DeFi Development Corp. (formerly Janover Inc.) is trying to raise $1 billion by selling securities to buy Solana (SOL) over time.

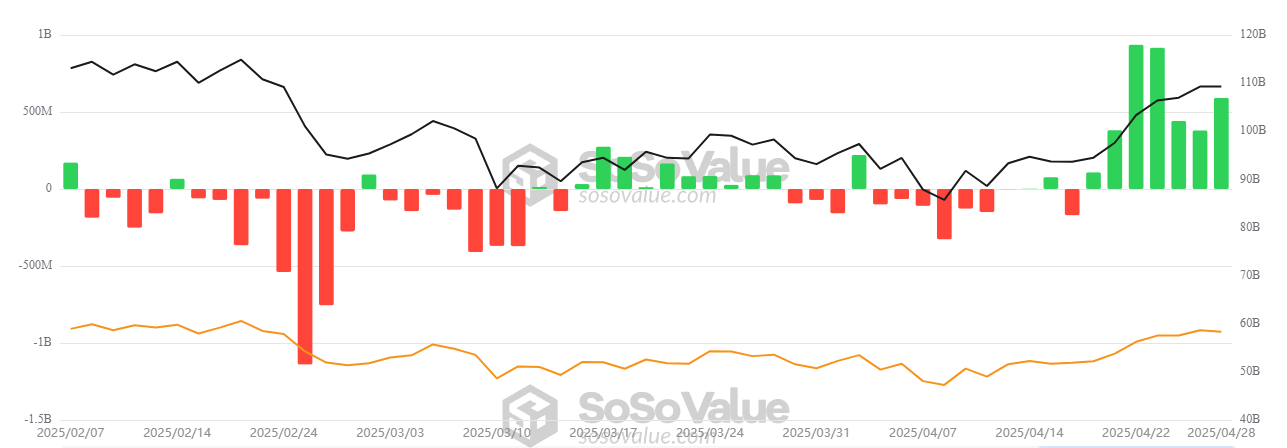

Earlier today, a report from Coinbase claimed that the firm had already raised $42 million for SOL purchases with similar sales. Apparently, these operations were only the beginning of a much larger ambition.

