said in the statement.

WLFI plans to use its distribution network to accelerate Falcon’s global adoption.

Such a move would mark notable alignment between a fiat-backed and synthetic stablecoin model. This is amid a broader race to dominate the next generation of on-chain dollars.

Falcon Finance To Build Trust in Synthetic Dollars

As competition among synthetic stablecoins heats up, Falcon Finance has crossed a major milestone, $1 billion in circulating USDf.

Based on this, BeInCrypto contacted the synthetic dollar protocol to learn how it plans to sustain growth and trust.

“Our approach has always been to prioritize and focus on transparency, overcollateralization, and real utility. Every USDf in circulation is backed by auditable collateral, with verification and transparency of reserve ratios and system parameters,” Andrei Grachev, Managing Partner at Falcon Finance, said in an exclusive statement to BeInCrypto.

With WLFI’s fiat-backed stablecoin USD1 now integrated as collateral on Falcon, the protocol is leaning into a hybrid model.

“Fiat-backed and synthetic dollars serve different roles. Fiat-backed models offer familiarity and direct redemption, while synthetic models unlock programmability, yield access, and broader collateral options,” Grachev explained.

He added that using USD1 as collateral shows that these models can be complementary.

“Our view is that the future of digital dollars will not be defined by a single design, but by how different formats interoperate—safely and at scale,” Grachev articulated.

On regulatory direction, especially in light of Hong Kong’s real-name stablecoin proposal, Grachev emphasized Falcon’s proactive stance.

“We are actively engaging with licensing pathways in the United States, Europe, and Asia, including jurisdictions like Hong Kong. That includes real-name frameworks, disclosure rules, and asset segregation requirements,” he said.

Ultimately, Grachev said Falcon Finance believes that regulatory engagement will be essential not just for compliance but also for building infrastructure that institutions and regulators can trust.

The post World Liberty Financial Invests $10 Million in a Synthetic Dollar Project appeared first on BeInCrypto.

US Loses Perfect Credit Rating – How Will It Impact Bitcoin Price?

