DWF Labs announced today that it invested $25 million into Trump Family-backed World Liberty Financial and is planning to open an office in New York City. It hopes to use this office to drive new relationships with regulators, financial institutions, and more.

Although this partnership would potentially create more liquidity opportunities for the US crypto market, previous allegations against DWF have raised some concerns about political misconduct.

Understanding DWF Labs’ Investment in WLFI

World Liberty Financial (WLFI), one of the Trump family’s major crypto ventures, has been making some big moves since the President’s inauguration in January.

The DeFi project allegedly entered talks with Binance to launch a new stablecoin, and it officially announced USD1 shortly after. Today, WLFI has entered a new partnership with Dubai-based Web3 investment firm DWF Labs.

“The US is the world’s largest single market for digital asset innovation. Our physical presence reflects our confidence in America’s role as the next growth region for institutional crypto adoption. Moreover, the USD1 stablecoin and forthcoming global DeFi solutions align with our broader mission to improve financial services,” claimed Managing Partner Andrei Grachev.

DWF’s statement includes a few key details about its new relationship with WLFI. It essentially boils down to two key points: the firm has already purchased $25 million in WLFI tokens, and it plans to open a physical office in New York City.

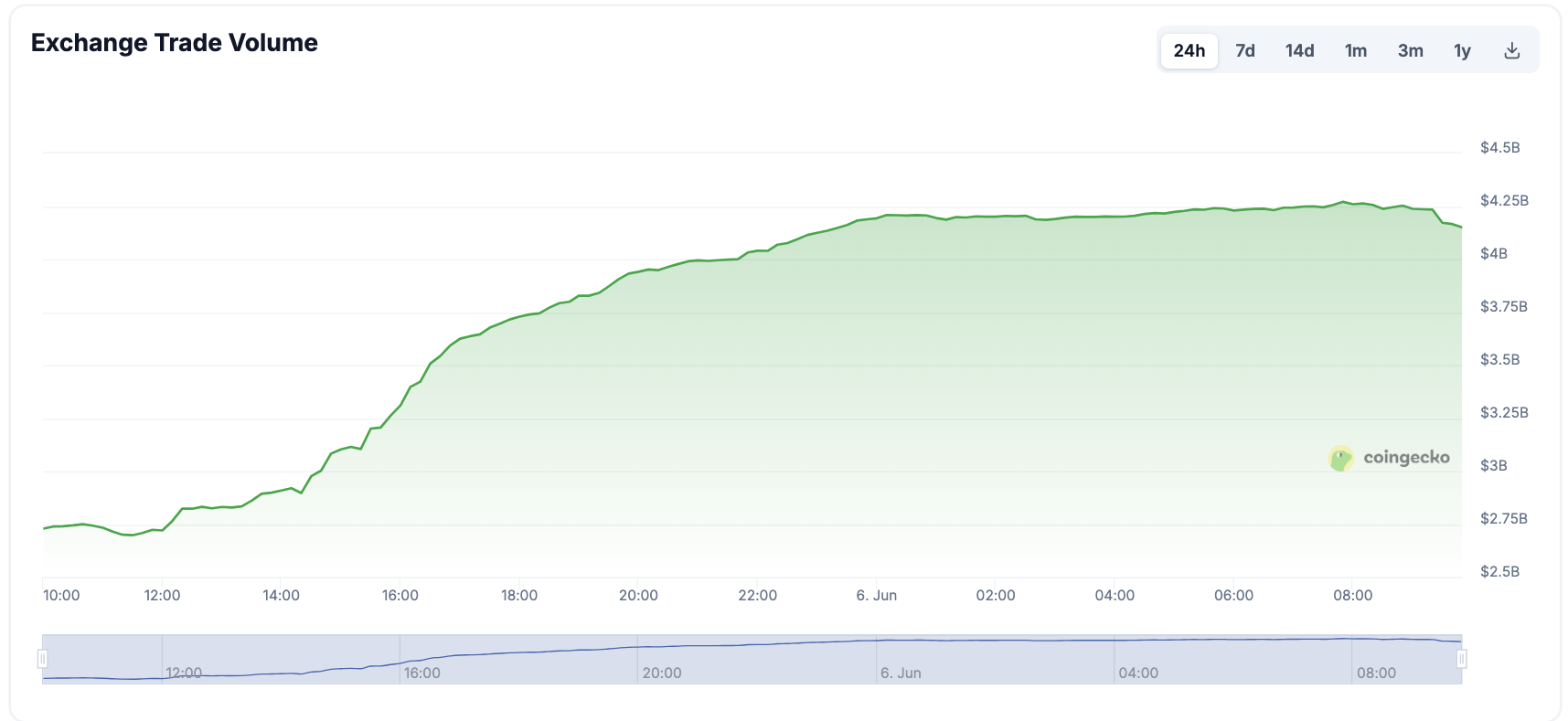

On a positive note, this partnership could be significant for the overall US crypto market. DWF Labs has a portfolio of over 700 crypto projects.

So, physically setting up a hub in New York will give me regulatory freedom and the opportunity to invest directly in the local crypto market. This would potentially open up more liquidity for upcoming Web3 projects and startups in the US

Concerns of Financial Misconduct

Although DWF Labs is a popular market maker, it has been at the center of major controversies. Last year, it was accused of wash trading and market manipulation, and Binance allegedly shut down its internal investigation due to financial incentives.

Also, one of its partners was dismissed back in October over allegations of drugging a job applicant. So, the firm’s credibility and reputation have been shaky in recent times.

This is to say that the crypto community has reasons to worry about a deal between DWF and World Liberty Financial. A report from late March determined that most WLFI revenues go directly to Trump’s family.

WLFI owners are unable to actually trade their tokens, and the stated governance use of the assets seems unclear. In other words, there isn’t a clear reason why anyone would invest.

The growing concern is that firms like DWF would invest in WLFI as an easy tool for political corruption. Shortly after the election, Tron founder Justin Sun invested $30 million into World Liberty. Trump’s family apparently got most of this money, and the SEC settled a fraud case against Tron in February.

If DWF Labs invested a similar amount in WLFI, could this give it some legal protection? The Department of Justice already gutted its Crypto Enforcement Team, and New York’s US Attorney also signaled its intent to stop crypto prosecutions.

As this deal goes forward, it will be important to look for signs of any possible financial misconduct.

BeInCrypto has contacted DWF Labs about the 2024 market manipulation claims but has yet to receive a reply.

The post DWF Labs Invests $25 Million in Trump’s WLFI Amid Growing Political Controversy appeared first on BeInCrypto.