DeFi Development Bets Hard on Solana

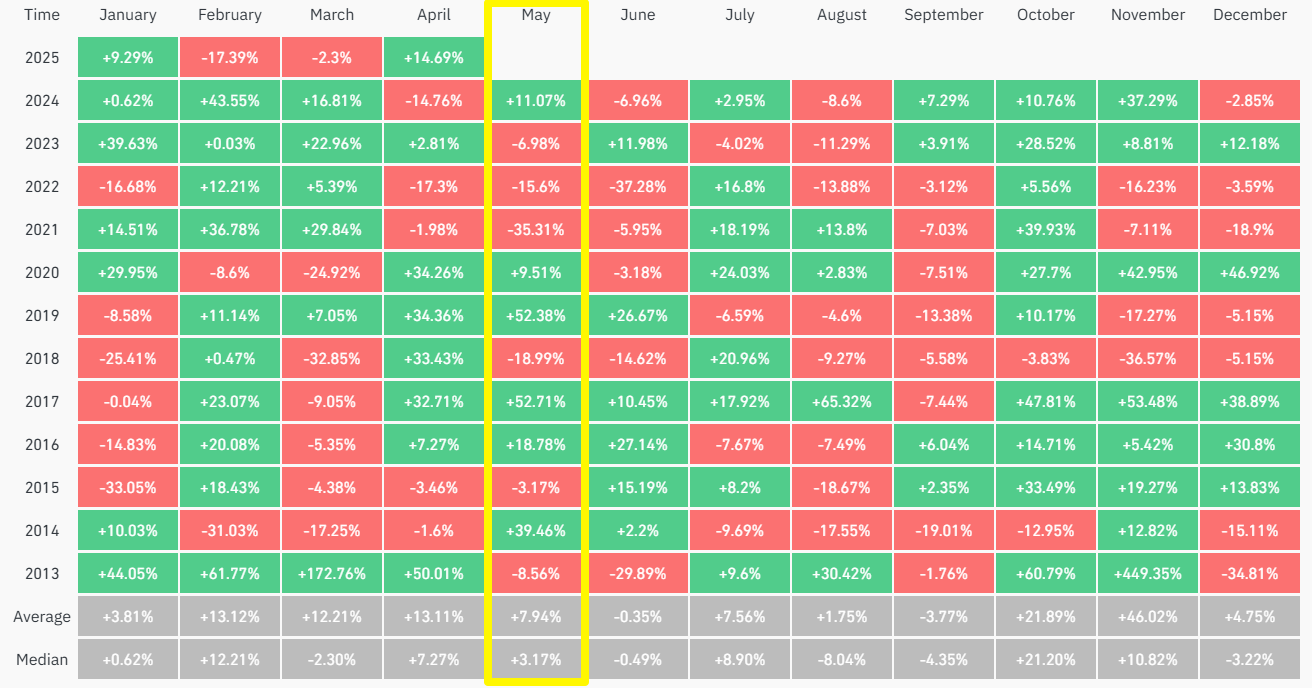

In a trend that the crypto community is calling “Solana MSTR,” corporate actors have been buying SOL tokens.

According to today’s SEC filing, DeFi Development is trying to fund this Solana acquisition through the same method as Strategy:

“[DeFi Development] has adopted a treasury policy under which the principal holding in its treasury reserve on the balance sheet will be allocated to digital assets, starting with Solana. The Board of Directors approved the Company’s new treasury policy on April 4, 2025, authorizing long-term accumulation of Solana,” the filing claims.

In addition to selling up to $1 billion in securities, DeFi Development plans to register up to 1,244,471 shares of common stock for potential resale by existing stockholders to use this liquidity to buy Solana.

Specific details about each offering will appear in a supplement provided at the time of sale.

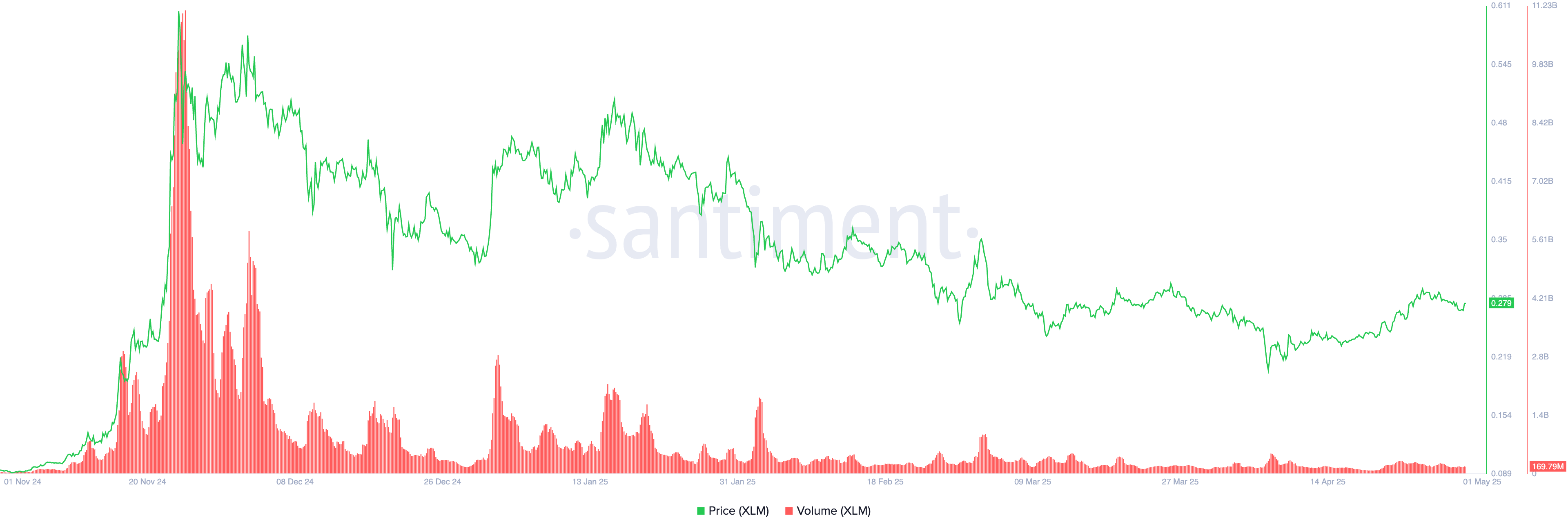

Coinbase noticed DeFi Development’s Solana ambitions and described them in a report released earlier today. The report described the company’s efforts to raise $42 million in convertible notes, using those funds to build an SOL reserve.

The company recently changed its name from Janover, and it now trades on the Nasdaq under the symbol DFDV. DeFi Development also aims to operate one or more Solana validators, enabling it to stake its treasury assets, participate in securing the network, and earn rewards that can be reinvested.