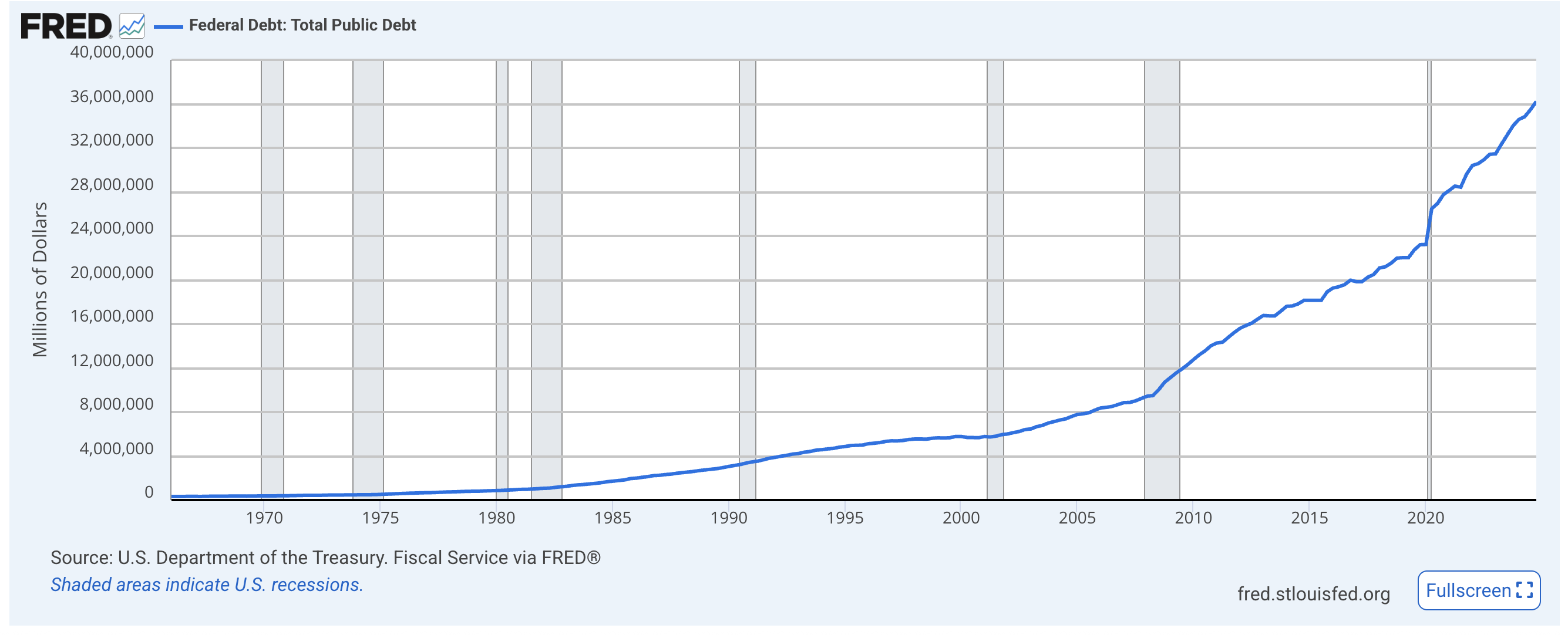

Bitcoin (BTC) is facing a mix of bullish signals and short-term uncertainty. Moody’s recent downgrade of the US credit rating has heightened long-term bullish sentiment around BTC, reinforcing its role as a hedge against rising debt and fiscal uncertainty.

