President Trump has once again called on Fed Chair Jerome Powell to cut interest rates, but the crypto community doesn’t seem interested anymore. Rate cuts seem as unlikely as ever, but the market has new bullish narratives.

Between a US-China trade deal, new investors, and technological advancements, recession fears have apparently left the crypto market.

Trump Keeps Pushing for Rate Cuts

When Trump’s tariffs threatened to disrupt the global economy, the crypto industry pinned its hopes on one bullish narrative: cuts for US interest rates.

The US President repeatedly harangued Jerome Powell, even threatening to fire him before relenting, yet Powell and his allies were firm: this was not happening. Trump has continued asking, appealing to Powell again today:

Throughout these proceedings, the crypto industry repeatedly urged more rate cuts, claiming that the “money printer” would stave off economic collapse.

Trump asked Powell to cut interest rates recently, but the latest FOMC meeting reaffirmed the status quo. How did crypto react to this? So far, it seems like it finally got the memo.

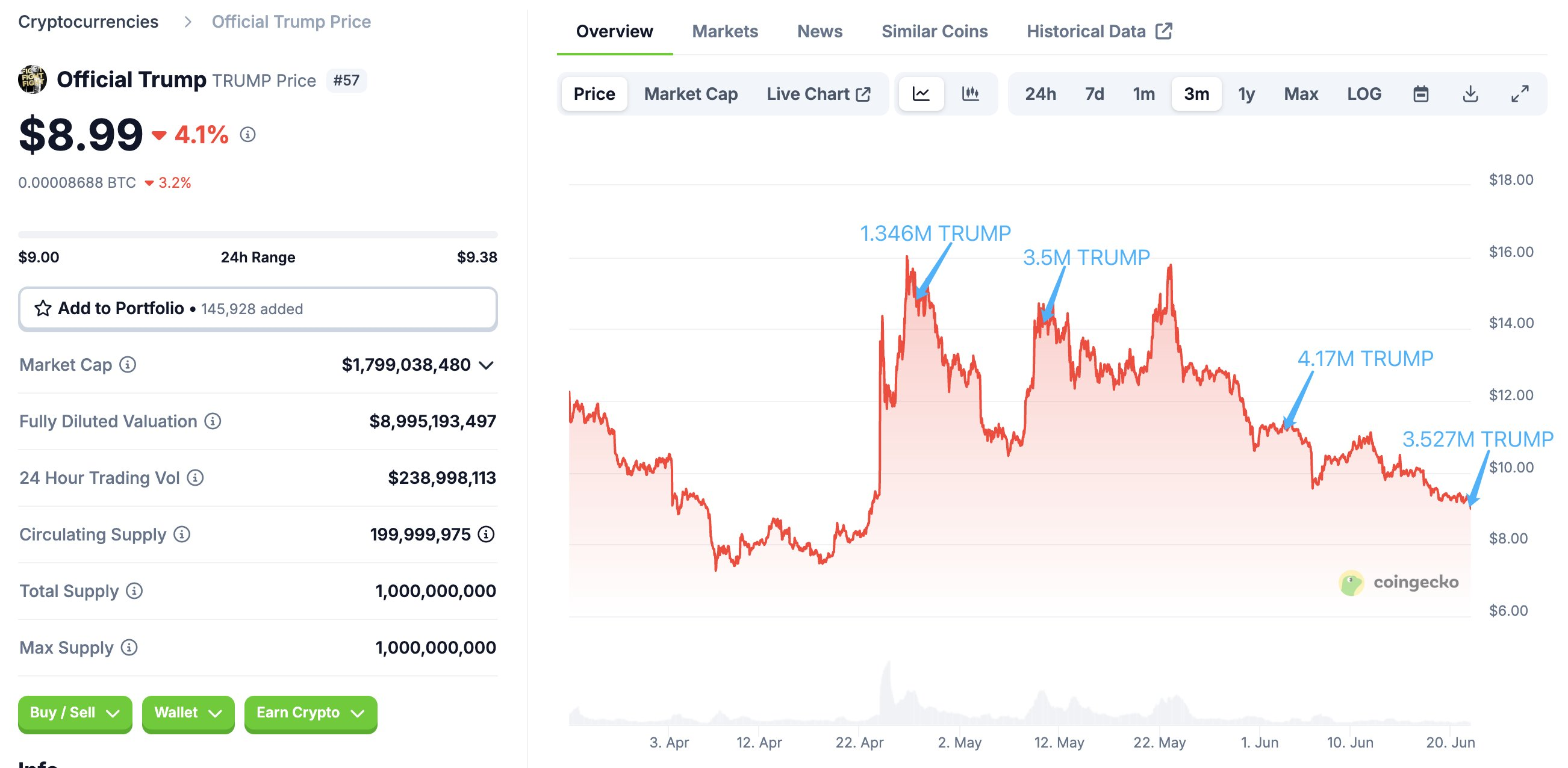

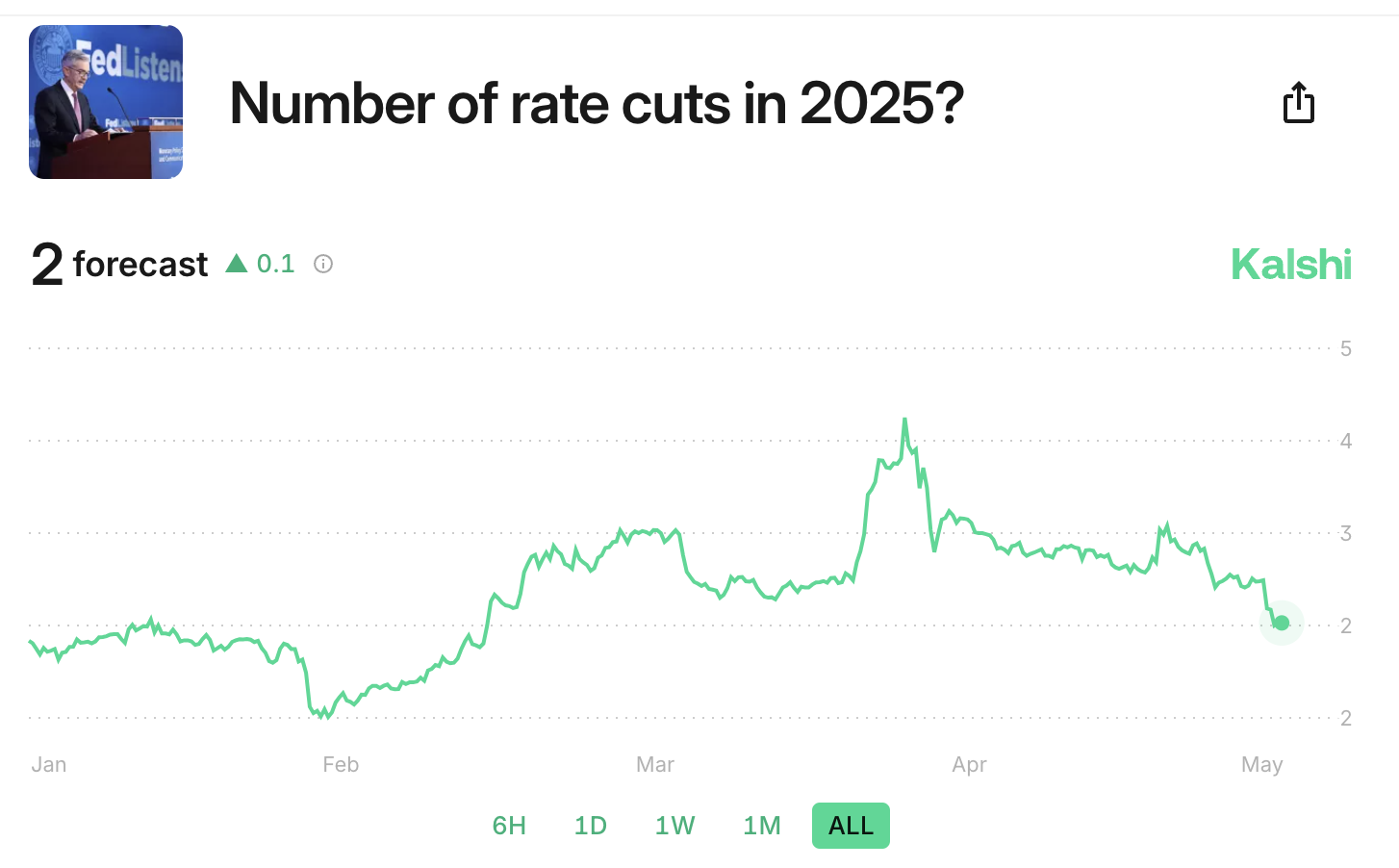

Crypto-affiliated prediction markets like Kalshi have repeatedly posted optimistic odds of Trump’s rate cuts compared to TradFi assessors like the CME Group. For example, the last time Trump made this request, Kalshi predicted that three cuts would happen this year.

At the time, this would have signified a cut at half of the year’s remaining FOMC meetings. In March, Kalshi even expected four! The CME, on the other hand, put over 98% odds on no cuts in May.

Indeed, this scenario is what happened, and Kalshi has since lowered its expectations. It currently anticipates only two cuts for the rest of the year, much more in line with other firms’ predictions.

What can crypto conclude from this? The community has apparently internalized that Trump can’t force cuts to interest rates. However, things are going well regardless.

A US-China trade deal pushed Bitcoin over $105,000, investors are returning in droves, and technology is advancing. Fear has largely left investors’ calculations. Who needs rate cuts, anyway?

All that is to say, Trump’s proposed interest rate cuts were just one way to potentially boost crypto investment. If Powell spontaneously changed his mind today, it’d be bullish, but as of now, the crypto market is slowly moving away from these macroeconomic drivers.

The post Crypto Market Moves On as Trump Pushes Fed to Lower Interest Rates appeared first on BeInCrypto.