The post Crypto News Today, 12th March : XRP News , Pi Network Price, XLM Crypto appeared first on Coinpedia Fintech News

March 12, 2025 06:15:47 UTC

Crypto Prices Today

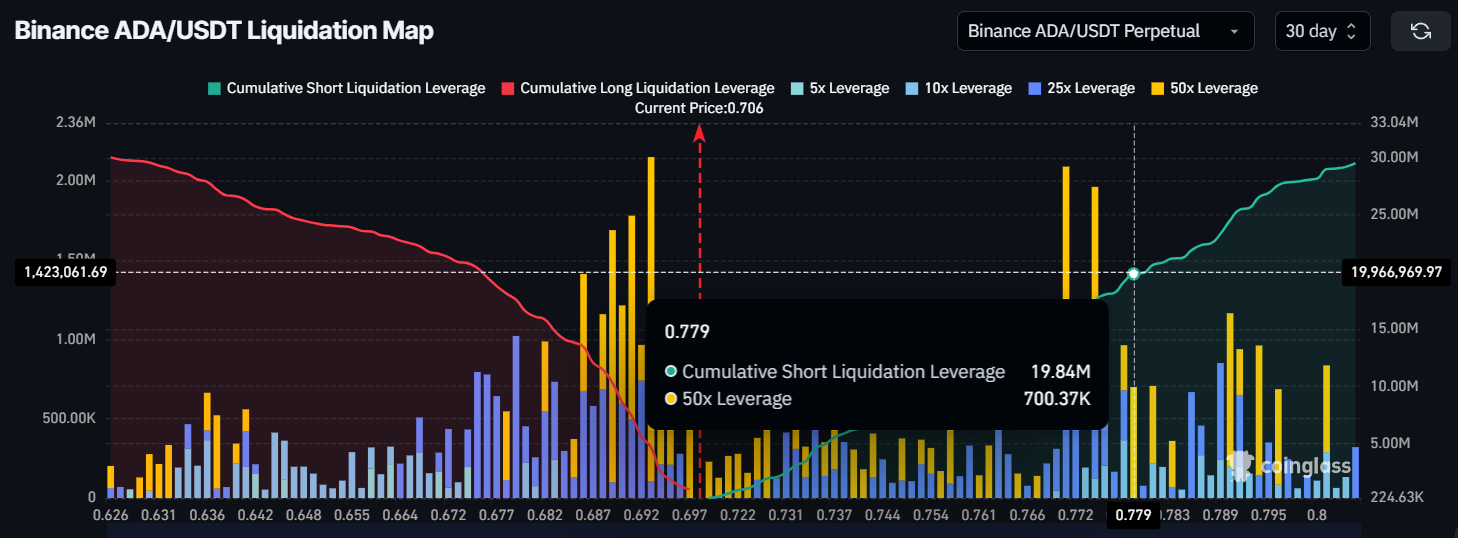

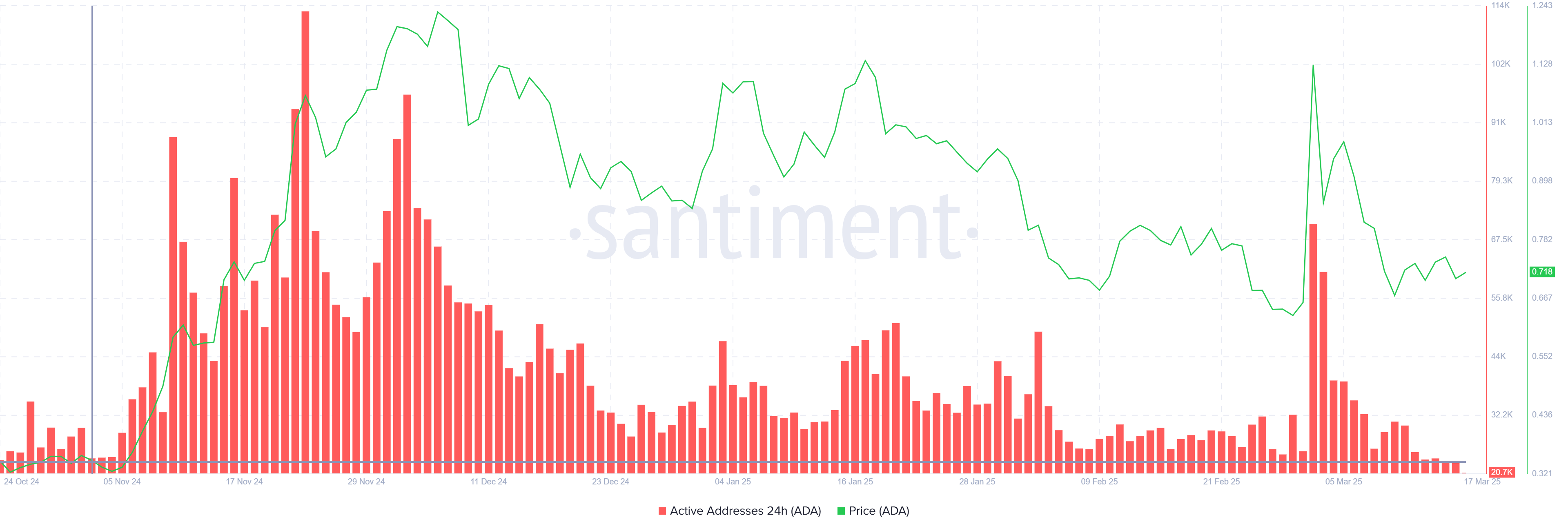

Bitcoin’s recent price rally drives a broad recovery across the cryptocurrency ecosystem. BTC is up by 4.68% over the last 24 hours, trading at approximately $83,014 after rallying from a low of $76,624. Meanwhile, altcoins such as XRP, Dogecoin, and Cardano have cleared key resistance levels, with XRP up 7.42% to $2.193, Dogecoin rising 7.67% to $0.1669, and Cardano staging a rebound from around $0.76. The total crypto market cap has surged by 4.51% to $2.69 trillion, driven by renewed investor optimism fueled by supportive regulatory signals and increased network activity. Despite the strong recovery, some analysts expect further corrections before a new market top is reached.

March 12, 2025 05:57:55 UTC

U.S. Strategic Bitcoin Reserve Implementation Will Be “Compressed”- David Bailey

Bitcoin Magazine CEO David Bailey stated that the U.S. Strategic Bitcoin Reserve Executive Order will be “far more compressed than the market expects,” with a timeline measured in “days and weeks, rather than months or years.” This rapid implementation contrasts with prevailing market expectations, suggesting swift action in setting up the reserve. The move is seen as a key step toward enhancing the government’s strategic approach to Bitcoin, and it could have significant implications for market dynamics and investor sentiment in the cryptocurrency space.

March 12, 2025 05:57:55 UTC

Franklin Templeton Submits XRP ETF Application

Franklin Templeton, boasting over $1.5 trillion in assets under management, has officially filed an application for an XRP ETF. The fund’s XRP assets will be secured by Coinbase Custody Trust Company, ensuring robust asset protection and regulatory compliance. This move reflects growing institutional interest in digital assets and could pave the way for broader investor access to crypto-based investment products. Industry watchers see this as a significant step in bridging traditional finance and the evolving cryptocurrency market.