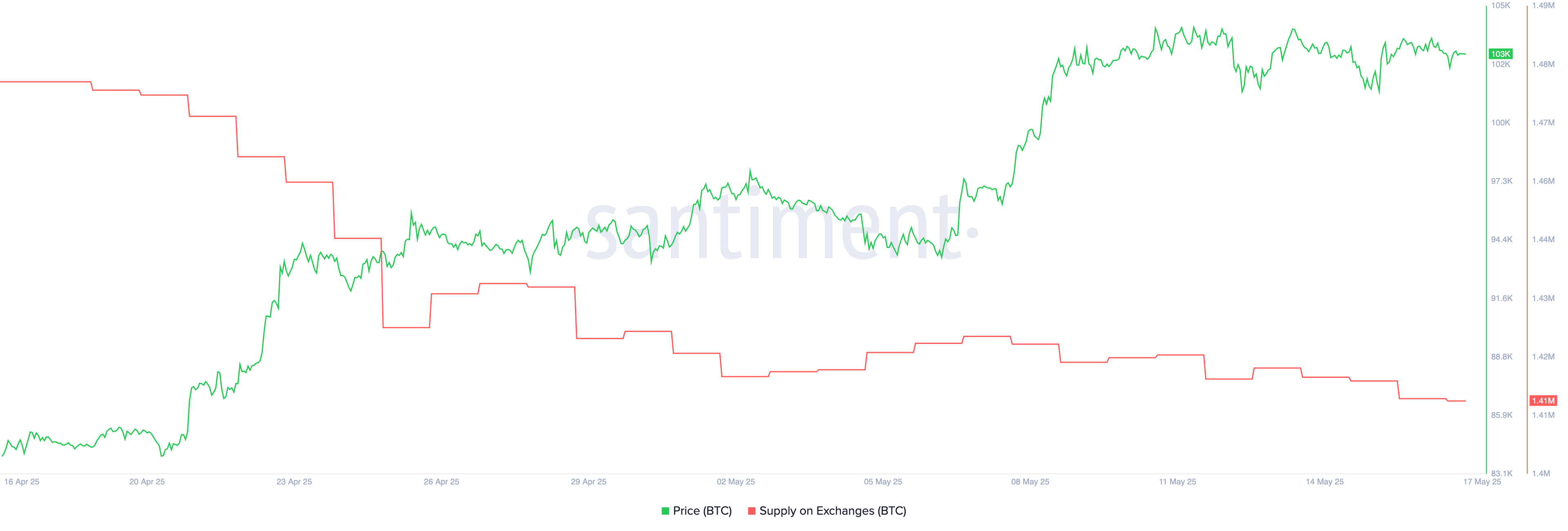

Meanwhile, on-chain data shows a declining supply of Bitcoin on exchanges, suggesting investors are leaning toward holding rather than selling. Despite these bullish fundamentals, BTC remains in a short-term consolidation phase, with price action needing fresh momentum to break higher.

Moody’s Downgrade Ends US Century-Long Perfect Credit Rating Streak

Moody’s has downgraded the US credit rating from Aaa to Aa1, removing the country’s last perfect score among major credit agencies.

It’s the first time in over a century that the US lacks a top-tier rating from all three, following downgrades by S&P in 2011 and Fitch in 2023. Rising deficits, mounting interest costs, and the absence of credible fiscal reforms drove the decision.

Markets reacted quickly—Treasury yields climbed, and equity futures slipped. The White House dismissed the downgrade as politically driven, with lawmakers still negotiating a $3.8 trillion tax and spending package.

Moody’s also warned that extending Trump-era tax cuts could deepen deficits, pushing them toward 9% of GDP by 2035—a scenario that may strengthen the appeal of crypto, especially Bitcoin, as a hedge against long-term fiscal instability.

Bitcoin Consolidates: Falling Exchange Supply Meets Ichimoku Indecision

After briefly rising from 1.42 million to 1.43 million between May 2 and May 7, Bitcoin’s supply on exchanges is falling once again.

This short uptick followed a more significant decline between April 17 and May 2, when the exchange supply dropped from 1.47 million to 1.42 million. Now, the metric has resumed its downward trend, currently sitting at 1.41 million BTC.

The supply of Bitcoin on exchanges is a key market indicator. When more BTC is held on exchanges, it often signals potential selling pressure, which can be bearish.

Conversely, a decline in exchange balances suggests holders are moving their coins to cold storage, reducing near-term sell pressure—a bullish signal. The current drop reinforces the idea that investors may be preparing to hold rather than sell.

