A DOGE whale has drawn the crypto community’s attention following a recent transfer involving millions of the meme coin. This development comes as crypto analyst Master Kenobi predicted that a Dogecoin price breakout will happen “within hours.”

DOGE Whale Moves 478 Million Coins As Dogecoin Price Eyes Breakout

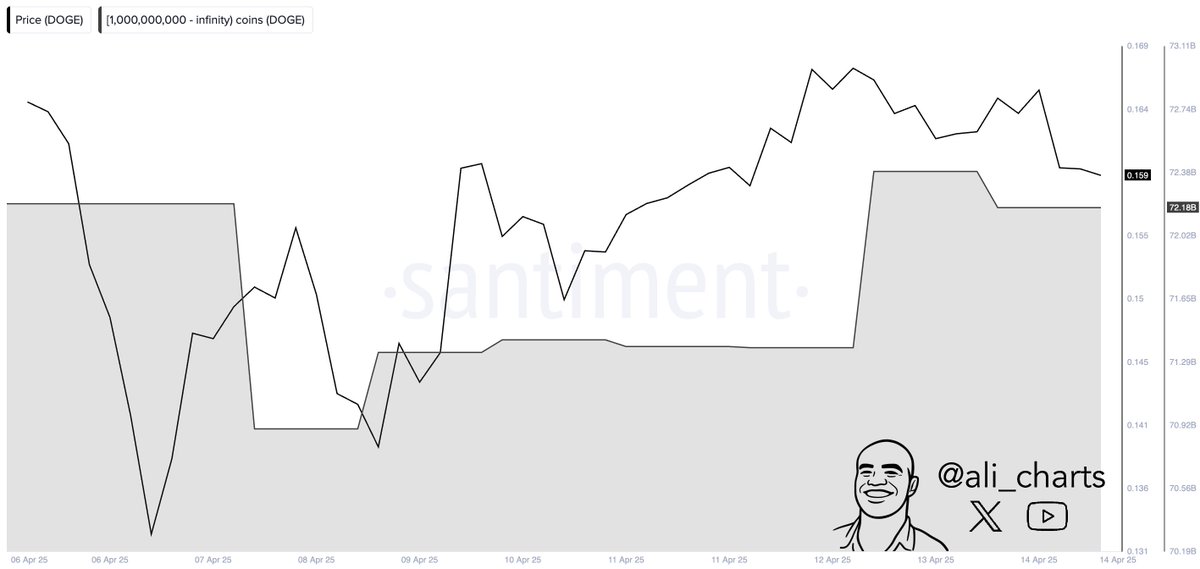

Whale Alert data shows a DOGE whale moved 478 million coins worth $72.9 million from an unknown wallet to another unknown wallet, hinting at active accumulation from this investor. Other whales also look to be actively accumulating, as crypto analyst Ali Martinez revealed that DOGE whales bought over 800 million coins in 48 hours.

This accumulation comes amid Master Kenobi’s prediction that a Dogecoin price breakout will happen within hours. His accompanying chart highlighted an ascending rectangle, from which the breakout could occur. The analyst further remarked that the breakout will also likely surpass the downtrend line.

The crypto analyst stated that this is arguably the most significant event for DOGE this year so far. He added that the Dogecoin price’s peak is anticipated around late May to early June, aligning with the BNB price and other major altcoins.

Meanwhile, his accompanying chart also showed that Dogecoin could rally to as high as $0.8 if it reaches the upper boundary of this rectangular channel.

Martinez also recently predicted that the top meme coin could soon reach $0.29. He stated that price needs to hold the key support at $0.13 and sustain a break above $0.17 to reach this level.

More Bullish Outlook For DOGE

In a series of X posts, crypto analyst Trader Tardigrade provided a bullish outlook for the Dogecoin price. In one post, he stated that DOGE is breaking out of a falling wedge pattern on the 1-hour chart. He added that DOGE’s Relative Strength Index (RSI) also shows a breakout after hitting the oversold zone.

In another post, the crypto analyst stated that Dogecoin is forming a prolonged symmetrical triangle. Trader Tardigrade remarked that the longer the consolidation within the triangle, the stronger the momentum builds, leading to a higher pump for the DOGE price.

His latest X post also showed that the Dogecoin price was eyeing a rally to the $0.8 target, just like Master Kenobi predicted.

The post DOGE Whale Moves 478M Coins As Analyst Predicts Dogecoin Price Breakout “Within Hours” appeared first on CoinGape.