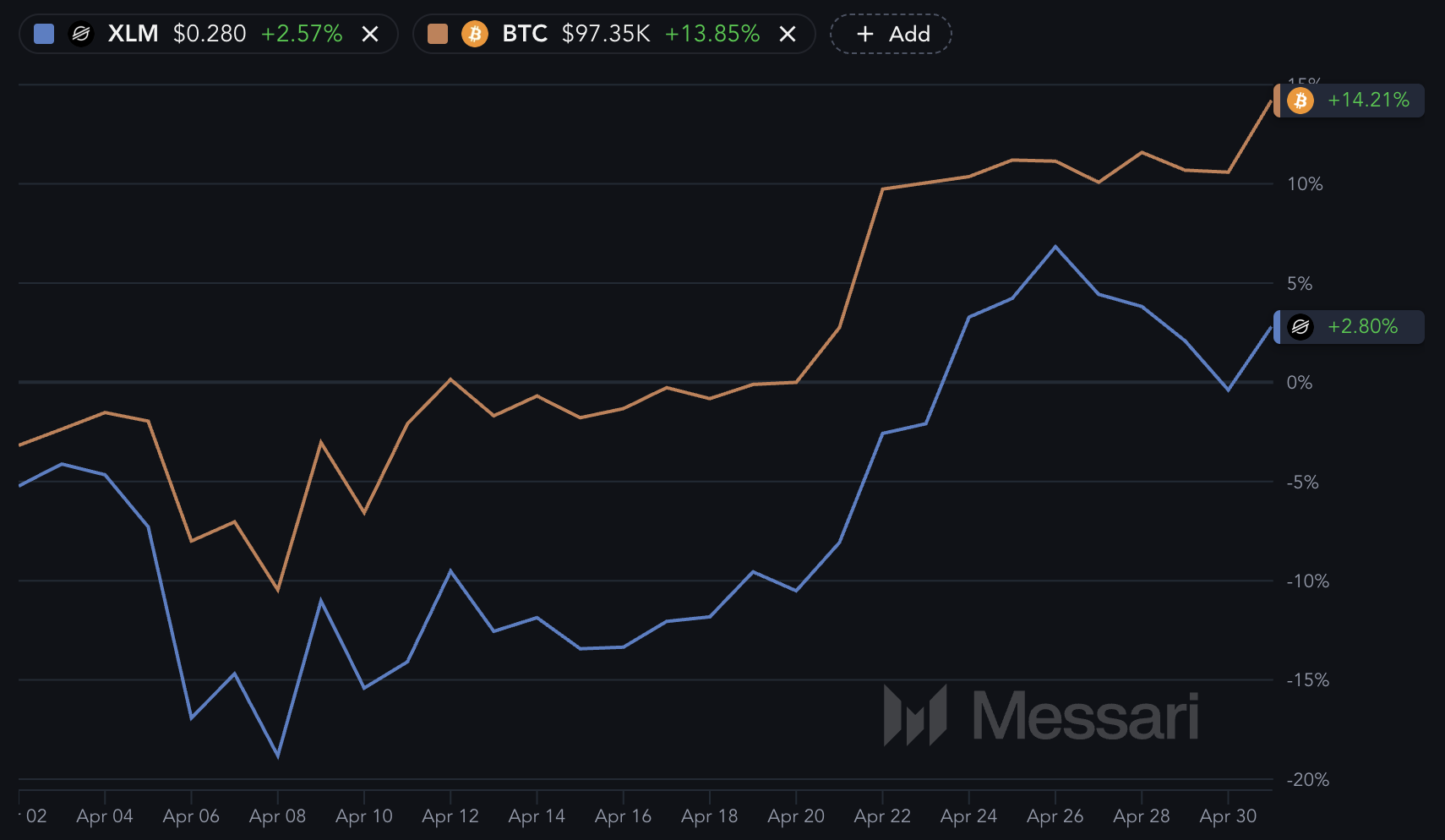

Corporate Solana investment is tiny compared to Bitcoin, but DeFi Development may just be its first whale. MicroStrategy’s plan to become a massive BTC holder didn’t just change its own character; it also transformed Bitcoin.

The company now serves as a major pillar of public confidence in Bitcoin. Perhaps DeFi Development could have a similar impact on SOL.

The post DeFi Development to Become “Solana’s MicroStrategy” With $1 Billion Plan appeared first on BeInCrypto.