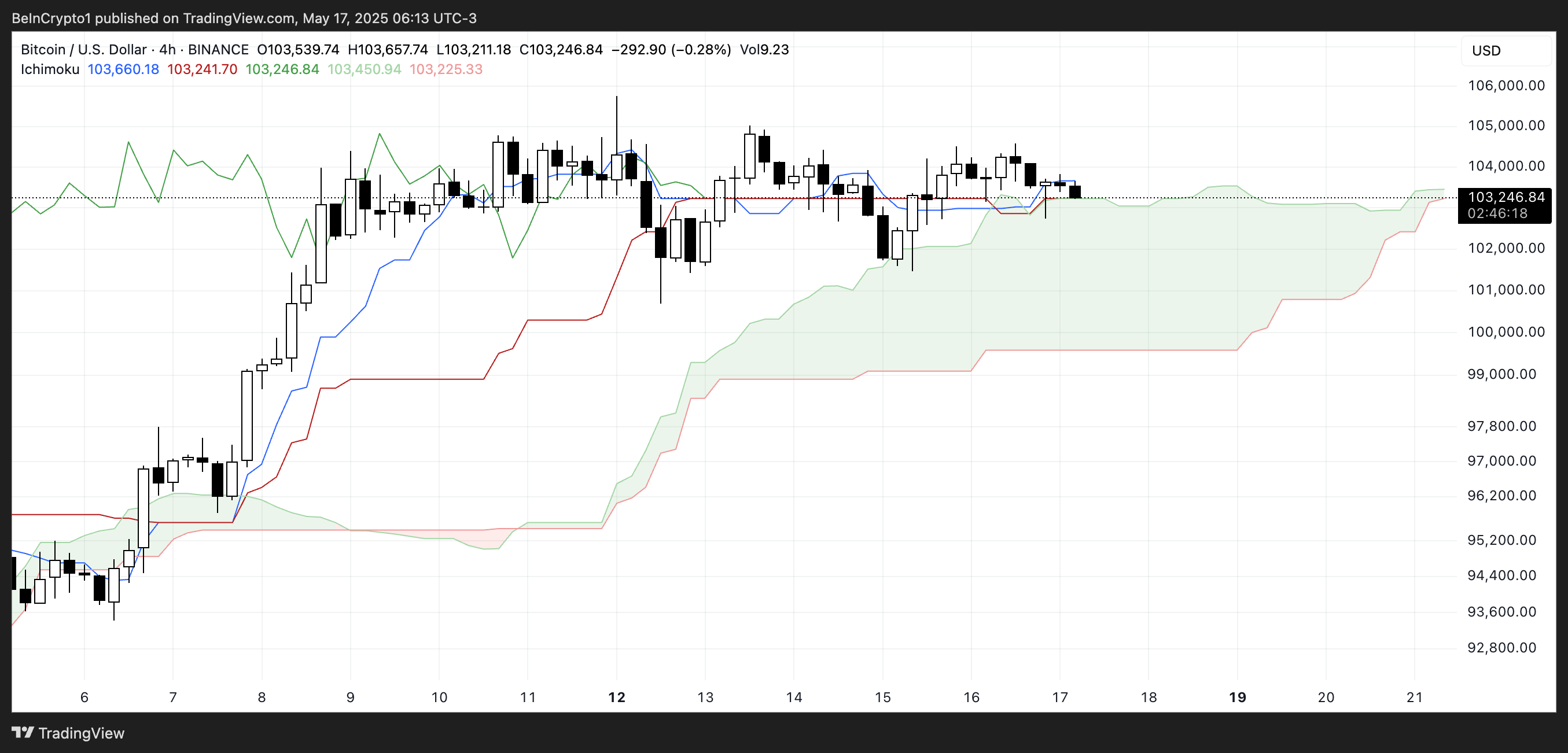

The Ichimoku Cloud chart for Bitcoin shows a period of consolidation with neutral-to-slightly-bearish signals. The price is currently sitting right around the flat Kijun-sen (red line), indicating a lack of strong momentum in either direction.

The Tenkan-sen (blue line) is also flat and closely tracking the price, reinforcing this sideways movement and short-term indecision.

The Senkou Span A and B lines (which form the green cloud) are also relatively flat, suggesting equilibrium in the market. The price is moving near the top edge of the cloud, which typically acts as support. However, since the cloud is not expanding and has a flat structure, there is no strong trend confirmation at the moment.

The Chikou Span (green lagging line) is slightly above the price candles, hinting at mild bullish bias, but overall, the chart signals indecision and the need for a breakout to confirm the next direction.

Moody’s Downgrade Strengthens Bitcoin’s Long-Term Bull Case Amid Short-Term Consolidation

The U.S. losing its last perfect credit rating after Moody’s downgrade could be a major long-term catalyst for Bitcoin.

While it may not trigger immediate price action, the downgrade reinforces the narrative of growing fiscal instability and debt concerns—conditions that strengthen Bitcoin’s appeal as a decentralized, hard-capped asset.

In the medium to long term, more investors may turn to BTC as a hedge against sovereign risk and weakening trust in traditional financial systems.

