The post Degens Gear Up for Both Scenarios Ahead of Option Expiry—Will BTC Price Breakout or Breakdown? appeared first on Coinpedia Fintech News

After the FOMC minutes and the digital asset summit, the option expiry is about to shake the volatility of the market. Triple Witching Day is here! It shakes the volatility of the market if it has remained stagnant for a long time, as it refers to the simultaneous expiration of options and future contracts. Currently, more than $2 billion in Bitcoin and Ethereum options are set to expire, and hence the investors are closely monitoring potential shifts.

Options expiry is the new normal for the crypto space but it does influence the markets to some extent. This time it could be more intensified as the crypto degens have entered and placed bets on either side. The degens are the ones who engage in high-risk and speculative trading or investment strategies. Now that the BTC price has remained still for over a while, it hints towards both the possibility of a breakout and a breakdown.

To act fast, these degens have placed a bet on either side of the current range.

The data from Coinglass suggests the nearly $50 million liquidation leverage is placed on $85,815 and $82,950. Hence, Bitcoin is expected to face a significant price action after hitting either of the levels if the expiration of the options influences the BTC price action. Currently, the price is facing equal bullish and bearish pressure with negligible volume, which suggests the token is experiencing an extreme price squeeze. Therefore, this suggests the BTC price is heading for a massive price action.

Despite the pullback, the BTC price is trading within a rising parallel channel in the short term and has dropped below the average. Meanwhile, the stochastic RSI is heading towards the lower threshold and may soon undergo a bullish rebound. This could help the price to rise above the average as 50-day MA is offering a strong base. Besides, after experiencing a small bearish pressure, which is expected to be overcome in a short while.

In the meantime, both the liquidation levels are pretty distinct, hence the Bitcoin (BTC) price needs to undergo a 3% to 5% upswing or pullback to trigger either of the actions.

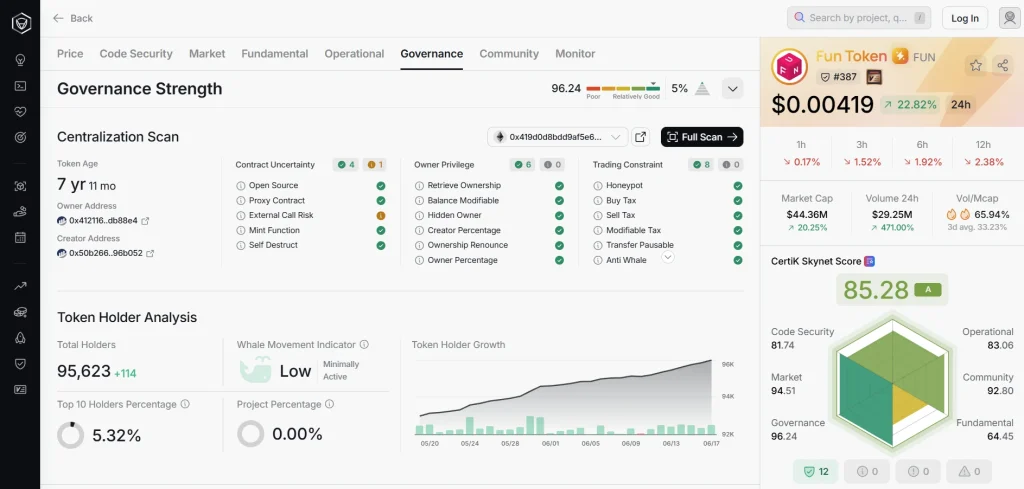

Security First: Backed by CertiK – no compromises.

Security First: Backed by CertiK – no compromises.