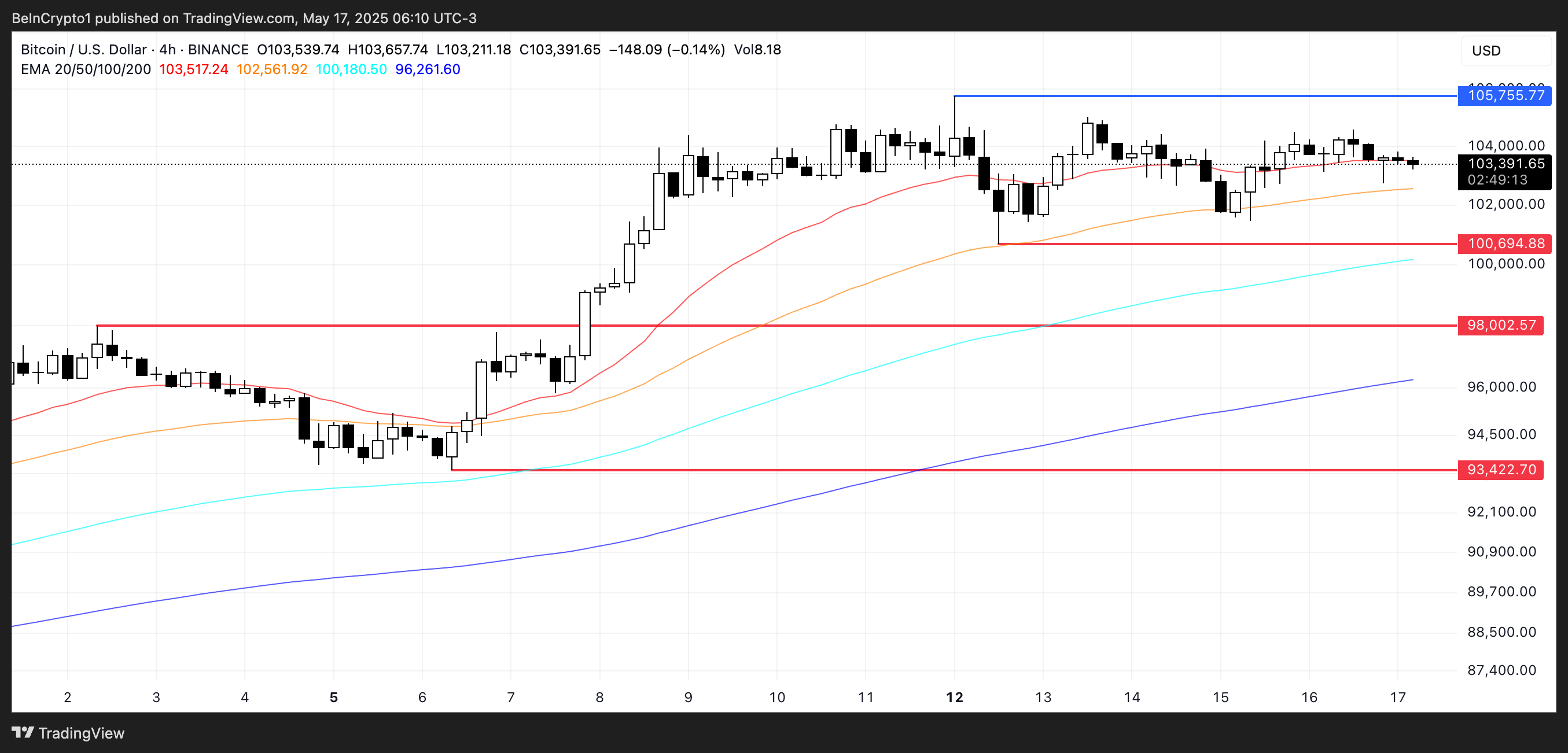

In the short term, however, Bitcoin price remains in a consolidation phase after breaking above $100,000. Its EMA lines are still bullish, with shorter-term averages above longer-term ones, but they are flattening out.

For bullish momentum to resume, BTC would need to push past the $105,755 resistance.

On the downside, holding above the $100,694 support is crucial—losing it could open the door for declines toward $98,002 and potentially $93,422.

The post US Loses Perfect Credit Rating – How Will It Impact Bitcoin Price? appeared first on BeInCrypto.